Larger regional banks will come under greater earnings pressure in 2024, due to both growing costs of maintaining deposit levels and increases in credit problems, according to analysts at the Fitch Ratings firm.

“Rising funding costs and increased [loan loss] provisioning are expected to further pressure earnings, while funding and liquidity profiles have weakened as excess liquidity has flowed out of the system,” said Brian Thies, director at Fitch, during a webinar based on a recent report focusing on large and super regional U.S. banking companies.

And Thies said that the challenging operating environment, credit quality slippage and pressures on earnings will make these institutions more vulnerable to ratings cuts than many had seen in recent reviews.

The Fitch Ratings report and webinar covered 14 large regional banks, from a threshold of $80 billion in total assets up to the super regionals, including PNC, Truist, U.S. Bank and Wells Fargo, which has $1.87 trillion in assets.

Generally, the large regionals included in the analysis tend to rely less on spread income (the difference between rates on deposits and assets like loans) than smaller regional banks, thanks to substantial fee-income-earning activities. In the third quarter 2023, the institutions had a median ratio of non-interest income to total revenue of over 30% — down but still significant. They also generally have diverse loan portfolios, with the exception of those (like Capital One) with heavy exposure to credit cards, and some that have concentrations in commercial real estate similar to many smaller banks.

Banks included in the nearby charts based on Fitch Rating’s research include the following:

CFG: Citizens Financial Group

COF: Capital One Financial Corp.

CMA: Comerica Inc.

FHN: First Horizon Corp,

FTB: Fifth Third Bancorp.

HBAN: Huntington Bancshares

KEY: KeyCorp

MTB: M&T Bancorporation

PNC: PNC Financial Services Group

RF: Regions Financial

TFC: Truist Financial Corp.

USB: U.S. Bancorp

WFC: Wells Fargo & Co.

ZION: Zions Bancorporation, N.A.

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

Digging into the Credit Outlook for Larger Regional Banks

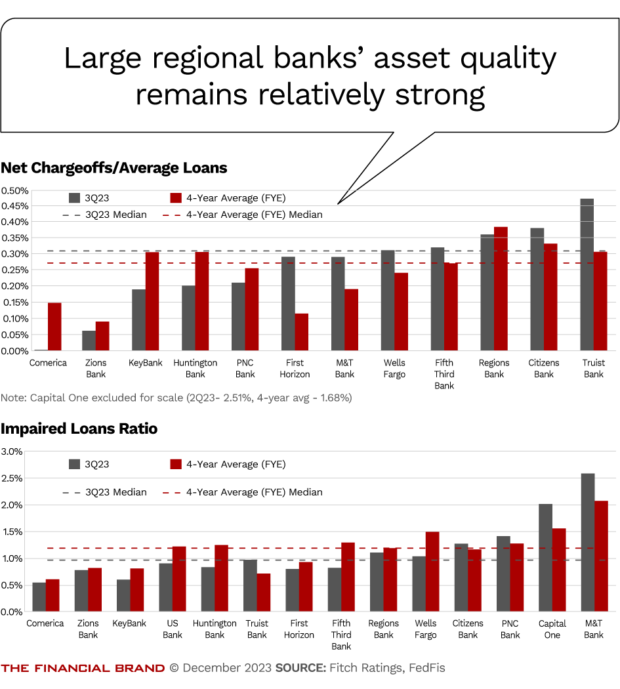

Increasing credit trouble will come from two directions, according to Thies. First, the banks have been seeing multiple loan categories gradually return to more normal levels of performance, the favorable conditions of the pandemic era being finally squeezed out.

“Over the past several years these banks have operated at extremely benign but ultimately unsustainable levels of asset quality, measured both by impaired loans to gross loans and in actual credit costs,” said Thies.

He added that asset quality currently remains decent relative to historical levels, but that “credit normalization” started in 2023 and will accelerate in 2024. While Fitch has factored this into the firm’s current ratings of these banks, he said the firm could downgrade an institution “for outsized deterioration relative to peers or long-term historical averages.”

A very rapid pace of deterioration in credit quality in 2024 could also push ratings down, said Thies. He said Fitch sees consumer credit and commercial real estate lending, especially the hard-hit office segment, as weak spots going in 2024.

Overall asset quality remains strong, according to the firm, but with “normalization” going on and the potential of institution-specific spikes, it needs careful monitoring.

The good news is that most of these banks have already been maintaining loan loss reserves much higher than typical. Because of this, Thies said, “We believe these banks are better positioned to absorb credit losses associated with normalization than they would have in prior cycles.”

Read more: Credit Card Trends Have Bank Issuers on Alert

The Early 2023 Industry Crisis Drove Banks to Reposition Themselves

Encouragingly, many institutions also took the events of the spring banking turmoil as a warning to shift gears.

“All banks within this cohort positioned defensively following the March events,” said Patrick Yu, director. “This included holding higher levels of cash, selectively exiting loan-only relationships, and prioritizing defense of deposit levels over optimizing for net interest income.”

