The global banking sector is becoming both more strategically focused and technologically advanced to respond to consumer expectations while trying to defend market share against an increasing array of competitors. A great deal of emphasis is being placed on digitizing core business processes and reassessing organizational structures and internal talent to be better prepared for the future of banking. This transformation illustrates the increasing desire to become a ‘digital bank’.

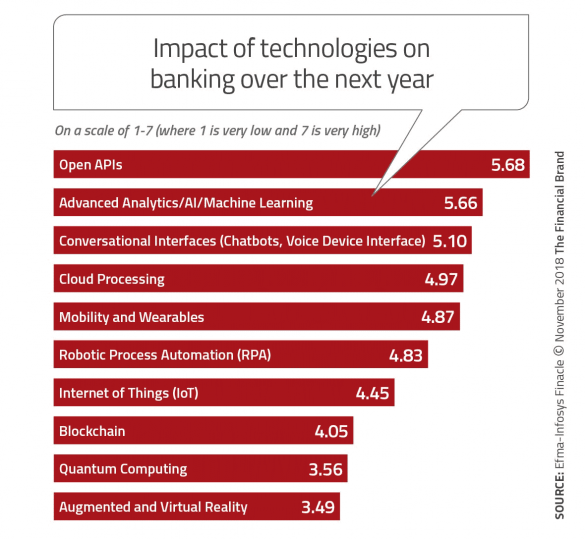

The importance of innovation and developing new solutions that take advantage of data, advanced analytics, digital technologies and new delivery platforms has never been more important. We are seeing organizations innovate in targeting, expanding services, re-configuring delivery channels, delivering proactive advice, integrating payments and applying blockchain technology.

These efforts will only increase in 2019, as global financial and tech giants revolutionize the financial services arena. As part of these mega-trends, banks will also experiment with new mobile applications and voice-enabled gadgets to enhance both delivery and contextual personalization. Ultimately, the consumer will be front and center. As technologies continue to evolve, the banking sector will continue to accelerate its investments in innovation and digital enhancements.

Free Download: Innovation in Retail Banking

Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

This webinar will offer a comprehensive roadmap for digital marketing success, from building foundational capabilities and structures and forging strategic partnerships, to assembling the right team.

Read More about Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

1. Serving a Segment of One

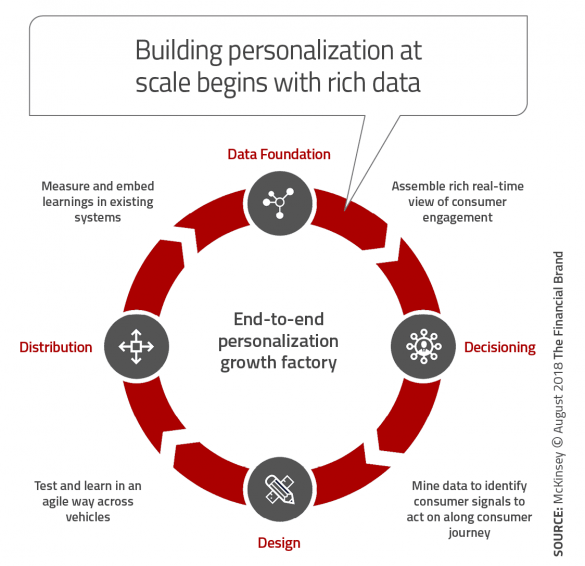

According to Accenture, “Many banks have initiatives aimed at targeting demographic-based clusters such as young people, Millennials or older people, but some banks are now targeting customers based on lifestyles, values, aspirations, mindsets and underserved needs.” In 2019, many banking organizations will go beyond personalization by segment, to develop individualized communication and experiences for the segment of one. This is the ultimate level of innovative personalization allowed through data, advanced analytics and digital technologies.

This level of personalization involves clustering a customer base with advanced criteria, where human-centric, design-thinking pillars and CRM tools help banks and credit unions match needs to solutions in real-time. One of the forgotten keys to success with segment-of-one personalization is estimating the potential customers’ willingness to pay for this added value. Or maybe, the key to success is a financial services organization’s willingness to monetize value in the way that Amazon sets pricing on delivering the value of Amazon Prime. Consumers must be ready to recognize the value behind a personalization solution and be willing and able to pay for it.

Innovation and serving a segment of one is not limited to individual consumers. Banks and credit unions should also focus their efforts on the small and medium enterprise (SME) segment and the needs of individual businesses. Many financial services organizations are taking a ‘GAFA’ (Google/Amazon/ Facebook/Apple) approach, leveraging insights and data derived from services and individual organizations to boost their core business.

