As data continues to emerge from 2020, it’s becoming clearer how much of an impact that extraordinary year had on financial institutions — both incumbents and their numerous challengers. Even while 2020 was barely in the rearview mirror, however, 2021 jumped out of the gate at full speed. A series of announcements by fintech challengers put the industry on notice that the new competitive environment was not going to settle down any time soon. Quite the opposite.

Within days of each other, the industry saw the launch of a new challenger bank by Green Dot, a further incursion into banking by PayPal’s Venmo app, and Walmart’s deal with Ribbit Capital — a highly successful fintech backer — with the intention to launch a new financial services venture.

These moves confirm that these nontraditional competitors continue to have momentum. In addition, clear winners are beginning to emerge among both challengers and incumbents, increasing the pressure on the large camp of undifferentiated institutions — both newcomers and veterans.

“We now are facing a generation of newer, tougher, faster competitors. I expect it to be very, very tough competition in the next ten years.”

— Jamie Dimon, JPMorgan Chase

Even Chase is nervous about the trend. As CEO Jamie Dimon told analysts on a conference call, “Absolutely, we should be scared shitless about that.” The blunt comment, was made in response to a question about the success of PayPal, Square and Stripe, and erases any doubts about the fintech threat.

Not just fintechs, but the big techs, as well. Dimon said he had shown his operating committee a slide deck of the valuations of Facebook, Google, Apple, Amazon, Ant Financial and others.

“We now are facing a generation of newer, tougher, faster competitors,” Dimon told the analysts, as reported by Seeking Alpha. “I expect it to be very, very tough competition in the next ten years.” But he also said, “I expect to win. So help me God.”

Dimon’s remarks are significant because the share of consumers that consider megabanks as their primary institution fell 6.5% during 2020, according to research from Cornerstone Advisors and StrategyCorps. Digital banks, by comparison, were up 7%.

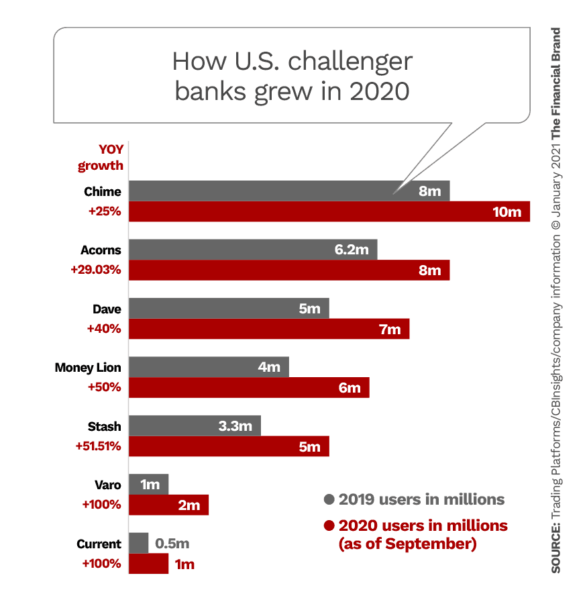

Drilling deeper into the neobank universe, data through September 2020 show some startling growth figures for the top U.S. players.

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

The seven neobanks in the chart, assembled by Trading Platforms, cumulatively recorded user growth of 39% between yearend 2019 through three quarters of 2020, adding about 11 million users during that time.

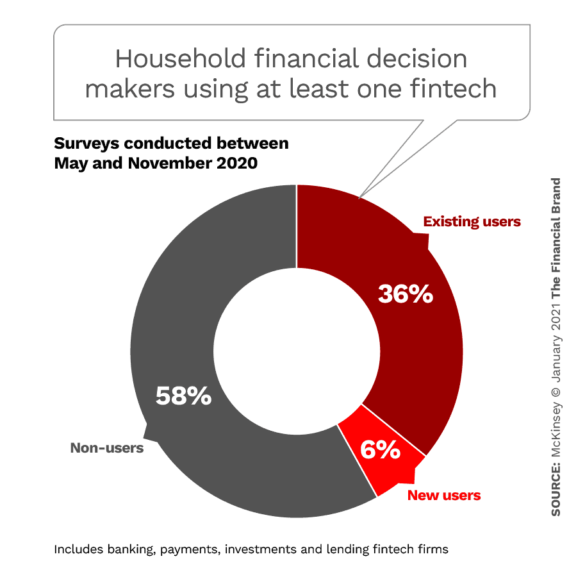

Based on its Financial Insights Pulse Surveys, McKinsey concludes that fintech banking has hit the mainstream. Two out of five household financial decision makers, for example, are now using a fintech for banking, payments, investments or loans.

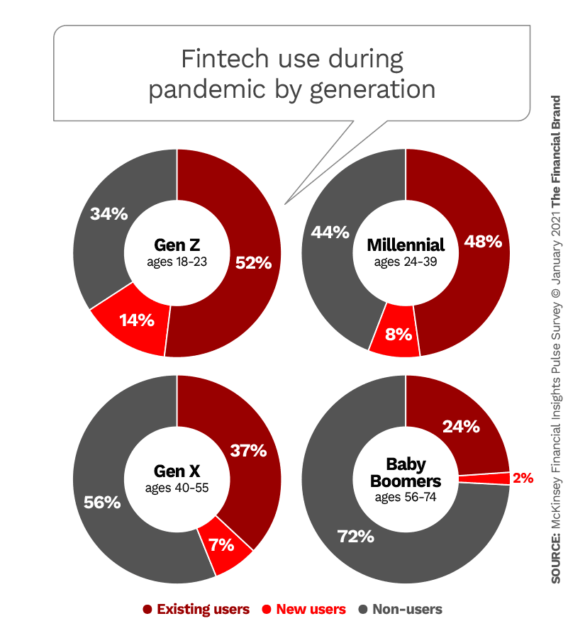

As shown above, younger adults are the most likely to use fintechs, but just over a quarter of Baby Boomers are also believers. (The figures for “new users” in the second chart understate the change. For example, while 8% of Millennials are new users of fintech services, that represents a 17% increase.)

Read More: Do Fintechs Scare You As Much As They Do These CEOs?

A Look at Three Neobank Announcements

Much like Google’s year-long “soft launch” of its Google Plex banking partnership, Walmart’s plans with Ribbit Capital, though officially announced, were very sketchy in the details. Given Walmart’s existing multi-faceted involvement in banking, and its huge network of stores, the retailing giant’s plans could significantly impact banks and credit unions.

Venmo, the peer-to-peer payment app, though it trails Zelle, the bank-owned P2P app, in total dollar volume, remains hugely popular with Millennials. PayPal has been aggressively positioning the app further and further into banking, adding a debit card, a credit card and now a mobile check-deposit feature. The Venmo app is expected to reach 54.4 million users in 2021, according to Insider Intelligence. To jump start its mobile check capture feature, Venmo waived fees on government stimulus checks. These funds, along with direct deposits and any other funds moved into a Venmo account are deposited into FDIC-insured custodial accounts at Wells Fargo or The Bancorp Bank, according to Venmo’s user agreement.

Green Dot Corp., which owns Green Dot Bank, a Utah-chartered state bank, has been providing prepaid cards for 20 years, and, more recently has been active as a banking-as-service provider. Early in 2021, the company launched GO2bank, a mobile-only bank specifically targeting low-to-moderate income Americans. The digital bank’s features include overdraft protection up to $200, early access to paycheck and government benefits, up to 7% cashback rewards at a variety of retailers, high-interest savings and a secured credit card.

“Branches are going away, point-of-sale terminals are going away, plastic cards are going away,” Green Dot CEO Dan Henry told a NYSE Floor Talk interviewer. “Moving money will be very intuitive and at the fingertips of every American. We are going to be in the middle of that, powering multiple solutions.”

The Competitive Threat for Incumbents

Many neobanks and fintechs are seeing a moment of opportunity, states Alan McIntyre, Senior Managing Director of Global Banking for Accenture. As spelled out in the firm’s report on top banking trends for 2021, many people have been forced into digital banking, so new and existing digital banking competitors are saying, “How can we take advantage of this increased engagement to build out our capability before it slips back to where it was before?”

Reinforcing the significance of this trend, Alaina Sparks of Deloitte observes that as some incumbent institutions have struggled to meet the growing consumer desire for a “highly tailored, convenient, smart and safe banking experience at no or low fees, aggressive marketing campaigns and intuitive brand positioning by challengers tweaked consumers’ interest enough to download their app and register for an account.” Sparks leads Deloitte’s U.S. Fintech Practice and its Global Financial Services Ecosystem and Alliances program,

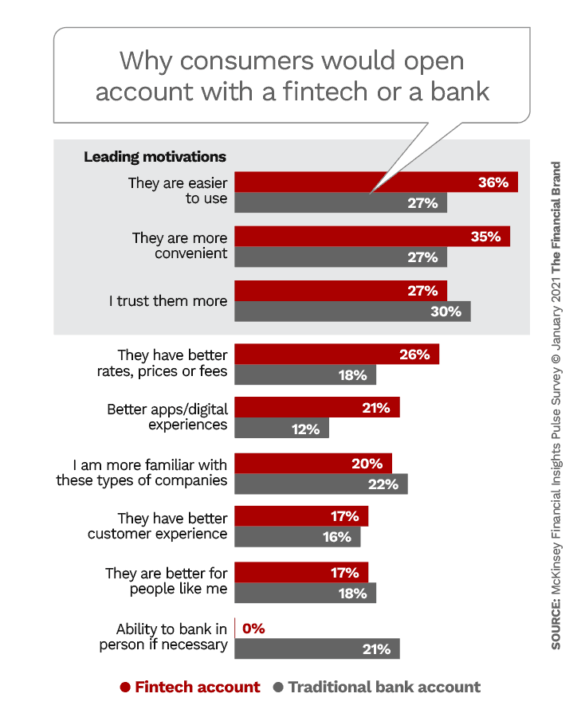

In a finding that could send shivers down the spines of many traditional banks and credit unions, McKinsey uncovered that the percentage of consumers who choose a financial institution based on trust was almost equal between traditional institutions (30%) and fintech service providers (27%). The consulting firm concludes that though incumbents still have an advantage in several areas, their edge has eroded.

