To succeed in the future, financial institutions must embrace a culture of innovation that reinforces the process of digital transformation. To accomplish this, a bank or credit union must have strong leadership, openness to experimentation and risk, willingness to challenge the status quo, and solid business strategy that “pushes the limit” of what can be possible with modern technology. Most importantly, the institution must possess an overarching focus on the customer.

Complacency continues to be one of the biggest challenges to becoming an innovative organization. It arises when strong revenues are being delivered, existing customers are not complaining, and shareholders are happy. (“If it ain’t broke …”) This is a dangerous scenario, however, since despite these positive indicators, we have also seen advanced digital technology being introduced, the competitive battlefield intensifying and the metrics for success shifting.

Today, small fintech and large technology organizations have found ways to reduce costs, improve back office operations, deliver a better customer experience and create banking solutions never before imagined. Unlike the iterative innovations from the past, a premium is now being placed on “big ideas,” agility, and real-time application of data for personalized contextual experiences.

To support an innovative culture in the digital era, there is a need for interdepartmental cooperation, the breaking down of legacy product silos, the creation of ideas and solutions at all levels of the organization, and a willingness to collaborate on innovations outside the organization. There must be an increased acceptance of risk taking and experimentation. Institutions must focus on the agile iteration of ideas in place of the traditional, lengthy, over-structured “conversion” mentality.

With advanced technology applications like AI, machine learning, the Internet of Things (IoT), robotic process automation, voice, the cloud and blockchain, leading innovative organizations must find new ways to use data to create a sustainable future at a time of digital disruption. And this must be done while we are on the brink of a global digital talent shortage.

Now more than ever, we have a need to upskill and reskill existing workers, while embracing a new generation of workers who have been immersed in digital technology since birth. The future will most likely not see machines replace humans, as much as a machine’s analytical power being combined with a human’s creative power to provide a platform for innovation and digital transformation.

Now more than ever, we have a need to upskill and reskill existing workers, while embracing a new generation of workers who have been immersed in digital technology since birth. The future will most likely not see machines replace humans, as much as a machine’s analytical power being combined with a human’s creative power to provide a platform for innovation and digital transformation.

The Innovation in Retail Banking 2019 report, published by the Digital Banking Report, and sponsored by Infosys Finacle in cooperation with Efma, found many characteristics that differentiated innovation pioneers from organizations less prepared for the future. This report, which is available at no cost ($495 value) provides guidance to organizations hoping to improve their innovation readiness.

Read More:

- Do Banking Execs Have It All Wrong With Innovation Labs?

- The Best Global Innovations in Retail Banking

- Innovation Causing Consumers to Switch Banks

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

This webinar will offer a comprehensive roadmap for digital marketing success, from building foundational capabilities and structures and forging strategic partnerships, to assembling the right team.

Read More about Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

Are Financial Institutions Innovating Fast Enough?

In research done over the past five years by the Digital Banking Report, we have found a trend towards overstating the proficiency of delivering against digital transformation capabilities. From the ability to leverage advanced analytics to offering digital functionality, financial institutions usually rate themselves higher than consumers or analysts would do when we dig deeper into the realities of digital banking readiness.

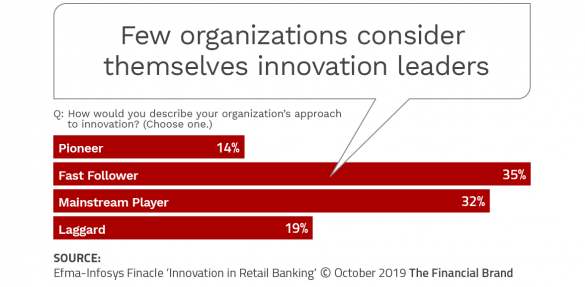

With this in mind, when we asked over 350 organizations worldwide to classify themselves on a scale of innovation readiness, only 14% consider themselves “innovation pioneers.” Among the rest, 35% say they are “fast followers” and another 32% considers themselves to be “mainstream players.” While these findings are not encouraging from a perspective of digital transformation, it is even more concerning if these are overstated.

Beyond that concern is this: Being a “fast follower” may no longer be as strategically sound as it used to be. The fast follower needs to take into account a constantly changing market. If needs are constantly changing, being a fast follower may mean that an organization’s innovations are almost always considered “late” or possibly even “unresponsive” in a digital marketplace.

This is especially true when a competitor or new product enters the market and shakes things up. For instance, when Venmo and Square changed the P2P payments market, consumer sentiment had already shifted towards these solutions before any viable competitive product was introduced by the legacy banking organizations.

In the areas of payments, digital lending and small business banking innovation, a small loss in market share can be disastrous. And if a consumer or small business embraces a new product, how likely will it be for the consumer to switch their business back. Bottom line, a fast-follower mentality may be more risky than at any time in the past.

