Gamification of banking can deliver not only for both very large banks but also for community financial institutions, but the “big” and “small” of gamification can also apply to the game itself.

Ally Bank, for example, has tried several campaigns using games to make a point to consumers about personal finance, but it outdid past efforts with its “Ally+Monopoly” augmented reality game. The game turned six U.S. cities —Charlotte, Detroit, New York, Chicago, Seattle and Dallas — into live Monopoly game boards. Think Pokémon Go meets banking and money.

While the Ally effort is gamification writ large, spread over many square miles, financial marketers can also think about gamification on a much smaller canvas. Specifically, as small as a mobile phone screen. Indiana’s Centier Bank has been offering its own gamification of savings, complete with cash rewards, through an app called Billinero. The game app’s name is a portmanteau of “Bill,” as in currency, and “Dinero,” Spanish for money.

Mr. Monopoly’s Giving Out Real Money

According to the site WorldOfMonopoly.com, over 2,000 versions and variations of Monopoly have been published. This includes foreign language editions, editions themed to movies and TV shows, a version that has a voice assistant in the shape of Mr. Monopoly’s hat that runs the bank, and even a version where the official idea of the game is to lie, cheat, and steal.

What amazed Andrea Brimmer, Chief Marketing and Public Relations Officer at Ally Financial, was that no one had ever licensed the game from Hasbro for a banking-related promotion.

Traditionally Mr. Monopoly wears a black jacket and gray trousers, but, hey, Ally Bank’s official color is deep purple.

That got an idea going at the online bank — why not turn Monopoly into a virtual reality game featuring cash prizes and Mr. Monopoly? Brimmer says that research indicates that just over a third of Americans surveyed say Monopoly and other games of its type represented their first hands-on exposure to using money and learning to manage it. Four out of five Americans believe that playing money-related board games like Monopoly helps teach basic money concepts.

“Gamification really works for us,” says Brimmer. “Once consumers engage with your game, they are more willing to consider doing business with your brand.”

Brimmer says Ally has found that over half of the consumers who play a game become prospects and 30% of the prospects identified by its various gamification efforts convert to customers in some fashion.

The Monopoly-themed game, offered in the six cities in augmented reality form, was also available in an online version. Ally offered $1 million in total prizes. A giant game piece was sent to each city so consumers could pose next to them and post the shot to social media. Postings of these and other discovered game spots became entries in a prize drawing.

Each city also had a designated Community Chest square. Every time a player passed that spot Ally made a donation to the area’s Junior Achievement chapter, to a total of $125,000 nationwide. That includes a $50,000 award to the chapter in the city with the most visits to the community chest square. (See posts made to Twitter here. Posts could also be made to Instagram. Mr. Monopoly took over Ally’s social feeds for the duration of the promotion.)

Read More:

- Ally Bank Touts High Ratings with Funny Phony Products on Social Media

- Funny Ally Bank Instagrams Get Consumers to Loosen Up About Money

- Ally Bank Pokes Rivals’ Negative Online Reviews in Fun Campaign

CSI surveyed community bankers nationwide to learn their investments and goals. Read the interactive research report for the trends and strategies for success in 2024. Create a sustainable competitive advantage with faster time to market by drastically reducing implementation time. Read More about Accelerate Time-to-Market with Rapid Implementation

Community Bankers’ Top Priorities This Year

Accelerate Time-to-Market with Rapid Implementation

The object of the augmented reality game was to find all the property squares and other points that had been set up for Ally in that city and capture them with the app. The app provided clues on how to find each physical location. Virtual images overlay the physical site. For example, on a Free Parking space Mr. Monopoly drives up in the game’s race car token, in the app.

Brimmer says Ally’s tracking indicates that somewhere over 350,000 people played the game. In addition to consumer tips embedded in the game, Ally presented some online, such as a blog discussing how Monopoly and other popular games provide financial education and familiarity and an online financial literacy quiz.

Gamification Helps Community Bank Reach Beyond Home State

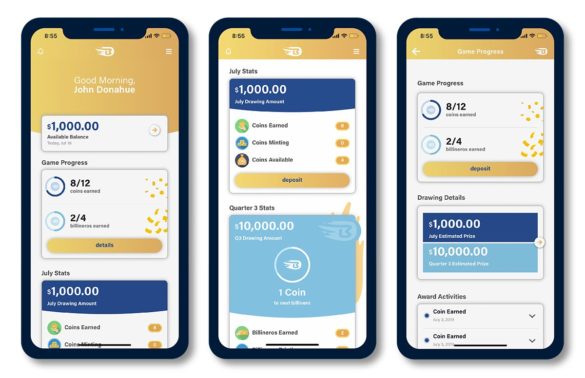

The Billinero program of Centier Bank, Whiting, Ind., is an app-adapted version of prize-linked savings accounts.

This type of account first came on the scene in a significant way towards the end of the 2000s and has had more of a foothold historically among credit unions, with support from credit union leagues. (The first pilot effort was with a credit union in Indiana.) A notably successful program called Prize Savings, offered to consumers holding Walmart MoneyCard prepaid cards, was adopted in 2017 and helped bring in $2 billion. That effort is a joint project of the retailer, Green Dot and Commonwealth, an organization set up to address issues such as consumers’ lack of emergency savings.

The general principle behind prize-linked savings is to encourage people to save by turning savings deposits into entries in periodic drawings for prizes. Generally, the more often a consumer saves, the more chances they have to win.

Because these types of accounts involve a form of lottery, they are not legal in every state and rules may differ from state to state.

Centier launched Billinero in August 2019 in recognition of statistics that indicate that two out of five Americans have less than $400 in their savings accounts, according to Chris Campbell, Senior Partner. The slogan of the program is “It’s like banking, but fun.”

The app is tied to a special savings account maintained at Centier. Each qualifying deposit of at least $25 earns a “coin.” Up to 12 coins can be earned in a month. Each coin earns a chance at the bank’s monthly drawing for a cash prize of $1,000. In addition, every three coins earns a “billinero,” which gives the saver a chance at a quarterly drawing prize of at least $10,000. Up to 12 billineros can be earned per quarter, four per month.

To maintain coins and billineros for the drawings, the saver must maintain at least 80% of the balance resulting after a deposit. After each drawing all depositors’ coin balances reset, and they go about earning fresh coins and billineros by making new deposits.

In keeping with the names of the game tokens, until deposits are verified the app reports coins as “minting” and billineros as “printing.”

Campbell says that as more people download the app the bank intends to raise the size of the quarterly drawings.

The bank’s research indicates that prize-linked savings programs can be offered in 27 states currently. It has selected 11 all told to promote the program, chosen because the bank feels its brand will resonate in those areas, according to Campbell. The bank is marketing the effort through digital, social, and traditional media. So far most consumers taking part come from Indiana.

Campbell says as time goes by, the bank plans to build out the app. One future possibility is encouraging referrals by granting additional coins, in some fashion. Another will be to devise more advanced forms of savings, a sort of graduate level of Billinero when savers build up larger balances.