According to the Nielsen Financial Track Survey, the top three reasons customers close an account is because of 1) costs/fees, 2) migration to a new market area and 3) a poor customer experience. With only 60% of customers saying they would be very likely to recommend their primary financial service provider, this leaves a large proportion of your customer base at risk. With a heightened need to retain at risk consumers and acquire new ones to replace those lost, understanding channel preferences of the consumer is an important part of the equation.

In the Nielsen report, Channel Effectiveness For Financial Services, it is shown that consumer still do not use any single channel when interacting with their financial institution. In fact, most customers use a multitude of physical and digital channels based on the activity they want to perform. And while banks and credit unions may prefer their customers and members to use the least expensive channel, this may not be the case due to lack of physical or digital convenience.

Digital Shifts in Channel Usage

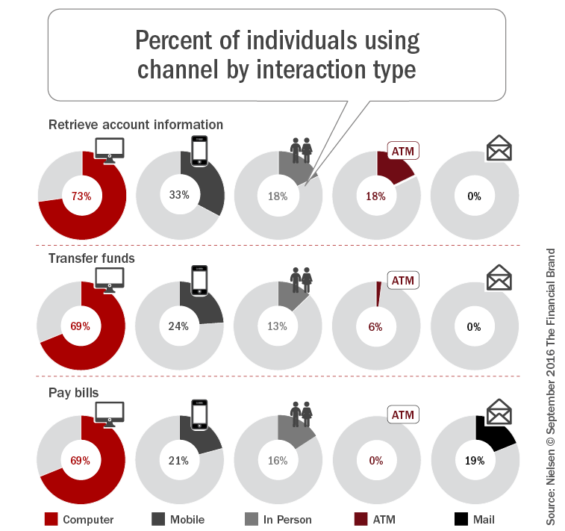

While the movement to digital engagement has been the most successful with activities such as checking balances, transferring funds and paying bills, activities that involve the physical handling of funds or exchange of private information have been slower to gain digital acceptance.

For instance, 73% of consumers are comfortable using their personal computer to retrieve basic account information, transfer funds (69%) or pay bills (69%). Similarly, 33% of consumers use their phone to check balances, transfer funds (24%) or pay bills (21%). These numbers are significantly higher than the interactions at the branch level, ATM or by mail.

The impact of this channel shift is most evident in the net change in physical branches. According to SNL Financial, major financial institutions (not including credit unions) opened 1,023 new locations and closed 2,464 locations from April 2014 to March 2015, for a net decrease of 1,441.

Read More:

- Digital Channels Delight, While Branches Struggle for Relevance

- How Digital Investments Are Changing the Face of Banking

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

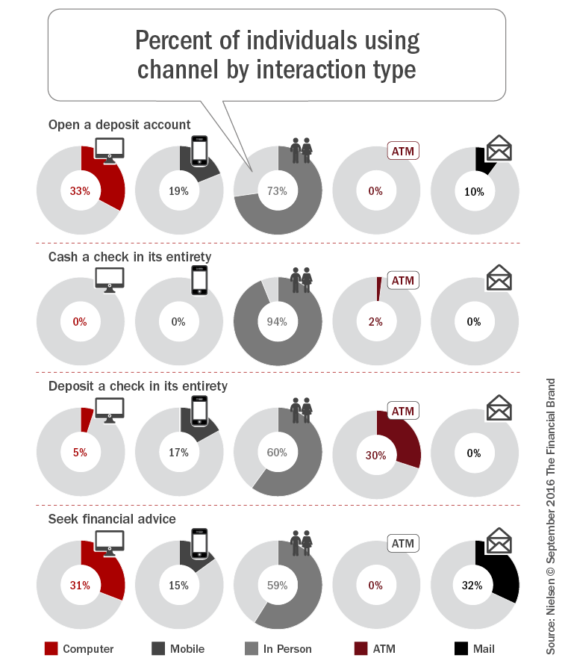

Consumers Still Attached to Physical Channels

Part of the reason physical branches remain open is because of the preference of consumers to continue to use branches for activities such as opening an account, cashing or depositing checks and seeking financial advice. As we have noted in previous articles, the reliance on branches should be taken with a grain of salt since many institutions have made the process of opening accounts digitally exceedingly difficult, and/or have not done an adequate job of educating consumers on services such as mobile deposit capture.

