Customers who believe their financial institution cares about their financial health are three times more likely to be “very satisfied,” three times more likely to recommend their primary financial institution, and five times more likely to be interested in purchasing additional products and services from their primary financial institution, according to a recent Financial Health Network study. In other words, showing empathy for the financial wellness of customers provides an opportunity for banks and credit unions to build trust, enhance loyalty, and increase sales and profitability.

The good news is that more and more financial institutions are providing digital financial wellness tools. Unfortunately, there is a significant gap between what consumers want and what they believe their financial institution is providing. For instance, the same study from the Financial Health Network found that 80% of consumers expect their primary financial institution to help them improve their financial health, but only 14% believe their bank or credit union is actually delivering on this preference.

“88% of financial institutions say that less than half of their customers actively use digital financial management tools offered.”

— Forrester study

The challenge goes beyond offering financial education and financial wellness tools. Banks and credit unions must personalize these tools and embed them within everyday banking applications that will drive engagement, retention and revenue.

Read More: Economic Fears Give Banks a Big Chance to Offer Personalized Insights

Success Story — Driving Efficiency and Increasing Member Value

Discover how State Employees Credit Union maximized process efficiency, increased loan volumes, and enhanced member value by moving its indirect lending operations in-house with Origence.

Read More about Success Story — Driving Efficiency and Increasing Member Value

Industry Cloud for Banking from PwC

See how PwC's Industry Cloud for Banking can help solve everyday business challenges.

Consumers Need Advanced Financial Management Tools

Digital financial management platforms are required now more than ever. As the financial landscape grows more complex, consumers need personalized tools that can help them understand and manage their finances more effectively – from planning for today and the future, to making educated decisions that help meet financial goals.

In response to a Personetics survey last year, bank customers and credit union members said they want personalized advice and money management support through their mobile banking app, as well as help with saving and understanding their cash flow.

The biggest finding was that more than half said they may switch to a competitor for better money management capabilities.

To respond to the increasing demand for assistance, banks and credit unions must provide integrated digital tools that help customers manage their personal finances across products, services and platforms. “Financial management tools must include transaction categorization, personalized insights, budgeting tools, saving goals, account aggregation, cashflow analysis, forecasting, and more,” states Personetics.

“The battle for deposits will be won not by banks that offer incentive marketing and promotions, but rather by those that deliver personalized engagement and product innovation that build sustainable customer relationships.”

— Jody Bhagat, Personetics

To accomplish this higher level of digital financial management, organizations will need to use multiple data sources and artificial intelligence, more engaging formats that leverage behavioral design, more personalized insights and recommendations, and automated components that “think on behalf of the customer.”

Personalization = Better Customer Experience

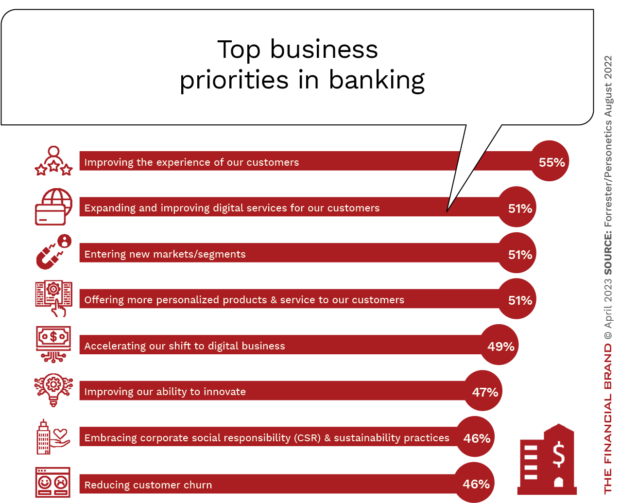

Research conducted by Forrester on behalf of Personetics found that as financial institutions increasingly focus on improving the overall customer experience, there is more attention being placed on refining digital convenience (fast and easy to use), creating new products and services, improving corporate responsibility, and most important, offering more personalized engagement opportunities. This focus on personalization allows financial institutions to provide tailored recommendations, product suggestions and relevant content to customers based on their preferences, behavior and real-time needs. This ultimately leads to higher levels of customer satisfaction, product sales and retention.

Read More:

- Both Banks & Fintechs Blow It With Financial Wellness… What’s Wrong?

- Go Beyond ROI With ‘Return on Experience’ in Banking

- BofA Crushing It with Financial Wellness App (Here’s Why)

Adoption of Digital Money Management Tools Lagging

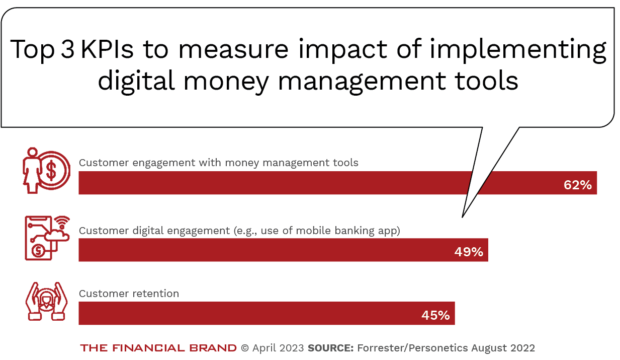

Over three-quarters of North American financial institutions offer digital money management tools for their customers, according to the Forrester research. In most cases, the key performance indicators include retention, engagement, and customer satisfaction to measure the impact of offering these tools.

