The COVID-19 pandemic has brought about an unusual situation for bank and credit union marketers.

One of their time-honored tasks — bringing in deposits — has become substantially easier as Americans seek the relative safety of insured deposits even in the face of extremely low rates. At the same time, the potential for consumers switching banking relationships, now or after the pandemic is past, appears to be higher as more people grow comfortable with digital options.

Switching a significant relationship may still take a branch visit, so institutions have a bit of a grace period on switching right now due to consumers’ reticence about going to branches because of COVID-19 risk.

This health factor may give banks and credit unions time to marshal their counter-arguments for when consumers try to make a move.

An important backdrop to all this is that the concept of being a “primary financial institution” is evolving. In addition, the pandemic is causing some expansion-minded institutions to weigh how much of a role branches need to play in making that happen.

Two consultants with Simon-Kucher & Partners — Betty Cowell, Senior Advisor, and Rohan Shah, Director — discussed these trends and strategies to deal with them with The Financial Brand.

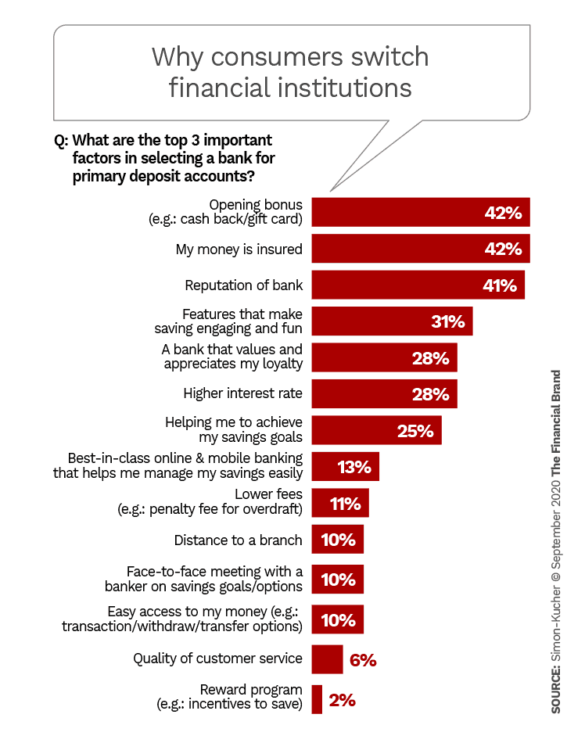

Research by the firm examined the top motivations among consumers for choosing a primary financial institution.

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

Move the Needle from Attrition to Acquisition

Vericast’s 2024 Financial TrendWatch explores seven of today’s most critical financial services trends to provide a complete view of the current loyalty landscape.

Read More about Move the Needle from Attrition to Acquisition

Financial Incentives for Picking an Institution and How to Address Them

The ultra-low-rate environment that has heated up mortgage lending during the pandemic has a flip side for savers. Already low rates have dropped further and even institutions that paid higher rates have backed off, points out Shah. The Federal Reserve has made it clear that very low rates will be engineered for years ahead. The firm’s research, in the above chart, makes it clear that for 28% of consumers higher interest rates could prompt them to move, but this factor will be nearly dead in the water.

Institutions, especially direct banks, paying up for deposits were always getting hot money, notes Shah and many mainstream institutions have stopped vying for those funds except for very targeted offers for specific, highly desirable consumers or in new geographies where they want to build share.

“But you won’t see blanket offers of higher rates anymore by mainstream institutions,” says Shah, “especially in markets where they are already fairly strong. They don’t want to compete on rate anymore.”

Financial bonuses in the form of cash back or gift cards, rank #1 in Simon-Kucher’s research, and the target audiences of mainstream players that are still vying for deposits will get those offers. Shah says institutions who stand to lose those deposits can counter by making a case for value.

This does not have to wait until the consumer is halfway out the door. Shah says banks and credit unions can take communications steps to sell current deposit holders on the benefits they enjoy that they may have forgotten about or haven’t taken advantage of.

“They may not understand what they are getting from the relationship with your institution,” says Shah. “They may not have quantified the value of free services, not getting charged for overdrafts and many other things. You can show them that they may already be saving $500 a year by banking with you.” This may not be as sexy as getting a bonus check or a gift card, but money is money.

One key here is that it is still not easy to move a household banking relationship that is tied in to automatic payments with ecommerce vendors, utilities, retirement savings, and various sources of direct deposit. Showing the value of the existing relationship means even more in that context. Is a competitor’s cash bonus worth the headaches?

Shah says this is the time for banks and credit unions to communicate in various channels that they intend to “be there” for consumers in increasingly troubled times, to demonstrate that they are a “trusted partner.”

