Disruptive neobanks have sent shockwaves across the financial industry, raising the stakes for traditional banks and credit unions struggling to keep up with digital transformation and consumers’ heightened CX expectations. But now, legacy institutions have a new weapon in their fight against neobanks.

Nymbus, a cloud banking platform provider, has introduced Nymbus Labs, offering a portfolio of prebuilt digital banks, also known as “neobanks” — digital alternatives to traditional banking, without any physical branches.

Built to systematically remove the barriers inherent in digital banking strategies, Nymbus Labs aims to help traditional banking providers radically accelerate innovation initiatives, explains Liz High, EVP/Marketing & Strategy at Nymbus and head of their new Labs division.

With Nymbus Labs, partnering banks and credit unions have three different options:

- Buy – Choose from one of Nymbus’ prebuilt digital niche banks, including business strategy, operational support and a playbook for future growth.

- Build – Retail banks and credit unions can bring their own digital banking model to life working with Nymbus to develop branding and a go-to-market strategy.

- Grow – For financial institutions that have already spun up their own digital bank brand, Nymbus can conduct a thorough, data-driven review and make recommendations for profitable growth.

Nymbus says the cost to purchase one of their prebuilt neobanks is a fraction of the cost of a branch, and immeasurably less than it would cost to build a digital bank from scratch.

Some can be launched in as little as 90 days, and come “incubated” with customers who signed up in a pre-launch period.

Each of the neobanks is built around the Nymbus technology platform, which is intended to run concurrent to whatever legacy tech core an institution may be using already. But High is quick to point out that the underlying tech isn’t what matters most.

“In a digital-as-default world, the new growth model is not about technology or adding more features,” says High. “It’s about understanding the customer and delivering value.”

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

Everything Included: From Branding and Business Plans to Marketing Strategies

Nymbus says it offers a complete turnkey solution, with the people, processes and technologies needed to operate the neobank, including call center support — all available for as long as the purchasing institution wants. Nevertheless, High says most banks and credit unions are choosing to take some- or all of the Nymbus blue print in-house.

Nymbus even offers marketing support for its neobanks, including a business plan, brand strategy, launch planning, segmentation strategies, advertising creative, and content development.

The range of products offered by these fully-functional, prebuilt digital banks include a wide range of features — integration with interactive teller machines (ITMs), “safe-to-save” AI functionality, “round-up” savings tools, personal bankers, loan origination, and modern financial planning tools, among others.

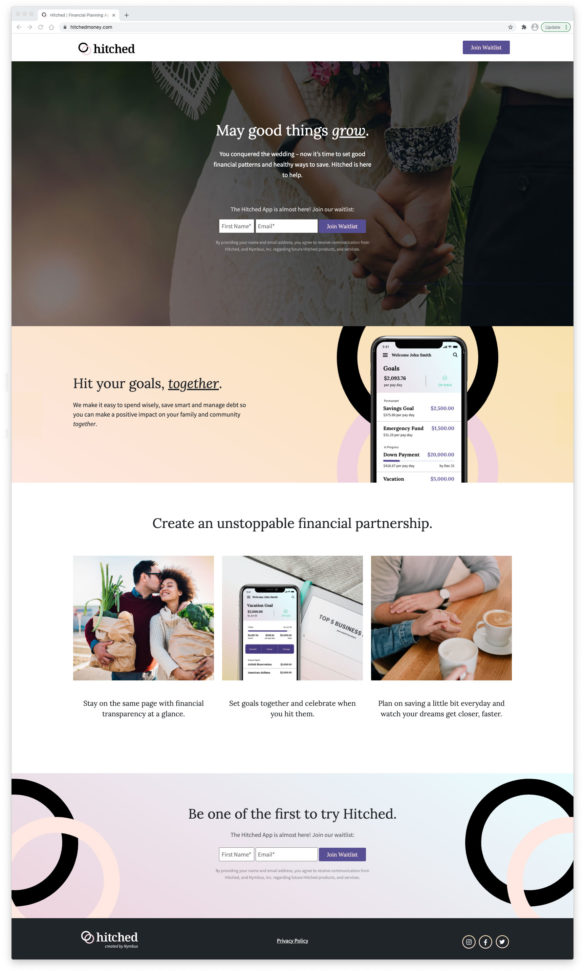

Nymbus’ current portfolio contains at least 14 prebuilt options, according to High. Niches in Nymbus’ portfolio range from Black small business owners and solar lending, to gig economy workers and higher education. The latest addition, Hitched, is tailored for newlyweds and their unique needs. It opened for pre-sign-ups in late March 2021, and is ready for launch.

Nymbus says they have been working with over a dozen banks and credit unions on various neobank models. One of those is TransPecos Financial, a modest and otherwise undifferentiated bank with $472 million in assets and three branches. Working with Nymbus, TransPecos rolled out a unique national digital banking brand focused on lending to physicians. Dubbed BankMD, President Moses Luevano says the new neobank has been “ridiculously successful,” blowing past all its goals.

“Challengers don’t own digital,” says Jeffery Kendall, Chairman and CEO of Nymbus. “Growth opportunities exist for any size financial institution willing to innovate beyond the boundaries of traditional banking and strategically compete in new niche spaces, spur disruptive growth, and build lifetime value for customers.”

Read More:

- How Financial Marketers Can Punch Back at ‘Consumer-Friendly’ Neobanks

- Who Wins the UX Arms Race: Traditional Banks or Neobanks?

Digital-Only Challenger Banks: An Existential Threat to Traditional Institutions

Chris Ward, principal consultant at Mapa Research/Informa, says neobanks have had a big impact in moving the goal posts in terms of what consumers expect from their banking providers. This has forced legacy banks and credit unions to accelerate their digital transformation strategies.

Unfortunately, the pace of change is too much. “Big banks have caught up, but many smaller institutions haven’t,” Ward explains. As a result, some traditional banks will disappear or be acquired.

Key Fact:

Globally, the neobank market is valued at $34.8 billion and is forecast to grow at a compound annual rate of 48% from 2021 to 2028, according to Grand View Research.

Research from Cornerstone Advisors estimates that roughly 3.25 million accounts have been opened across the seven leading U.S. neobanks thus far. Total deposits amount to approximately $1.68 billion, equal to a mere 0.014% of U.S. deposits. While that might not seem like much today, neobanks are growing at an exponential pace. In fact, research from A.T. Kearney projects that one in ten European banks will disappear by 2026, as neobanks continue to steal more and more market share.

Analysts with PwC suggest the market for banking services could exist without traditional banks by as soon as 2025. While most experts agree that it will likely take longer — until 2030 or later — the challenges to existing banking providers’ business models will only magnify as the barriers to entry for non-banks erode.

“The most likely scenario is that every country will have at least one or two neobanks serving retail and business segments,” says Christoph Stegmeier, Managing Partner of Exton Consulting. “These will achieve parity, reaching eye level with those countries’ leading banks in terms of both client numbers and profitability.” However, like others, he doesn’t foresee that happening in most countries until 2026 or beyond.