In 1993, a then revolutionary book, “The One to One Future: Building Relationships One Customer at a Time” was published, proposing the idea that as technology makes it affordable to track individual customers, marketing shifts from finding customers for products to finding products for customers. According to the authors, Don Peppers and Martha Rogers, Ph.D., a company could use technology to gather information about, and to communicate directly with, individuals to form a commercial bond. The book became a bestseller, and was on every marketer’s bookshelf … almost a quarter century ago.

The central concept of the book was that mass manufacturing, mass marketing, and mass communications would give way to one-to-one relationships. It was believed that the companies that would do it first and best would be the ones that had huge stores of data and communication channels already in place. For example, telephone companies, cable firms, credit card companies and banking.

It was proposed that the firms with the most data would collaborate with consumers to build a better relationship together, with the payoff of this collaboration being more targeted messages and better, more proactive solutions. Written in the formative years of the World Wide Web, the authors believed the Internet would be the perfect setting for institutions that delivered messages and solutions only to those who expressed an interest.

It was known 23 years ago that data, analytics and new technologies would change the balance of power for marketing. It was believed that those firms that succeeded in harnessing insight on behalf of the consumer would establish a close, lifelong relationship that would be virtually impossible to subvert.

The concepts in the book are as relevant today as they were in 1993. A sampling of the chapters include:

The concepts in the book are as relevant today as they were in 1993. A sampling of the chapters include:

- Share of Customer, Not Share of Market

- Collaborate with Your Customers

- Differentiate Customers, Not Just Products

- Economies of Scope, Not Economies of Scale

- Engage Your Customers in Dialogue

- Take Products to Customers, Not Customers to Products

- Make Money Protecting Privacy, Not Threatening It

It is clear that the authors were spot on … just a bit ahead of their time. We really haven’t done exceedingly well as an industry over the past 20+ years. Research shows that most banks and credit unions still don’t succeed in delivering personalized insight or solutions in real time.

What is exciting is that the accessibility of the tools needed to realize the one-to-one vision are available today to virtually any bank or credit union, of any size, that has the commitment to use advanced analytics to deliver contextualized experiences. Instead of watching as non-banking organizations or fintech start-ups set expectations, the banking industry can now offer individualized engagement, integrating advanced analytics, artificial intelligence, machine learning, robotics and even blockchains to build a cognitive bank.

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

Becoming a Cognitive Bank

The banking industry continues to be challenged be a low interest rate environment, intense competition from new market entrants, and heightened consumer experience expectations set by highly digital non-bank organizations. Despite these pressures, the response by most institutions has been initiatives focused on cost reductions.

In one IBM report, it is emphasized that tapping into huge quantities of dormant, bank-owned data is essential to offering the individualized engagement that customers demand. It is also proposed that cognitive systems can continually build knowledge and learning, providing the insight needed to increase efficiency and effectiveness throughout the organization. In other words, the one to one future on steroids.

IBM interviewed 2,000 executives worldwide for their 2016 Cognitive Bank Survey. The analysis not only confirmed the challenges of low profitability, disruptive competition and increased consumer expectations, but also allowed a comparison of ‘outperformers’ with others in the industry.

Unfortunately, while almost all agreed on the challenges being faced, only 28% of the executives surveyed were familiar with cognitive computing, and only 11% of the respondents said they have adopted cognitive technology. Not surprisingly, the “outperformers” were more likely to understand and be using the tools of cognitive computing.

Read More:

Creating Competitive Differentiation

In the IBM research, “outperforming” banks are significantly more aware of cognitive computing than the overall base, while 32% of the “outperformers” describing their organizations as prepared to adopt cognitive computing.

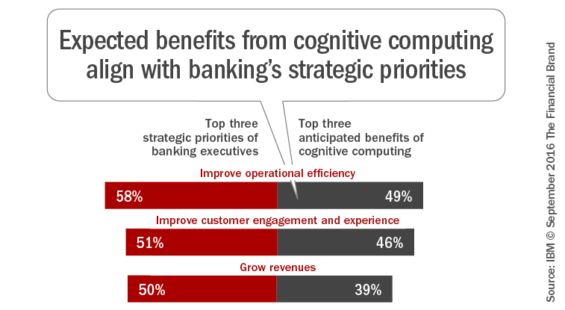

When asked about the expected benefits of cognitive computing, the benefits were very aligned with the industry’s strategic priorities. Improving operational efficiency was named by 58% of surveyed executives as their most important strategic priority, with 49% seeing this as being a benefit of cognitive computing. Similarly, improving customer engagement and growing revenues were also both important strategic objectives and benefits of cognitive computing.

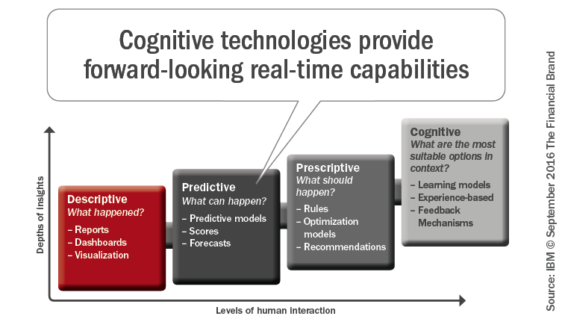

According to IBM, “Cognitive computing solutions offer valuable capabilities by enabling systems to process and act on data in a human-like manner. They can transform how organizations think, act and operate”. The four principles that form the foundation of cognitive computing include; 1) learn and improve, 2) build speed and scale, 3) collate human intelligence, and 4) interact in a natural manner.

