Bank of America’s unveiling in March of a unified mobile app experience had all the earmarks of a big splashy announcement. But the consolidation of five BofA apps into a single digital platform was actually evolutionary, not revolutionary, requiring four years and 400,000 lines of code.

Much of the interoperability of the company’s apps had been rolled out gradually, quietly and (in some ways) behind the scenes, as the bank introduced users to new connections and functionality among the five apps — Bank of America for banking, Merrill Edge for discount securities brokerage from Merrill (formerly Merrill Lynch), MyMerrill for full-service investment relationships, Bank of America Private Bank, and Benefits OnLine, the app for BofA-provided employee benefit plans.

Internally, digital staff coined a meme for the goal: “Five doors, one building.”

The final touch, a unified view of all of a given customer’s account relationships, began rolling out about six months before the March launch— and the simultaneous announcement that Celent had recognized the unified app with a 2024 Celent Model Bank award for Customer-Centered Innovation.

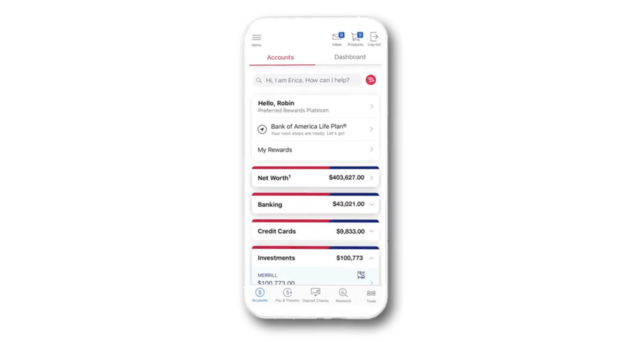

The account page “is the most important in the unified mobile app,” says Jorge Camargo, managing director and SVP for digital product management. “It’s where you come in to monitor what’s going on with your accounts and from there you can navigate anywhere in the app.”

Over more than a decade of app development, Bank of America learned important digital lessons, according to Camargo.

A key learning: “People don’t like dramatic change. They prefer smaller, incremental, digestible improvement in their digital experiences as opposed to big changes.”

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

Instant Messaging. Instant Impact.

Connect with your customers and provide lightning-fast support as effortlessly as texting friends. Two-way SMS text messaging is no longer optional.

Behind the Scenes as Bank of America Unified its Apps

“Clients continuously asked us for a simplified digital experience that would allow them to monitor and manage their finances all in one place,” says Camargo. “That was the seed from which this initiative grew.”

Camargo says one of the earliest steps was linking the banking and investment apps so customers could see their overall balances in one place. The next step: Enabling customers to move directly from seeing the two types of accounts in one place to being able to jump from one to another to take various actions.

Now that the unified app is fully public and operational, Bank of America has high hopes that the new arrangement will make it easier and more attractive for people to open more relationships with the company.

Camargo would not share specific numbers but said that the vast majority of customers have BofA banking relationships alone. However, “a not insignificant portion of clients have dual relationships, particularly our Merrill clients or our private bank clients. The most common use cases are people with one or two relationships.”

Many of the customers with three or more relationships (and apps) are company employees. “And they were our pilot audience,” he explains. “They are the folks that have three, four, maybe even five relationships at the same time.”

Five apps have now been unified into one, all reachable through a new all-in-one home screen for BofA customers. The company’s meme for this approach is “five doors, one building.”

This helped development because a key goal of the project was to make it possible to personalize the app based on the relationship the consumer has with the company. Camargo says this affects the navigation presented to the consumer. It also affects the “plumbing” that each individual consumer can access.

Camargo explains that investment clients and retirement plan clients can both access equity research by BofA analysts, but not so people who have only BofA banking services.

Read more: Offer ‘Test Drives’ of Mobile Banking Apps for a Marketing Advantage

Creating Common Tools that Work Well for All Banking Needs

A key component of the project was to share and connect common utility functions to present a more consistent and seamless way of moving money across the customer’s accounts.

