The future of banking is on everyone’s mind, but often as something abstract, not urgently imminent.

But consider that the future that was talked about five years ago — which seems almost like yesterday — is what is happening now. So it’s a little unnerving to learn that two-thirds of banking customers in a major new study believe most consumers will consider their primary bank to be completely online in five years.

Maybe that will be true. Maybe not. But already more younger adults — Millennials and Gen Z — regard a big tech company like Apple or a fintech like Venmo or an online only bank like Chime to be their primary financial provider than they do a regional or community bank.

Clearly the future of banking will be different and primarily digital.

What Bank Customers Are Saying

Traditional institutions, particularly regional and community banks and credit unions, have a window of opportunity to meet the needs and desires of their future customers and claim competitive advantage, but only if they act quickly, according to the study.

“Digital banking … clearly no longer optional or a nice-to-have but a must-have that drives growth, loyalty, and positive experiences, concludes a nationwide survey by Alkami Technology. “At the same time, younger generations are bringing new and different expectations that … create a significant opportunity for every financial institution willing to adapt.”

The company polled 1,500 U.S. bank account holders who are, to various extents, active in digital banking. The respondents were weighted to the 2020 U.S. Census for age, region, gender, and ethnicity. Among the key findings:

- Younger generations are up for grabs as nearly a quarter of them are not sure if their current primary financial institution will remain as such in the coming year.

- People who engage with their financial institution by digital means, whether through mobile apps or a website, tend to use more products than those who don’t — and the more often they connect digitally, the more products they take advantage of.

- Regional and community financial institution customers are less likely than all other groups to believe their financial relationship will grow over the next year.

- Providing excellent digital banking experiences will go a long way to increase usage of other products — regardless of generation.

- An often overlooked way to appeal to consumers is to provide personal financial management services through digital platforms.

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

The Time for Studying the Trend is Past

On top of the report’s primary conclusions is the blunt assessment that financial institutions need to act fast to deliver the digital services consumers increasingly want.

“The financial institution of today is not what consumers believe the financial institution of the future will look like or deliver,” the study states. It found that 44% of banking customers believe the bank of the future will be a technology company.

Digital Expectations:

65% of banking customers believe that most Americans will consider their primary bank to be completely online in five years.

As noted above, the Alkami sample was of people who were active users of digital banking. However, the report indicated that “active” includes fairly basic things like looking up account balances, paying bills and transferring funds — a fairly low threshold, in other words.

“This all underscores the urgency and importance of financial institution leaders taking action right now to best adapt and serve consumers,” the report states.

Read More: The Battle for Consumer Attention in the Digital Banking War

Primary Financial Provider Preference Is Shifting

The two younger adult generations — Millennials and Gen Z, collectively ranging in age now from 22 to 45 — are more likely to claim that a neobank, big technology company, or fintech company is their primary financial provider. Gen X and Baby Boomers skew towards regional or community banks and credit unions by a wide margin.

Which companies consumers regard as their primary banking provider

“This creates a clear imperative for regional and community financial institutions as they risk their customer bases or membership increasingly aging while emerging generations initiate and build relationships with alternative financial providers,” the study observes. “Regional and community financial institutions need to take notice and act now to reverse this trend.”

Interestingly, all generations fairly evenly claim major national banks or credit unions as their primary financial institutions — approximately one third each of Gen Z, Millennials, and Gen X, and almost half of Baby Boomers. That may change, though, as noted below.

Regional and Community Bank Growth at Risk

Regional and community banks and credit unions are far from top of mind when account holders consider growing their primary financial institution relationship over the coming year. Just 27% of the customers primarily using those institutions expect to increase deposits, loans or other transactions there. By comparison, the percentages of customers primarily using the other categories of provider were all significantly more likely to grow their relationships: major national financial institutions (35%); neobanks (51%); fintechs (53%); and big technology companies (57%).

“This is a dramatic difference in expectations that may influence consumer behavior,” the study says. “Regional and community financial institutions must act with urgency to address this potential risk to organic growth.”

Straight-Line Trend:

Simply put, the more often account holders access a financial institution digitally, the more products and services they use.

The research also probed the correlation between digital banking use and depth of relationship. The data revealed that digital banking users who access their mobile app and/or online banking multiple times per day have 1.71x the number of products with their primary financial institution than those accessing digital banking at least once a year.

The correlation is linear across engagement frequency with those accessing digital banking at least once a week having 1.3 times the number of products; those accessing it a few times a month having 1.21 times the number of products; and those accessing it once a month having 1.08 times the number of products.

Read More:

- Critical Strategies to Meet Increasing Digital Banking Expectations

- 4 Ways Citizens Bank Keeps ‘Human’ in Its Digital Banking Experience

- Digital Banking Strategy: Four Essentials to Finding Success

Digital Excellence Is the Equalizer

What’s the first thing any financial institution needs to do to attract and keep customers? Make the digital experience easy to use, clear, intuitive, comprehensive, and personalized.

This is particularly crucial for regional and community financial institutions. The study found that these have a 14% lower existing product penetration than the national average.

“40% of regional and community financial institution account holders say that the relationship gap between them and their financial institution can be closed through a completely satisfactory digital banking experience,” the study notes.

This applies across all generations. “In the case of digital banking, a great experience is age-agnostic, allowing regional and community banks and credit unions to confidently evolve their capabilities to meet their existing consumers and an untapped market of emerging account holders where they currently are,” the study says.

Growth Opportunity Hidden in Plain Sight

Three words could spell out banking’s next big growth area: personal financial management. Specifically the modern app-based version that is easy to use and often incorporates prompts and reminders.

“The rise of personal financial management is creating new expectations and clear differentiators for financial institutions to take the lead in serving their stakeholders,” the study says. “Not only is personal financial management highly desirable across generations, but it can drive engagement and connection with consumers at a critical time in the current fiercely competitive marketplace.”

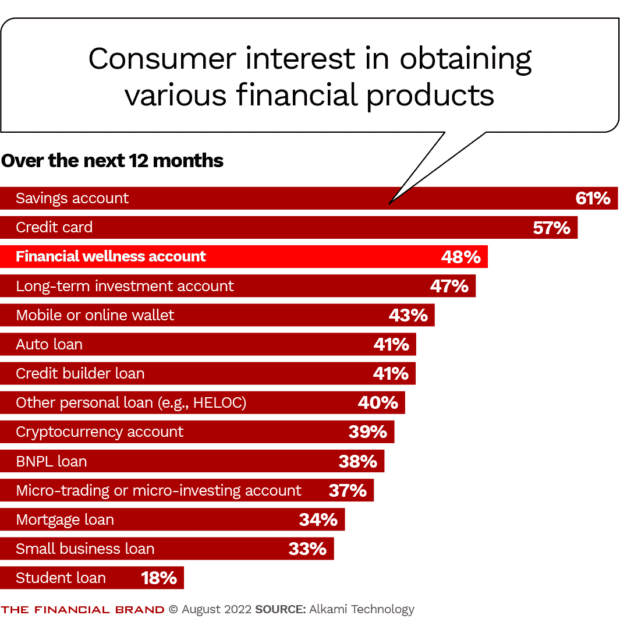

As shown below, when asked to rank 14 distinct financial services as most important, financial wellness accounts came in just behind savings accounts and credit cards.

The study asserts that 64% of the banking market does not have a financial wellness service.

“The desire for personal financial management is a hidden trend that should move up the priority list for financial institution leaders,” the study advises. “Most consumers do not subscribe to financial wellness services today, representing a significant … opportunity for financial providers to seize.”