Digital transformation remains a high priority in the banking industry for a number of reasons. The primary one is that it can help banks to improve the efficiency and effectiveness of their operations. By streamlining processes and automating tasks, financial institutions can improve the ability to be future-ready and to be able to improve customer and member experiences.

Additionally, digital banking transformation can help banks and credit unions to better compete in a rapidly changing financial ecosystem. In recent years, the banking industry has faced increasing competition from fintech companies and other non-traditional players, including big tech organizations. By embracing digital technologies and processes, financial institutions can improve their offerings and how they deliver services.

Finally, digital banking transformation helps financial institutions reduce costs and increase profitability. By automating processes and leveraging modern technologies, including automation, bank institutions can reduce their reliance on manual labor and lower operating costs. This helps maintain healthy margins, redeploy human and monetary assets, and stay competitive in a challenging market.

The questions become:

- What stage are financial institutions in their digital banking transformation journey?

- What are the digital banking transformation priorities for 2023?

- What stands in the way of updating back offices for improved top-of-glass experiences?

Read More:

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

Digital Banking Transformation Maturity

Financial institutions have made significant progress in their digital banking transformation journeys, but the level of maturity varies. Some organizations have fully embraced digital technologies and have implemented a wide range of digital solutions, while others are still in the early stages.

As with much of the change taking place within the financial services industry, the best results and highest level of maturity have been present at the largest financial institutions. Modest success has also been seen at the smallest banks and credit unions, while most midsized firms ($10 billion – $100 billion) have been lagging the industry as a whole.

Digital Banking Transformation Imperative:

Financial institutions have made significant progress in their digital banking transformation journeys, but the level of maturity varies among institutions based on size, commitment to change and investment levels.

There are several factors that can influence the level of maturity of financial institutions in their digital banking transformation journey. These include the size and complexity of the organization, the level of investment in digital technologies, the level of regulatory compliance already in place, and the level of customer demand for digital banking capabilities.

The good news is that there are a multitude of options available to work with third-party providers that can deploy digital banking transformation solutions faster than can be done if developed internally. Incumbent institutions can also partner with fintech and big tech competitors while modernizing their systems and processes at the same time.

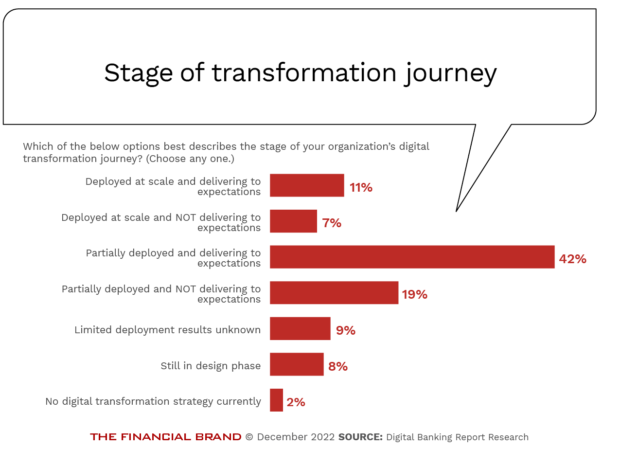

When Digital Banking Report asked financial institutions worldwide about their level of digital banking transformation maturity, we found that 18% of institutions believed their solutions were deployed at scale, with 61% stating that their solutions were partially deployed. Of concern was that 38% of organizations that believed they had deployed digital banking transformation solutions at scale were not receiving the level of results expected. Similarly, 31% of organizations with partial deployment had not received the results expected.

In many cases, the lack of success can be attributed to a lack of pre-planning of initiatives with a focus on results desired. In some cases, there was not an adequate level of investment made in the desired solution.

At every level of digital banking transformation maturity, financial institutions are increasingly recognizing the importance of digital banking transformation strategies to become future-ready. Many financial institutions have invested heavily in digital technologies in recent years and are actively working to improve the customer experience through the use of digital channels. However, there is still a significant amount of work to be done in order to fully realize the benefits of digital transformation.

