The long-term impact of Covid-19 on banking has yet to be fully seen, but the pandemic has already dramatically changed how consumers and businesses bank, as well as how we all live and work.

To dig-in deeper on these themes, Citizens Bank conducted its second annual nationwide Banking Experience Survey, asking consumers and business leaders how they currently interact with their financial institutions and how they hope to interact with them in the future.

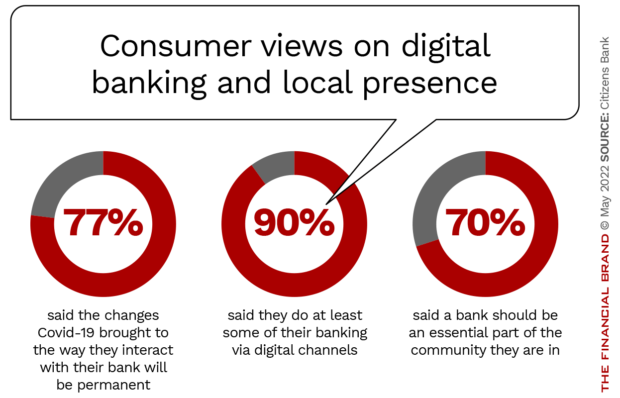

The findings of this year’s survey reinforce the trends we’ve been observing and planning for. As the chart below shows, more than three quarters of consumers expect that the changes in their banking habits brought about by Covid will be permanent. (For businesses, the percentage was just slightly less, at 70%.)

While it’s still essential to invest in digital banking capabilities, the survey showed that focusing on experiential components and putting humans at the center of customer experience (CX) is a priority. Even with the current tech revolution, digital technology won’t replace the need for human expertise. Nor will it diminish the important role banks play in the communities they serve.

Here are four ways banks can focus on delivering a human-centered experience and better connect with their customers.

Move the Needle from Attrition to Acquisition

Vericast’s 2024 Financial TrendWatch explores seven of today’s most critical financial services trends to provide a complete view of the current loyalty landscape.

Read More about Move the Needle from Attrition to Acquisition

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

1. Speak Like Your Customers

In focusing completely on the customer experience, it’s critical to put the needs of the customer at the beginning of all exploration. This requires customer research to clearly identify problems from the customer’s perspective when implementing new products, services or technology, so that solutions are built to meet customers’ needs, rather than the other way around.

Key Learning: We found through implementing this process at Citizens that our digital and mobile banking tools needed to navigate and communicate in the way customers think. A big part of this was using customers’ language. Terms that resonate for banking professionals don’t always connect with our customers and how they frame their wants and needs.

One example of this was eliminating the word “wealth” where possible since most people don’t actually consider themselves wealthy. By tweaking language to meet customers where they are and acknowledging sensitivities to certain words, we are creating a welcoming experience that will increase retention.

Read More: 5 Ways Citizens Bank is Turbocharging Its Digital Transformation

2. Deliver Bite-Sized, But Relevant, Insights

Consumers’ cognitive load is heavy. It’s been said we each make over 35,000 decisions a day! With that in mind, it’s natural for customers to feel anxious and overwhelmed with the possibilities and crave control and confidence around their decisions, especially involving money.

More Than Digital:

For banks, quality digital capabilities are table stakes. Where banks can really deliver for customers is by building trust and showing value.

Banks should play a key role in helping to reduce customers’ cognitive loads with personalized insights at the right moment so they’re better able to make financial decisions. This requires marrying data, design and culture to deliver personalized and relevant experiences. Done right, this drives brand loyalty.

Key learning: This process came to life at Citizens when we launched our updated mobile application. We integrated attention-grabbing insights, tailored to the customer, to proactively deliver the right information at the right time and help customers build confidence in their decisions.

To give a personal example, I recently logged into my account and saw a notification that a refund had been processed for a return that I had recently made. That simple insight took one thing off of my mind and helped me better track my personal finances.

Read More: The Future of Customer Experience in Banking is Personalized

3. Recognize That Every Interaction Matters

Even outside of digital banking channels, experiential components matter. Retail and business customers still value the power of relationships — whether they are in person or virtual. Financial institutions will find success when they have a clear understanding of where automation is appropriate and where human-to-human interaction is better served.

Customers are certainly ready for technology to enhance their banking experiences, however. Our survey showed that 53% of consumers felt that technological advances will allow banks to leverage data using artificial intelligence to better anticipate consumers’ future needs. To use this data most effectively, banks need to identify ways to blend human and digital interactions, enabling us to empower customers and serve as a trusted advisor.

Key learning: Often, this blending of human and digital capability empowers our colleagues to better serve customers with the right tech-enabled tools. For example, when you step into a Citizens Bank branch, you’re greeted by a colleague with an iPad. That lets them immediately connect you with the right information or person. The iPads are also helpful in streamlining the account-opening process.

We’re also leveraging data for the customers’ benefit with our AI-powered customer service chatbots. We’ve found that chatbots drastically reduce the customer wait times typically present with human-only support by answering many straightforward questions. The chatbots also enable human representatives to focus on complex requests and issues.

Read More: HSBC Retreats from the U.S. as Citizens Bank Reaps Branch Reward

4. Lean on Automation, Analytics and Data to Streamline Processes

Creating a human-centered customer experience in banking not only means exploring and implementing the newest technologies to minimize wait times, it also allows us to communicate a better understanding of the customer and to streamline experiences.

While some consumers may be hesitant to grant companies access to their data, our research has found that most of them are comfortable with their data being used if it’s for their benefit.

Key learning: We’ve had success in reducing data fields required in applications by using data that can be retrieved through existing tools. A good example is our upgraded home equity line of credit process. Citizens now uses data end-to-end to present offers in multiple channels and help customers quickly apply for our FastLine home equity offer.

We leverage data models to prefill applications with readily available customer data. The time a customer saves by not filling out personal information can be spent making meaningful financial decisions.

Looking ahead, banks should continue to find pinch points where automation makes the most sense. As banks double down on transforming the digital banking experience, now is an opportune time to ensure customers and their needs are considered at every point in this transformation.