If Americans want to figure out how to do something, from replacing the carburetor on a snowblower to making chicken pastina soup, they often wind up on YouTube.

And when they want a new mobile banking app, they generally go to the App Store or Google Play.

Financial institutions that want to build digital user bases need to take note, as many are overlooking an opportunity to give their app a boost with their prospective customers.

Recent research by Keynova Group suggests that some things viewed as a “nice to have” — video tours, demos, test drives and other ways of showing how mobile banking apps work — are becoming a “must have” as the digital emphasis grows.

Such demonstrations are more important with the banking apps than with many other types of apps, according to Susan Foulds, managing director at Keynova. “If I’m going shopping at Bloomingdale’s or L.L. Bean, if something’s not working well, you can just move on to something else,” says Foulds. “You can’t do that with your banking accounts.”

In the earliest days of mobile banking — beginning in about 2007 — the apps were rudimentary, she says. The attitude was, “Who needs a demo?” There wasn’t that much to talk about.

But the apps continue to add functionality, and increasingly the digital channel is where the day-to-day customer relationship happens.

Options like demos and test drives allow potential customers “to get the feel of your institution,” says Foulds.

“Digital banking is a key consideration when customers are shopping for a new bank,” says a Keynova report called Mobile Banker Scorecard Q3 2023. “Financial institutions that illustrate their mobile services on their websites with thorough tours of banking and payment activities or simulated test drives stand to attract more customers going forward.”

Among the 17 major banks studied for Keynova’s semi-annual report, 70% now offer some form of demonstration, tour or test drive.

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

Checking Out the App Store and Google Play

So what do consumers searching for mobile banking apps actually find when they visit YouTube, App Store and Google Play? The Financial Brand explored that.

With the two app marketplaces, App Store and Google Play, when they go to a specific institution’s app page, they will generally see a composite user rating along with recent comments, some of which may actually belie the tone of the rating.

This is followed by the digital equivalent of a billboard for the app.

Promo vs. Demo:

Originally many banking app providers used the vertical panels of the displays, which scroll from side to side, to show actual screens demonstrating the app's features. Increasingly, what people see today are promotions, spread across multiple panels of the display. The promos tend to be heavier on marketing than giving a sense of how the app works.

Though the App Store and Google Play serve as the trusted “car lots” of the app world, there’s no such thing as a test drive based in either place. Nor, in any banking app entry, is there a link to relevant pages on the institution’s site. Typically, the apps don’t cost anything by themselves, unlike many games and other types of apps, but you can’t really get a feel for how they function until you download, install and link them to accounts.

Presentation of apps as done in the two stores “does not provide adequate customer experience insights or activity flows for prospective banking customers to assess digital banking capabilities,” the Keynova report states.

Read more: What SMBs Want from Mobile Banking Apps (But Don’t Get)

Searching for Mobile Banking Apps on YouTube

Alternatively, if someone winds up on YouTube seeking help with a particular task on their mobile banking app, or doing a search to learn more about these apps, what would they find? We searched YouTube for the term “mobile banking app,” pairing the term with the name of a specific institution each time. We did this with 10 large banks and 10 large credit unions.

What we found was sometimes ugly. In some searches, videos posted by the financial institutions show up, though in a number of cases, these official posts were as much as six to eight years old. In the app business, that’s practically historical.

On the other hand, especially in the case of the banks, there is a variety of third-party videos showing how to use the apps. Roughly half a dozen different third parties typically show up. The quality varies.

Fintech apps are also the subject of videos. One YouTube maven, Cindy Scott of SmartFamilyMoney.com, has 10 professional-quality videos on her YouTube channel demonstrating how to use aspects of Block’s Cash App, for example.

Bank, credit union and fintech marketers ought to have a look at what comes up on YouTube about their app and ask themselves if they want those results to be the only demos consumers see.

It gets worse too.

Mixed into each set of search results are paid YouTube mentions. Some are ads that lead to sketchy-looking sites that should shout “caution” — if not “danger” — for the casual web searcher. But some consumers may not be sensitive to the potential risks.

