Most financial institution executives agree that the purpose of a digital banking transformation strategy is to leverage technology and improved processes to deliver an exceptional user experience. Optimally, the end-users would include both customers and employees, with the interests of both internal and external constituencies being considered in the development and deployment of the digital banking transformation roadmap.

What most banks and credit unions often do not understand, however, is that digital banking transformation does not have an end point, since the process is evolutionary, with new technologies, processes, consumer expectations and competition impacting what is required to succeed. According to the MIT Sloan Management Review, “Digital transformation is the continual adaptation to a constantly changing environment.”

Despite an overwhelming awareness of the importance of becoming a more digitally adept organization, the ability to act on this awareness continues to be a challenge for most financial institutions. Beyond the investment in, and the deployment of, digital technologies, financial institutions must have the leadership and culture to enable organizational change.

According to the Digital Lending and Account Opening report, published by the Digital Banking Report, some financial institutions have successfully used digital technologies to improve parts of their business. Some organizations have even recognized the need to fundamentally change the way business is done, and have discovered new avenues of value creation – both through cost reductions and revenue opportunities.

Read More:

- How to Avoid Digital Transformation Failures in Banking

- Digital Transformation Requires More Than Technology Upgrades

- Banking Must Bridge the Growing Digital Transformation Skills Gap

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

The Keys to Digital Banking Maturity

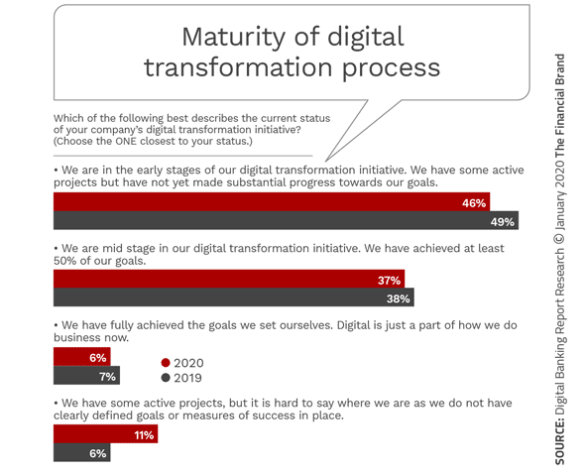

Despite the success stories where some organizations almost instantly enabled digital functionality, many banks and credit unions have not been able to embrace the true potential of digital banking transformation. In fact, even after many institutions introduced new digital banking capabilities as a result of the shutdown of physical facilities brought by the COVID pandemic, fewer organizations rated themselves as mature in digital banking transformation.

This lack of digital transformation maturity has resulted in a widening of the gap between the capabilities of digital transformation leaders and those of their less capable competitors.

To achieve digital maturity, organizations must focus on the essential components of digital transformation success. The foundation (and most important component) of this success is an executive leadership commitment and a culture that shifts the way an organization thinks, works, and manages in response to digital trends in the banking ecosystem.

- Data and Analytics Leadership — Real-time customer intelligence is enabling highly personalized interactions and making it possible to deliver accurately focused, proactive offers as well as data-driven decision making.

- Enhance Customer Experiences — Understanding the customers’ perspective is more important than ever as more consumers embrace digital technology. The three elements of the customer experience include experience design, customer insight, and emotional engagement.

- Foster Innovation — Digital technologies provide the opportunity to catalyze innovation and reimagine both the present and the future. Innovation can be deployed internally, with partners or purchased from third parties.

- Leverage Modern Technologies — Digital technology is creating new business model opportunities including digital enhancements to current offerings, insight-based service extensions, and expanded platform ecosystems.

- Upgrade Systems and Processes — Most financial institutions still need to modernize their core systems, applications, and data structure that supports business processes. Even without system upgrades, back-office processes must be streamlined, simplifying customer experiences and creating business models that competitors cannot copy.

- Make Employees ‘Digital-Ready’ — Employees can be either the greatest inhibitors or the greatest enablers of transformation success. As a result, financial institutions are increasingly focusing on the employee training and experiences as intently as they do on the customer experience.

The Journey to Digital Banking Maturity

Financial institutions need to shift their thinking from a focus on digital transformation being a destination to being a journey where digital maturity is achieved across many parameters. There are many benefits to breaking down digital transformation into different components and assessing the maturity of an organization within these components.

