Over most of the past decade, fintech firms have experienced rapid growth and increasing consumer adoption, fueled by digitization, changing consumer behaviors, and abundant investor funding. In response to a continued inflow of investment funding, many fintechs prioritized hyper-growth above all else, focusing on acquiring users over achieving profitability.

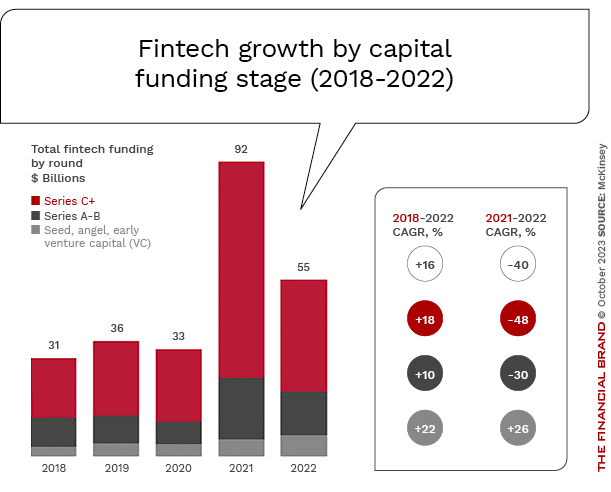

In 2022, the funding environment shifted significantly as economic conditions deteriorated. Investors grew more risk averse and emphasized profitability over growth. As a result, fintech valuations dropped precipitously.

Invasion of the Fintechs:

During the past decade, fintechs have profoundly reshaped certain areas of financial services with their innovative, differentiated and customer-centric value propositions, collaborative business models, and cross-skilled and agile teams.

These shifts in marketplace behaviors forced most fintech firms to focus on building sustainable and profitable business models, moving away from unbridled pursuit of scale. Many fintech firms needed to re-calibrate their cost structure. This resulted in layoffs, reductions in marketing budgets, and even a closing of existing customer relationships that did not meet minimum revenue or engagement criteria. This transition also required a review of existing business models, opening doors to potential M&A, partnerships and collaborations.

Adding to these headwinds was a change in competitive environment. Large tech organizations began to offer digital financial alternatives and legacy banks and credit unions stepped up their game in offering personalized solutions.

Emerging open banking frameworks and innovations like AI generated opportunities for both fintech startups and incumbent banks to better collaborate. Many fintechs pivoted their models to partner with traditional institutions, realizing they needed the risk management expertise and regulatory capabilities of established players.

Move the Needle from Attrition to Acquisition

Vericast’s 2024 Financial TrendWatch explores seven of today’s most critical financial services trends to provide a complete view of the current loyalty landscape.

Read More about Move the Needle from Attrition to Acquisition

Instant Messaging. Instant Impact.

Connect with your customers and provide lightning-fast support as effortlessly as texting friends. Two-way SMS text messaging is no longer optional.

Digital Disruption Creates Opportunities for Fintechs

As we have seen over the past decade, digital transformation and financial industry disruption has opened the door for both challenges and opportunities. For the most part, the entire banking industry has responded well under unprecedented pressures. For fintech firms, despite a massive drop in funding, this segment of banking still benefited from massive digitization of finance and rising consumer digital engagement.

Digital First Ecosystem:

Digital adoption is no longer a question but a reality: Around 73% of the world’s interactions with banks now take place through digital channels.

Recent research from McKinsey finds that 73% of customer-bank interactions are now digital. Moreover, retail consumers globally now have the same level of satisfaction and trust in fintechs as they have with incumbent banks.

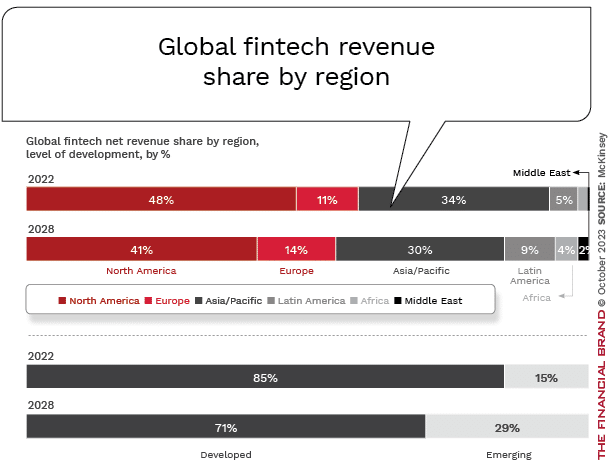

These dynamics are driving up fintech usage globally, with 41% of consumers surveyed planning to expand fintech use, according to McKinsey. Demand is particularly high in emerging markets where traditional banking is less accessible or where trust in legacy banking remains low. In these markets, fintech providers have opened the door to financial options never used by the vast majority of underbanked populations.

