Google has loosed a double-barreled challenge on the financial services business. First, the big tech announced major advancements in functionality for its Google Pay digital wallet. Second, it simultaneously revealed more details about its partnership expansion with banks and credit unions, which now has a name: Plex by Google Pay.

The strategy behind Plex is coming into better focus and speculations about its look and intent are fading. Participating institutions will begin unveiling their versions of Plex accounts sometime in 2021.

Taken together, the expanded Google Pay and Plex represent a major financial platform play that clarifies Google’s near-term interests in the financial services business. The common element of the moves, overall, is to bring consumers greater financial management capability with a minimum of pain and a maximum of simplicity.

“Google has no interest in ever becoming a bank,” says Felix Lin, VP of Payment Ecosystems at Google in an interview with The Financial Brand. “We’ve worked for many, many years with banks in the financial ecosystem and we are continuing to do so in a way that enables our banking partners to offer their financial services and products in the most helpful way to as many users as possible.”

Essentially, the new Google Pay is an expanded, reimagined version of the company’s wallet in which many payment services can be accessed. Google Plex will be a way for participating financial institutions to offer a combined check and savings account in a mobile-first configuration that will rely on the institution’s dedicated Plex product using a Google user experience. Plex accounts, which will have both common and institution-specific features, will plug into Google Pay only, and not be available through other companies’ e-wallets nor on their own apps.

Digital transformation expert Jim Marous spoke highly of the overall thrust of the effort.

“Google Plex is taking almost everything that is available from fintech firms and digital-only banks and putting it under one mobile roof,” says Marous, Co-Publisher of The Financial Brand and Owner/CEO of the Digital Banking Report. “Over the last several years, many in the industry joked about the ‘Bank of Google’ or ‘Amazon Bank’ – well, it’s here. And as projected, they have taken the best of what Google can do — hyper personalization — and are deploying it as the front-end relationship building platform using an increasing number of traditional financial institutions as the rails.”

“This will be the way that Apple and potentially Amazon will build their financial platform in the future,” Marous believes.

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

Move the Needle from Attrition to Acquisition

Vericast’s 2024 Financial TrendWatch explores seven of today’s most critical financial services trends to provide a complete view of the current loyalty landscape.

Read More about Move the Needle from Attrition to Acquisition

Alyson Clarke, Principal Analyst at Forrester, had predicted that Google’s foray into banking would be a marketplace strategy.

“I’m pleasantly surprised that savings is going to be included,” she says, “not just checking accounts.” The new service had been going by the buzzwords “Google Checking” and “Google Cache” as news about its development began dribbling out in late 2019. Clarke sees room for financial institutions to compete within the Plex marketplace. She also expects that while Plex accounts will function in that universe, as improvements continue to be introduced there they will also start spreading into the general banking product landscape.

Clarke also notes that setting up Plex as a partnership rather than a strict take on banking as a service is a smart move in terms of consumer relationships. “Google has a long way to go on the whole trust issue,” says Clarke. “I think they needed to do it this way.”

Clarke also believes the partnership continues a trend seen in the Apple Card partnership between Apple and Goldman Sachs and more, towards collaboration. “Collaboration is critical for the future,” she says. “No firm is going to do it alone.”

“Google Plex is a shot across the bow of traditional banks telling us that the future is in a smart, contextual wallet or bank account,” says digital futurist Brett King. “Discretionary spending in China has already moved almost entirely to mobile wallets, and the U.S is many years behind China on this, but Google Plex is definitely the start of this shift.”

Only a handful of institutions are participating in Google Plex, begging the question of whether this is a race going to the swiftest or one of multiple opportunities.

Citibank and Stanford Federal Credit Union, at opposite ends of the size spectrum, were the first institutions on board with Google and are initially the only two to offer waitlists prior to rollout. Google added Green Dot Corp., Seattle Bank and The Harbor Bank of Maryland in unveiling program details. The rest of the list: BMO Harris Bank, BBVA USA, BankMobile, Coastal Community Bank, First Independence Bank and SEFCU.

Despite his praise for the concept behind Plex, Marous doesn’t see consumers flocking to have the ability to do all that Google Plex offers as a reason to unwind a current relationship with an established financial institution. Nor does he see an urgency for other large organizations to join in, since what Google is offering is not completely defined yet.

A “slow then fast” perspective comes from King. “Tech giants will have an advantage because they have the technology layer that this data will be presented to the consumer with. Smartphones, smart speakers and smart glasses will all be able to use this to embed financial services with greater context and personalization,” he says. “Once those players push these capabilities out, everyone will want their own ‘Smart Bank Account’ to try to compete.”

In this report we’ll review details about Google Pay and Google Plex, including information from an interview with Google officials; discuss the parts to be played by banking institutions, including interviews with Citibank and other institutions; and look at what the future may hold now that Google has put more meat on the bones of its banking vision.