First, no organization can adequately tackle all of the areas that comprise digital transformation at once. And even if this was possible, organizations will realize that their maturity level in any area differs based on business objectives, investments made, and marketplace dynamics. For instance, while a financial institution may be a leader in leveraging data and advanced analytics, they may still have an outdated core system or lack an innovation spirit within the organization.

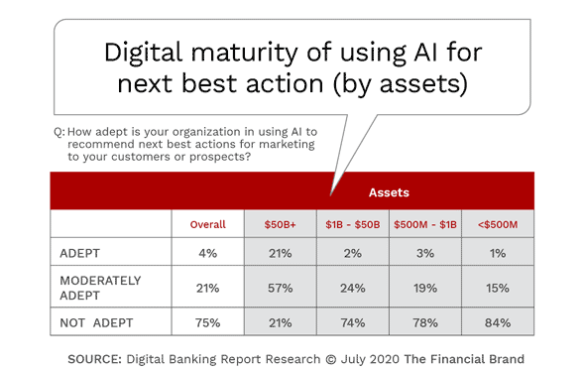

The Digital Banking Report entitled, State of Financial Marketing, found that despite significant efforts to improve the use of data and analytics to drive an improved customer experience, the majority of financial institutions (75%) consider themselves inept at deploying the most basic proactive recommendations around next most likely product. This is usually considered the most basic level of data maturity.

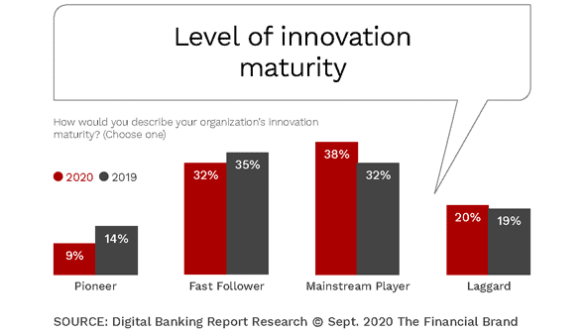

In addition, the Innovation in Retail Banking 2020 report found that the innovation process at financial institutions globally also regressed since the pandemic, despite many advances made with new products and processes. This was because the marketplace expectations increased significantly during the pandemic.

Read More:

- What The Most Innovative Leaders in Banking Have in Common

- Rethinking Innovation, Leadership and Marketing in Financial Services

The Benefits of Recognizing Digital Banking Transformation As a Journey

The Digital Banking Report has found that there is a direct link between greater digital banking maturity and superior financial performance. The research also found a correlation between digital transformation maturity, innovation maturity and data maturity within financial institutions. In other words, when the leadership and culture of an organization illustrates commitment to digital maturity, all components of digital transformation improve.

Improving the components of digital banking transformation delivers a multitude of business benefits that contribute to improved financial performance, including efficiency, higher customer satisfaction ratings, revenue growth, improved product quality, increased employee engagement and reduced cost of service delivery.

In addition, financial institutions with higher digital maturity tended to be much more focused on innovation, customer experience, employee satisfaction and growth than less digitally mature firms. Organizations with lower digital maturity tended to focus more on benefits such as cost reduction and efficiency improvements. These banks and credit unions also focused more on lowering the cost of customer acquisition than on the growth of customer relationships and lifetime value.

Digital banking transformation is a highly overused term in banking. But its impact has never been more important. The research from the Digital Banking Report supports the reality that an organization-wide effort to improve the components of digital banking transformation can deliver a business and financial benefits.

In the report, Using Data to Drive Improved Customer Experiences, it was found that investments in digital banking transformation are continuing to rise. The benefit of a strong digital banking transformation process is that it has the potential to be self-funding, reducing costs through efficiency initially, then paying off in improved experiences driven by innovation, personalization, employee satisfaction and growth. But the benefits are not achieved overnight. Understanding the importance of the journey and the maturity model that supports this journey is important.

As written by Gerald C. Kane in the MIT Sloan Management Review, “No child grows up overnight — and no organization can become digitally mature overnight, either. Even though different companies may be at different stages of digital maturity, there are always ways that they can continue to grow and adapt in order to become more digitally mature.” He continues, “It is never too late to begin becoming more digitally mature, and the process is never complete.”