The Report: Financial Stability Report

Published: October 2023

Source: Board of Governors of the Federal Reserve System

Why we picked it: The Financial Stability Reports can provide critical understanding of the Fed’s perception of both current economic conditions and the state of the financial sector generally. While the Fed’s tone is usually measured and reassuring, the report also includes nuggets of insight on the Fed’s specific areas of concern, and what they are watching closely.

Executive Summary

The Fed’s latest biannual report on financial stability paints a picture of a currently stable banking system that still faces notable near-term risks. While balance sheets of banks, businesses, and consumers look decent, interest rates and falling real estate values are the Fed’s areas of concern.

“Balance sheets of many nonfinancial businesses and households remained solid, with vulnerabilities at moderate levels. That said, there are increasing signs that higher interest rates are beginning to strain some borrowers.”

Key Takeaways

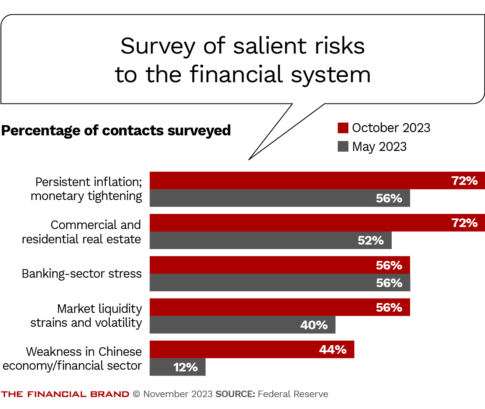

• Approximately three-fourths (72%) of respondents were concerned about inflation and interest rates, and the potential for large losses on commercial and residential real estate.

• The same percentage (72%) are worried about risks in commercial and residential real estate, up from just 52% in the last survey in May.

• While mortgage debt and other loans are not yet at increased risk, there is a subset of consumers who are experiencing more financial stress.

The unfair advantage for financial brands.

Offering aggressive financial marketing strategies custom-built for leaders looking to redefine industry norms and establish market dominance.

Improve Your Business Outcomes Through Data & Analytics

Gain centralized access to the credit bureaus and 20+ alternative data sources. Leverage advanced analytics to optimize marketing campaigns and loan decisions.

Read More about Improve Your Business Outcomes Through Data & Analytics

What we liked: The Fed report does a good job laying out the fundamentals of the consumer market and offers a good summary of how banking conditions have changed over the past six months. The report also addresses many of the key risks, including rising interest rates and real estate values.

What we didn’t like: The report takes too long to get to the point, presenting too much data and charts early on without context. The most important part of the report — the “Near-Term Risks to the Financial System” — doesn’t start until page 47.

Things that made us go “Hmm”: The Fed does indicate that inflationary pressures could lead conditions to change and that a subset of consumers are starting to show distress.

However, there are even more negative factors this report doesn’t consider. For example, Fed also noted that in another report in August 2023 that credit card debt now exceeds $1 trillion, and Transunion also reported the average credit card balance is now at a ten-year high of $6,000, up 15% from a year ago. Census data reports household income is on the decline, and consumer sentiment remains low, according to the University of Michigan’s Consumer Sentiment Index.

Read more:

- Stressed Millennials Could Use Some Advice on Managing Growing Debt

- FedNow Turns Instant Payments into a Must-Have for Banks

The Back Story

The Federal Reserve’s biannual Financial Stability Report, which comes out every fall and spring, offers an assessment of the stability of the U.S. financial system. The Fed considers a financial system to be “stable” when financial situations and markets can offer consumers and business financing they need to grow and participate in the economy, even when hit by adverse events.

In this report, the Federal Reserve of New York solicited views by surveying 25 contacts, including professionals at broker-dealers, investment funds, research and advisory firms, and academics. Since the last survey in May 2023, the Fed noted changes in the four broad categories of vulnerabilities:

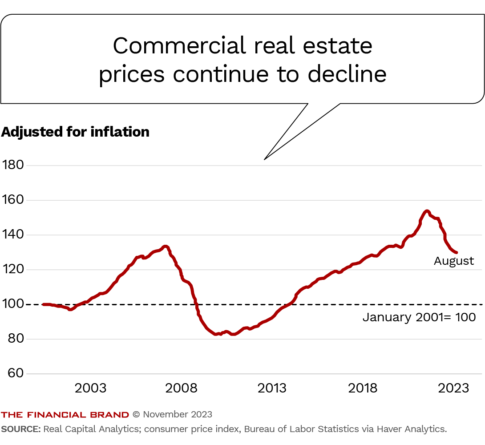

• Asset valuations: P/E ratios are now at elevated levels and residential and commercial property prices remain high relative to fundamentals.

