If banking executives could have one wish granted for deposits right now, many would ask for loyal depositor relationships insulated from pricing competition. But, do institutions provide account holders with interactions that create loyalty?

Banking loyalty circa 2020 and 2021, which focuses on digital transformation, is still in vogue among institutions. And, it’s only natural. Everything went remote in 2020: work, shopping, and banking. Banks and credit unions needed to provide digital solutions so people could access their funds. Account holders adopted them for necessity’s sake, and once they learned the conveniences of digital banking they never looked back.

Polling by Forbes in 2022 found 78% of consumers now prefer to bank via a mobile app or website. Only 29% of Americans prefer to bank in person. (Respondents could select more than one option in Forbes’ survey.) So, go digital, and you’re good? Not so fast, there’s a caveat in Forbes’ findings. Access to a branch was a top-three feature when people shopped for a new savings account. Only fees and APY were listed as more important. For those looking for a new checking account, branch location was second only to fees.

Why do depositors care about a dusty old bank branch? Consumers say they want access to a human being when they have a problem or need to make an important financial decision. And, people – the staff at a local branch – still have certain advantages as advisors.

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

A New Deposit Loyalty Landscape

Institutions have closed the metaphoric door — along with the physical one — on branches since 2019. It’s compelling to note the correlation between branch closure and deposit decline.

While credit unions added another 34 branches in the first quarter, their count is still down compared to pre-pandemic levels. Banks closed 3,065 branches in 2022 alone.

Three-year Decline in Bank Branches

| wdt_ID | Institution Type | Branch Count 2019 | Branch Count 2022 |

|---|---|---|---|

| 1 | Banks | 86,392 | 79,186 |

| 2 | Credit Unions | 22,015 | 21,708 |

| 3 | Total | 108,407 | 100,894 |

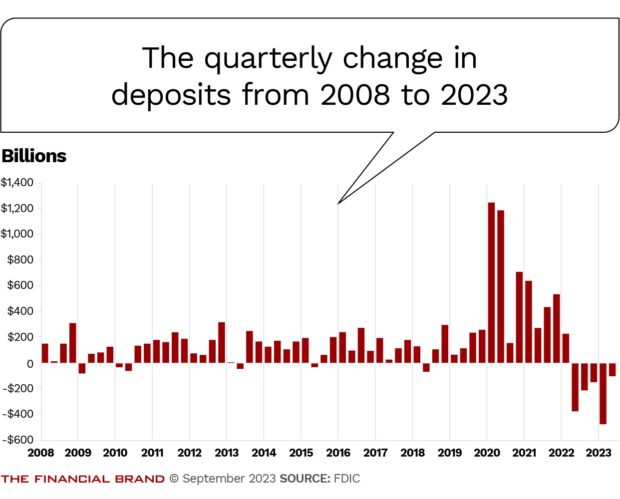

Deposit volumes are down considerably at banks this year, following branch closures during the past three years. In second quarter of 2023, total deposits were down 0.5% quarter over quarter. That might sound low, but they hold $18.6 trillion in deposits.

Lower-yield accounts such as transaction, money market deposit, and other savings accounts declined by $412.8 billion at banks . While time deposits increased by $306.7 billion, brokered deposits (AKA no-relationship deposits) also increased by $177.4 billion, or 17.3%. That’s after banks lost more deposits quarter-over-quarter in the first three months of 2023 than they have since regulators began collecting data in 1984.

Credit unions, on the other hand, show low deposit outflows. They also had low net decline in branches over the past three years. In fact, total shares and deposits rose by $23.0 billion (1.2%) in the first six month of 2023. Regular shares declined by $75.1 billion (10.9%), but other deposits increased by $97.5 billion (12.5%), led by share certificate accounts, which grew $164.5 billion, or 68.6%.

There’s no silver-bullet argument intended here that branch closures caused deposits lost at banks, or that deposits retained at credit unions are because of branches retained. Bank failures in March stirred deposit movement. And, “customers are actively seeking higher yields,” as FDIC Chairman Martin Gruenberg’s said in his September statement on banks’ second-quarter results.

Yield seekers may have gone to loss-leader strategies, competitors with unique advantages, or new disruptive entrants. But it’s not a question of who took the deposits and how. Executives don’t control the competition. How could they have affected people to stay?

Relationships with depositors are the only tenable answer. But then relationships — real ones cultivated between people — are rare if people can’t meet in person when needed. Society is acclimating to remote work and digital, and someday most depositors may prefer to access staff remotely. For the foreseeable future, institutions’ deposit-base expects access to a human being. Or, as Forbes polling found, to people at a brick-and-mortar location.

