“I can’t imagine anybody in the room who 45 days ago thought we’d be here doing this today.”

That’s how Bryan Jordan kicked off First Horizon Corp.’s investor day in early June, a month after its $13.4 billion sale to Canada’s TD Bank Group fell apart. The two mutually agreed to terminate the deal after a fruitless 14-month wait for regulatory approval that had no end in sight.

Now Jordan, First Horizon’s chairman and chief executive, had to give investors and analysts a reassuring answer to the question: “What do we do now?”

He succeeded.

The leadership team presented a detailed overview of First Horizon’s strategy for playing offense and an upbeat message about how employees are energized and deposits are growing.

“TD was unable to get the regulatory approvals,” said Jordan. (Concern about anti-money-laundering practices at TD reportedly played a role.)

“But I’ll tell you, we hit the ground running when we terminated the merger agreement.”

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

Improve Your Business Outcomes Through Data & Analytics

Gain centralized access to the credit bureaus and 20+ alternative data sources. Leverage advanced analytics to optimize marketing campaigns and loan decisions.

Read More about Improve Your Business Outcomes Through Data & Analytics

New Technology and Talent on the Way

First Horizon intends to build on that momentum by putting to good use the $200 million in cash that TD has to pay because of the terminated merger.

Between $75 million and $100 million will go toward new technology and more tech talent.

“I’m a big believer that you can’t win with technology, but you can darn sure lose without it,” Jordan said.

The tech earmark will cover upgrades on multiple fronts over the next three years, including digital banking, wealth management, treasury management, marketing technology, and artificial intelligence. Tech staff is slated to increase by 20% over the next two years.

About half of the projects financed by the TD payment will be efforts to beef up the security and reliability of First Horizon systems, according to Tammy LoCascio, the chief operating officer. This includes cyber fraud defense, compliance upgrades and improvements that will hasten implementation of cloud technology and use of application programming interfaces, or APIs.

Projects to improve banking operations from the customer perspective — including tech such as artificial intelligence and machine learning — make up the other half.

First Horizon had been focused on improving the customer experience even before the TD payment came into play. In late 2022, it rolled out a new website, in part to achieve a 26% improvement in site load time, according to Erin Pryor, the chief marketing officer.

The revamped website has already produced a four-fold increase in leads from a marketing push for deposits, resulting in $500 million in new deposits so far in 2023, Pryor said.

Read More: 3 Reasons Financial Institutions Can’t Let Mergers Stall Innovation

First Horizon Moving Past Years of ‘Noise’

Many of the speakers at investor day underscored the proactive posture the bank is embracing now that it is free of other distractions.

Before the proposed TD deal, it had completed the integration of New Orleans-based Iberia Bank just in mid-2020. As of the end of the first quarter, First Horizon ranked as the 36th-largest institution in the country, at $80.7 billion in assets. (TD’s U.S. arm is number 11.)

The speakers often shared anecdotes during their presentations about the positive reaction customers had to the termination of the TD deal. Some companies said they’d be bringing funds back to First Horizon, after having gradually withdrawn them because they wanted to do business with a U.S. bank, not a Canadian one. A nonprofit the bank had long pursued is a new customer that came on board with $50 million.

Once the deal was nixed, “we started leaning forward on our deposit franchise,” Jordan said. The staff had a reason to reach out to customers and prospects to have “positive conversations about attracting new relationships and expanded relationships.”

Top managers made a point of quashing rumors that First Horizon, which has 417 branches across a 12-state footprint, was “hollowed out” by staff exits while the merger was pending. They cited a retention program the bank had put in place and TD’s promise to give all a shot at jobs after consummation of the deal.

Overall retention between the first quarter of 2022 and the first quarter of 2023 was 87%, and retention at the top two tiers of management was 94%, according to Hope Dmuchowski, the chief financial officer. (First Horizon has a reputation for its focus on fostering a positive workplace culture.)