• Borrowing by businesses and households: The ratio of private debt to GDP remained average and household debt was at most relative to GDP. However, the business debt-to-GDP ratios remain high.

• Leverage in the financial sector: Risk-based capital ratios at average indicate the banking system remains resilient. However, high interest rates continue to depress the fair value of long-maturity, fixed assets that represent sizeable holdings for many banks.

• Funding risks: While most banks mainlined high liquidity and stable funding levels, a subset of banks face funding pressures. Structural vulnerabilities persist at some money market funds and liquidity risks for life insurers remain elevated.

Critical Issues

Many of the Fed’s survey respondents have deep concerns about future risks.

Interest rates: Three-quarters of those surveyed are worried about persistent inflation and further monetary tightening. Treasury yields have increased notably higher since the May report and are now near their highest levels in 15 years.

Real estate: Nearly three-fourths of those surveyed are also concerned about real estate. Commercial real estate valuations continue to decline but still remain elevated, meaning there may yet be more room to fall. Valuations are particularly elevated for the office sector where vacancy rates have increased and rents have declined since May. Housing prices began rising again in recent months.

Where The Fears are Rising:

Three-quarters of those surveyed by the Fed said they're worried about persistent inflation and three-fourths are monitoring the real estate market closely.

However, one model of valuation based on prices relative to equivalent rents and the 10-year Treasury suggest valuations are still stretched. The Fed also noted that credit conditions for borrowers remain considerably higher than in the early 2000s.

China: Another growing risk is that slowdown in Chinese growth could ultimately strain markets worldwide. Many firms in China carry high levels of debt, and given the size of its financial system and economy, stresses in China could broadly strain global markets through disruption to economic activity, deterioration of risk sentiment and a potential sharp appreciation of the U.S. dollar.

Geopolitical wild cards: This survey was conducted before war broke out in Israel, so it doesn’t factor in the risk of an escalation in the Middle East. Analysts have already indicated that if the conflict spreads across the region, oil could spike as high as $160 per barrel. Fed Chairman Jerome Powell said in late October that the potential for skyrocketing oil prices could “pose important risks” to the global economy.

Consumer Debt is Okay — For Now

Overall, consumers remain on a decent footing with debt. The slight uptick in delinquencies in some categories in the past year are mostly a return to normal trends. However, the Fed survey indicates the cost of new debt, and the impact of rising variable rate debt, is having a growing impact on a subset of consumers.

Little impact from interest rates on household debt: Many households that bought homes or refinanced when rates were low continue to benefit from lower interest rate payments, thus strengthening their financial position. Adjusted for inflation, outstanding household debt also trickled down slightly in the second quarter. The Fed notes that higher interest rates have only partly passed through to households because, aside from credit card debt, only a small share of household debt is subject to floating rates.

Dig deeper: What Bankers Need to Know About Higher Consumer Debt

Low risk for mortgage debt: The upside is that mortgage debt, which accounts for roughly two-thirds of total household debt, has relatively low risk. Delinquency rates remain near historically low levels, and very few homeowners have negative equity in their homes.

Some strained borrowers: While business and household balance sheets remain solid, there are growing signs that interest rates are starting to strain some borrowers. In the first half of 2023, borrowing costs increased to levels not seen since before the Great Recession. The share of small businesses that regularly borrow has also declined since the start of the year and remains low by historical standards.

Delinquencies: The Fed report indicates that while the credit risk of outstanding debt remains generally low, borrowers with low credit scores continue to show signs of stress. Additionally, there has been a rise in delinquency rates with newly issued consumer loans.

The share of auto loans in loss mitigation remains in line with its historical median, although delinquency rates mask a sharper rise in auto loan delinquency rates for subprime borrowers. Delinquency rates from these borrowers rosed notably in the second quarter of 2023 and are not an elevated level compared to pre-pandemic.

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

The Final Verdict

While the overall banking system remains solid and profitable, there is a subset of large and regional banks who have seen notable declines in the fair value of fixed-rate assets. Additionally, pressures to raise deposit rates to compete with higher-yielding alternatives may continue to affect profit margins at some banks. Consumers and businesses may be okay for now, but there are growing risks.

For some additional reading and a closer look at what consumers think about their finances and the future, check out this article from McKinsey.

About the author:

Craig Guillot is a longtime contributor to The Financial Brand who specializes in technology. He often writes about IoT, cybersecurity and SaaS, primarily in the verticals of retail, manufacturing, financial services and healthcare. His work has appeared in The Wall Street Journal, Entrepreneur and elsewhere.