For Innovation Leaders, Size Matters

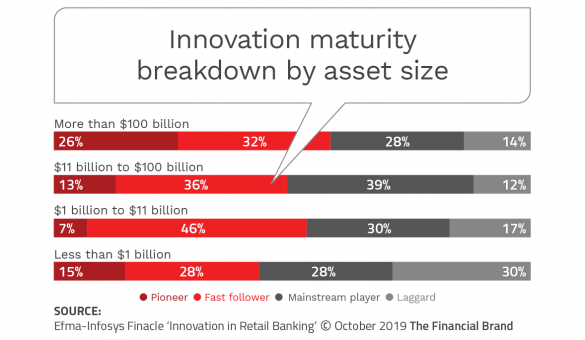

Not totally surprising, larger organizations tend to consider themselves more innovative than their smaller counterparts. Interestingly, organizations in the $1-10B range have the highest percentage who consider themselves to be a “fast follower.”

While “fast follower” is the second level of innovator after a “pioneer,” there is a large difference between a leader and a fast follower during times of significant transformation – when expectations of the marketplace are changing faster than ever before.

Innovation Leaders are Digital Transformation Leaders

The banking industry has increasingly become aware of the need to “be innovative,” but the importance of innovating as part of digital transformation could never be greater. A Gartner survey entitled, 2018 Strategy in the Digital Era confirmed there are two key ways organizations are innovating to remain competitive:

- Improving existing products and services. Nearly 90% of organizations have digital initiatives focused on improving current products and services.

- Creating new products and services. Over 80% of organizations have digital initiatives focused on creating new products and services.

According to Gartner, “The success of such transformation efforts depends on the degree to which an organization is effective at identifying new opportunities, determining which opportunities to pursue, and adjusting business processes to act on those opportunities. This is what we call their ‘innovation effectiveness’.”

The study found that, compared to organizations with lower levels of innovation effectiveness, organizations with a high level are more likely to:

- Be ahead of peers in using data and technology.

- Have successful digital transformation efforts.

- Meet their employee performance goals.

- Meet their customer satisfaction goals.

- Meet their profit goals.

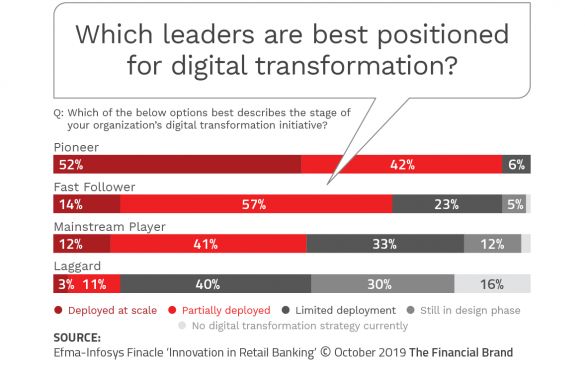

The Innovation in Retail Banking 2019 research found that organizations that ranked themselves as “innovation pioneers” overwhelmingly stated that they had digital transformation efforts that are “deployed at scale.” In fact, an astounding 94% of innovation pioneers indicated that they had digital transformation initiatives that were at least “partially deployed.” This is a full 20% higher than “fast followers.”

Again, while we can certainly take issue with whether or not any financial services organization truly has digital transformation ‘deployed at scale’, there is definitely a difference in the readiness level for the most innovative banking organizations.

Innovation Leaders Deliver Better Customer Experiences

The increasing influence of non-traditional financial services companies has been driven by their ability to leverage new technology and data for an improved customer experience. According to the Innovation in Retail Banking 2019 research, as many as one-third of consumers across the world are now using at least one FinTech app, whether that’s peer-to-peer payments, financial planning, savings and investments, borrowing, or insurance.

Consumers value these apps because they provide exceptional digital-first experiences, and because they seamlessly integrate with other apps that they are using. In other words, the battlefield has changed and legacy banking organizations need to respond.

The most obvious way for traditional financial institutions to respond to new competition is to innovate ‘like a fintech’. While this may not be a ‘build from within’ solution, even a partnering opportunity can move the needle and either retain or acquire customers.

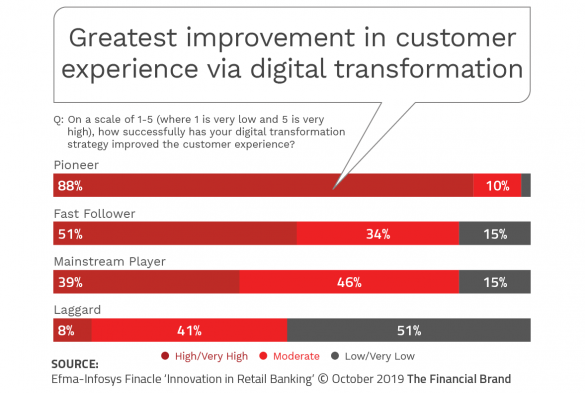

The research done for the Innovation in Retail Banking 2019 report found that the most advanced innovators are acutely focused on improving the customer experience and are seeing results far superior than less advanced innovation firms. In fact, this correlation between innovation and customer experience digital transformation success may be the most important finding in our research this year.