Channel Migration Through Improved Experiences

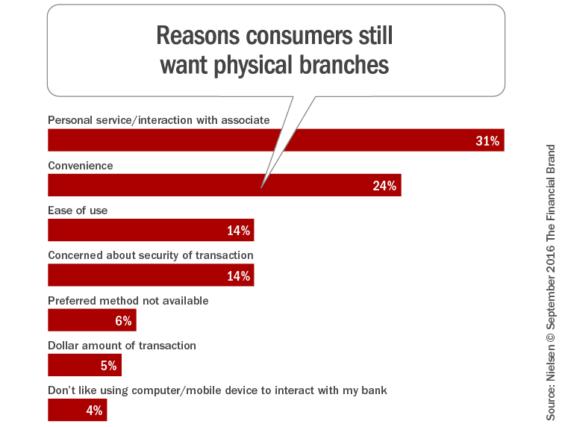

According to the Nielsen research, “Understanding the drivers of the behavior is the first step to creating a migration plan to lead customers to use the desired channel.” The study mentions that while some of the desired shift can be impacted by better communication, some of the lack of shift may be the result of digital technology shortfalls at some institutions. There is also the possibility that continued use of physical facilities may be more deeply rooted in the concern for security and privacy.

As an example, 73% of consumers opening a new deposit account still did so in-person at a physical location according to Q4-2015 Nielsen Financial Channel Track Survey. When asked for the reasons why a physical branch was used, the leading reasons were were the desire for personal service (31%) and convenience (24%), followed by ease of use (14%) and concern about security (14%).

These numbers can be a bit misleading, however. In the 75-page Digital Banking Report, ‘State of the Digital Customer Journey,’ there is strong evidence that banks and credit unions of all sizes are not making every stage of the customer journey easy, seamless and contextual. This includes the entire account opening process, early new account onboarding and even subsequent engagement around the building of a stronger digital relationship once an account is opened (cross-selling).

For instance, in the research, it was found that:

- Less than 20% of financial institutions can open a new account entirely online, with less than 5% being able to support a complete account opening on a mobile device.

- Only 16% of financial organizations provide a tablet assist account opening option in a branch.

- Branch based ID verification and/or signatures/supporting documentation are required at the majority of organizations.

- Multi-channel digital account opening (save and resume) is not supported at most financial institutions.

In-depth analysis of alternative digital solutions and ways to improve the digital customer journey are provided in the Digital Banking Reports entitled, Digital Account Opening and Guide to Multichannel Onboarding in Banking. Providing case studies from “best-in-class” organizations, these reports have become the industry’s most used guides for organizations hoping to improve the early stages of the customer journey.

The Risk of Doing Nothing

As mentioned in our article, the biggest banks have significantly improved in overall customer satisfaction, while midsize banks have declined and regional banks have plateaued. This appears to be driven by a focus on improved digital offerings, with satisfaction with big banks rising for the sixth consecutive year, according to the J.D. Power 2016 U.S. Retail Banking Satisfaction Study.

More concerning could be that midsize banks’ intended attrition has doubled over the past 5 years, and is currently the highest among the different asset sized bank segments according to the study. This indicates that, while the consumer is becoming more comfortable with digital applications across industries, the banking industry may not be keeping pace, with the spoils going to those organizations that provide a better digital experience.

Worse yet, the satisfaction with physical facilities, product offerings and transaction activities have all decreased over the last four years for midsize banks, indicating that consumers may be ‘penalizing’ organizations without a strong multichannel strategy.

It is clear that there is a growing need to serve the increasingly digital consumer that is no longer defined by demographic variables like age and income, but by the way an entire segment of the population hopes to engage. The strategic impact and resultant actions may differ by institution, but the ability to decrease costs and improve customer satisfaction rides in the balance.

For any organization, the priorities should be to improve the digital deliverables that include making basic transactions (balance inquiry, funds transfer and bill payments) more simple and intuitive, while also making the next stages of engagement (account opening and check deposit) more easy to complete with an online and mobile device.

About the Nielsen Data

The Nielsen Financial Channel Track is a survey designed to understand the differences in behaviors and preferences for the financial services industry across various channels. The Nielsen Financial Channel Track is an online survey that is fielded semi-annually.

Each wave of the survey includes approximately 7,500 respondents. The survey provides information including, but not limited to:

- Satisfaction with each channel interaction

- Primary reasoning for selecting each channel for each interaction

- Cross-channel behaviors

- Types of interactions by channel in the last 30 days

Additionally, the survey helps to better understand which channels are delivering the best results so they can optimize their channel interactions.