What is the Danger in Digital-Only?

Traditionally, financial institutions invested in branches to achieve lower funding costs than brokered or wholesale options, Jean-Pierre Lacroix, president of SLD, tells The Financial Brand. But that lower cost was built on service, and not just the smile-and-cookies kind.

“It was about access to knowledge and insights and support,” he says. “And that’s where the branch network plays an important role, not because it’s a physical network, because it’s a network of qualified people. And that’s how relationships are built.”

The most profitable parts of an institution are often the least sticky: car loans, home loans, insurance, and other similar products. People have far more options with the proliferation of online services and non-bank institutions. While it’s a hassle for customers to change banks, deposit accounts are, for the most part, purely transactional. Unless there’s a problem with the account, there’s no human interaction needed.

“That’s where the branch network plays an important role, not because it’s a physical network, because it’s a network of qualified people. And that’s how relationships are built.”

— Jean-Pierre Lacroix, SLD

More than 79% of respondents typically visit a branch less than once a month, according to an SLD study, and more than 25% visit their branch only once a year. Doesn’t that prove people are primarily interested in a digital banking experience? They are — until something breaks. Then they want a person for important decisions, a problem, or major life event.

“[Customers] go to the branch for different purposes,” says Lacroix. “They go for advice. They go for exploring products, having conversations…[where] physical presence gives credibility and trust. It provides that human factor which has a major impact.”

Digital-only depositors by definition don’t go to a branch, and it shows in their loyalty. “The more digital-only a [customer or member] becomes, the less loyal they are,” Lacroix says. “Your least loyal are those that only use mobile or online services.”

Institutions adapting to the current loyalty landscape are looking across their full experiences to close the gap between the physical and the digital, Lacroix says. “And doing that will ensure that the customer stays in the ecosystem, rather than switching [institutions] through silent attrition.”

Read more about banking branch transformation:

- Flexible Designs, Floorplans & Branding Help Future-Proof Bank Branches

- Digital Banking Has a Long Way to Go to Surpass Branch Sales

- JPMorgan Chase Defends Contrarian Branch Strategy as Deposit-Gathering Machine

Ending the False Dichotomy: Digital Renewing Physical

So, what is the “right fit” for branches in terms of quality and quantity?

Lacroix suggests first looking at the bank’s purpose, specialty, and market differentiators: the core strength of the institution and what the bank believes in. From there, institutions should evaluate its employee engagement and commitment, because it must deliver on the brand promise. They should also assess any friction points in customer interactions, including if the branch is not conducive to customer needs.

For example, SLD partnered with an institution in Europe that re-introduced greeters within its branches over a five-year period, a job that otherwise had long since disappeared in most banks because they were considered unnecessary. But, as this one institution found, greeters can serve an important role in changing customer behavior, by showing customers how to use smart ATMs or making them aware of features available on mobile, or guide customers to the right human.

Conventional transactions now occur online and through mobile technology. That frees staff to have conversations about loans, investments, and financial management at a branch. They have the time to engage with customers on a one-to-one level and provide advice they might be seeking — all of which can be accomplished through proper training of employees.

To Lacroix, it’s about connecting the physical, the digital, and the human. “You have to start with the premise that the facility gives you permission to deliver a better customer experience,” he says. “It gives you the permission — but the better customer experience is delivered through people.”

Digital shouldn’t be seen as the end of physical, it should launch the golden age of advice during a time when institutions need loyalty from depositors.

Do Appearances Matter?

Relevancy is a key consideration for today’s branch designs. Does it look like a place for advice? Studies completed by SLD show renovating a branch drives 20% more visitation and 20% more sales growth, Lacroix says.

He explains that executive leadership may worry a renovation will alienate older accountholders, who are thought be accustomed to certain branch designs, like dark woods and traditional colors. Lacroix says financial institutions need to ditch those misconceptions. “They may be 80 years old but many of those same customers have mobile devices and iPads,” he says. “They’re connected to technology and they want to know that their institution is remaining up to speed.”

“They can be a place where you build relationships if the experience is right.”

— Jean-Pierre Lacroix

Banks and credit unions can miss new relationships too because they don’t appear to fit with younger people. Consider parents who refer their children to a bank. The children are adults, they will look assess the referred institution and compare it to ones down the street. It is just mom’s and dad’s old bank or does it fit them? “Use branch design to appeal to them as they consider banking with a competitor,” Lacroix says.

Buildings serve as “highly visible beacons in the community,” Lacroix says. “They can be a place where you build relationships if the experience is right.”