Dmuchowski said that recruiters were trolling the ranks of First Horizon executives and employees, often with offers to buy out their retention agreements to enable them to move. But comparatively few bit. “Most of them could have gotten bought out and yet they didn’t even take the calls.”

Read More: Reviving Customer Testimonials with Flair in Huntington Bank’s Ad Campaign

First Horizon’s Outlook on Its Growth Prospects and the Economy

The optimism aside, Jordan forecast a less rosy economic backdrop. He expects tighter lending conditions, given the combination of the Fed draining funds from the system and the Treasury Department refinancing its balance sheet. He also noted that many of the industry’s deposits remain tied up in long-dated securities and long-dated mortgages that are underwater because of rising rates.

Jordan told analysts that he expects economic activity to slow significantly in the latter part of 2023 or in early 2024, with a slow but sustained recovery coming afterward.

Asked to assess the bank’s growth potential, Jordan punted, suggesting that it could grow by $5 billion or, just as likely, shrink by that amount, given the economic outlook.

He also said it was not in a hurry to cross the threshold of $100 billion in assets because the regulatory burden increases at that point. And it might increase even more in the wake of the failures of three large regionals in the spring. “$100 billion is not just expensive, it’s extraordinarily expensive,” Jordan said. “And it doesn’t add much in terms of customer service ability nor shareholder returns. I’d want to see how the regulatory framework plays out.”

First Horizon isn’t afraid of organic growth or M&A, but only wants growth if it is profitable. “We’re going to do what makes sense for the environment,” said Jordan.

In response to another question, he used the bank’s loan-to-deposit ratio to illustrate his current strategic mindset.

“A loan-to-deposit ratio of 100% with the wrong kind of credit doesn’t make any sense. But a ratio of 90% and missing great customer opportunities doesn’t make any sense either.”

— Bryan Jordan, First Horizon

Jordan said he likes the ratio to be at or below 100% and is not comfortable going above that for more than a brief time. (The bank had a ratio of 93.9% at March 31.)

The bank is strongly capitalized and plans to add to capital, which Dmuchowski said is a differentiator for First Horizon. (Its common equity tier 1 ratio of 11.3% last quarter was more than a percentage point above the median for its peers.)

Read More:

- What Does It Take to Attract Deposits with a Digital-Only Bank Brand?

- Truist Plays ‘Long Game’ with Gamified Mobile App to Boost Deposits

- Apple Card’s Newly Launched Savings Account Is Another Brick in the Walled Garden

Industry Cloud for Banking from PwC

See how PwC's Industry Cloud for Banking can help solve everyday business challenges.

Creating A Community with CQRC’s Branch Redesign

Find out how SLD helped CQRC Bank to create the perfect harmony of financial services, local culture, and the human touch in their branch transformation.

Read More about Creating A Community with CQRC’s Branch Redesign

Deposit Strategy Goes Beyond the Usual Approaches

First Horizon is focused on delivering “top tier returns” going forward, Jordan said. So the staff will be watching more than just spreads as the bank adds loans and deposits.

“If we’re in a transaction or credit relationship and in three years we haven’t picked up any ancillary or relationship business, we’re fine walking away from that,” Jordan said. “We’re going to use our balance sheet for the most profitable business.”

The bank is heavy on commercial loans, with significant diversification in terms of industry and, in the case of commercial real estate, property type. (The loan mix at the end of the first quarter was: 54% commercial and industrial, 23% commercial real estate, 21% secured consumer lending, and 1% unsecured consumer lending.)

The commercial borrowers bolster First Horizon’s deposit gathering, as do a group of specialized business lines.

The bank also has a strong branch network in growth markets in the South — encompassing 32 metropolitan statistical areas which, it estimates, have approximately $5.1 trillion in deposits overall.

Treasury management relationships with commercial customers account for about $25 billion of deposits. First Horizon was able to grow in treasury management while the merger was pending and now 80% of commercial deposits come from those who use this service, Restel said.