Read More:

- Big Chance to Grab (or Lose) Consumers Primed to Switch

- Just Because Banking Customers Don’t ‘Switch’ Doesn’t Mean They Love You

- Five Ways Marketers Can Get People to Switch Banking Providers

Rethinking What Relationships Matter, and Why

This is also a time when more institutions conversely have been looking at which accounts matter the most to the institution, in terms of overall value and long-term potential. Consumers with relationships that are broad and deep, with credit connections, investment accounts and more, represent the ones to hold and nurture, says Shah. Those with low balances and no indication of further potential may be worth letting walk, especially when many institutions are flush with deposits that they can’t put into anything more lucrative than Treasury securities.

“There are sustained conversations going on now in institutions on how to figure out which accounts just aren’t worth it,” says Shah.

This is also the time to focus on digital services and to beef those up and publicize the improvements.

“Nobody is leaving for rate these days, not with family accounts,” says Shah. “The people who are leaving are people who like to do more of their banking online, via apps or through call centers.”

The consultant says younger consumers are most likely to go because they are attracted to institutions that offer state-of-the-art digital services — both traditional institutions as well as challenger banks and fintechs.

The firm’s own research has shown that branches aren’t dead, though networks can be thinned without bad consequences.

A mental adjustment that more institutions are making, is to the fact that your institution is one of a consumer’s primary banking relationships, but not the single one that was traditionally aspired to. “They understand that and are more accepting of it,” Shah states, but this also sets up the opportunity to promote the institution so it takes on a greater share of the consumer’s financial potential.

Read More:

- How COVID Is Reshaping the Way Financial Marketers Target Consumers

- Fintech Buys Bank in Pursuit of Radical New Business Model

- Gen Z Says They’re Eager to Use Big Techs for Banking – But Will They?

- Wealthfront: A Digital Solution In The Battle For Millennial Deposits

Americans Haven’t Been Savers But They Want More Control Over Their Financial Affairs

Even now, Shah observes, many Americans don’t emphasize savings. When he moved to the U.S. from India he was initially surprised how many people here live life up to their salaries and their available credit. Even now, in the current economy and health crisis, longstanding tendencies may not have changed much.

However, something Americans do like, and seem to be increasingly focusing on amid the crisis, is control over their finances. Fintechs and challenger banks are talking directly to that urge. To the degree that they are thinking about savings, it may be that their impetus is control over their lives.

Betty Cowell notes that Acorn has reported opening a record number of accounts online during the pandemic. She thinks this comes from the desire for control, plus the appeal of all-digital, always-available service.

Both consultants see these as the strongest cards in the hands of the challengers. This is especially so because the Acorns, Chimes, Qapitals and others of that fraternity use gamification that make savings, and other elements of financial management, engaging and fun. This was the fourth-ranking factor in Simon-Kucher’s research. Nearly one out of three consumer respondents cited this.

Shah says that Qapital’s basic pitch is that it is “the money app that makes it easy to fund your future — while taking care of you now.” The app stresses goal setting in various forms. This is something only some of the direct banks, such as Ally, have done.

Something especially interesting to Shah is that Qapital offers a 30-day free trial, after which it charges a monthly fee for its transaction accounts — $3 at the basic level and $12 for “Qapital Master” accounts. This again goes to the need for traditional institutions to point out value they provide and to build more digital improvements into those offerings. While banks look for ways to offer free accounts, Qapital goes into the competitive fray with an explicit charge.

“And Qapital has never offered particularly high interest rates,” Shah adds.

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

How Much of a Threat is ‘Google Checking’?

Cowell points out a common failing of all digital banking services: It’s quite rare to have any kind of opportunity to “test drive” financial services, even apps, for look and feel and functionality. The App Store and Google Play show a few screens and include reviews, but to really get an app’s utility, you have to take a leap of faith.

Cowell says this makes it clear that word of mouth remains a critical element of building share. Even in this digital age, recommendations of family and friends continues to be a strong factor in consumers deciding to switch to another financial provider. Institutions that want to be the winners of the switching battle must ponder that.

Which brings up the industry’s big question mark: What is Google going to do in conjunction with the handful of banks and credit unions of all sizes that have announced partnerships with the tech giant? Details have been sketchy at best.

Cowell and Shah believe it is important to understand that Google, unlike many fintechs, has no desire to be a bank in financial terms. What Google wants to access is a huge swath of financial and spending data. While the front end will look like a banking product as imagined by Google, Google and the banking industry are playing different games on the same gameboard.

That said, both consultants feel that the threat of “Google Checking,” or some other label, is not that immediate.

“I think adoption might not be as fast as we would imagine it to be,” says Cowell. “I think it will take people a lot more time to become comfortable with moving their financial relationships to places like Google and Facebook and even Amazon. Trust is quite low in these companies right now, especially from a privacy point of view.”