Ultimately, cognitive computing enables banks to exploit the benefits of available data by:

- Providing deeper and more personalized customer insights

- Supporting more-informed decisions across the whole bank

- Accelerating operational and organizational efficiency

Meeting Customer Expectations

The industry is highly aware that today’s consumer is more demanding than ever, wanting organizations to digitally ’embed’ solutions to simplify daily life. This was confirmed by the IBM research, where 54% of executives surveyed said, “consumer buying behavior is moving from products and services to experiences”, yet these same organizations are struggling to live up to expectations.

What is a bit disconcerting, however, is that there is a disconnect between consumer perceptions and how financial institutions rate themselves. In the 2015 IBM research study, only 35% of customers said retail banks provide an excellent customer experience, while 62% of bankers thought they delivered an excellent experience. The gap was even worse for wealth managers.

The transition to being a more cognitive bank enables personalization through continually deeper insight, context and learning. There is also the ability to deliver one-to-one experiences at scale, with highly personalized conversations that can help to serve, guide and advise customers via web and mobile communication. There is even the potential of using virtual agents. In either case, there is the ability to learn from each interaction for improved engagement in the future.

Most importantly, with access to deeper analytic insights, a cognitive bank can leverage internal and external data for a unified view of the customer. These insights can contribute to proactive as opposed to reactive solutions, creating new value opportunities.

The Cognitive Bank Ecosystem

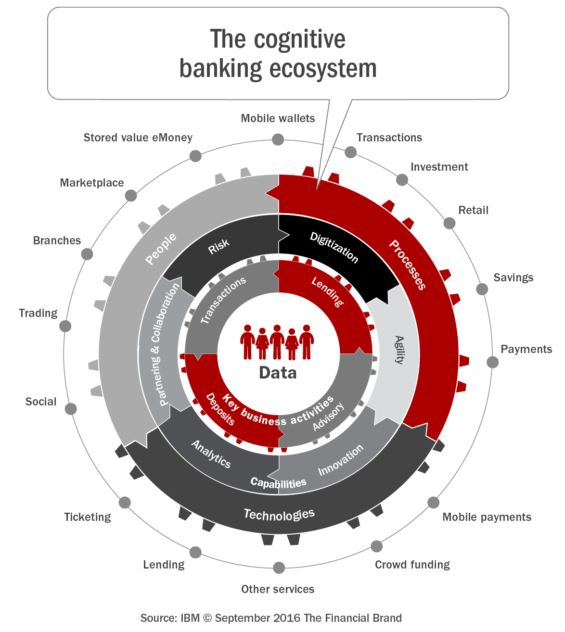

Cognitive computing enables banks and credit unions to achieve strategic priorities in ways not previously possible. The benefits to the bank occur across three dimensions:

- Improved engagement: Personalization through continually deeper insight, context and learning.

- New analytic insights: Can enable relationship managers to advise clients more accurately than imagined in the past, scaling sales and accelerating service.

- Enterprise transformation: Greater visibility into specific business challenges and support proactive decisions across the organization.

A cognitive ecosystem and also assist with compliance. Monitoring risk and compliance with cognitive capabilities enables assurance across business processes. “Imagine a system that understands an entire global client base individually, with comprehensive knowledge of both existing and proposed banking regulations across continents, countries, states and provinces,” states IBM.

By combining internal and external data (both structured and unstructured), banks and credit unions can position their organizations at the center of rapidly evolving banking ecosystems. Because legacy banking organizations have such a wealth of knowledge, cognitive banking organizations can provide ‘doorways’ for existing fintech firms to build relationships with households they could not reach or serve before.

Leveraging the trust and immense data already in place, traditional banking institutions could transform from being ‘utilities’ to becoming central to a consumer’s daily life. Most importantly, similar to what was referenced almost a quarter century before, a cognitive bank becomes a ‘learning organization’ improving decision making and value to the consumer with each transaction and interaction.

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations. Read More about Navigating the Role of AI in Financial Institutions Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind. Read More about The Financial Brand Forum Kicks Off May 20th

Navigating the Role of AI in Financial Institutions

The Financial Brand Forum Kicks Off May 20th

Becoming a Cognitive Bank

“Patents and copyrights expire, product developments are imitated, new products are knocked off, new services are adopted by competitors. No matter how creative and innovative your firm is, the only software genuinely worth having is the customer relationship, based on mutual advantage and trust. Individual, differentiatable customer relationships will be the ultimate software in the 1:1 future. All of your products are ephemeral. Only your customers are real.”

– The One to One Future, 1993

IBM recommends following the 3 P’s to becoming a cognitive bank … plan, prepare and progress … with key components for each step.

Plan

- Design a holistic cognitive strategy and business case.

- Formulate your cognitive intentions using design thinking.

- Prototype and conduct pilots, refining continually.

- Promote ongoing executive alignment and commitment.

Prepare

- Invest in new kinds of human talent, not just banking experts.

- Adjust processes and policies.

- Build and help ensure a quality corpus of data.

- Establish a cognitive-ready infrastructure.

Progress continually

- Communicate the cognitive vision at all levels.

- Apply cognitive technologies.

- Measure and achieve outcomes.

- Enhance, expand and share collective knowledge.