The bank versus fintech competitive situation too often is oversimplified. McIntyre believes there are multiple competitive cycles occurring simultaneously within banking. One is what he calls “standalone digital banking,” in which players like Chime increasingly are taking accounts from regional banks in the U.S. Ultimately, though, McIntyre believes these players “are in head-to-head competition with the Bank of Americas and Chases of the world for supremacy.”

Another simultaneous cycle, the consultant states, is the building out of broader-based digital financial services by fintechs. This goes beyond basic transaction accounts to the provision of credit, and the wealth and asset management side of the business.

Niche-focused fintechs such as Robinhood and Affirm should be seen as threats to traditional banking, warns Sparks. “It’s only a matter of time before single or limited-product fintech companies become larger, multi-product companies or even banks, competing across various businesses or product offerings,” she states.

A third cycle is being created by Google, Apple and other big techs that act as gateways to embedded services, McIntyre maintains. “We’re at the earlier stages of the big tech movement,” he adds, “and the question is, ‘Who do the big techs take share from?'”

The threat coming from these large technology companies underscores the reality that providing smart and seamless delivery of financial services products to customers increasingly relies on data. “These giant institutions have massive amounts of data and the analytical capabilities to use it,” she says. But like fintechs, they either have to partner with regulated institutions or become one to make full use of that advantage.

Read More:

- Neobanks Pile Into Digital Marketing Channels and TV Advertising

- How BaaS Turns Traditional Banks Into Digital Deposit & Loan Machines

- U.S. Challenger Banks Turn Up the Heat on Incumbents

- Four Ways Banks Must Change Before Millennials & Gen Z Will Love You

The Result? More Mergers and Changes in Business Focus

Faced with this competitive onslaught both McIntyre and Sparks expect to see continued consolidation within the ranks of banks and credit unions.

Among smaller banks (annual revenues between $1 billion and $5 billion), 57% said their institutions could pursue M&A opportunities over the next 6 to 12 months, according to Deloitte’s 2021 Banking & Capital Markets report. Further, a third of respondents indicated their banks may also look at rationalizing assets or divesting non-core operations.

Mergers, when done well, buy time and add scale for traditional institutions, but McIntyre believes mid-sized regional and community banks will continue to be squeezed. He predicts that much like happened with travel agents, traditional banking providers will “retreat to complexity.”

For the agents that meant abandoning airline ticket sales and concentrating on things you can’t do, or do easily, on Expedia, such as booking multi-location trips. With financial institutions the more complex applications will be handling inter-generational wealth transfers, middle-market lending and trade finance, McIntyre states.

The Hurdles Faced by Challengers

The path for neobanks and fintechs is far from assured, however. For many of them, McIntyre foresees a “feature functionality arms race” as players seek to convince people “why they should try us.” Features that a few years ago were a reason to bank with some of these players have become table stakes, he says.

As a result, venture capitalists are being very careful about what the underlying business model is and where the revenue is coming from. In the U.S., the consultant states, debit interchange is still rich enough to make transaction banking attractive, whereas that’s really not the case in Europe, where cross-border money transfer has been the big neobank revenue source.

Ultimately, interchange (or money transfer fees) alone won’t be enough for neobank success as fees compress, McIntyre maintains, unless there’s credit attached and the ability to borrow and charge for that borrowing. There is an exception, however. If a neobank can get to primary bank status, then debit interchange would still enough to support the business model without having to add a huge product range to profitability. Chime has managed to do this so far, McIntyre observes.

“What you’re seeing with Chime,” he states, “is the network effect of getting a bigger customer base, generating more interchange revenue, putting that into more brand advertising and just basically getting the flywheel moving in terms of customer acquisition.”

Still, the longer term danger for interchange-powered challengers, McIntyre believes, is the move underway around the world to account-to-account payments and away from card-network intermediated payments “A2A doesn’t have the same kind of juice in it that debit interchange has,” he states.

Overall Accenture expects a shift towards a “winner take all” situation in retail banking. “A bifurcation,” as it states in its banking trends report, “in which the best traditional banks and the best neobanks win customers while everyone else — both weaker incumbents and undifferentiated challengers — struggles.”