In recent research by the Digital Banking Report, close to 90% of organizations indicated that they have increased their focus on digital banking transformation since the pandemic, with over 60% indicating that they had established new partnerships and alliances with either fintech firms or third-party solution providers. Despite this increased attention to digital transformation, however, the vast majority of financial institutions globally have concern about their organizations’ ability to respond to the digital and technological prowess of large legacy banks, fintech providers or big tech competitors.

The question becomes, will traditional financial institutions do what is required to respond to new marketplace norms, or will they fall further behind? Put more simply, will banks and credit unions put themselves in a position to survive and thrive in a new digital banking ecosystem?

Balancing Act:

Organizations must balance today’s immediate needs against the need to be agile and resilient in the future.

While there is agreement that digital banking transformation is required, the playbook for success is less defined. Financial institutions of all sizes must prioritize digital transformation strategies that address existing shortfalls, while building a platform for future innovation and competitive advantage. This requires changes in back office processes, infrastructure, legacy culture, and in the skills and talents needed to execute new business models.

Just as importantly, organizations need to improve data and advanced analytic maturity to enable the deployment of real-time insights for decision making and enhanced experiences across the customer journey. For most organizations, this will require moving to the cloud and rethinking of how data is collected, managed, deployed and used.

Read More:

- The 6-Step Survival Guide to Digital Banking Transformation

- How to Avoid Digital Transformation Failures in Banking

- Digital Transformation Requires More Than Technology Upgrades

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

The Need for Speed at Scale

One of the biggest challenges for banking leaders is how to plan and execute new digital banking transformation initiatives quickly and at scale. With the dynamics of what the customer expects – and what is possible – accelerating every day, it is exceedingly difficult to build for the future when needing to deal with the present.

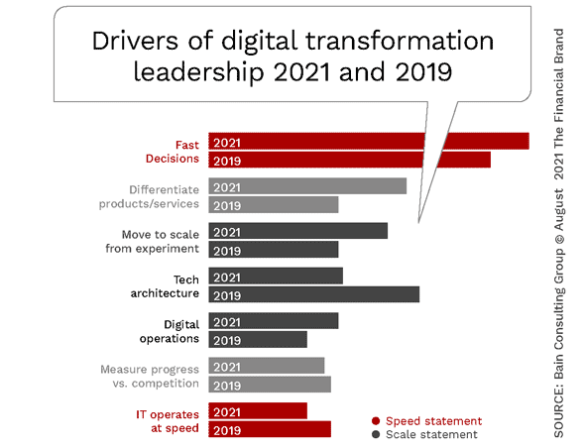

Three years ago, when Bain & Company asked organizations what it took to establish digital leadership, the focus was on making faster decisions and executing quickly to create differentiated offerings. In an updated survey, there is a growing realization that speed on its own isn’t enough. While speed remains essential, capturing the full value of digital transformation involves scaling a company’s best initiatives across the organization for broad impact.

According to Bain, “The advantage that digital disrupters such as Amazon or Tesla have over incumbent companies is that they were built for purpose. Not only is their underlying tech infrastructure tailored specifically to their digital ambition, but so is the way they operate, how they make decisions, and the way they use technology in their everyday approach to business.

Rebuilding the Foundation:

Unlike digital-first competitors, legacy financial institutions must rebuild existing infrastructure for a digital future.

Many financial institutions have done a really good job with the deployment of new digital capabilities such as improved digital account opening, digital PPP loan deployment and adjustments to operating models. The challenge is that to actually create digital experiences and leverage real-time insights, most banks and credit unions need to deal with outdated systems, siloed data, highly fragmented processes and other dynamics that slow down the transformation process.

“Competing in a digital world ultimately means transforming both hard capabilities (the tech stack) and soft capabilities (the operating model) to create a business environment in which change can take root at scale and strategy is fully enabled by digital technology,” states Bain.

These challenges are made more acute as financial institutions reevaluate how, where, and by whom work is done. In the 2021 Deloitte Global Human Capital Trends survey, 72% of respondents identified the ability of “people to adapt, reskill, and assume new roles” as one of the most important factors to navigate future disruptions. In other words, digital banking transformation also involves people and a leadership and culture shift.

Executing Digital Transformation

It is clear that the vast majority of financial institutions will require a partnership with fintech firms and third-party solution providers to successfully transform legacy banking. The key will be the ability to focus efforts and execute as efficiently as possible. This involved the determination of what parts of the current business model remain in place and which need to be transformed. It also involves a prioritization of initiatives and looking beyond existing paradigms to accelerate change.

Partnerships for Progress:

Most banks and credit unions are leveraging partnerships with fintech firms and third-party solution providers for speed of innovation and digital execution.

Deloitte suggests five key areas of focus when executing digital transformation:

1. Assume a hybrid workforce. By adopting a virtual-first or hybrid workforce, organizations can determine where physical engagement may be required and when it can be optional. This also will help determine the technologies and workflow required to support a hybrid workplace and workforce. While there is still a lot to be answered with regard to the impact of a workplace reconstructed, no digital transformation effort can progress at both speed and scale without addressing how people will engage with each other.

2. Move to the cloud. Extending current data processing architecture to the cloud allows for greater standardization, automation, and scalability while enabling agility. With the importance of both data and advanced analytics only increasing, the use of the cloud is a necessity. According to Deloitte, “The full value of the cloud is not only efficiency—it’s about amplifying innovation and flexibility as well.”

3. Automate to enhance humanization. AI and machine learning are quickly making banks and credit unions more efficient and more effective. By automating operations that are repetitive, high volume and require little human interaction, firms can redeploy human resources to improve customer interactions, innovation, and competitive differentiation. A major ancillary benefit is that automation of more mundane tasks also increases employee satisfaction.

4. Amplify innovation. With a move to the cloud and increased automation, data and analytics have an increased potential to assist with R&D at a speed and impact only once imagined. Real-time data analytics and AI also allows for more accurate and immediate prototyping and testing while lowering risk. Finally, using the technologies available allows for the entire organization to participate in the innovation process.

5. Become a digital transformation leader. Financial institutions that move towards being a digital banking transformation leader create a halo effect for their solution providers, partners and even within the organization to accelerate change across the ecosystems. Rather than being pushed by outside organizations, leaders can be the force of change for others.

In the end, effective execution will require data and analytics as a foundation as well as the leadership, talent, and partnerships that embrace change, are willing to take risks and will disrupt themselves for a digital future. While certainly disruptive, the pandemic created great opportunities, removed some tentativeness at many organizations and provided a vision for what is possible.