Traditional banking providers and their digital competitors have become intertwined for consumers, who don’t want to give up either one.

Instead, they are opting to use multiple financial services companies.

Their cafeteria-style banking choices are often based on features and services they want, not so much on other factors like the type of provider.

They aren’t abandoning traditional banks and credit unions entirely, but neobanks, fintechs and other innovative competitors are chipping away with increasing speed at the advantage that the incumbents have with consumers, particularly in the United States.

Those are some of the major takeaways from a survey by Marqeta, a card-issuing platform in Oakland, Calif., that operates internationally. The survey compiled responses from 4,000 adults across the U.S., the United Kingdom and Australia.

Join industry’s leading AI conference - free passes available!

Ai4 is coming to Las Vegas, August 12-14 2024. Join thousands of executives and technology innovators at the epicenter of the AI community.

Read More about Join industry’s leading AI conference - free passes available!

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

U.S. Consumers Use Both Traditional & Digital Banks

Marqeta frames the trend toward splintering financial relationships as one where consumers in the habit of using traditional banks and credit unions are also drawn to the convenience, innovative features and superior user experience of nonbank digital providers.

“Consumers are having their cake and eating it,” the Marqeta report says. “They’re opting to stick with traditional banking options while also leveraging other tools.”

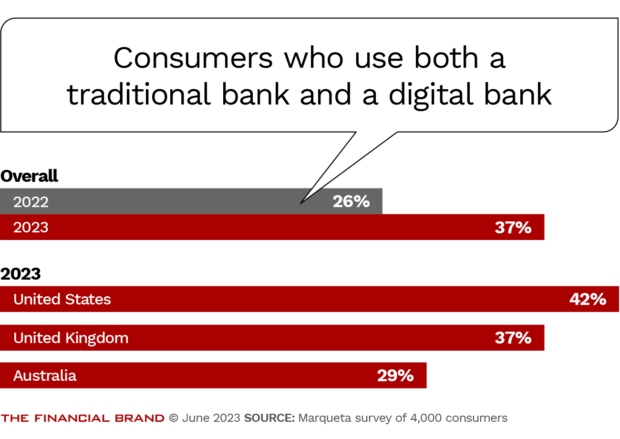

The trend is playing out faster in the U.S. than elsewhere. For example, 42% of U.S. consumers said they use both traditional and digital banking providers, compared with 37% of survey respondents overall.

And, while a majority of consumers still have their primary account with a traditional bank or credit union, this is less prevalent in the U.S., according to the survey. (By the survey’s definition, the “primary” institution is where consumers deposit their paycheck or hold the majority of their funds.)

Among U.S. consumers, 77% said their primary account is at a traditional financial institution, and 60% said they keep the majority of their funds there. That compares with 81% and 64%, respectively, for survey respondents overall.

Of all those using additional financial services outside of their primary institution, just over half (51%) reported using a total of three or more different providers. A smaller subset (13%) uses six or more. The types of services people say they are accessing from other providers include person-to-person payments, credit cards, and an additional checking account, among other things.

Notably, there is a wide gender disparity in the results. Men are more likely than women to use multiple banking providers (25% vs. 11%) and to use a digital bank (52% vs. 32%). These types of differences are in line with a well-documented gender gap across fintech, which is attributed to women generally being less willing to share their personal information with digital providers, Marqeta says in its report.

Banks Losing Primary Checking Account Status to Fintechs

Separate research from Cornerstone Advisors backs up the assessment that, when it comes to relationships with banking providers, Americans have become far less monogamous.

Of the consumers who have opened a checking account in 2022 or 2023, six in 10 have more than one checking account, according to Ron Shevlin, Cornerstone’s chief research officer.

As with Marqeta, Cornerstone’s survey also shows much greater consumer comfort with fintechs. Shevlin goes so far as to say that fintechs are winning the checking account war.

Cornerstone found that a growing number of U.S. consumers are not only opening checking accounts with digital providers but giving these accounts “primary” status. The trend is evident across generations. “More than a third of Gen Zers and Millennials, and nearly three in 10 Gen Xers, consider a fintech or digital bank to be their primary checking account provider,” Shevlin wrote.

Conversely, megabanks, regional banks, community banks and credit unions are all seeing a decline in the percentage of their customers and members who consider them to be the primary provider, he said.