Read More: The Future of Banking: Tomorrow Will Be Radically Different

Google Plex and the Improved Google Pay It Plugs Into

The name for the Plex by Google Pay product is neither a take on the colloquial description for Google’s California headquarters nor the mathematical quantity googolplex, signifying a huge quantity.

“I think ‘Plex’ was coined around the fact that the service is so multifaceted and that we’re interested in working with so many banks,” says Felix Lin. The initial group is not intended to be the only institutions to partner with Google.

The improved Google Pay is designed to eliminate common pain points for consumers in their financial affairs, initially, around spending and savings.

“What I’m generally looking for as product manager is where people are grumpy, like where they are complaining about something that relates to their money that has a lot of friction,” says Josh Woodward, Director of Product Management at Google.

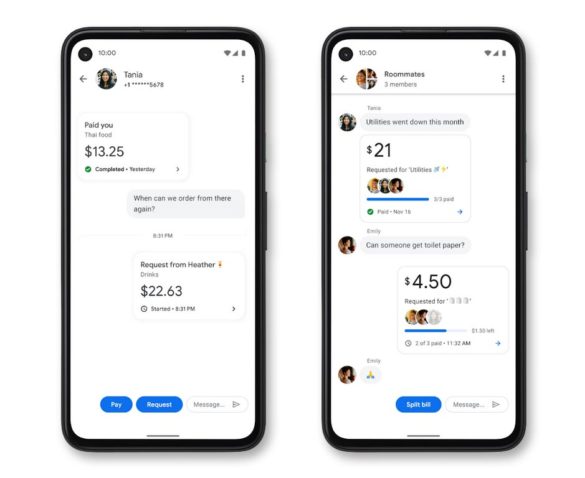

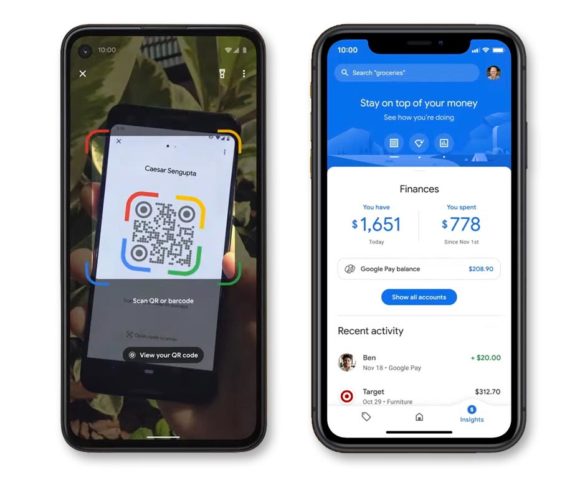

The new Google Pay offers three “tabs” on the app to facilitate smoother use of financial services.

• The first — “Pay” — is used for digital payments, including P2P and P2B transactions. The transaction capabilities are designed to follow the way people spend among themselves, including splitting bills, and with businesses. Google Pay users will be able to interact with other consumers in multiple ways, including using their mobile device camera to shoot another person’s on-screen QR code to facilitate easy payment. A large number of retail merchants have added functionality so consumers can make payments directly to them through the app.

• The second tab — “Insights” — helps the consumer by providing financial observations, pointing out how and where the consumer is spending their money.

“You don’t have to categorize your transactions and classify or label things,” explains Woodward. “Google can do that for you and then you get the benefit of those insights.” The new app can also search out past purchases using only key words.

• The third tab — “Explore” — highlights deals and rewards from retailers and enables the Google Pay user to opt in to the various offers so they will execute when qualifying transactions take place.

“At first it looks like those are very distinct problems,” says Woodward. “But the more we started to talk to people, the more we felt like these were all kind of part of the same continuum. And that’s how we started to get to this design, all in one app.”

Certain optional functions will allow other Google services to link into Google Pay. One example would be for consumers to be able to authorize the app to monitor Gmail in order to intercept and act on bills and receipts coming in via Gmail. Consumers can also opt in to using their mobile phone camera to shoot receipts, which will then be pulled into the system. (Google’s nearly 30-minute introduction on YouTube can be found here.)