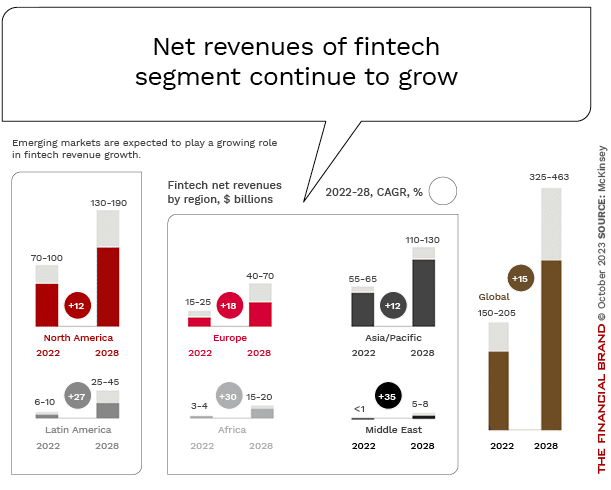

In both developed and developing countries, fintech firms have profoundly reshaped areas like payments, lending, investments and financial advice. Their 5% share of global banking revenues is expected to potentially reach over 15% by 2028, which is three times the growth rate for incumbent banks. It is clear that, despite industry challenges around funding, fintech and big tech organizations will continue driving disruption across the industry.

Changing Economics Require Strategy Shifts

Abundant funding previously allowed many fintechs to prioritize hyper-growth over sustainability. That era has passed. The path forward requires refocusing on profitable growth and long-term viability. Looking ahead, the fintech industry continues to face a challenging future, but there are several opportunities yet to be unlocked.

The McKinsey research indicates that revenue in the fintech industry is expected to grow almost three times faster than those in the traditional banking sector between 2022 and 2028. Compared with the 6% annual revenue growth for traditional banking, fintechs could post annual revenue growth of 15% over the next five years.

This growth will be made possible by significant shifts in the existing marketplace for financial services combined with shifting strategies within the fintech sector. First, widespread digital adoption shows no signs of slowing — be it in retail or commercial settings. Fintechs focused on enhancing digital financial experiences will retain strong demand.

Second, the broader financial services ecosystem continues expanding, creating openings for fintechs providing targeted solutions as new needs emerge. Finally, though the correction impacted most fintechs, resilience varies. Vertically-focused fintechs solving specific niches, along with earlier stage companies with room to endure market turbulence, remain well-positioned to chart steady, sustainable growth trajectories.

In other words, pockets of fintech resilience exist, especially for firms strategically aligned with enduring digital trends and evolving financial needs. By maintaining agility, the most adaptive fintechs can flourish despite sector-wide headwinds.

Read more: 5 Tips for Creating Successful Bank-Fintech Partnerships

Not All Fintechs are Equally Impacted

The overall funding correction hurt most fintechs, but some remained resilient based on maturity stage and segment. For example, early stage fintechs grew funding in 2022 as longer timelines insulate them from short-term shocks. Business-to-business fintechs for small and medium-size entities and corporates also showed relatively stable funding versus business-to-consumer payments and lending.

Here is a list of early-stage fintech startups that successfully raised funding in 2022:

- Unit: A banking-as-a-service platform that allows companies to integrate financial services into their products, Unit raised significant funds to expand its platform and services.

- Paceline: This health and wellness fintech rewards users for exercising, integrating health and financial wellness. It raised money to expand its reward and partnership programs.

- Lendflow: Lendflow offers embedded lending infrastructure, allowing software companies to integrate credit solutions into their products. It raised funds to enhance its technology and scale operations.

Some B2B fintech firms showing a great deal of resilience include:

- Adyen: A B2B fintech company that provides payment processing services to businesses. It offers a unified platform for accepting payments online, in-app, and in-store, catering to the needs of global enterprises.

- Brex: A fintech focusing on providing financial services to startups and small businesses. It offers corporate credit cards, expense management tools, and rewards programs tailored to the needs of emerging businesses.

- Plaid: A fintech company that provides a platform connecting financial applications to users’ bank accounts. It acts as an intermediary between apps and financial institutions, enabling secure access to banking data.

- Marqeta: A fintech company that specializes in modern card issuing and payment infrastructure. It provides businesses with the technology and APIs to issue physical and virtual payment cards.