Digital Banking Transformation Trends

As we enter 2023, there are several underlying trends impacting the prioritization of investment and the progress made in digital banking transformation. One of the biggest underlying trends is the continued growth in the use and customer expectations around digital banking. As more and more consumers embrace smartphones and other mobile devices, banks are increasingly focusing on developing mobile-first strategies and offering services optimized for mobile users. This includes capabilities such as mobile payments, mobile check deposits, and other features that make it easier for customers to manage their finances on the go.

A trend that is receiving a great deal of attention, but is still very challenging for organizations to embrace and deploy, is the use of artificial intelligence (AI) and machine learning. Beyond using AI and machine learning to enhance cybersecurity and reduce fraud, banks and credit unions are using advanced analytics to improve the accuracy and efficiency of operations and to provide personalized experiences for customers. This includes providing time-sensitive personalized product recommendations to customers to improve financial wellness.

Key Digital Banking Transformation Trends:

The focus of digital transformation revolves around the customer journey and the need for increased engagement in a safe and secure environment.

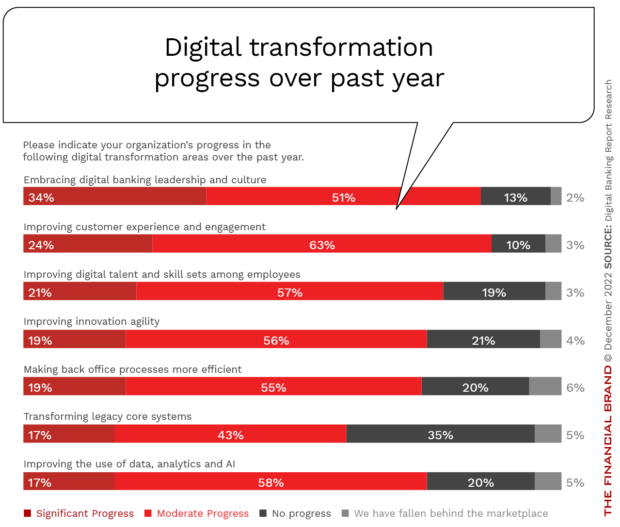

When Digital Banking Report asked global banking executives about their digital banking transformation progress in the past year, the greatest progress was around leadership support of digital transformation efforts (34% with significant progress) and improving the customer experience and engagement (24% with significant progress). Interestingly, the lowest level of progress was in the area of transforming legacy systems (60% having moderate (43%) or significant (17%) progress).

It was encouraging to see that, while the improvement in the use of data, analytics and AI was not as high as expected, 75% of organizations stated they had made moderate or significant progress.

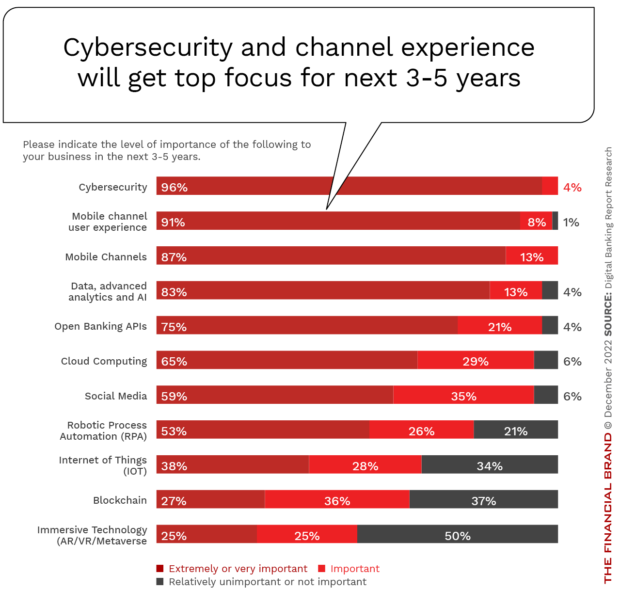

When DBR asked global financial institution leaders what digital banking transformation areas of emphasis would be extremely or very important in the next three to five years, cybersecurity (96%), mobile experience (91%), mobile channels (87%), and data and analytics (83%) were the top priorities. As more and more financial transactions are conducted digitally, it is becoming increasingly important for banks to prioritize security and protect their customers’ data from cyber threats. As a result, financial institutions are investing in advanced security technologies, such as encryption and biometric authentication, to keep their customers’ data safe and secure.