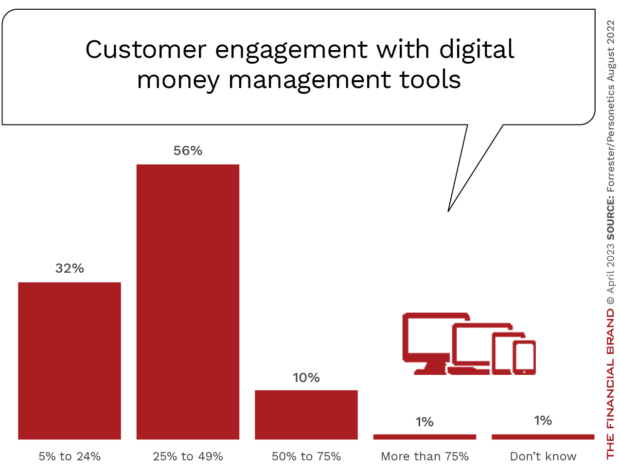

Despite offering advanced tools and having the requisite measurement tools in place, 88% of financial institutions say that less than half of their customers actively use the tools offered. Forrester’s research indicates uptake is low because “many of these solutions fail to drive behavioral change and deliver tangible outcomes for customers, as they are too static and generic, not relevant to customers’ specific needs and unpredictable financial lives, still require a lot of manual input, and place too much cognitive load on the customer.”

Building an Advanced Financial Wellness Strategy

There are some concrete steps that are required to build a successful advanced financial wellness platform but there must be a solid foundation. That base must include leadership alignment, a strong and trusted development partner(s), and advanced technologies that support the development and deployment of desired solutions.

“Delivering intelligent, proactive personalized insights to help customers better manage their day to day banking will become table stakes for all banks and credit unions in the next two years.”

— Jody Bhagat, Personetics

Forrester found that over half of financial institutions struggle with the creation of a clear, unified vision for digital money management programs. Some institutions lack alignment on a build versus buy strategy, while others have difficulty defining KPIs, setting ROI goals or building a compelling business case. As with any digital transformation initiative, if the foundation is weak, the business model often fails.

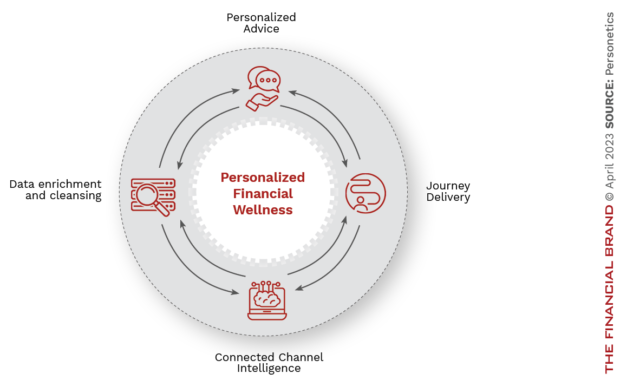

Once the foundation is established, an advanced financial wellness strategy can be created. Personetics has created an illustration showing four key components that financial institutions should include:

- Data Enrichment: As with any advanced personalization strategy, leveraging customer account holding and transaction data for contextual insights requires a definition of the state of the financial relationship, changes that are occurring within and outside the financial institution, and where opportunities are based on behaviors and needs.

- Personalized Advice involves delivering intelligent, proactive and contextual insights based on relationship and transaction monitoring. The key is to help the customer understand what they need to know and act on, at any given moment. This could include helping customers better understand their cash flow so they have enough to cover expenses or if they should transfer money to their savings account.

- Journey Delivery: Organizations must recognize that customers are on a financial journey, with long-term goals beyond immediate needs. Banks and credit unions must offer a tailored set of products and tools that can help customers accomplish their goals. An important component of this is to provide reinforcement along the way.

- Connected Channel Intelligence: Effective delivery of an advanced financial wellness solution includes the democratization of data and insights so that humans and digital channels can work independently and cohesively as a uniform platform. Customer recommendations should be delivered digitally to the customer, to the banker, and to your institution’s marketing team to ensure a comprehensive communication of wellness opportunities.

The need for improved wellness solutions is evident, and the opportunities are significant. The key is to begin the development of solutions today with the support of the entire organization.

“Leadership needs to view hyper-personalized financial wellness as something customers value and something that produces tangible gains for your organization,” states Personetics. “That involves providing a set of advanced capabilities and a way of operating that is more intelligent and proactive and focused on helping improve customer financial well-being.”