Read More:

- KeyBank Fighting Megabanks & Big Techs With a ‘Digital-Plus’ Strategy

- Inside the Strategy Behind BofA’s Digital Life Planning App

Digging Into Google Plex — And What Google Gains

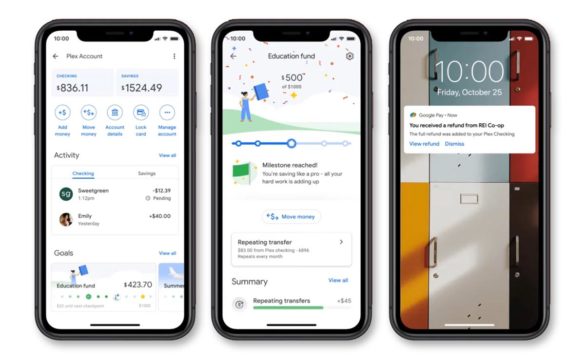

Google Plex, branded in tandem with the participating financial institutions, adds more depth to certain functions when plugged into Google Pay. These include assistance in meeting savings goals and updating users when payments and refunds arrive in the account. Consumer will be able to set up multiple buckets for different savings goals, all within the basic Plex account.

Felix Lin explains that while Google Plex accounts will have some common elements, they will be able to differ from each other in the same way that mobile devices using Google’s Android operation system can be differentiated from each other.

“We want every partner to be able to play to its strengths,” says Lin. “Every bank will have the ability to create a proprietary experience within Google Pay.”

A natural question is what Google gets out of offering the functionality and the platform to financial institutions. Much of the speculation among pundits has until now revolved around data. However, Google has pledged in its latest announcement that it will never sell transaction history to a third party nor share it across other Google products for targeting ads.

“Transaction history inside Google Pay stays inside Google Pay,” says Woodward.

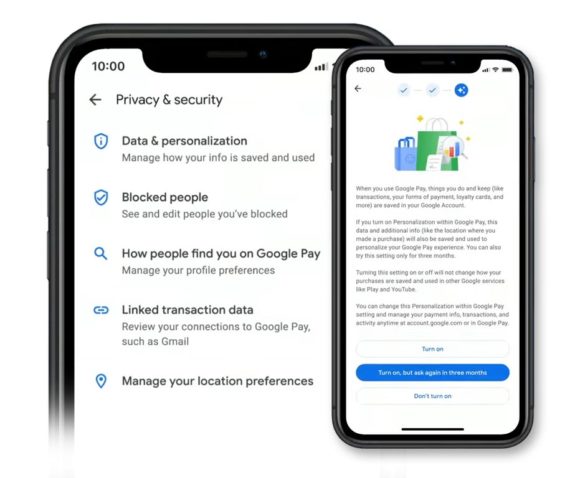

Indeed, on signing up for Google Pay accounts consumers will be able to decide whether they wish to allow usage information to be saved and tapped to provide greater personalization. Besides deciding yes or no, they will be able to choose a three-month trial, after which the wallet will automatically ask if they wish to continue, stop or try another three-month period.

“Google has seen the writing on the wall and come out and said it,” says Forrester’s Alyson Clarke. She applauds the three-month option as a good addition to a simple yes-no. People often forget what they’ve selected and in the beginning may appreciate the opportunity to change their minds.

The initial payoff for Google will be increased interchange income via the anticipated increase in volume that adding Google Pay-based Plex accounts will bring. Google will also obtain a fee for P2P payments received and taken out instantly, and where rewards are distributed through Google Pay the company will obtain a distribution fee for handling the offer.

How Citigroup Will Launch Its Version of Plex

Back when the industry was first absorbing the news that Citi would be the first major bank partner in Google’s banking venture, CEO Michael Corbat said one challenge for any financial institution partnering with a tech company would be to avoid becoming the “dumb pipes.”

Now that more details have come out, Elyse Lesley, Head of U.S. Partnerships and Franchise Development in Citi’s Consumer Bank, says with assurance that “this is not a dumb pipe. The reason we can say so is that this is going to be a Citi-branded account. When folks come onto the Google Pay platform and have multiple banks to choose from for a Plex account, they will know that they are picking Citi, and they will continue engaging with Citi as long as they have a Citi Plex account. As we market it, this will be the Citi Plex account enabled by Google Pay.”

In an interview with The Financial Brand, Lesley says it’s important to understand that “Google is not fibbing when they say they don’t want to be a bank. Working through this experience, I think they have a very deep appreciation for the role that banks play and what they bring to the equation in terms of not only the banking know-how, but how to deliver products in a compliant and controlled way right to the marketplace.”

The company’s involvement in Plex will get even more consumers engaged with Google Pay, says Lesley, and will get Google even more deeply involved in how people engage with, spend and save their money.

A key consideration for Citi will be picking up many new consumer relationships among Millennials, Gen Z and other technically inclined consumers who value digital accounts featuring no fees and simplicity.

“Plex will allow us to further scale our retail bank franchise,” says Lesley. She explains that the bank has a very light retail branch footprint in the U.S. that’s predominantly in six major geographic markets. However, “we have a very extensive card franchise with over 70 million current customers in the U.S., the majority of whom live outside of the markets where we have branches.”

Most of those consumers only have a card with Citi at present. Tapping into partner ecosystems like Google, with a national platform, represents a way to grow those relationships beyond single card-based relationships.