Another area of primary focus was open banking. Open banking has the power to enable banks to offer more innovative products and services to their customers, as well as to better compete with fintech companies and other non-traditional players in the market.

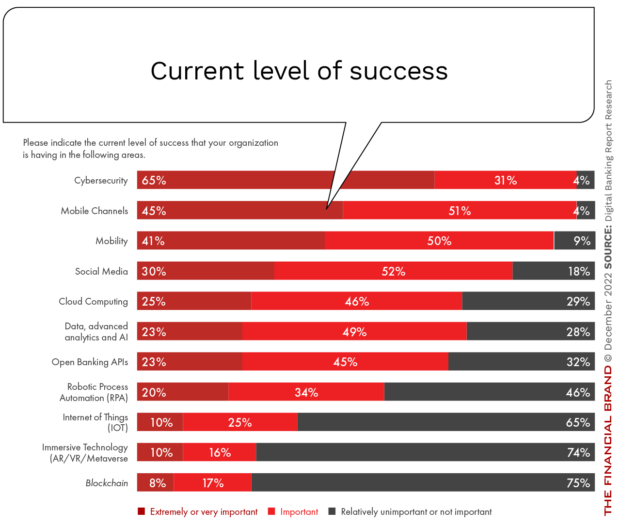

When DBR asked financial institution executives about the success of their digital transformation efforts, organizations overwhelmingly believed their efforts in cybersecurity and supporting digital channels were the most effective. There was significantly lower consensus on the success achieved in the use of social media, the deployment of cloud computing, the use of data, AI and advanced analytics, and the success with open banking APIs.

Overall, these areas of focus and components of success indicate that the digital banking space will continue to evolve and change in the coming years. Banks that are able to adapt to these changes and leverage emerging technologies will be best positioned to succeed in this increasingly competitive market.

Challenges to Digital Banking Transformation Success

In research conducted by DBR, there are several major challenges that financial institutions face as they embark on their digital banking transformation journey:

- Cultural resistance to change: Digital banking transformation requires significant changes to the way an organization operates, which can be difficult for existing leadership and current employees to accept. In both our research and in interviews done for the Banking Transformed podcast, we have found that it can be challenging to get everyone on board with the changes needed for the future and to ensure that the entire organization is aligned with the digital transformation strategy.

- Limited resources: Financial institutions may struggle to allocate the necessary resources to support digital transformation initiatives, especially during times of economic uncertainty. This becomes more challenging when significant investments in technology or training are required.

- Complexity: Financial institutions often have legacy systems that are mired in past business strategies. Frequently they are difficult to integrate with newer digital technologies. This can make it difficult to implement new digital solutions unless the solutions are integrated incrementally. This can introduce new complexities.

- Data and security concerns: As banks and credit unions managed more and more data, concerns about data privacy and security grow. Ensuring the security of this data is imperative, but it can also be a challenge as organizations implement new digital technologies.

- Regulatory compliance: Financial institutions must adhere to complex and ever-changing rules. They become more challenging as organizations implement new digital banking transformation technologies.

Overall, financial institutions must be strategic and proactive in addressing these challenges as they work to transform their internal and external operations through the use of modern digital technologies.