Many legacy financial institutions continue to rely on legacy infrastructure that limits flexibility and speed and can often be more costly. To address these challenges, many legacy financial organizations are working with fintech providers for services such as payments, open banking and core banking technology. These activities are also driving growth of the sector.

For fintech firms, strategies must be tailored to fintech maturity and target segment. Early stage companies should extend runways and build sustainable models for future scale. B2B fintechs can capitalize on digitizing commercial client segments, generating above-market growth.

- Digital Banking Transformation Trends for 2023

- Top Retail Banking Priorities for 2023

- 5 Payment Trends to Watch in 2023

Four Pathways for Sustainable Growth

As noted, the decade of abundant funding is over. It is clear that fintechs must now pivot to sustainable business models focused on measured expansion and disciplined costs. So, how do they do that?

According to McKinsey, the same strategies used by long-term public companies that have weathered prior economic cycles can be used by fintech firms. The consulting firm identified four avenues to offering the most potential to enable fintechs’ shift from rapid experimentation to sustainable growth.

Cost Discipline: With investor priorities realigned, targeted cost control is imperative. McKinsey found 50% of post-IPO public fintechs were profitable in 2022 – the differentiator being cost management, not revenue growth. Profitable fintechs grew costs 60% less than unprofitable peers. Leaders like Paytm have achieved profitability ahead of schedule through disciplined cost optimization.

Not surprisingly, fintechs must scrutinize expenses, protecting margins while pursuing growth. This seemed less important when funding was easy to come by, but imperative today. Refocusing on profitability often requires operational changes to become more agile. Strong unit economics must be embedded across the business.

Measured Growth: Growth should come from a stable core business, not expansion alone. Per McKinsey, firms with strong home market footholds see 66% higher returns. Fintechs should consolidate core offerings with proven fit before exploring adjacent businesses.

Expansion remains an option once core products are robust and competitive advantages can extend into new segments or geographies. But measured value-creating growth is key versus hyper-growth. Finally, shrinking non-core assets will help redeploy capital into higher-potential business lines. For example, Scalable Capital and Wealthsimple strategically exited certain geographies to concentrate on core markets.

Strategic M&A: Many fintech firms are finding that partnerships and acquisitions can accelerate capability development, though cultural mismatches often erode value. But current conditions make some targets more attractive. In fact, 60% of fintech executives surveyed are considering acquisitions.

M&A typically outperforms in downturns with higher returns, according to McKinsey. So, transactions enabling focused expansion or bolstering core competencies can catalyze the shift to sustainable models – if done to grow strategically as opposed to relying on organic growth.

Maintain Culture Advantages: It’s important to retain the cultural advantages that made most fintech organizations successful. Innovation and customer centricity must remain cornerstones. Incumbent organizations now aggressively invest in capabilities once unique to fintechs. More than ever, AI, embedded finance, super apps and other innovations are redefining competitive positioning.

Fintechs must avoid compromising the nimble, collaborative cultures underpinning their disruptive success to date.

Read more: Open Banking Fintech Partnerships Required for Better CX

Why Traditional Bankers Should Care

Traditional retail bankers have reasons to closely track fintechs’ changing trajectory. Leading fintech firms are still reshaping banking, driving digitization and personalization expectations among consumers and businesses. The focus on sustainable models doesn’t negate the competitive threat or the collaboration opportunity. Studying fintechs’ response provides perspective on optimizing established institutions for the present landscape and future of banking.

The need for fintech M&A is increasing as valuations have dropped. Banks acquiring fintechs gain strategically valuable capabilities and assets if integrations succeed. Open banking and embedded finance highlight symbiosis between banks and fintechs. Shared future success depends on mutual understanding. Generative AI, blockchain and other emerging technologies could quickly create competitive advantages for legacy financial institutions.

Just as fintechs now recognize their need for banks’ risk management and compliance expertise, banks should identify lessons from the fintech ecosystem. Cost discipline and hyper focus on profitability drivers like unit economics and customer loan-to-value have direct applicability for banks and credit unions. Measured growth based on consolidating core competencies provides a blueprint for pruning unproductive assets to reinvest in high-potential business lines.

Programmatic M&A, not just opportunistic deals, allows smart expansion. Cultural integration remains key, taking the best from both legacy and fintech models to build future-ready mindsets. Preserving innovation DNA must be prioritized – competitive advantage depends on an entrepreneurial spirit.

Overall, retail bankers ignoring present upheaval among fintechs miss insights that could drive their own realignment. At its root, both sectors now share a common mandate – evolving models for a new economic reality. Banks studying fintechs’ adjustment strategies can accelerate their own transformation.