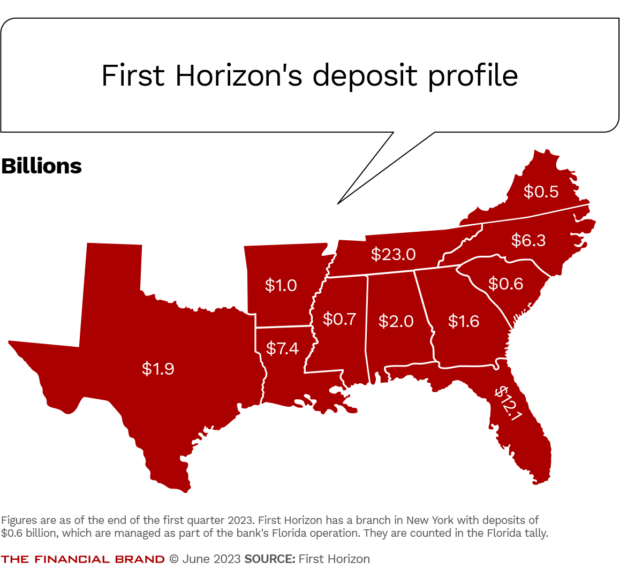

An Overview of First Horizon’s Deposits

First Horizon’s deposits are roughly 50% consumer and 50% commercial. About a third of its total deposits are non-interest-bearing.

Executives stressed that the deposits are diversified, addressing what has become a hot button after bank runs toppled several large regionals. First Horizon’s top 15 unsecured deposit relationships represent 1% of its deposits, and the top 40 represent 3%.

The bank had a total of $57.2 billion in deposits at the end of the first quarter, down from $58.8 billion in the previous quarter and $67.7 billion at the end of 2021. Anthony Restel, the president of regional banking, attributed this to consumers spending down their savings, which had benefited from government stimulus money during the pandemic. He said the bank retained 97% of its depositors in the first quarter.

Deposits in the second quarter are on the rise again, and First Horizon has the best new account origination level that it’s had in the last three years, Restel said.

A deposit acquisition campaign for new customers began in February 2023, and net deposits gained in April and May totaled $400 million.

Deposit costs are going up too. First Horizon’s total deposit costs rose by nearly 61% from the end of 2022 to the end of the first quarter of 2023.

About 63% of the bank’s total deposits are either covered by insurance from the Federal Deposit Insurance Corp. or, in the case of certain commercial deposits, collateralized.

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

The unfair advantage for financial brands.

Offering aggressive financial marketing strategies custom-built for leaders looking to redefine industry norms and establish market dominance.

Specialty Banking Brings in Deposits Too

First Horizon is involved in asset-based lending, franchise financing, equipment financing, correspondent banking, energy lending, healthcare lending, mortgage warehouse lending and mortgage lending — activities that enhance its deposit gathering and treasury management push.

Specialty banking accounted for $3.2 billion of deposits as of the end of the first quarter, which is down from a pandemic peak of $6.2 billion. However, the staff has been seeing results from a push to get additional deposits from these companies over the last couple of months, according to David Popwell, the bank’s president of specialty banking. The strategies include seeking new escrow deposits from mortgage warehouse borrowers; arranging additional investment sweep deposits from the largest correspondent banking customers; and regaining commercial deposits that were moved to alternative investments, such as Treasury securities.

Some areas have ebbs and flows simultaneously — for example, even as mortgage warehousing clients bring in more escrow deposits, some are selling off mortgage servicing rights to build liquidity, which drains deposits.

The strongest results in attracting deposits have been with asset-based lending, franchise finance and equipment finance customers.

The gains help make up for deposits that leave when commercial customers play hardball on deposit pricing, in the game of musical chairs that banks find themselves playing on rates.

Actively asking for deposits is a shift for First Horizon. With the TD merger scratched and the noise caused by the pandemic and the post-Iberia systems conversions over, the staff can focus once again on outside relationships — or “play offense,” as Jordan put it.

“Our people are super pumped,” he said.