Not long ago, consumers shopped for financial services by visiting branches of multiple banks and credit unions, collecting an assortment of brochures from a rack, talking to branch personnel, and comparing various value propositions. The decision was based on the human connection with the people at the branch, combined with the alignment of the products offered and the financial needs of the consumer.

For today’s consumer, shopping for a new banking relationship is far different. The increase in online and mobile banking options has empowered the consumer with far more alternatives, while making the decision-making easier. Consumers can browse, compare and purchase virtually any financial product or service from their computer or mobile device 24/7, without ever stepping foot in a branch.

While the shopping and purchasing process for banking solutions may have become faster and easier with digital channels, the desire for a financial institution that can respond to a consumer’s specific financial needs has only increased. The consumer wants their financial institution to know them, understand them and reward them. The answer is to create intuitive, friction-free and personalized engagement that can proactively help a consumer feel more financially secure.

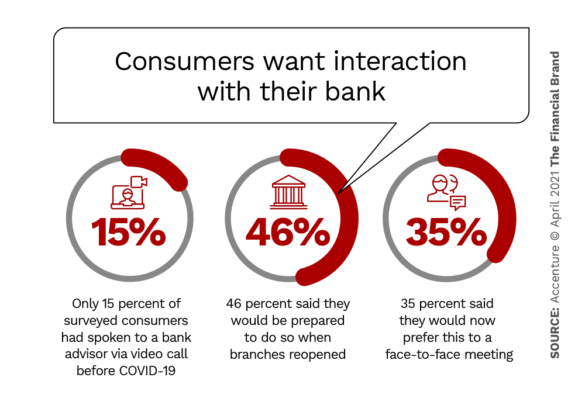

Consumers have become accustomed to digital experiences where any process can become a one-click engagement. 50% of consumers are now interacting with their financial institution through mobile apps or websites at least once a week, according to Accenture. This is an increase from only 32% two years ago.

This major shift away from branch-based banking makes understanding a consumer’s individual needs more difficult as well as more important. In fact, research from Accenture found that those organizations with strong capabilities for understanding and responding appropriately to the specific needs of their customers outperformed their peers financially.

Key Insight:

Empathetic banking leaders are distinguished by their ability to gather and use data insights to engage with their customers. They also offer customers channel choices based on their emotional state and financial need. – Accenture

Read More: Can Banking Industry Meet Consumer’s New CX Expectations?

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

The unfair advantage for financial brands.

Offering aggressive financial marketing strategies custom-built for leaders looking to redefine industry norms and establish market dominance.

Consumers Want Personalized Solutions to Reduce Financial Stress

As government relief programs start to wind down, consumers are looking for ways to protect their finances and find ways to reduce financial stress. For some, there will be a need to build additional savings, while for others, there will be a need for credit relief or alternative credit options. While digital banking options provide the ability to scale solutions unlike branch-based engagements, organizations must avoid the temptation of commoditization. Consumers will require personalized solutions.

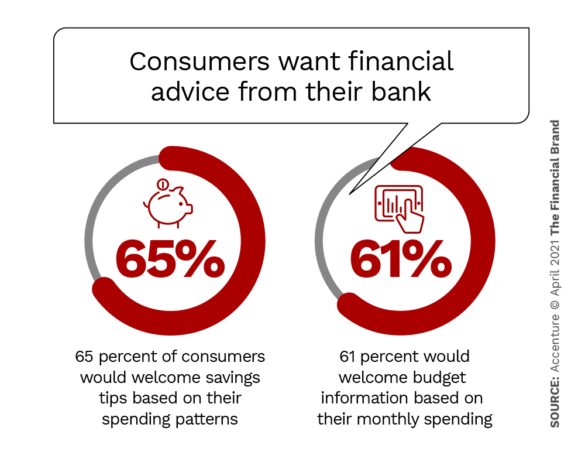

What is required is the ability to leverage data and insights to build solutions that are contextual in real-time. Consumers not only want these types of solutions, they are willing to let their bank, credit union (or fintech provider) use their personal data to deliver the solution.