Read More: This Virtual Bank Wants to Be The Engine Behind Fintech Brands

The unfair advantage for financial brands.

Offering aggressive financial marketing strategies custom-built for leaders looking to redefine industry norms and establish market dominance.

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

Innovation Leaders Rely on Advanced Analytics

Innovation and advanced analytics are interconnected. Not only is there an increasing need for data and advanced analytics to support an agile, “always-on” innovation environment, but innovation is improving the use of advanced analytics and AI throughout the organization.

As more components of traditional banking migrate to the cloud and automation assumes more of the traditional repetitive analytic tasks, there is an increasing ability to innovate smaller scale, iterative innovations with fewer people. This not only increases the importance of advanced analytics within the organization, but increases the value of innovations.

Investing in advanced analytics and AI becomes more important as organizations attempt to use innovation to adapt to constant change and try to keep up with the frenetic pace of innovation in other industries that is driving improved customer experiences.

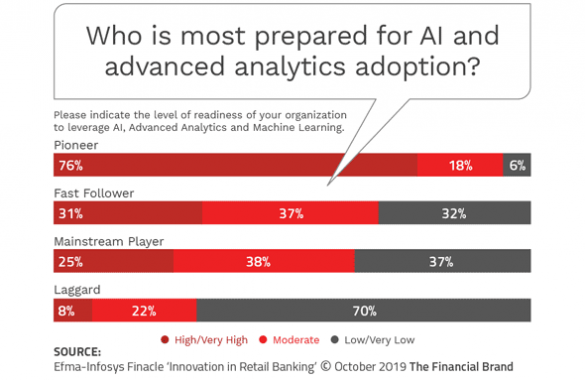

Using this premise, it is not surprising to see that innovation leaders are more committed to the investment in advanced analytics and AI. Not only are they more likely to increase their analytics investment, these firms were also more likely to have significant investments in the first place, and are more than twice as likely to have a high or very high level of analytics readiness.

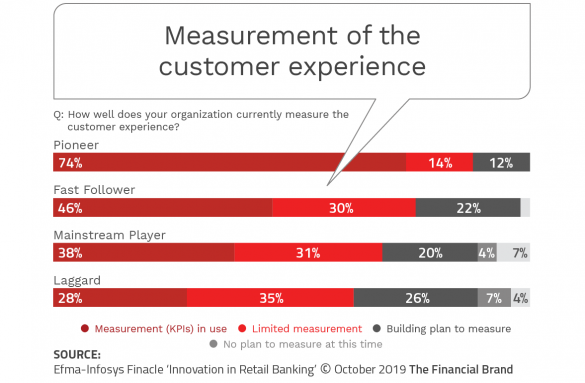

Innovation Leaders Measure Results

The research establishes that innovation leaders have progressed the most with their digital transformation journey, are the most focused on customer experiences, and invest in the deployment of advanced analytics. So it is not surprising that innovation leaders also are the most likely to measure their results. Across all areas of measurement, we found that innovation leaders are committed to measuring if their efforts are successful. They don’t leave the results to chance.

The degree to which innovation pioneers exceed other levels of innovators in their commitment to measurement was a surprise. While there could be a “cart vs. horse” argument made for whether innovators are better at measuring success or organizations that measure success are better innovators, there is a clear benefit to being progressive.

Innovation Leaders Stand Out from Their Peers

Our research found that organizations that considered themselves innovation “pioneers” are significantly different from their less-advanced peers in many ways beyond those described above. Much more than having an innovation lab or hosting a hackathon, innovation leaders have a clearly defined innovation strategy that is well communicated and supported across the organization.

Not only do the leaders and employees know there is the commitment to innovation, so do the organization’s customers. Other characteristics we found to be differentiators of innovation leaders included:

- High-level support: Innovation leaders were more likely to have the highest levels of an organization leading the innovation process. The prevalence of a C-level leader being in charge was greater for innovation pioneers.

- Better Digital Transformation Results: Not only were innovation pioneers further along the digital transformation journey, they were also achieving better results against their strategic objectives.

- Users of Advanced Technologies: Innovation leaders were more likely to be using advanced technologies, including the cloud, voice, the Internet of Things (IoT), etc.

- Prepared for Future of Work: The most advanced innovation leaders had a stronger commitment to retraining current employees as well as using outside resources to meet the future needs from a human resource perspective.

When it comes to the concept of innovation, the gap between aspiration and accomplishment is still very large. There can even be an argument made that organizations have overstated their level of readiness across the board. That said, clearly there are very positive correlations between innovation and the likelihood of business success in the future.

Being serious about building an innovation engine means a financial institution must go beyond simple projects. It must commit to upgrading innovation skills across the organization, establish comprehensive metrics, hold leaders accountable for innovation, and reset the organizational culture to support innovation all the time. The results will most likely do the talking.