Key point:

Even though your customers haven’t closed their account, they might be well beyond flirting with your rivals. What’s your plan to revive the relationship?

Cornerstone found that 14% of Americans opened a new checking account in the first half of 2023. Where did these accounts get opened? They split almost evenly between digital and traditional options.

Digital banks and fintechs captured nearly half (47%) of all the new checking account openings. That’s up from 36% in 2020.

Megabanks had a 17% share (down from 24%) and regional banks 21% (down from 27%). Shevlin did not specify what percentage went to community banks and credit unions, though he noted that they held steady compared with 2020 figures.

Read more:

- Are You Fighting Yesterday’s Checking Account War Instead of Today’s?

- If You Are Going to Bank on Customer Loyalty, Return the Loyalty

- See our latest coverage of checking accounts

Many People Don’t Want to Give Up Bank Branches

To gauge branch use and digital adoption, the Marqeta survey asked consumers how they most frequently deposit a check or cash into their bank account.

Perhaps not surprisingly, there were big differences based on age. Roughly half, or 49%, of those ages 51 to 64 said they would visit a branch, as did 36% of those ages 35 to 50. The same holds true for just 26% of the 18-25 and 26-34 age groups.

There are also notable differences in branch use based on country. Asked whether they had visited a branch within the previous seven days, Americans were twice as likely to say they had (25%) than those in the U.K. (12%) and Australia (13%).

Marqeta suggests this is because the banking market in the U.S. is far less consolidated than in the other two countries. The report says that the wide range of banks and credit unions in the U.S. include many that lack well-developed mobile and digital products.

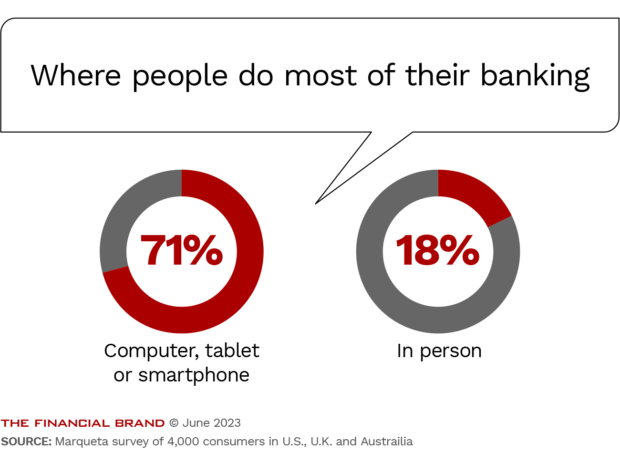

Still, a majority of people across all three countries, when asked directly how they do most of their banking, said they use a computer, tablet or smartphone (71%).

Would consumers ever consider taking all of their business to a bank without physical branch locations? Already, 7% have done so.

Nearly half (49%) were on the fence about that idea, while just over a quarter (26%) said they would consider such a move, and just under a quarter (23%) said they were unsure. Less than half (44%) said “no.”

When asked to choose factors that would sway them to make a digital bank their primary provider, a better mobile app (22%) was the most popular response. This was closely followed by cash incentives or a switching bonus (21%) and features such as access to savings recommendations and better security (20%).

Read more:

- JPMorgan Chase Defends Contrarian Branch Strategy as Deposit-Gathering Machine

- How to Stop Attrition from Stalling Your Growth Strategy

Switching Banks More Common in U.S. Than Other Countries

Even though banking relationships are getting more fragmented, those tempted to switch their primary institution are in the minority: 74% of the survey respondents said they are not even thinking about such a move.

Similarly, 72% said they are satisfied with where they are.

But these percentages imply that more than a quarter of primary banking relationships may be vulnerable to poaching.

The survey also found that 10% of respondents had just switched their primary banking provider within the past year.

It’s often been said that consumers tend to be relatively sticky in terms of their primary banking relationship, though perhaps more out of lethargy than loyalty. The results of the Marqeta survey seem consistent with this view.

More than half of the respondents (54%) reported having used their primary banking provider for more than six years.