One click-through site offered a download of the Chase app, clearly not through either trusted marketplace. Legit? Let’s not get into technicalities about neophytes using “apk files.” Suffice it to say that the risk to consumers is great when financial apps can be downloaded at no charge from the App Store and Google Play.

Will Rates Change Behavior?:

Keynova's Susan Foulds suggests that consumers may begin commencing their app searches on a financial institution’s own website because they are paying more attention to rates now. This creates an opportunity for an institution to strut its digital stuff.

Read more: The Top 15 Features People Want in Their Mobile Banking App

What Fintechs and Neobanks Do About Demos

Keynova’s research concentrated on a group of large commercial banks, plus USAA. All are institutions that the firm studies on an ongoing basis.

Because all of these institutions have greatly expanded the functionality of their apps, it has become a challenge for them to offer demos, test drives and such, Foulds says. The sheer volume of what they have to demonstrate has gotten unwieldy.

By contrast, many fintech and neobank offerings start off “skinny” — confined to a handful of functions that can be navigated fairly easily. A quick review of the websites of a few popular fintechs and neobanks shows little in the way of demos and test drives.

Some of these have grown to the point where, if and when they explore test drives, they’ll have challenges. PayPal, for example, offers a growing menu of payment services, but no demos yet.

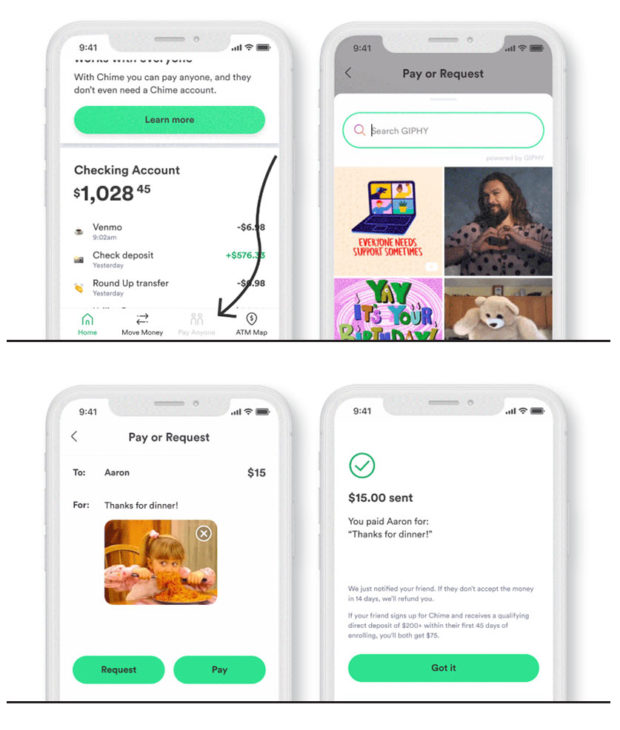

Chime, which is still relatively skinny, offers guided walk-throughs for some aspects of its app. The frames below are selections from a demo of actual screens that includes animated arrows, such as in the first frame, that guide the consumer’s eye as needed. This demo covers Chime’s “Pay Anyone” function.

In the early days, mobile banking app demos were simplistic. “You would get these sort of animated promos for mobile apps, little cartoonish kinds of things that didn’t really tell you anything,” Foulds says.

But those who are doing demos these days generally have upped the quality, she says. “Now there are some nice examples out there of what can be done to showcase banking apps.”

The bigger challenge has become keeping this info up to date, she adds, noting that it’s become common for mobile banking apps to be updated and improved on an almost continuous basis.

Read more: Banking Apps Are All Alike — But Consumers Clamor for New Features

The unfair advantage for financial brands.

Offering aggressive financial marketing strategies custom-built for leaders looking to redefine industry norms and establish market dominance.

Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

This webinar will offer a comprehensive roadmap for digital marketing success, from building foundational capabilities and structures and forging strategic partnerships, to assembling the right team.

Read More about Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

A Mix of Videos, Test Drives and Cheat Sheets at Large Banks

Most of the banks covered in Keynova’s research do one or more of the following:

- Videos giving either an overall tour of the app or a series of videos exploring specific functions. They give a sense of how the apps work. Some have head-on views of the app screens, while others are fancier with higher production value.