“Plex is meant to be a consistent client experience across all participating banks,” says Lesley, “but each institution will have the ability to showcase their offerings on this platform and to present value propositions that encourage consumers to pick, in this case, Citi versus another financial institution.”

What would be among Citi’s Plex plusses? Lesley says an important one is that the bank offers one of the largest fee-free ATM networks in the country. Another lies in the area of incentives and rewards, which each institution would devise for its Plex account holders. Over time, rates offered on balances would also be a differentiating point, she adds, as those are up to each provider.

A key point will be dual branding in the sense that “it’s a combination of a technology firm that delivers really friction-free user experiences, coupled with the security and trust they’ve come to expect from a bank like Citi,” according to Lesley.

What Brings Green Dot and Community Financial Institutions to the ‘Plexiverse’

Among the latest additions to Google’s banking world is Green Dot Corp., a bank holding company and fintech that offers multiple financial lines using its primarily branchless retail bank. In addition to operating as a direct bank with a banking app, Green Dot offers a variety of debit, prepaid, checking, credit and payroll cards and a selection of money processing services. It also has a Banking-as-a-Service operation.

“Plex is like comparing a regular car to a Tesla or a regular exercise bicycle to a Peloton.”

— John Blizzard, Seattle Bank

This makes Green Dot stand out a bit from the traditional institutions taking part in Plex. Mike Tekulve, SVP and Head of Banking as a Service, says that the new Google Pay “takes a very holistic approach to payments, money and finances, which is what our customers are looking for in an environment where financial tools are very fragmented.”

Tekulve says that participating in Plex appealed to the company’s desire to continue building its digital-first approach to financial services. In addition, he says, “a substantial segment of the population continues to be underserved by the financial services industry and we’re continually looking for ways to get new and helpful financial tools to anyone that can benefit from them.”

Green Dot sees the Plex approach, joined with Google Pay, as changing the role that banking accounts play. “The trend we’re seeing, particularly as it relates to digital and mobile banking tools, is that today’s consumer wants to bank in the flow of their life, meaning there is a demand for banking and financial services that are integrated more natively into people’s lives,” says Tekulve. The new Google Pay P2P and P2B payment streams play to that preference and Green Dot Plex will plug into that functionality for the streamlined experience that the company wants to offer.

The ability to open Plex accounts right within the Google Pay app has strong appeal to the financial institutions, given that it provides an on-ramp right within the Google platform.

For Seattle Bank, one of the latest sign-ons, the potential for building additional consumer accounts for this boutique bank was attractive. Consumer Plex accounts offer an opportunity to broaden the bank’s based from private banking and community business banking to a wider scope. John Blizzard, President and CEO, says the Google technology makes a good compliment to the bank’s new architecture that is API friendly and cloud-based since it made a recent major core change.

“Plex is like comparing a regular car to a Tesla,” says Blizzard, “or a regular exercise bicycle to a Peloton.”

Getting involved in Plex demands a significant commitment from a smaller institution. At Coastal Community Bank, in Everett, Wash., Laura Byers’ job has completely become managing the effort necessary to create its Plex account. The essentials of the underlying accounts remain pretty standard, but “it’s how you solve consumers’ problems and meet their needs,” says Byers, now EVP and Chief Digital Banking Officer.

“It’s a big project,” says Byers. “The challenge is finding the right skill sets.” The bank has been adding new talent in order to handle its end of Plex preparation.

What Comes Next for Participants and the Industry

Forrester’s Clarke has some concern for banking brands entering the Plex circle. While there is room for branding, she says, “your brand starts to disappear” when you are dealing with a major force like Google. In a related vein, Jim Marous raises the issue of the partnerships resulting in institutions unintentionally relinquishing control of the customer relationship to Google.

Marous, Clarke and King all agree that the Google collaborations will spur more disruptive evolution.

“There is no option than to be able to offer fully functional digital banking services geared to the digital consumer,” says Marous. “Instead of providing legacy services on an online or mobile platform all legacy financial institutions need to find partners who can provide the digital functionality needed for the consumer who is used to the ease of opening a credit card with Apple, Discover or Amex, create a savings or investment account with Acorns or Betterment, or opening a new checking account with Varo or Chime.”

Not every institution will partner with a big tech, says Marous, but he believes most will need a jump start.

Expansion is inevitable, in King’s view.

“There’s only so many partners that Google can have, and eventually,this breaks wide open the real-time API-led approach for sharing bank data for broader applications,” he explains. “The E.U. has long taken the position that account and transaction data is owned by the customer, and that has driven open banking there. In the U.S., while big banks have maintained that they own customer data, the reality is that Google’s move will force a major rethink on that front. There’s no way that banks get to deny customers access to their own data.”