The lines between traditional banking and fintechs continue to blur. Case in point: Fintech consumer lender LendingClub has completed its acquisition of digital-only Radius Bank — but this is far from a buy-a-charter deal. LendingClub plans to blend elements of both its marketplace lending model that relies on investors with the Radius deposit-funded lending model to create a “marketplace bank.”

With the completion of the acquisition in February 2021, LendingClub became a bank holding company that will conduct most of its operations through the bank.

The combination is a marriage made in cyberspace.

Two Digital Creatures With Never A Branch Between Them

As a direct bank, Radius — now LendingClub Bank, N.A. — raised deposits via a combination of internet advertising, affinity-group marketing, banking as a service arrangements and other remote methods. It put the deposits back out through a combination of national lending programs in multiple credit types.

LendingClub, on the other hand, used its online platform to make unsecured personal loans, funded by sales to investors (including banks), with initial funding obtained through warehouse credit lines, typically. The company’s stock in trade was personal loans used to consolidate other consumer debt, notably credit card debt, to enable consumers to bring down their cost of borrowing.

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

LendingClub now aims to become a financial health brand, beginning with offering Radius deposit products to the three million members of LendingClub. During a presentation to analysts, LendingClub CEO Scott Sanborn said that surveys indicate that most members would like to increase their relationships with the company.

A Key Distinction:

“Financial health” can mean different things. While Varo Bank promotes to people who tend to be unbanked or underbanked, LendingClub’s target is the heavily banked middle class that needs help.

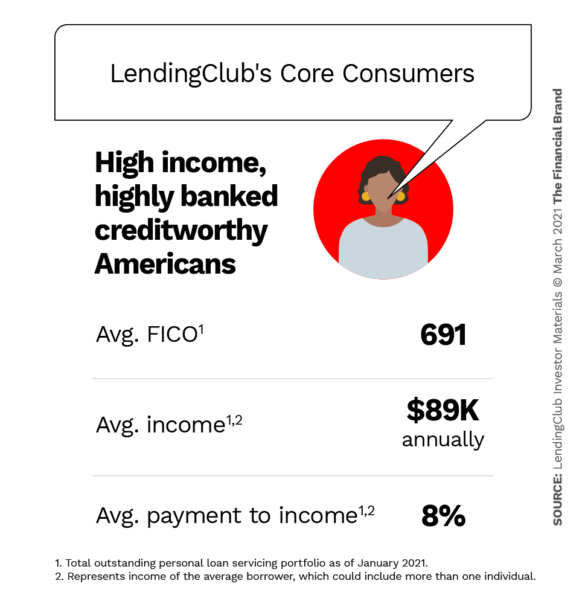

“Our customers are not the underbanked or those shut out of the financial system,” says Sanborn. “These are high income, highly creditworthy individuals who are already fully utilizing bank services. In fact, they are some of retail banking’s most profitable customers. It’s just working out better for the banks than it is for them.”

The typical member has an average FICO score and average annual income of about $89,000. “That’s pretty much the mainstream of America,” says Anuj Nayar, LendingClub’s Financial Health Officer and Head of Communications. “They do tend to skew a little older than people who are just joining the financial world.” Nayar says many LendingClub members fall in Generation X, though other generations also borrow from LendingClub.

Because these consumers tend to have higher-than-average income and higher-than-average debt, including credit card, auto and student loans, banking and the credit card industry rely on them.

“These are their most profitable customers and they are also our customers,” says Nayar. “They are desperate for a new solution to their age-old problem — getting out of debt and staying out of debt.” The company’s core membership tends to return to LendingClub if they need another loan, according to the company’s annual report, “which increases the lifetime value of our members while helping them improve their financial health.”

There are two sides to LendingClub’s evolution — expansion of its desired niche as a financial health brand and using the advantage of having a bank under its roof that can raise insured deposits.

Read More: What the Surge in Fintech Launches Signals for Banking’s Future

Helping Consumers With Borrowing, Spending and Saving

In a message to consumers on the LendingClub website, Sanborn jabbed at both traditional players and at neobanks.

Regarding the former, he wrote that, “We think there is a disconnect between claiming to improve the financial health of customers, while also promoting a high interest, variable rate credit card — which is the antithesis of promoting financial health. But that’s not how the existing system is set up.” (LendingClub loans carry fixed rates.)

Neobanks, on the other hand, promise to upend the existing financial system, offering freedom from fees and a good mobile experience. However, with many not offering credit, “they lack the ability to manage their customer’s volatility in cash flow and expenses and they lack scale,” he wrote.

Nayar says the goal, over time, for the new LendingClub is to offer solutions in borrowing, spending and saving now that a bank is part of its structure. Assistance in each category can go into building financial health for the middle-class consumers the company aims for.

Opportunity in a Fad:

LendingClub may find deep potential in the hot ‘buy now, pay later’ trend — helping people out of it.