Read More: How Data and New Technologies Are Transforming Digital Lending

2. Expansion of Open Banking

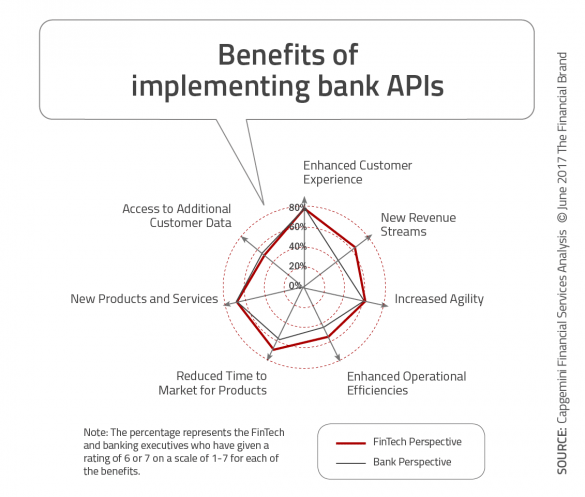

More and more regulatory bodies globally are requiring banking organizations to enable customers to share their data securely with third parties to power new financial services and increase competition in the banking industry. By making account and payment data available through secure application programming interfaces (APIs), consumers have greater freedom and control in how they interact with their financial service providers.

Open banking APIs accelerate innovation and collaboration, leading to expanded banking ecosystems that could include more than just financial services to make a consumer’s lifestyle better. What is exciting about open banking is that making consumer consent a central part of open banking strategy places an increased emphasis on consumer value propositions. In other words, if improved value isn’t part of the open banking consumer proposition, the customer will not allow the sharing of their data. Alternatively, those firms that provide the best consumer value proposition will be the relationship winners.

The understanding and leveraging of the innovation potential of open banking will allow legacy financial services organizations to build on their existing customer relationships. By giving customers choice and control of their own data, first-mover banks and credit unions can become leaders in an era of increasingly personalized financial services. The expansion of open banking also will encourage non-traditional financial firms to collaborate with traditional banks or go solo with the same intention … innovating on behalf of the consumer.

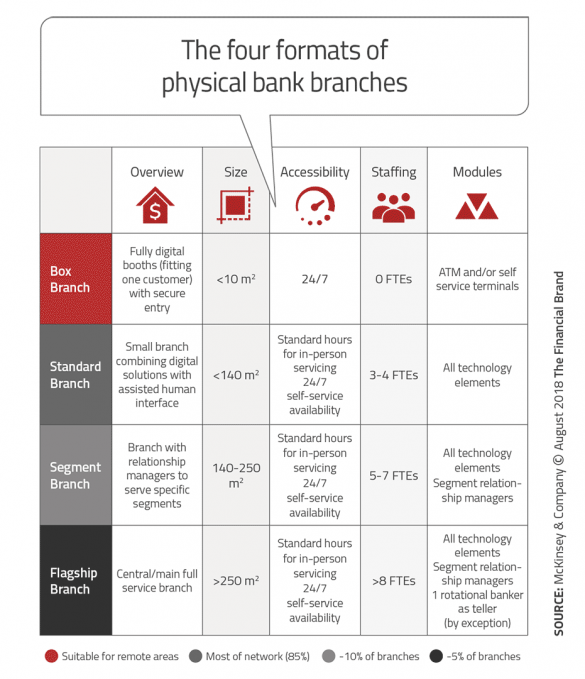

3. Commitment to Phygital Delivery

With the high cost of a traditional branch network and the increasing number of transactions moving to digital channels, more and more traditional financial services companies are introducing digital-only banking entities. Some banks are launching digital-only banks to collect deposits, while other financial firms are using digital platforms to provide lending, investing and specialty services. In each instance, the focus is on innovative customer experiences and increased value to the consumer, supported by customer data and advanced analytics that can personalize engagement.

Some of the organizations that will move in this direction in 2019 will do so to protect their current customer base, while other firms will be trying to expand (or generate) market share. In all cases, the desire will be to introduce first-to-market products that are consumer-focused. This focus on innovation is empowered through Open Banking APIs and cloud technologies.

The pressure to create an alternative delivery model is driven by the cost of maintaining branches. Obviously, the raw cost of operating a branch is high, which makes return on assets significantly stronger for a branchless bank. While new entrants will usually pay an increased cost for funding with brokered or online deposits, existing organizations that build a digital-only “sub-brand” benefit from already having a low cost of deposit funding.

As in the retailing industry, consumer expectations and the cost of alternative forms of delivery are redefining the way the banking industry is structured and the importance of innovative new delivery models. The challenge will be in determining the right mix of physical and digital in 2019 and beyond.

Read More: Bank Branches Are Dead. Long Live the Branch!

4. AI-Driven Predictive Banking

One of the most exciting innovation trends in 2019 will be the continued movement to predictive banking. For the first time time, the banking industry can consolidate all internal and external data, building predictive profiles of customers and members in real time. With consumer data that is rich, accessible and financially viable to deploy, financial institutions of all sizes can not only know their customers, but also provide advice for the future.

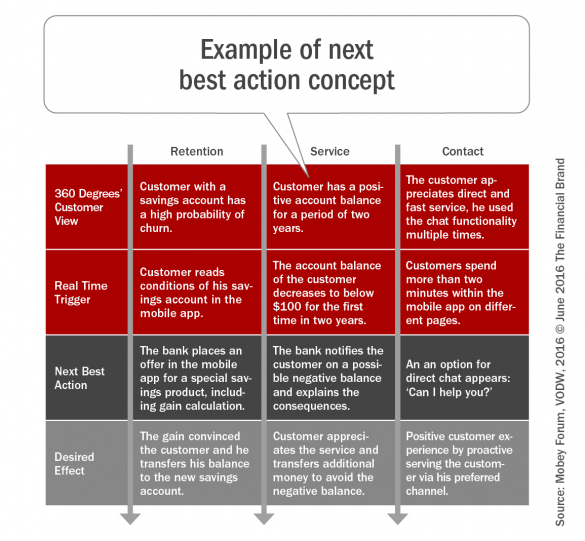

This enhanced use of data will enhance the consumer experience, while increasing security and efficiency. By moving from a rear-view-mirror perspective of customer communication to services deployed by robo-advisors and AI-driven chatbots, financial institutions will provide consumers with value through ‘next-best actions’ as opposed to blind selling of products. The real innovation will occur when financial institutions integrate this capability with the expanded services of open banking and connected devices.

The reach of banks and credit unions can be expanded as virtual agents work on behalf of the consumer to find the best mix of solutions for each individual in real time. This transformation may also result in the elimination of specific traditional products (checking, loans, payments) with the emergence of universal cash management solutions that address all needs in an integrated service.

In the end, the focus is no longer on putting together good information and waiting for someone to look at it; information is now shown with the goal of proactively changing customers’ everyday behaviors, with figures and insights contextually delivered.

5. Payments Everywhere

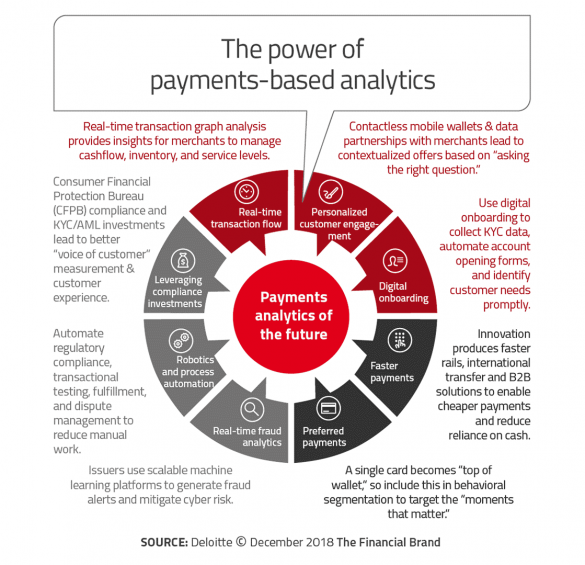

The payments industry has been, and will continue to be, one of the most dynamic areas of innovation in the banking industry. Impacted by changing consumer expectations and driven by technological advances, innovation will continue to come from traditional financial institutions, fintech firms and big tech players.

As the infrastructure of payments continues to evolve, innovation will move the payments industry from a series of specific products to part of everything consumers do. Differentiation will be driven by data, technology and delivery, changing the dynamics of how and where we pay and receive payments. Payment innovation trends will occur in conjunction with the Internet of Things (IoT), point of sale (POS), mobile wallets, cryptocurrencies, and the blockchain.

The impact of this innovation in payments will be a decrease in the ability to differentiate on back-office capabilities, a decrease in transaction fees, and an increase in the importance of differentiated user experiences and the application of a vast array of data. Payment insights provide the foundation of consumer and small business behavior, positioning those organizations capable of processing vast amounts of payment data as the best to serve consumers in the future.

( Read More: Banking Providers Fail to Sell Benefits of Mobile Banking and Payments )

Innovating for Tomorrow

To be able to compete and grow where margins are thin, competition is fierce, regulations are changing and technology has an increasing impact, financial institutions must place innovation as a top priority. Organizational cultures must be shifted to support innovations that will impact increasingly outdated business models. Banks and credit unions must also anticipate consumer needs and innovate in ways that will prioritize the most effective mix of capabilities, processes and people.

Download 10th Annual Innovation in Retail Banking Report

Increased commitment to innovation in response to consumer expectations and increased fear of non-traditional players are two of the primary findings of the 10th annual Innovation in Retail Banking report, sponsored by Efma and Infosys Finacle and published by the Digital Banking Report. The report includes a review of the previous nine years of the publication, providing a snapshot of the marketplace and innovation trends through the years. During this period, there was increasing investment in innovation, a shift from efficiency to experientially focused breakthroughs, evidence of continued strength of Eastern European and developing financial marketplace banks as innovators, and the integration of new technologies.

Increased commitment to innovation in response to consumer expectations and increased fear of non-traditional players are two of the primary findings of the 10th annual Innovation in Retail Banking report, sponsored by Efma and Infosys Finacle and published by the Digital Banking Report. The report includes a review of the previous nine years of the publication, providing a snapshot of the marketplace and innovation trends through the years. During this period, there was increasing investment in innovation, a shift from efficiency to experientially focused breakthroughs, evidence of continued strength of Eastern European and developing financial marketplace banks as innovators, and the integration of new technologies.