Loyalty Is Key:

The portion of consumers who have been with their primary bank or credit union for 6+ years:54%

Longevity varies by region. U.S. respondents were the least likely to have stayed with their primary institution for more than 10 years (22%). Twice as many consumers in the U.K. (42%) and Australia (47%) said their main banking relationship has lasted more than a decade.

Marqeta attributes this, once again, to Americans’ plethora of choices. With this competition comes far more attractive incentives to switch banks. Plus financial incentives such as cash back and rewards are more common in the U.S.

In the U.K. and Australia, “less choice, smaller incentives, and negligible differences between institutions create a much more ‘loyal’ customer base,” the Marqeta report says.

Read more:

- In the Battle for Direct Deposits, New Technology Is a Game Changer

- The Mobile Banking Features U.S., U.K. and Australian Consumers Want Most

Fintechs and Digital Banks Seek ‘Primary Institution’ Status

Americans are seeing even more aggressive competition than usual lately. One nascent trend is that fintechs and digital banks are battling not just for deposits, but for “primary institution” status. It’s become increasingly common for them to reward customers who sign up for direct deposit with higher interest rates.

SoFi, a fintech that now has a bank charter, is one example. Executives at the parent company, SoFi Technologies, said in early June that deposits are growing by more than $2 billion each quarter and that about 90% of this volume is tied to direct deposit relationships that earn preferential rates. They expect to be able to sustain the growth on an ongoing basis, in part because the digital banking model allows flexibility to increase rates on deposits more so than traditional banks and credit unions with branches.

In addition, new technology from fintechs like Pinwheel and ClickSwitch have made it much easier for consumers to switch their direct deposits to a new bank account. So if consumer inertia has worked in favor of traditional banks and credit unions, it may be less of an advantage going forward.

“Over time, we want to work towards being ‘primary’ because everything that you need in your financial life you can find within Cash App Card. So that’s our goal.”

— Jack Dorsey, Block

One of Pinwheel’s clients is Square’s Cash App, which has been clear that it covets “primary” status with its customers.

“Over time, we want to work towards being ‘primary’ because everything that you need in your financial life you can find within Cash App Card,” Jack Dorsey, co-founder and chairman of Square’s parent company, Block, told analysts during its third-quarter earnings call. “So that’s our goal.”

The results of Marqeta’s survey suggest that alternative providers are poised to make deeper inroads over time, especially given that many consumers are already using them to some degree.

Branches still offer traditional banks and credit unions some insulation against such incursions, but how much longer that continues to be the case is open to debate.

Marqeta found that branches often factored into how people initially chose their primary banking provider, a finding consistent with surveys by many others in recent years. Overall, more than one-third of respondents in the Marqeta survey (38%) cited convenience and branch proximity as their biggest considerations. Another 29% based their decision on a recommendation from a friend or family member.

Digital Payments Popular, But Cash Isn’t Dead

A majority of consumers said they have used digital payment options over the past year, with person-to-person transactions, or P2P, being the most popular (83%). This was followed by contactless payments (80%), mobile payments (77%), credit cards (70%) and buy now, pay later (50%).

But traditional payment methods still top the list. Nearly all consumers said they have used cash (95%) and debit cards (93%).

The most common reasons they cited for using cash were: making smaller purchases (34%), making purchases at cash-only businesses (34%), or receiving money from friends, such as for a split restaurant tab (31%). However, the Marqeta report says, use of cash for the latter is being challenged by P2P apps.

Marqeta also notes that 35% of consumers said they use cash less than they did one year ago, holding steady with the 2022 survey results when 36% said the same. It suggests that the decline in cash usage during the pandemic — prompted by hygiene concerns, businesses declining to accept cash and a boom in contactless payments — could have led to a shift in consumer preferences.

“It’s clear that traditional financial institutions have a considerable challenge ahead as they work to keep up with consumers’ increased expectations for user experience,” the Marqeta report says. “It will be interesting to see if the balance tips in favor of traditional or digital moving forward.”

It is the fourth consecutive year for the massive survey, which the research firm Propeller Insights conducted on behalf of Marqeta in February. Half of the 4,000 respondents were in the U.S., while 1,000 came from each of the other countries (the U.K. and Australia). Respondents ranged in age from 18 to 65.

Marqeta published the results in its “2023 State of Payments Report” in June.

See our coverage of the 2022 report: Surging Digital Wallet Use Threatens Credit Card Market