Now more than ever, we are seeing the rise of the digitally empowered consumer whose pursuit of improved financial wellness will drive product development and could reshape the competitive dynamics of the financial services industry. “By being empathetic, a [financial institution] shows that it cares about each customer,” Accenture states. “In being purpose-driven, the organization demonstrates its commitment to building win-win, deep-rooted relationships.” In an interview for the Banking Transformed podcast, customer experience guru Jay Baer likened this level of commitment to the consumer as the way all companies did business with customers “in the old days”.

Read More: Becoming a ‘Digital Bank’ Requires More Than Technology

The Fintech Advantage

Consumers are looking for more than just reduced fees. They want a financial partner that has simplified opening a bank account, applying for a loan, performing basic transactions and will help them meet their financial goals. This is the competitive ‘sweet spot’ of many fintech providers. They leverage machine learning and AI, deploying predictive analytics to support the next best action strategy needed for personal finance management.

Consumers don’t want budgeting tools that require effort on their part. They want solutions that will make decisions on their behalf. From reducing debt, increasing savings, determining the best time to pay a bill, or avoiding a fee, consumers want their financial institution to be empathetic to their personal and financial needs. This is why firms like Betterment, SoFi, Credit Karma, Chime and Wealthfront have appealed to consumers.

Key Insight:

Consumers who are stressed about their finances, and want to simplify their life, want a hands-free approach to managing their money.

Part of this personalized engagement process is letting customers determine the touchpoint they want to use as opposed to forcing them to use a branch, digital channel or other engagement method. The key is for financial institutions to continually collect insights that can help anticipate needs and the best channel for engagement. This can be as digital as a chatbot … or as personal as a call from a human. The key is to be consistent across all available channels.

Consumers Want More Than Commoditized Products

Consumers do not enjoy managing their finances, especially during times of stress. Fintech firms have illustrated that many daunting financial chores like budgeting, investing, saving and even borrowing can be simplified. Beyond simplification and personalization, consumers want solutions that will empower them to proactively make better decisions themselves.

Financial institutions must position financial well-being as a core principle and illustrate how digital products and services create value. For instance, providing tools for better decision making will solidify consumer relationships and differentiate your solutions in the marketplace. These tools should include analytics, calculators, and projection tools that illustrate current financial positions and how improvements can be made. AI assistants and even simple projection tools can display a level of empathy that the consumer desires.

During this learning process, engagement with the consumer increases (which creates loyalty). By monitoring how the consumer engages with the tools provided, financial institutions can respond to common queries, provide account/balance data, send warnings and reminders via text or chat, set up recurring payments, etc. Some organizations have already taken this step, such as Bank of America with its digital assistant, Erica and its Life Plan app.

Key Insight:

Consumers want faster access to better information through digital tools to develop and maintain a sense of financial well-being.

Here are some ways banks can illustrate a more empathetic perspective of helping consumers meet their financial needs:

- Put the consumer at the forefront. Build financial solutions that empower consumers to manage their finances more effectively.

- Leverage digital capabilities. Create digital solutions that are fast, simple, proactive and personalized. Digital functionality provides the benefits of scale and context.

- Deploy data and insights. As opposed to simply using data for internal reports, deploy data and insights to customer-facing employees as well as to consumers themselves to help them make better financial decisions.

- Partner with solution providers. Many of the best financial management solutions already exist in the marketplace. Rather than building from scratch, find solution providers or fintech firms that currently meet an important consumer need and collaborate. This will save time and money and provide increased flexibility.

Consumers want more than a traditional checking, savings, credit card or loan relationship. They want a financial institution that is interested in them on a personalized basis and is empathetic to their specific financial needs and overall financial well-being.

According to Accenture, “The growing maturity of today’s AI solutions, paired with customers’ growing willingness to use digital channels even for complex interactions, gives banking leaders the opportunity to not only offer more personalized services and experiences, but to do so at scale. This can give banks a sustainable competitive advantage.”