While the company’s legacy and sweet spot lies in credit card consolidation lending, the rush to offer buy now, pay later (BNPL) programs by merchants and lenders potentially gives LendingClub fresh opportunities by coming up with offers that would assist consumers to back out of these deals.

“Merchants are very public about why they love BNPL plans,” says Nayar. “It makes people spend more money.” Nayar says many consumers seem to regard the point of sale installment plans as deferred debit card payments, rather than as credit. Yet if they should miss a payment, typically very high interest rates kick in. Nayar says reports indicate many people are missing payments.

“We think there might be an opportunity there for us,” says Nayar. “We could help people save money, instead of paying a lot of money on a very high interest credit product. In fact, we know we can save them money.”

Read More: ‘Buy Now, Pay Later’: An Innovative Lending Program Heading for a Cliff?

Plans to Move Into Proactive Financial Advice

One of LendingClub’s bragging points is the prowess of its proprietary credit scoring system. Nayar says the artificial intelligence behind this system, married to the additional data that LendingClub Bank’s records will now bring, will give the company further vision into what makes consumers tick. This improved insight into member behavior represents another service angle that could also improve LendingClub’s business.

“People are always thinking that their finances are complicated and they worry, thinking about how to make their money work best for them,” says Nayar. He explains that in the future LendingClub will be able to make proactive suggestions. For example, its algorithms may pick up that someone is having difficulty keeping up with credit card payments and can propose a solution from LendingClub.

“This could save them from the hamster wheel of revolving credit card debt,” says Nayar.

The company’s loan processing activity allows evaluation on the fly and Nayar sees a point where LendingClub will be able to pinpoint ways it can save members money. A consumer with an auto loan from another bank might be approached with a LendingClub refi opportunity.

The Big Picture:

Inertia doesn’t tie depositors down as much as it used to, and LendingClub Bank stands to gain.

Efforts to help consumers with deposits will build on the former Radius Bank’s online and mobile deposit offerings. Nayar suggests that transaction accounts will be a strong opportunity because, while many of the company’s members are well-banked, many are annoyed over overdraft charges and fees on these accounts.

Nayar relates a personal story here. He recently refinanced his mortgage with a new lender. He had forgotten that he had free checking with his original mortgage lender, a megabank. A couple of months after the refi he realized he was paying $30 in monthly fees on the formerly free account, with no warning. When he complained, he was told he could bring over a deposit of $25,000 and the bank would then waive the monthly fee. He moved his checking account.

“So I’m thinking, ‘It’s not 1960. If you won’t offer me free checking, I can open another account — which is what I did.”

— Anuj Nayar, LendingClub

In a time when consumers are flocking to Chime and other neobanks, Nayar thinks many consumers will respond to a square deal from LendingClub Bank. As Radius Bank it won multiple awards and other recognition for its digital deposit services.

How Lending Club And Its Bank Will Dovetail

Much of what Nayar discusses above is down the road, but the advantage of stable deposit funding is something that the bank acquisition will bring to LendingClub from the start.

Why It Matters:

The LendingClub/Radius deal underscores why federally insured deposits remain a key advantage for banks and credit unions.

Prior to the Radius Bank acquisition, LendingClub sold all loans to investors, using warehouse lines of credit as an interim step. Now the origination stream will be split. For 2021, the company plans to sell 75%-85% of its origination volume to investors and to retain 15%-25% of volume as an investment. It will be able to make this change because it will have deposits in LendingClub Bank, N.A., to fund the loans.

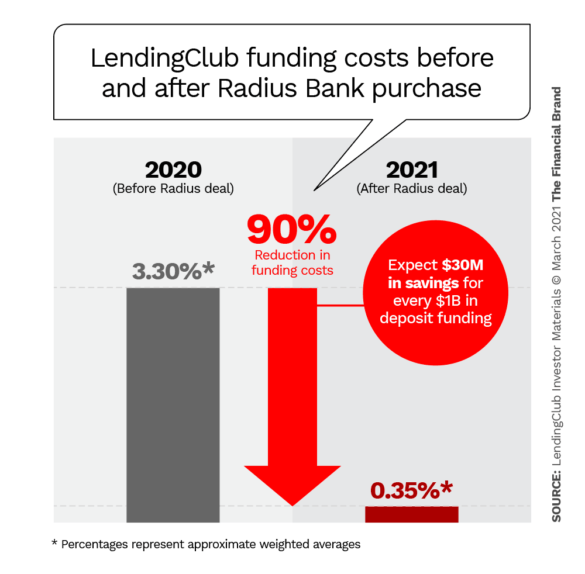

As the visual above illustrates, at the time of LendingClub’s completion of the bank acquisition, warehouse funding cost 3.3% on average, versus only 0.35% on average for deposits.

So deposit funding will replace the warehouse lines, with the portion of deposits used for sold loans rolling over as investors fund them.

The company will have two revenue sources going forward: interest income from higher-quality loans retained in its portfolio and origination and servicing fees taken for loans sold to investors. In addition, because LendingClub Bank will be the originator of most loans (with the exception of a few specialized loans), origination fees will be eliminated.