The global impact of challenger banks, neobanks, fintech firms and financial services offered by big tech organizations is increasing as consumers realize the benefits of some of the solutions offered. These non-traditional financial institutions are challenging the longstanding business models of banks with a laser focus on customer-centricity, lower-cost infrastructure, innovative products and services, and digital-first accessibility.

Once considered a minor nuisance by established financial institutions, many of the challenger organizations have gained favor with consumers and small businesses, reaching a scale that can no longer be ignored. Without changing existing business models, banks and credit unions will continue to lose business to the challenger organizations – often in the most profitable business lines and/or with desirable segments – as the new digital banking battlefield moves from consumer to small business accounts, and from checking and payments to lending and investment services. Adding to the competitive threat is the reality that venture funding is again flowing at a record pace into both early start-ups and large challengers, allowing this competition to expand services and improve growth potential.

The ability to expand services offered and geography served is what makes the threat to legacy banking organizations so real. For instance, Brazil’s Nubank introduced its first product, a credit card, in 2014. In 2016, Nubank had 1 million credit card customers, offering lower interest rates, an easy application process, and fast approval and delivery of the card. In 2017, the company received its full banking license, growing to serve more than 35 million customers today, with a valuation of $25 billion.

New Challenger Bank Database

The Financial Brand‘s Neobank Tracker finds that nearly 200 challengers compete for consumer banking on a global basis, with the number of challengers growing daily.

The largest fintech start-up in the U.S. is Chime, with 12 million customers. The growth of Chime, launched in 2014, has accelerated due to the pandemic, doubling in size since the beginning of 2010. With a focus on serving the middle market consumer, Chime offers a no-fee pledge, overdraft coverage up to $200, higher rate savings plans and ways to build credit with a secured card. The neobank has even opened an office in Vancouver, with additional expansion possible.

According to Cornerstone Advisors’ Ron Shevlin, as consumers expand the number of financial institutions they are willing to work with, penetration by challengers grows. “Just 8% of U.S. consumers consider an online bank like Chime or Varo their primary bank. But among consumers with two accounts, digital banks have a 14% market share, and of Americans with three accounts, they’ve captured 17% of the pie.”

Read More: Buy Your Own All-Digital Neobank From a Portfolio of Prepackaged Brands

Challenger Banks Have Significant Cost Advantage

Challenger banks have a significant advantage from the start because of their underlying infrastructure, which differs significantly from most traditional banking organizations. The vast majority have shifted the consumer and business value proposition from branches to their API layer, using a Banking-as-a-Platform model and cloud-native technology. This allows for reduced costs and increased flexibility.

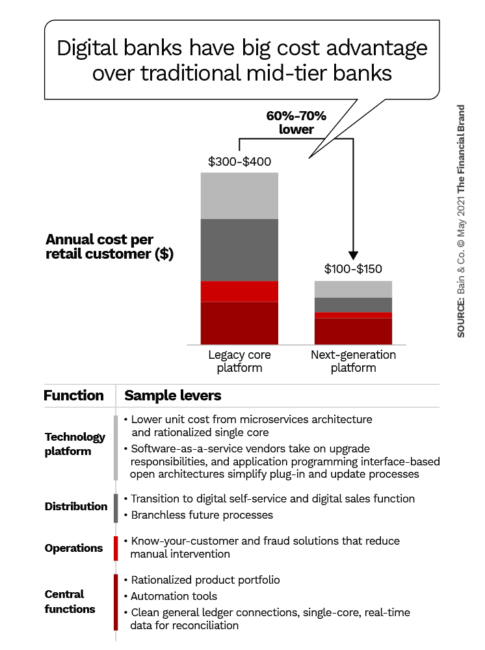

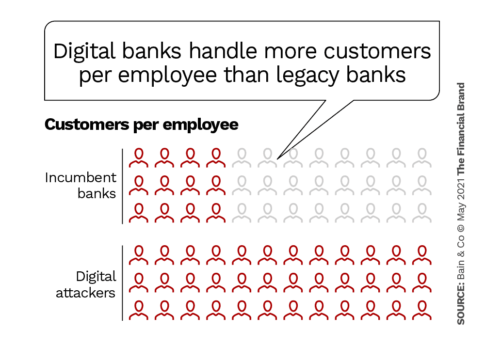

According to Bain & Company, a digital bank launched on cloud platform could have a cost base that is 60% to 70% lower than a mid-tier legacy bank. This allows digital-only challenger organizations to serve two to three times as many customers per employee. This is important, especially since many challenger organizations do not yet have the scale or revenue per customer that traditional banks enjoy. While most start-up fintechs do not yet generate a profit, having a much lower cost structure (from both a back-office and cost of delivery perspective) allows them to break even at a much more modest level of market penetration.