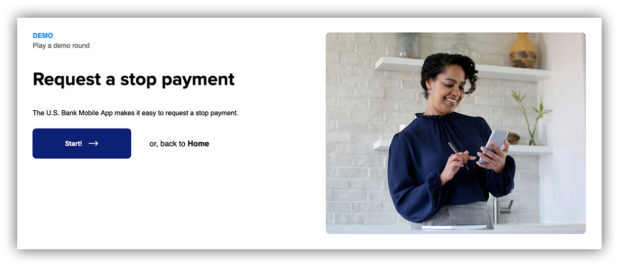

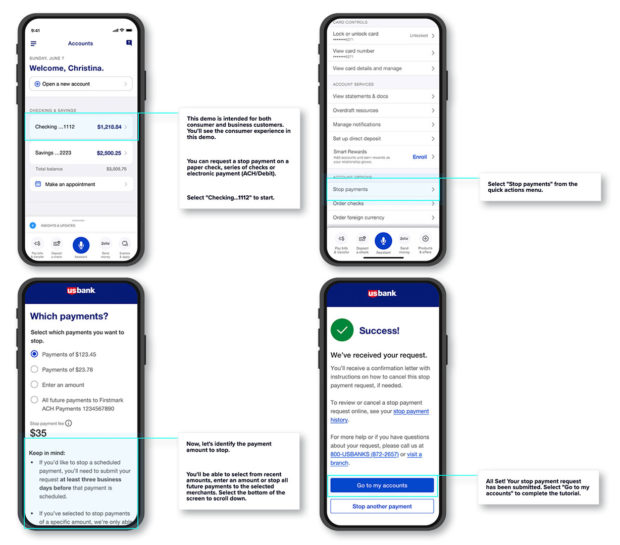

- Interactive test drives, or walkthroughs, that allow people to perform many functions just as they would on the app. Typically a colored, semi-transparent circle prompts them where to click, using their mouse for the demo (instead of their finger on the phone), or where to enter information. These test drives are closest to the real experience. They generally focus on a single type of function.

- Cheat sheets can be used in a static way to guide the consumer through a dynamic process, providing prompts as to how to start a particular function within the app.

One of the most extensive efforts in the demos and test drives area comes from U.S. Bank. Its “Digital Explorer” page provides a selection of dozens of videos and interactive walkthroughs of mobile and online functions. The mobile walkthroughs let the user go through specific functions screen by screen while also providing timely dialog boxes commenting on what the consumer is seeing. The sampling below comes from a walkthrough of how to request a stop payment with the U.S. Bank mobile app.

Another institution that makes detailed interactive walkthroughs available to customers and prospects is Truist. On the bank’s “Meet our app” page, links to three interactive test drives are given: how to make transfers and payments, how to use Zelle, and how to set up estatements. The samples below come from Truist’s transfers and payments test drive. The full test drive entails 14 screens, and the “tourist” is prompted throughout by the green circle in the samples.

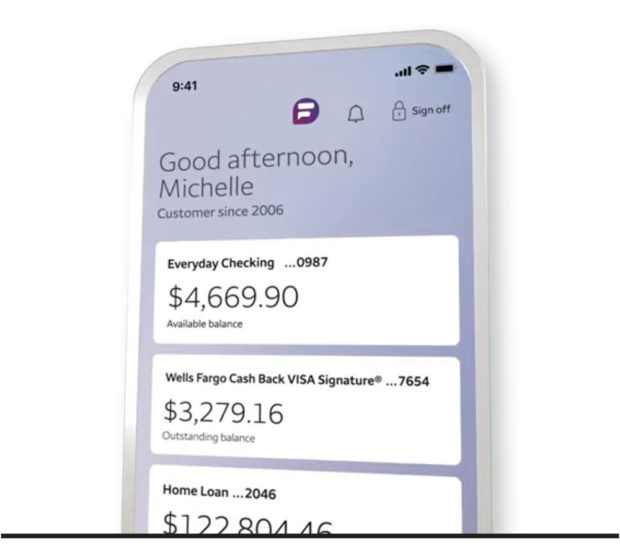

For institutions that make virtual assistants available to customers, there may be more emphasis on using them to guide customers through mobile banking once they are signed up. A video by Wells Fargo, for example, promotes its “Fargo” virtual assistant, showing how it can interact with the mobile banking app.

