Saving is usually more fun in the past tense (“I saved up $100!”) versus the scrimping and budgeting that it can take to get there (“I’m trying to save $100, so I can’t go out tonight”).

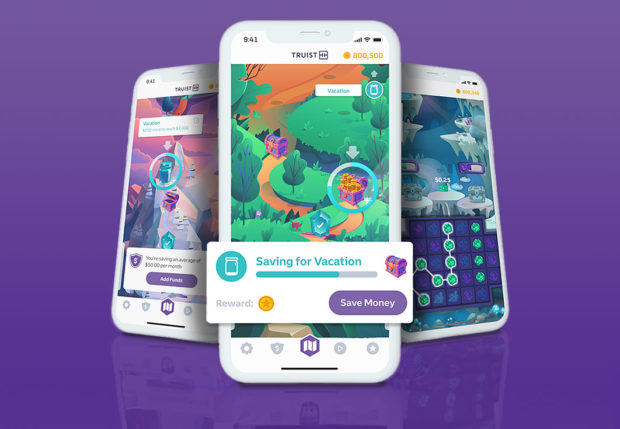

But Long Game — created by a fintech that Truist Financial Corp. acquired in May 2022 — is based on the premise that the actual process of saving can be fun. The mobile app aims to help adults jumpstart their savings and learn more about smart financial behavior through a variety of gamification techniques.

“Millennials and Gen Zers are always on their phones and most of them actively play mobile games,” says Lindsay Holden, who co-founded the fintech in 2015 and has continued to lead her team of engineers and designers as the head of Truist Foundry.

“Long Game uses games to help people save more money. What we’re doing is taking the thing that is really beloved by this generation and making it into a tool that can help them better their lives,” Holden explains.

The $574 billion-asset Truist also stands to benefit in the form of account acquisition, new deposits at a time when competition for them is fierce, and deeper customer engagement.

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

More to Come from Truist Foundry

Holden’s former fintech functions as a tech development unit at Truist. Though based in San Francisco, operationally it is part of the Truist Innovation and Technology Center, which opened in Charlotte, N.C., the same month that the bank announced the acquisition of Long Game.

The new version of the Long Game mobile app — released in May 2023 — is the first of a series of products slated to come from Truist Foundry, Holden says in an interview with The Financial Brand. (She isn’t at liberty to speak publicly about other pending projects.)

It is chiefly intended to be a tool to promote financial education, with gamification making the education fun and perhaps even profitable for users.

“Our vision for the app is to integrate it into other areas of people’s finances, and to build financial wellness features into it,” says Holden, who is also a senior vice president at the bank.

The standalone app — it isn’t part of Truist’s mobile banking app — can be downloaded for free through either the App Store or Google Play. Anyone can give it a 24-hour trial run, with the rewards strictly for fun.

Using the games after that point, getting access to all of the functionality and benefiting from those rewards, requires a Truist account — though it is possible to participate in some contests without an account. (Truist Long Game is wholly owned by Truist Financial Corp. and does not maintain any relationship with any previous partner institutions.)

Read more: Consumers Expect Financial Advice: Banks Are Falling Short

How Truist Long Game Ups Engagement Using Gamification

Even before the advent of the mobile phone, banks and credit unions tried different techniques to improve financial literacy and to encourage savings. One could argue the old Christmas Club booklets of deposit coupons were a form of gamification. “Club members” liked tearing the coupons out. Watching the stack dwindle was tangible evidence they were making progress.

Truist Long Game combines multiple forms of gamification that are distinct yet tie into the overall experience. The name of the mobile app is an acknowledgement that the habit of saving toward goals is a “long game,” not something that’s going to happen overnight.

The main game board calls to mind a treasure hunt, with a map of the entire journey towards the savings goal that the user has selected to work towards. Users save towards their goals with real money that they deposit in a Truist account. When they hit the goal, the game suggests they set a new one.

Truist Long Game has various mini-games that serve as standalone sweepstakes. Each mini-game costs a number of “coins,” the in-app currency, to play. Users can earn coins to play games by performing various actions including, depositing money into their linked Truist deposit account to make progress towards their savings goal, setting up direct deposit, answering financial wellness trivia questions within the app, and more. Depending on the mini-game, users have a chance to win more coins or real cash. To celebrate success, when coins are earned or won, an animated stream of them shoots up to a running tally at the top of the phone screen. Among the growing variety of games are variations on popular ones like Candy Crush and even one reminiscent of the classic Brick Breaker.

Here and there financial tips pop up in easily digestible bites.