“There’s now a single enterprise infrastructure to power all money transfers and mobile check deposits, as opposed to multiple instances, each being a different experience,” says Camargo.

To adopt this approach, a variety of business rules had to be accounted for, Camargo says. Certain types of accounts carry restrictions on deposits or withdrawals based on size or timing, for example. Other account types may carry tax implications depending on what is done with the funds.

“A lot of effort went into making sure that all of those scenarios worked correctly for all combinations of clients,” says Camargo.

Read more: Two Screens, One Goal: Where Mobile and Online Banking Meet Local Growth

Erica’s Role in BofA’s Unified App

If BofA’s goal was “five doors, one building,” then its AI-based virtual assistant Erica can be regarded in two ways.

First, says Camargo, it can play the part of navigational assistant, a guide that can bring the consumer to the right place to execute any type of transaction and to answer numerous questions. In a Celent podcast, Nikki Katz, head of digital at BofA, called this Erica’s “concierge” role.

Second, Erica can simply help the customer execute what they want to do once it brings them to the right part of the app. It can also connect the user to a staffer who can offer the type and level of assistance they may need. Katz refers to this as Erica’s role as “mission control for finance.”

Training Erica in the unified app proved a critical mission. “Erica is able to understand all of the capabilities that exist around banking, investment, and retirement,” says Camargo.

Despite the excitement about generative artificial intelligence, Camargo says Erica will continue to be based on its natural language processing model. Many speak of GenAI’s abilities to personalize transactions for customers, but Camargo says the bank prefers to take a cautious approach.

“We’re experimenting with some interesting use cases for GenAI in the background, but nothing that’s going to be consumer-facing anytime soon,” Camargo says.

The key reason for not adopting GenAI yet: “The answers that we provide to clients have to be 100% accurate, 100% of the time. And with GenAI that’s just not the case.”

At present Erica is handling over 1 billion customer interactions annually, according to BofA.

Read more: Why it’s Time for Banks to Hire a Chief AI Officer — and What That Looks Like

The unfair advantage for financial brands.

Offering aggressive financial marketing strategies custom-built for leaders looking to redefine industry norms and establish market dominance.

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

How the Unified App is Doing

The unified product is an example of an app as financial hub, according to Susan Foulds, managing director at Keynova Group, which analyzes and compares major bank digital offerings. Foulds has been supporting the hub idea for some time. The ability to navigate the unified app with Erica is “a game changer,” says Foulds.

An early indicator of acceptance: Camargo says 64% of customers eligible for the unified app have opted in to having a single login, which opens all accounts so they can be navigated as one.

“That’s a good proxy for the level of adoption we have so far,” he says. He adds that customers tend to have a preferred “door” and once they go through it, they generally can use that all the time because it leads them to the whole “building.”

Camargo says the bank expects to save millions of dollars annually on future costs of app development, thanks to shared development, a consistent architecture and the consolidation of the digital infrastructure.

The company has also seen significant sales results. One indicator: Camargo says 147,000 internal referrals have resulted from the unification, resulting in $13.5 billion in new assets under management.

The bank also anticipates that the unified app will make more cross-promotion possible via marketing within the app, replacing some spending on media promotion.

Read more about mobile banking:

- What Small Businesses Want from Mobile Banking Apps (But Don’t Get)

- Consumers Have Embraced Digital Wallets. But They Also Want Them to Be Better

- Banks Must Ramp Up Protections as Mobile Fraud Grows

What’s Next for BofA’s Unified App?

The unified app is not the end of the journey. A customer can receive alerts and other messages from any of the legacy apps — alerts from BofA and alerts from Merrill, for example — but they still reside in separate in-boxes, according to Camargo. “In the future we’re going to pursue a true single in-box without that brand separation,” says Camargo.

Camargo says BofA is also considering ideas from other, nonfinancial apps, that could be worth adding into the mix. Once might be live updates on requested actions, akin to the tracker functions in some food and restaurant delivery apps.