An example of the “cheat sheet” approach comes from Fifth Third Bank, which provides tips on where to start certain tasks on its mobile app.

A key point about these tools: They can serve present customers as well as they serve prospects “kicking the tires.”

Four or five years ago branch enthusiasts spoke of offices being the place where customers confused by digital tools could go for orientation or a question. Maybe that still goes on with some segments, but many younger consumers today would just as soon get digital advice from a digital source.

And wouldn’t have branch staff selling new services be more efficient than demonstrating mobile banking apps?

Read more: 12 Must-Have Mobile Banking Features Consumers Expect Now

The Most Free-Wheeling Mobile Banking App Test Drive

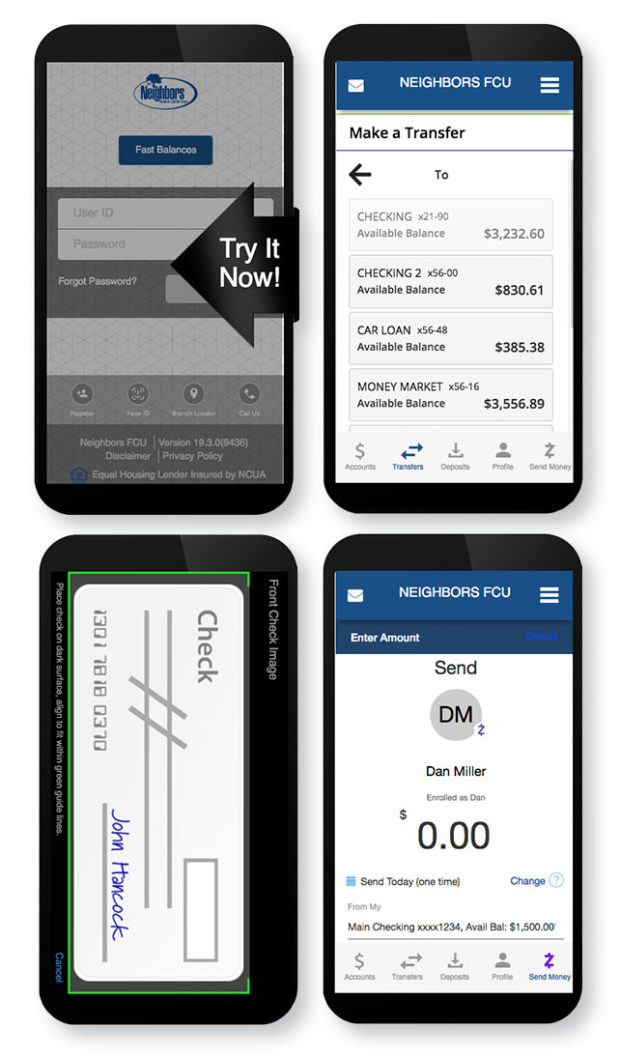

Though not part of the Keynova study, the test drive from Neighbors Federal Credit Union in Baton Rouge, La., is interesting. The $1.2 billion-asset institution, which has a community charter, offers one of the most “free-wheeling” test drives The Financial Brand came across.

Rather than being devoted to one particular function, this test drive essentially provides a simulator of the entire mobile app. Once users log in with made-up credentials, they can go into any function and explore. Below are just a few basic screens from this test drive. Neighbors also offers a selection of video tours of the app.

Read more: 5 Mobile Banking App Pain Points That Must Be Eliminated

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

Why Hide This Light Under a Bushel?

One takeaway for banks and credit unions exploring how to promote their mobile banking apps is to focus on discoverability. If you’re going to go through the effort of creating demos, make them easy to find.

In many cases, hunting down demos and walkthroughs required a good deal of looking around on each financial institution’s website. We were on a mission, but will prospects work as hard?

Additional test drive graphics from other institutions can be found in this earlier article.