From a monetization perspective, many digital challengers have had success by focusing on a narrow product line or specific customer segment that can be provided a differentiated offering with clear value proposition. For instance, challengers have delivered a market leading pricing (no fees or higher deposit interest rate), unique delivery (buy now, pay later instant credit or Acorns auto investment transfers), or simple daily life integration (PayPal payments).

Challenger Banks Deliver Superior Customer Experiences

By leveraging more narrow targeting than most traditional banks and credit unions, challenger banks differentiate themselves by using personalized insights, advanced analytics, unique digital delivery models and minimized friction. This often results in a heightened customer experience. From a user perspective, neobank solutions appear more interested in the needs of the customer than the bottom line of the organization.

Some customer experience enhancements highlighted by Strands include:

- Smart money management integrating spending and saving analysis, control functionalities and send push notifications on accounts activity.

- Use of data, applied analytics and AI to provide greater levels of personalization and to enable faster response to customer behaviors. This can range from fraud and risk detection to instant offerings of credit or balance transfers based on customer behavior.

- Lower or no fee models made possible by the combination of lower costs or operation, revenues from open banking solution partners are greater emphasis on interchange.

Read More: Do Fintechs Scare You As Much As They Do These CEOs?

Community Bankers’ Top Priorities This Year

CSI surveyed community bankers nationwide to learn their investments and goals. Read the interactive research report for the trends and strategies for success in 2024.

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

Challenger Banks Simplify Engagement

With a digital-only proposition, challenger banks begin and continue the engagement online or with mobile technology. Despite having similar compliance guidelines, neobanks have a vastly simplified new account opening process and the simplicity of engagement continues throughout the entire customer journey. As opposed to an average account opening time at legacy financial institutions of 10-15 minutes (or longer), opening a new relationship at a challenger organization rarely exceeds two minutes.

In most instances, the majority of needed information is available for validation as opposed to requiring manual entry. This not only makes for an improved customer experience, but also eliminates the massive process abandonment that most traditional financial institutions experience.

Many challenger banking organizations have also leveraged the ability to embed banking into everyday behaviors or with other financial and non-financial organizations. This allows for simplicity of engagement as well as product cross-selling. And all of this integration is offered 24/7 because the deployment of services is not restricted to traditional branch hours. It occurs in real time.

Potential Responses for Traditional Banks and Credit Unions to Consider

The banking industry competitive battlefield has been altered significantly, and it will not return to the “good old days.” In fact, the change we are seeing will never happen this slowly again. So, legacy financial institutions need to respond … quickly.

All financial institutions will need to build their value proposition around the customer, with new business models that streamline back office operations and leverage modern technologies. Banks and credit unions will need to learn from, and respond to challenger organizations in and out of finance immediately. In addition, the competitive set that organizations view must extend beyond geographic boundaries because international players will increase in the future.

Differentiation will be achieved through data- and AI-driven personalization that is deployed from the initiation of the relationship throughout the entire customer journey. Customers will no longer accept generalized banking solutions that are difficult to open or use. In fact, most consumers and small businesses will expect proactive recommendations based on contextual behaviors. They will also expect banking to be embedded within daily activities.

According to Strands, “As banks design and offer intelligent propositions they need to make them accessible not only on their own platforms but also in other ecosystems that their customers are part of.”

Embedded banking, supported by modern technology and enhanced by high levels of insights, provides unlimited opportunities for financial institutions to retain current customers, generate new relationships and deepen the customer journey through the purchase of both financial and non-financial products and services. To do so economically, will require a reduction in operating costs that will necessitate a modernization of back office infrastructure and a move to the cloud.