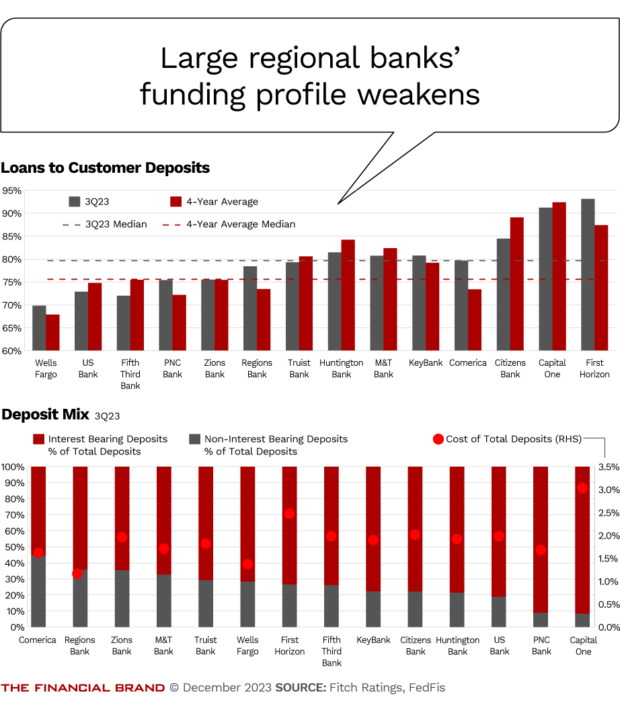

Of course, as Yu pointed out, that intensified competition for deposits and woke up once-comatose savers and others who wanted better rates.

“We see a substantial remixing of non-interest-bearing deposits into interest-bearing and time deposits,” said Yu. “That said, relative to pre-pandemic levels, deposits still look healthy and most of the banks’ loan-to-deposit ratios are still at or below 2019 levels.”

Yu said Fitch expects that there will be a temporary let-up on pressure on deposits next year as the Federal Reserve begins buying securities from banks in the fourth quarter, which will add to liquidity.

However, Fitch subscribes to the “higher-for-longer” scenario that bank asset-liability managers have been watching.

“We expect funding costs will continue to creep up slowly and more of that will be essentially to catch up on consumer deposits,” Yu said. The institutions in the study will still enjoy some insulation from the pressures on smaller firms because of their higher share of diversified commercial deposits.

Read more: Timeline and Explainer About the Banking Crisis

No Exit Ramps: Consolidation Will Not Be an Easy Solution

The Biden Administration has made it much harder to obtain federal approvals for bank mergers and the merger picture remains cloudy, according to the Fitch analysts.

“The regulatory bias against larger bank mergers is a continuing source of friction, but there’s also resistance among the banks themselves to mergers that aren’t strategically essential.”

“M&A is far less likely [in this peer group] now than would have been considered a year or two ago,” said Thies. The regulatory bias against larger bank mergers is a continuing source of friction, but there’s also resistance among the banks themselves to mergers that aren’t strategically essential, according to Thies. One reason: Given the levels of unrealized losses in institutions’ securities portfolios, obtaining clear valuations of potential targets has become much more difficult, he explained.

Fitch’s Christopher Wolfe, managing director, added that the valuation gap between buyers and sellers is actually widening.

Expectations of a continuing M&A slowdown are shared elsewhere.

“The role of regulation — which continues to evolve — will remain an active consideration in determining the pace and profile of future bank M&A activity, and a thawing of the regulatory environment is a necessary development as well,” said analysts at Keefe, Bruyette & Woods in a late-November special report on the merger outlook in banking.

The firm’s analysts believe that further evolution of the industry, including allowing mergers to repopulate some of its asset classes, is necessary to improve its health. A handful of institutions have reached a size that achieve optimal scale, according to the report.

However, other institutions could avail themselves of combinations that would improve their profitability and their ability to scale. KBW indicated that Huntington, Fifth Third, M&T, Regions and East West Bank were among one group.

The analysts also identified some institutions that could be the source of scale for potential acquirers. These include Comerica, Zions Bank and First Horizon. The latter bank had been slated for acquisition by TD Bank Group but the deal fell apart, predominantly due regulatory difficulties, in May 2023.

Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

This webinar will offer a comprehensive roadmap for digital marketing success, from building foundational capabilities and structures and forging strategic partnerships, to assembling the right team.

Read More about Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

More M&A Would Inject More Competition into Larger-Bank Tiers

A key reason for the industry needing more M&A, in KBW’s view, is that American banking has become much more concentrated in the major leagues than before the Great Financial Crisis.

Enabling more banks to merge would increase competition in the higher tiers. And elsewhere it would increase efficiencies. The report pointed out that while $10 billion in assets remains an important regulatory threshold, actual “economic breakeven” for merged players comes more at $12 billion in assets today.

“We believe a dynamic and thriving banking system needs greater competition up and down the asset gamut in order to not only serve the needs of communities and larger scale businesses, but also to promote a safer financial system altogether,” KBW said in its report. It predicted that while consolidation among larger institutions has slowed, “M&A will again play an active role for banks on either side of the profitability ledger in the coming years.”

Read more: