As America keeps attempting to reopen, a key question among traditional financial institutions continues to be whether the branch has a future. New research from Simon-Kucher & Partners indicates that branches do have a strong outlook, but that institutions won’t have to maintain as many of them to provide the key services that the public as a whole wants from them. That prediction, however, comes with a big “if.”

The research, conducted in June 2020, confirms that as COVID-19 pushed branch-using consumers toward digital channels, many of them found they liked mobile and online banking, and will do more that way going forward. However, when asked for their preferences for more complex banking transactions, such as obtaining a mortgage, many still preferred an in-person interaction in a branch to a digital transaction.

And when they do want personal interaction, consumers would be willing to walk further to visit a branch, in urban areas, and would be willing to drive further in suburban and rural areas.

The implication is that some of the infilling of branches in many markets done over the years can be reversed. The chance to reduce facility, staffing and other branch costs in this way is attractive, especially with the industry facing a recession economy.

Here’s the “if.” The research makes it clear that the “price” to be able to do that branch trimming is to provide great digital banking service.

Therein lies the rub.

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

Most Digital Banking Doesn’t Wow People

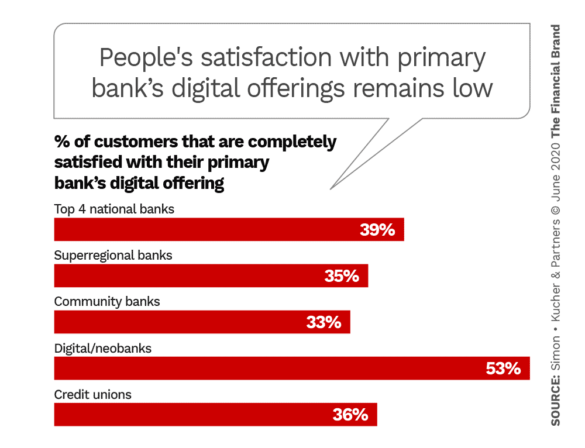

The Simon-Kucher research indicates that many consumers don’t think so highly of the digital services that banks and credit unions offer. In fact, as the chart below shows, only a bit over half of consumers whose primary financial institution is a digital bank or neobank say they are happy with even those institutions’ digital services. And that’s all that those companies bring to the table.

“Are people satisfied with their institution’s digital capabilities? Not so much,” says Wei Ke, Managing Partner at Simon-Kucher in an interview with The Financial Brand. “If about 40% of consumers using the top four banks are satisfied with their bank’s digital service, that means 60% are not satisfied.”

While many pro-digital commentators have spoken of the coronavirus lockdown as an accelerating factor for digital adoption, it is important to remember that COVID-19, shuttered lobbies and long wait times for call centers forced many consumers to try out mobile and online services for the first time.

Routine digital transactions like mobile deposit could conceivably still be favored by many newcomers, but complex deals like home loans may still tend to happen in branches. Concerns about fraud and the desire to pursue account disputes in person also favor physical branches.

“It’s much easier cognitively to just talk to a human to take care of you in situations like that as opposed to trying to use digital channels,” says Ke.

The study’s findings suggest a balanced approach to rethinking retail banking in the wake of all that has happened during the pandemic. Trim branches where it makes sense. But only do so while simultaneously investing in improving digital services.

“The typical bank digital strategy prioritizes efficiency over customer experience,” the report states. It further warns that much pre-COVID thinking about omni-channel strategies may be outdated permanently by the public’s attitudes towards safety in physical locations. This is a fluid situation that demands constant monitoring.

What People Will Prefer to Do in a Branch

Financial executives trying to divine the best strategies going forward have to remember that financial institution COVID-19 tactics differed from market to market and state to state. While some institutions sealed up tight as vaults, many did permit in-branch visits for essential purposes, with social distancing in place as well as appointments-only policies. Even at the height of the crisis and shutdowns, things didn’t go all digital all the time.

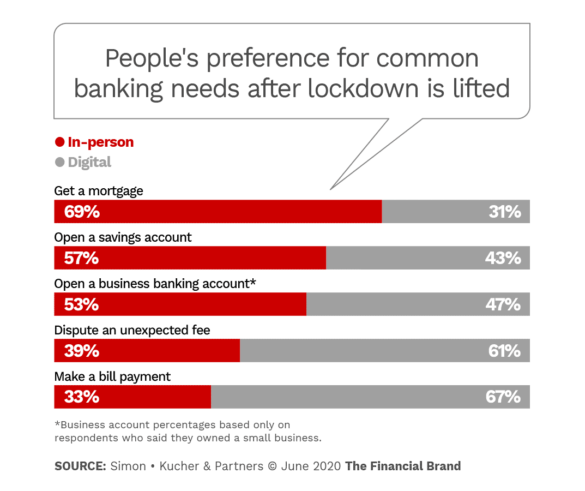

The research found that preference for doing these activities did increase during the crisis, and are expected to do so afterward. In the following bullets, the first number is preference for digital before lockdown, the second is preference during lockdown, and the third is expected preference after lockdown (corresponding to the gray section of the bars in the chart above):

- Get a mortgage: 24%, 32%, 31%

- Open a savings account: 39%, 43%, 43%

- Open a business account: 44%, 49%, 47%

- Dispute an unexpected fee: 58%, 61%, 61%

- Make a bill payment: 66%, 67%, 67%

“The increases will likely stick as the lockdowns are lifted,” says Ke. (If states backtrack due to perceived spikes, it is conceivable the stickiness could increase, though that goes beyond the parameters of the study.)

Ke finds the strong interest in continuing to open savings accounts intriguing given that many institutions have the ability to open accounts online now. The survey found that bank brands with extensive branch presence came to consumers’ minds first when asked where they might open a new savings account.

The study also found that many consumers expect to visit branches less after lockdowns end. Over the entire sample, 42% expected to go to branches less frequently, 52% expected no change and 6% said they would go more often. Among age groups, in the bullets below the first number is the portion that will visit banks less frequently, and the second expects no change:

- 18-24: 57% vs. 37%

- 25-34: 52% vs. 39%

- 35-44: 49% vs. 45%

- 45-54: 38% vs. 54%

- 55-64: 38% vs. 57%

- 65+: 29% vs. 69%

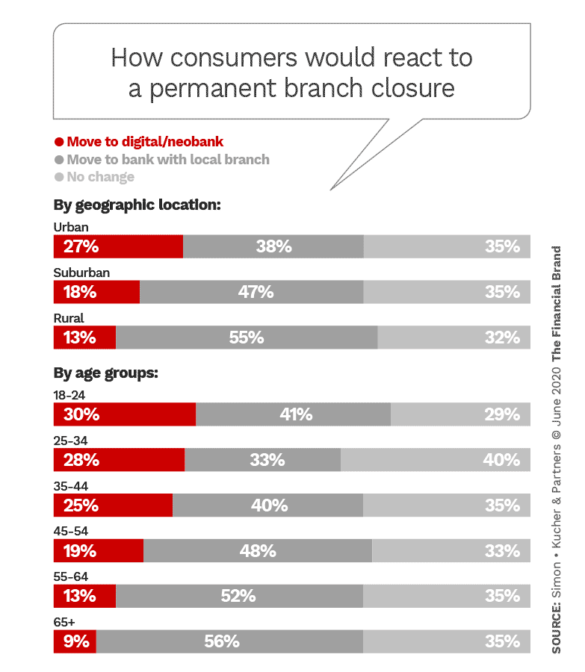

Ke says this pattern isn’t unexpected, given past research. However, the study also asked consumers how they would react if their primary financial institution closed their usual branch. In nearly every case, as depicted in the chart below, the respondents said that they would move to another banking institution with a local branch.

“Digital behaviors increased during the COVID-19 lockdowns,” says Ke, “but branches continue to play a pretty important role. There is a psychological phenomenon, a fear of a domino effect. If you have some bank benefits, you don’t want to lose them.”

Read More: How People’s Changing Habits Will Impact the Future of Branch Banking

Considering a Branch’s ‘Gravity Field’

So, “the million-dollar question becomes, will people be willing to travel longer distances to the nearest branch,” says Ke — if their provider gives them best-in-class digital options.

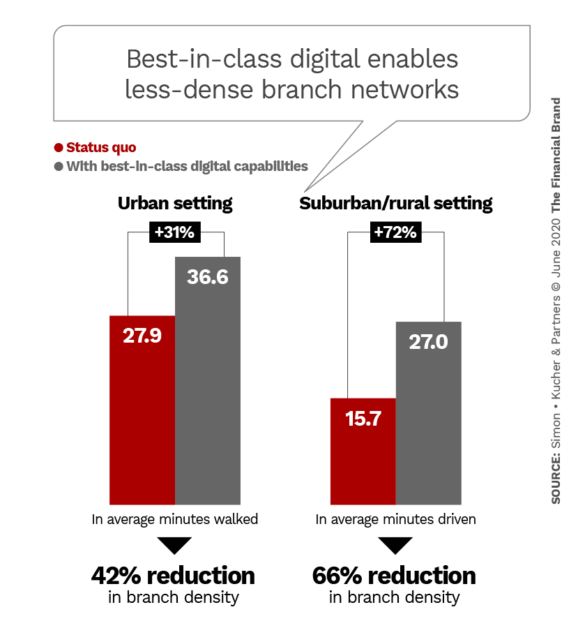

Here the research introduces the idea of the “gravity field” that any given branch has. This is defined as how far a consumer would be willing to travel to get to the closest branch maintained by their provider. The measure for urban areas is walking, the measure for suburban and rural settings is driving.

