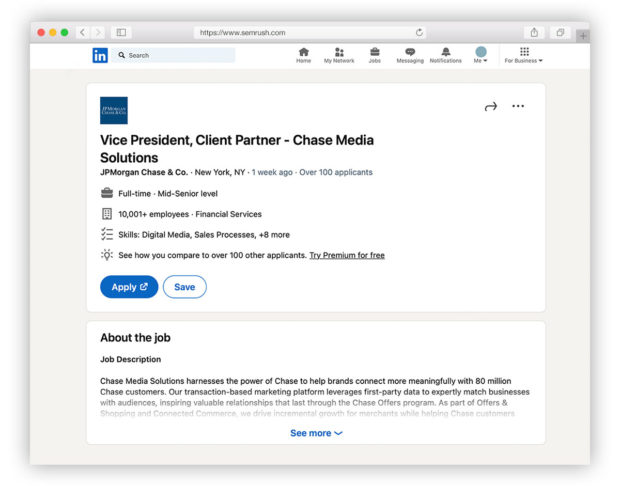

Bankers, fintech execs, pundits and analysts were still mulling JPMorgan Chase’s early April announcement about Chase Media Solutions, a media business tied into the bank’s digital channels, when another shoe dropped on the other side of The Pond.

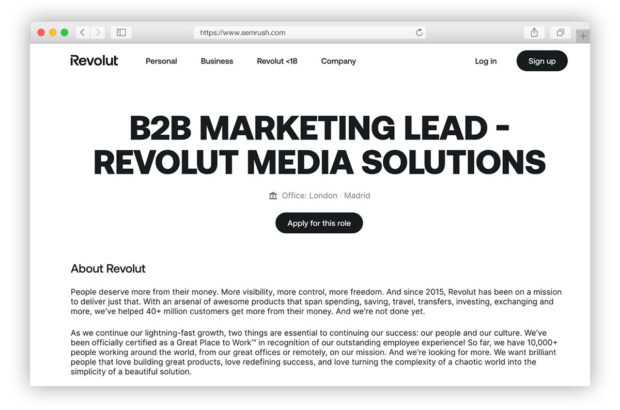

The shoe was a fintech sneaker, not a banker’s wing tipped oxford, as, in late April, Revolut revealed that it too was getting into the ad business.

Revolut’s Antoine Le Nel, global head of growth, told The Financial Times. that Revolut Media Solutions had already hired Inam Mahmood, formerly the head of ecommerce partnerships at TikTok UK, to run the fledgling operation. Mahmood has begun inviting applicants to try for positions with the new digital advertising service via his LinkedIn page.

Revolut’s move may be rooted in Le Nel’s own background: Before moving into financial services at Revolut, he served as vice president of growth in over seven years at King, the producer of big-name mobile game hits such as Candy Crush Saga. One of King’s revenue sources is in-app third-party advertising.

Le Nel told The Financial Times that Revolut could become a media business, “a place where you have an audience and data about the audience and you monetize this.”

Community Bankers’ Top Priorities This Year

CSI surveyed community bankers nationwide to learn their investments and goals. Read the interactive research report for the trends and strategies for success in 2024.

The New AI: A Banker’s Guide to Automation Intelligence

Manual tasks across channels is costly. And while AI is hot, there’s a simpler way to bring efficiency that many bankers have overlooked.

Read More about The New AI: A Banker’s Guide to Automation Intelligence

Pushing the Boundaries Between Finance and Commerce

Sounds promising. But analyst and advisor Rupak Ghose was skeptical. In a LinkedIn post, he posed three key questions for marketers:

- How much time do you spend on your Revolut app?

- Will you be happy with targeted adverts leveraging your personal finances?

- How will this impact Revolut’s slow journey towards getting a full banking license in the U.K., a crucial element to drive higher deposit sizes and sell many banking services?

“Looking at Amazon.com’s $47 billion of advertising revenues in 2023, which has really exploded over the last 5 years, is clearly exciting all online marketplaces! Fintechs and banks will have seen JPM Chase also making noises on offering some advertising on its apps,” wrote Ghose.

In FT, Le Nel indicated Revolut wanted to encourage people to make daily visits to the app, which would encourage advertisers to run there.

Revolut’s move is not the first such European effort. A payments and buy now, pay later app called Zilch launched “ASPN” in mid 2023. The acronym stands for “Ad-Subsidized-Payments-Network.” The company took the measure in part to bring in funds to subsidize aspects of its services. The point was to present advertising in context, what Zilch calls the “Googlization of Payments.” ASPN started as in-app marketing for goods offered under BNPL financing and is now open to other merchants. The company claims high conversion rates for these ads. (The U.K.-based Zilch launched a version of its payments service in the U.S. but “paused” it for redesign in early 2024. Amazingly, it waived all outstanding BNPL debt incurred by its American customers.)

Meanwhile, Back in the U.S.: Strategies and Sentiments

The Chase Media Solutions announcement has been analyzed from multiple perspectives. It’s early days, only a handful of campaigns have been tested, and it may take some time before Chase customers realize what’s going on, even though Chase Media Solutions builds on an earlier “offers” program. Among the vantage points

• As an alternative to the disappearing third-party cookie system, mining a major bank’s own valuable first-party data.

Knowing Where the Bucks Stop:

Banks, after all, know exactly how a consumer's money was spent — online and at point of sale — versus what people merely explored on the web while shopping.

• As a big bank plucking new revenues from the digital advertising business using the “retail media network” mechanism.

• As an ingenious blending of fee income for advertising — advertisers only pay when someone makes a purchase — and thereby bolstering payment volume and interchange.

• As a way for a big bank to recover from the likely results of the pending settlement on credit card interchange fees (and perhaps a way to turn the tables on retailers).