Rethinking Existing Business Models

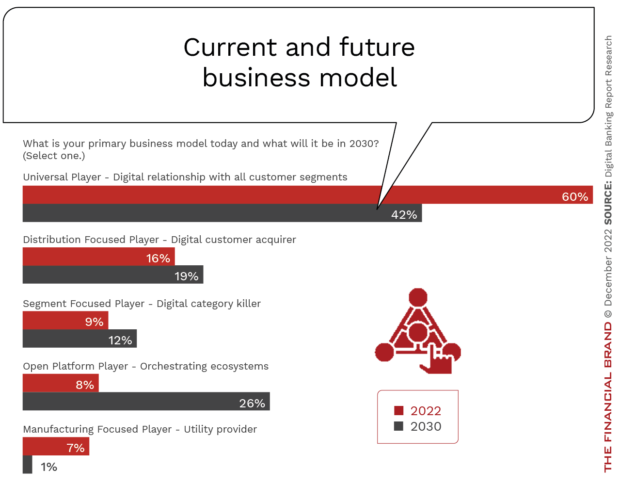

As digital banking transformation occurs, financial institutions must consider changing their existing business model to meet the needs of a changing marketplace and to remain competitive as new players enter the marketplace. When we asked financial institutions worldwide about their existing and future business model, the biggest change was in the reduction of organizations that believed they would be a universal player in seven years (from 60% today to 42% in 2030).

The biggest shift in business model deployment was the expected increase in open platform players (from 8% to 26% of financial institutions in 2030). This could result in diversification of product offerings by banks and credit unions. Organizations can change up their product offerings by offering a wider range of financial products and services, such as wealth management and investment services or by serving additional customer segments.

Major Shifts in Banking Business Models:

Financial institutions are rethinking the value they provide the marketplace and the best way to deliver this value at scale. The business models of many financial institutions will undergo massive change in the near future.

There can also be modest modifications to existing business models in order to respond to a changing market. As more people conduct financial transactions digitally, banks and credit unions could resell their digital banking capabilities, such as mobile banking, digital account opening and digital payment options, to other legacy banks or alternative providers.

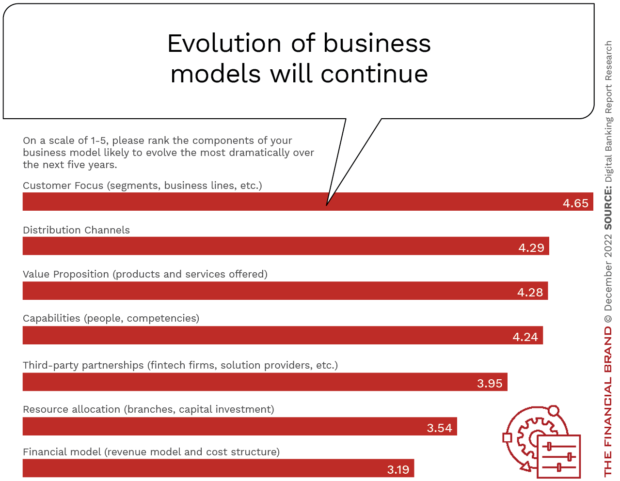

It is clear prioritizing the customer experience will be at the foundation of the evolution of business models going forward. Banking institutions will focus on improving the customer experience by offering personalized services, improving the value proposition, simplifying the distribution channels, and using technology to make banking more convenient and efficient.

Overall, the key to successfully rethinking a banking business model will be to stay attuned to the changing needs and preferences of customers, and to be open to exploring new opportunities and technologies that can help the business stay competitive and relevant at a time of ongoing change.

As financial institutions prioritize digital transformation initiatives, they must take into account the integration of the following megatrends:

- The growing importance of mobile devices and the increasing adoption of e-commerce.

- The importance and impact of social media in marketing and customer engagement.

- The threat of cybercrime and importance of cybersecurity.

- The benefits of big data, artificial intelligence (AI) and machine learning, and the value of the democratization of insights.

- The potential of cloud computing to improve speed, scalability and efficiency.

- The changing nature of work, both on employees and customers.

- The future of emerging technologies such as the internet of things, virtual and augmented reality, and Web3 and the vision of the metaverse.