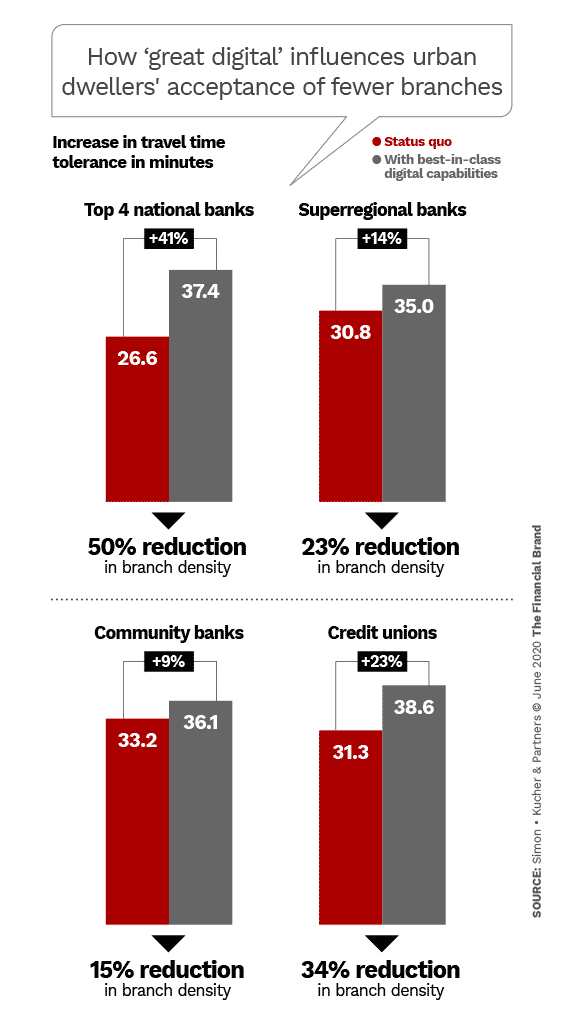

Overall the study found that in urban areas, consumers who are offered the best digital banking services would be willing to travel nearly 37 minutes by foot to get to a branch, an increase of 31%. In the case of suburban and rural areas, consumers were willing to drive 27 minutes, an increase of 72%.

Using simple geometry on area maps, the firm theorizes that as the “gravity field” expands with increased willingness to travel, the range represented by those circles reduces the need for parts of the existing network.

In the charts below, Simon-Kucher provides estimates of how heavily an institution could reduce the density of its branch network and still meet consumer needs, provided the excellent digital element is there.

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect. 83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations. Read More about Navigating the Role of AI in Financial Institutions

Why Industry Cloud for Banking?

Navigating the Role of AI in Financial Institutions

So How Can Financial Institutions Get the Payoff?

The report found that 51% of respondents said that they would never consider opening an account at a bank that doesn’t offer best-in-class digital capabilities. In addition, 24% said they would switch banks if the new provider offered better digital capabilities than their current institution. And 39% said they want banks to be more like Apple, Google, and Amazon.

Ke acknowledges that these three numbers all represent high bars for banks to vault.

So here’s a challenge for financial marketers and retail bank executives: If an institution can bring in consumers because of superior digital services, under the firm’s “gravity field” argument they could save substantially on branch costs. But how do you interest consumers in your mobile app, for example, especially if they aren’t currently banking with your institution?

Various rankings can be found through Google, but they are fairly limited in what they cover. Ratings and comments for banking apps appear on the App Store and Google Play. However, merely looking at static screens may show you that the app looks attractive graphically — but that doesn’t mean it isn’t a bear to use or that it won’t stall in the middle of an operation. And user comments after an update, for example, can be nasty enough to send any would-be enrollee packing, especially because you need to move your account to the institution before you can use the app.

Ke acknowledges the challenge. He’s had the experience of learning about a service his own banking institutions offer only when he’s set out to fix a problem, like a disputed merchant charge.

He thinks improved communication about digital services is a big part of the answer. TV commercials and online video ads will help. He points out that Chase has been aggressive in promoting its apps in this way, and that other major brands have been getting more aggressive as well. During the coronavirus crisis banking brands stepped up communication concerning features that would permit contactless banking, for example.

There’s also word of mouth, with consumers who bank with an institution with a great app talking it up to friends and family. That underscores the importance of improving digital offerings, to drive higher satisfaction than exhibited by the chart at the beginning of this article.