Personal financial management tools built into mobile banking and credit card apps are rapidly becoming a table stakes item for financial institutions.

The implications are serious for a variety of reasons. If the PFM functionality is well done, the apps could prove to be stickier in terms of customer retention, a key advantage.

However, the flip side of that advantage is that many consumers are shopping around.

People are splitting off part of their primary banking accounts to try out other financial providers. The incumbent providers run the risk that, if a competitor’s app is better, consumers could decide to consolidate more of their financial business at this new home.

Consumers Are Toe-Dipping with Your Rivals:

29% of all bank customers shifted money to a secondary deposit account in the previous 90 days, according to J.D. Power. They did so for higher rates, cash back and digital tools. On average, they moved 39% of their deposits.

Meanwhile, there is a tug of war going on with independent personal financial management apps such as Mint and YNAB (You Need a Budget). These apps aggregate consumers’ accounts from multiple providers in one place. Traditional financial institutions would prefer to keep consumers in their “tents” for everything, rather than end up as a category or entry in someone else’s app.

These insights come from an interview The Financial Brand had with Jennifer White, senior director of banking and payments intelligence at J.D. Power. White’s views were based on the findings her firm from a cross section of consumer banking studies as well as a recent pulse survey.

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

Instant Messaging. Instant Impact.

Connect with your customers and provide lightning-fast support as effortlessly as texting friends. Two-way SMS text messaging is no longer optional.

Good News and Bad News on PFM

The typical personal financial management tool covers these three areas: budgeting, analysis of actual spending and credit score monitoring.

Many traditional financial institutions — most, really — have a long way to go before the PFM features in their banking and credit card apps will come close to meeting consumers’ expectations.

But it’s not too late for them to improve their PFM offerings.

These tools aren’t yet table stakes, though White suspects it won’t be long. “Adoption isn’t quite high enough yet,” she says, “but the momentum behind the use of them and the impact that it has on customer satisfaction tells me that it’s quite possibly on the horizon.”

Financial institutions that get personal financial management right have a lot to gain. They can position their apps as “the hub of their customers’ financial lives,” White says.

In addition, as a late 2022 Deloitte report on digital banking maturity pointed out, pioneers have found that PFM offerings can actually become cross-selling tools.

Read more:

The Ultimate Goal: Becoming the Financial Hub for Customers

Underscoring the need for financial institutions to pay attention to the PFM elements of their apps is the growing importance of these tools to both today’s and tomorrow’s customers and prospects.

Consumers of all ages have gaps in understanding key aspects of their personal finances, White says. They are seeking out more help with closing this knowledge gap.

However, younger generations particularly like dashboards and tools so they can see where they stand at a glance.

“Being able to open an app and see instantly if you have actually reduced your spending in the last month and see if you’ve improved your credit score as you’ve paid off more debt — that’s pretty powerful,” White says. She adds that the elements of gamification that can be seen in certain PFM offerings helps consumers visualize how they are doing.

Tying these personal financial management functions to transactional tools, all under the umbrella of the mobile app, “makes you feel in control of your finances, even if you only have $200 to your name,” White explains.

Giving consumers tools that produce such peace of mind has taken on added urgency, in light of a 2023 J.D. Power study on financial advice.

“Most customers don’t remember receiving advice. While successfully delivered financial advice is consistent with significant gains in customer satisfaction, nearly two-thirds of bank customers do not recall receiving financial advice from their bank in the past year.”

— J.D. Power study on financial advice

What makes this lack of recall especially alarming is: Traditional banks often claim their ability to provide expert financial advice is what sets them apart from fintechs and other nonbank financial providers.

The same study found that five factors influence satisfaction with advice — when consumers recognize that they’ve received it.

The advice:

- Is delivered frequently.

- Includes high-quality content.

- Is relevant and personalized to the consumer.

- Demonstrates concerns for people’s needs.

- Provides a call to action.

Many consumers’ financial lives — and lives in general — revolve around their mobile devices. Given this, it’s possible that the more memorable forms of advice may be arriving digitally.

Read more:

- Truist Plays ‘Long Game’ with Gamified Mobile App to Boost Deposits

- 5 Mobile Banking App Pain Points That Must Be Eliminated

4 Key Insights on PFM Tools in Banking

J.D. Power analysis over multiple retail banking studies reveals four key points that institutions working to implement and improve PFM tools need to consider.

• PFM tools overall aren’t as useful as other app features.

The more mature transaction functions of mobile banking and credit card apps tend to work well and are being used more and more by consumers. By contrast, PFM tools are less robust, and this shows up in the satisfaction ratings that consumers give. Utilitarian functions like account transfer, person-to-person payments, bill pay and mobile check deposit score in the 700s (on J.D. Power’s 1,000-point scale), while PFM functions come in at 673.

The figures are specific to a selection of mobile banking apps from major banks. The same trend applies to features of credit card apps.

• PFM tools drive satisfaction — when they are used.

Satisfaction with PFM tools increases when people use more than one of them, according to J.D. Power. A synergy makes them more useful as a group — info a person gets from a budgeting tool ends up being reinforced by a spending analysis tool, for example.

White thinks a shift in mindset is necessary on the part of both the consumer and the institution, if the most is to be made of these tools. “It’s about moving beyond a transactional relationship to an intentional partnership between the consumer and their bank or their credit card issuer,” she says.

She adds that building on that broader, deeper relationship can help persuade customers to stay put rather than migrate elsewhere for additional interest on a savings account. Some of the larger institutions that have opted not to keep up with rivals offering higher deposit rates have found PFM tools to be a hedge against customer defections.

“And if you can give me both, that’s pretty attractive,” White says.

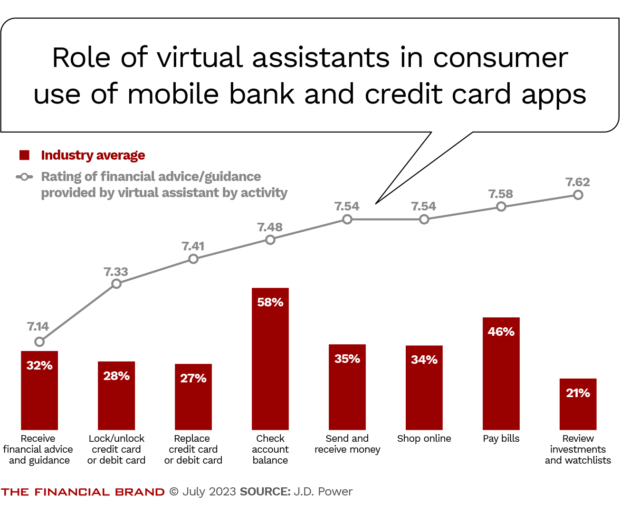

• Virtual assistants can hasten adoption of PFM tools.

Where providers offer both a suite of PFM tools and a virtual assistant, J.D. Power finds that consumers are four times more likely to use the full suite. The research determined that there is a synergy that kicks in when both are used, resulting in a significant boost to satisfaction levels.

People who use a virtual assistant are more engaged with their institution overall, the research shows. Such users also are twice as likely to take advice from their bank, and 1.6 times as likely to use the bank’s digital tools.

The poster child for this trend is Bank of America’s Erica virtual assistant, according to J.D. Power.

“Erica seamlessly incorporates aspects of PFM functionalities and alerts,” making usage of the tool relatively effortless, says a J.D. Power report. The combination of the virtual assistant and the tools led to much higher ratings for BofA.

The bank’s satisfaction rating for the PFM tools in its mobile banking app ran 44 points higher, at 717, versus the 673 industry average. Among credit card app PFM tools, BofA earned a satisfaction rating of 730, which is 52 points higher than the industry average of 678.

• Many regional and midsize banks lag on the PFM front. But there are exceptions.

Developing useful PFM tools requires an investment. Large banks are simply spending more, according to White. Regionals and midsize players, by contrast, “are not,” she says. “They’re one or two steps behind in being able to leverage these types of tools.”

But Huntington Bank and Regions Bank are among the exceptions. For the fifth straight year, Huntington topped the regional bank category for satisfaction with its mobile banking mobile app. Huntington’s consumer checking account holders can avail themselves of “The Hub,” which includes saving and budgeting tools, among other things. Regions Bank expanded its “My GreenInsights” PFM functions from its online portal to its mobile banking app in early 2023.

White notes that regional and midsize institutions generally are active in the PFM area. They just haven’t gone in with both feet. They might be offering spending analysis but not credit score monitoring, for example.

“The breadth of their PFM components isn’t as wide,” White says.

Read more:

- How Virtual Assistants Take Mobile Banking Apps to the Next Level

- 5 Popular Fintech App Features Banks Should Add to Mobile Banking

PFM at Community Banks and Credit Unions

Much of J.D. Power’s research deals with the largest players along with the regional and midsize financial institutions referenced above.

In many cases, community banks and credit unions offer mobile banking and credit card apps through third-party vendors. White says the importance of personal financial management options is not lost on these organizations.

“The larger of the platform providers are definitely incorporating tools that are in the PFM space,” says White. “So midsize institutions can start having some of these tools in place.”

White notes that a key part of credit unions’ stated appeal to their members is improving their financial lives. So credit unions see the connection, in her view.

“They might not have gone all-in like a Bank of America, a Capital One or Chase. They might not have built the tools that go all the way up to the idea of a virtual assistant,” White says. “But they are starting to build these tools into their offerings.”