• As a bigger win-win for consumers and the bank if offers came right at purchase time, rather than being banked away for the occasion of a future purchase. With Chase Media Solutions, at present, bank customers see offers and click on those they like. Those offers hover in the background, ready to kick in if the purchase is made via a Chase payment vehicle.

“Given the proliferation and growth of retail media networks, it makes sense that any business with access to customer purchase data surfaces that data so it could be leveraged for ad space,” Sarah Marzano, principal analyst at Emarketer, says. It’s natural to seek ways to monetize the data, she says. “But any company introducing a media offering will need to strike the right balance between ad visibility and relevance in order to avoid disrupting the customer experience.”

In other words, there are limits to this strategy, not discovered yet.

“Everything today is an ad network, but consumer attention is finite,” says Eric Seufert, independent analyst and investor and proprietor of Mobile Dev Memo, in a LinkedIn post. “How does the commercial calculus of integrating advertising into an existing consumer platform change as the retail media space becomes more saturated? … At some point, the finite nature of consumer attention constrains the size of the retail media space.”

Read more: Move Over CMOs, Data-Driven Growth Marketers Are Taking Over

How Will Consumers Feel About Seeing Their Behavior Mirrored in Chase Media?

A significant caveat, though, is how consumers will feel about becoming ad fodder inside their banking experiences — and whether efforts like this, as well as the addition of travel services and more, will push through the traditional but often perforated line between banking and commerce.

“There’s a sentiment of ‘this is my data’,” says Andrew Davidson, senior vice president and chief insights officer at Comperemedia, a Mintel company. “There are questions about privacy that may come up.” He adds that some consumers may at some think, “I don’t recall telling Chase that they could use my data to serve up ads.” And what if Chase were to add a fee to not be exposed to ads and offers, à la Amazon Prime Video?

Consumers use bank websites and apps for transactions and other banking purposes; unlike some buy now, pay later sites, the Chase digital destinations are not shopping portals at present.

“Someone logging on to pay their credit card bill isn’t necessarily in a shopping mindset or looking to spend time browsing cash back offers — which for now are located several scrolls down the app.”

— Sarah Marzano, Emarketer

In its State of Brand Safety study, published in January, Integral Ad Science found the following percentages of U.S. consumers were receptive to advertising when visiting websites:

- Shopping 36%

- News 35%

- Social media 35%

- Entertainment 34%

- Travel 22%

- Music 21%

- Sports media 18%

- Gaming 17%

- Fitness 13%

- Financial 12%

For his part, Ron Shevlin, chief research officer at Cornerstone Advisors, disagreed with privacy concerns in a recent blog on Forbes. “Advertisers won’t get or even see individual customer data or transaction history,” he wrote. “The bank will simply display ads to its customers based on their previous purchases.”

In fact, Shevlin points out that Chase, big and broad as it is, doesn’t have a complete picture of customer purchasing habits. He noted that many Chase customers — the company is said to do business with one in four Americans — use the bank’s cards for specific types of purchases, for example.

Marzano points out that the Chase Media announcement “is really an update to an existing offer.” The most notable aspect of the latest move, she says, is the improved ability to provide data targeting abilities. Something advertisers will weigh, she adds, is whether the Chase Media effort can avoid advertising to consumers who already had a high purchase intent with that advertiser’s products. Why offer them an incentive — and pay for it when they bite — when they are already interested?

It’s also been pointed out that Chase Media Solutions is essentially a “card-linked offer.” Bank of America has been offering its take on card-linked offers via BankAmeriDeals.

A veteran of this type of marketing that did not wish to be quoted by name says that a weakness of linked offers is that they are “ex post factor” — the reward comes after the signup, as in the Chase program. This person says consumers really prefer instant savings — get the offer, get the deal, all in the moment: “Customers love instant value.” Such efforts typically get more lift for the retailer, according to this source.

Read more:

- New Email Rules 2024: Marketers, Authenticate or Get Trashed

- Gallery: Priming Your Social Media Strategy for Amazon’s Prime Day

- Digital Marketing Tactics, Trends and Tips to Know About

The unfair advantage for financial brands.

Offering aggressive financial marketing strategies custom-built for leaders looking to redefine industry norms and establish market dominance.

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

Tying the Chase Strategy into the Pending Interchange Settlement

There’s another way of looking at Chase Media Solutions: A means to gain competitive advantage using merchants’ ammunition, assuming the recent credit card interchange settlement moves ahead.

Here’s the logic: Using the bank’s own transaction data, retail brands and their advertising agencies can target Chase customers for special offers based on what they’ve bought in the past. When they pay with their linked Chase payment account they receive cash back, savings credits or points.

Chase provides the audience, the merchants provide the deals, Chase gets the card volume.

A handful of other efforts with the same goal, such as PayPal Honey, already exist, ready to be repurposed in the atmosphere of tender steering — which the settlement would permit. (“Tender steering” is the merchant practice of nudging consumers towards one payment type over another preferred by the merchant — typically in favor of the one that costs the least to receive.)

Read more: How the Mastercard/Visa Settlement with Retailers Could Remake the Payments Business

Card issuers that lack the pockets of the giants like Chase can tap third-party services that offer similar appeal. Three possible partners identified by payments consultant Richard Crone include Kard Financial, Cardlytics and Prizeout.

A challenge as more players in both payments and retailing take this path will be sheer inventory, according to Crone. To have a supply of attractive offers, a steady supply of merchants has to be available to make them.

Ultimately, the card-carrying consumer will decide this one. Along the way, this may help push digital wallets and pay-by-bank services. Crone sees the settlement as increasing the role of the free market in payments.

Again, Chase Media Solutions — and the likely followers in the U.S. — are in the earliest of days.

“This is all about the execution,” says Comperemedia’s Davidson, “and how it can add value.”