The app rations certain activities. For example, quizzes are limited to two rounds per day.

At the end of a session, the main game board appears so users can see what progress they are making towards their own financial goals.

Read more about Truist:

- The Strategy Behind Truist’s New AI-Powered Digital Assistant

- Truist’s CMO Has Strong Views on Fintechs and Personalization

Rewards in the Mobile App Are Similar to Prize-Linked Savings

Truist clearly intends the mobile app to be for customers. Once the brief trial period is over, progress is halted until users input their account information. So the bank doesn’t want others using it merely for the games.

An incentive to sign up for a Truist account and be able to fully participate in Long Game is an introductory reward of 1 million in-game coins. Accounts that permit multiple transactions in and out — including checking, savings and money market deposit accounts — are eligible.

The rewards in Long Game are pegged to balances maintained, and new deposits in the linked Truist account earn bonus coins. Going on a “savings streak,” or depositing $20 or more into the account each week, ups the bonus coins.

The approach is similar to “prize-based savings,” which itself is a basic form of gamification used to encourage people to save. This commonly used technique often gives participants who make a deposit an entry into a sweepstakes run by their bank or credit union. It’s an option made available to more institutions by a federal law enacted in 2014 — the American Savings Promotion Act.

Truist itself piloted a prize-based incentive program in 2021. It partnered with BlackRock’s Emergency Savings Initiative and the nonprofit Commonwealth on the program, called the “Start. Save. Win! Savings Sweepstakes.” Over six months the program generated $37 million in new savings, according to a white paper by Commonwealth, in part by running monthly prize drawings. For each deposit of $25, participants earned a prize entry, up to a limit of five monthly. The maximum prize in the pilot was $500, whereas drawings run under Truist Long Game will include prizes of as much as $1 million.

Read more: The Toaster Effect: Free Gifts Can Boost New Account Openings by 15% or More

Industry Cloud for Banking from PwC

See how PwC's Industry Cloud for Banking can help solve everyday business challenges.

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

Truist Aims to Build Long-Term Relationships

Sometimes gamification and financial literacy training get boring and repetitive or simply run their course. Holden makes it clear that Truist wants to keep gamers coming around. The goal is long-term relationships that the bank can build on.

“This game has a long-term journey. When you come into the app, you set a savings goal. As you make progress towards the goal, you earn rewards, and you’re getting to play games.”

— Lindsay Holden, Truist Foundry

Holden says the mobile app was built around the idea of daily interactions — five minutes here and there — rather than spending two hours at a time playing.

Earlier iterations of Long Game were produced before the company and its team came to Truist, so there’s already a body of experience to draw on.

“We find that this product is really sticky, and it does engage people over a long period of time,” says Holden. “The engagement is for a few minutes a day, but it’s something that becomes part of their daily habits, which we encourage to increase their savings habits.”

Longer term, as the app incorporates other aspects of financial health beyond savings, Holden anticipates tie-ins to more bank products.

“Getting rewards for paying down loans or for planning for your retirement is not in there today, but those are some things that we would like to continue working towards,” she says.

Read more:

- Can Banks Deliver the Personalized Financial Wellness Tools Consumers Crave?

- Behavior-Based App Helps Consumers Manage Rising Credit Card Debt

Why Should Financial Institutions Try Gamification?

Truist Long Game was designed with consumers ages 18 and up in mind, especially the Gen Z and Millennial segments.

“For some Americans, it is difficult to engage with their finances because it’s not always been going great,” says Holden. Many people come from family situations where money matters weren’t spoken of. She herself is grateful that her father was a small business owner and that she had the opportunity to see what that entailed.

“But I learned a lot of my own financial habits just by experience,” says Holden. “I got my first job at 15 and started saving to try to buy things.”

Holden has both an engineering degree and an MBA, and she believes gamification, when well executed, can give younger consumers tools to learn with. Being able to see progress means something, she says. Blending financial concepts with fun can help too.

Past efforts to improve financial literacy tended to emphasize negatives too much — so the experience felt more like a stick than a carrot, in her view. “Obviously we need to be realistic about where people are and what they can do,” she says. “But we always try to be positive when we’re presenting finances through Long Game, encouraging people to take the next best step they can.”

Holden hopes at some point to expand the reach of Long Game by developing a junior version of it for people under 18.

“Not everyone has parents who are going to focus on teaching them financial literacy,” she says. If financial institutions like Truist reach out, “they can have some tools that will help them start saving and learning about finance early on.”

A Financial Brand Classic: 101 Fun Marketing Ideas for Banks & Credit Unions