A Federal Reserve Bank study provides insights into mobile banking and mobile payment trends as well as the future digital banking plans of U.S. financial institutions. The Mobile Banking and Payment Practices of U.S. Financial Institutions report provide results from 706 financial institutions in the Atlanta, Boston, Cleveland, Dallas, Kansas City, Minneapolis and Richmond Federal Reserve Districts, as well as historical comparisons to previous research by the Fed.

According to the study, there continues to be strong consumer sign-up for mobile banking. Unfortunately, the usage of both mobile banking and mobile payments remains either rudimentary (only checking balances vs. more advanced functions) or lacking altogether (mobile payments at POS).

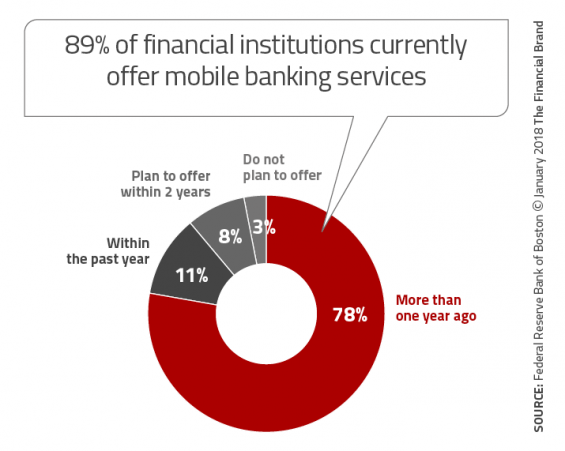

The survey confirms that mobile banking is an almost ubiquitous bank offering, offered by 89% of bank and credit union respondents. Digging deeper, of those financial institutions tracking customer adoption, 54% indicated they had more than 20% of their retail customers enrolled in mobile banking, with 44% having more than 20% actively using these services.

While mobile banking services are offered by the vast majority of financial institutions, integration of mobile payment applications are lagging … albeit poised for growth, as banks and credit unions respond to competitive pressure and consumer desire for basic mobile payment capabilities.

According to the Fed study, 24% of organizations surveyed already offer mobile payments, with an additional 40% planning to do so within two years. In addition, more than two-thirds of respondents already partner or plan to partner with third-party processors, with more than half considering a partnership with a near-field communication (NFC) wallet provider.

Instant Messaging. Instant Impact.

Connect with your customers and provide lightning-fast support as effortlessly as texting friends. Two-way SMS text messaging is no longer optional.

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

Mobile Device Capabilities Raise Consumer Expectations

Mobile devices are a central part of most consumers’ lives, driven by increased functionality and improved app design and usability. Mobile innovations are introduced continuously, including mobile commerce apps, point-of-sale (POS) integration, in-app payment, wallet and loyalty capabilities, real-time location-based marketing, hospitality, travel and transportation apps, Internet of Things (IoT) advancements in addition to mobile banking services. As a result of mobile technology upgrades and smartphone accessibility, mobile devices are becoming increasingly pervasive and indispensable across most demographics and geographies in the US and worldwide.

In response to consumer expectations and competitive pressures, financial service organizations have responded. According to the Fed report, “Financial institutions understand that mobile banking can improve overall customer satisfaction and loyalty, and that customers with high mobile banking satisfaction are more likely to recommend their organization to others.” Mobile banking also improves cross-selling rates, with mobile banking customers having 2.3 products compared to 1.3 for branch-only customers, with the mobile app providing the platform to sell products and generate more revenue.

While over 95% of mobile banking users log in to check their balances or transaction history, transacting via mobile – depositing checks, transferring funds and sending P2P payments – is far less universal. Advanced mobile banking capabilities are mostly used by younger consumers.

As consumer expectation increase, banks and credit unions must respond to acquire and retain customers and members. According to the Fed report, “Financial institutions will need to enhance their mobile services and apps. Features that make mobile banking interactions faster, safer, more convenient and easier to use, and that add value by allowing customers to access more complex services from their phones will help to increase the number of mobile banking users.” This applies to both mobile banking and mobile payment capabilities.

Offering of Mobile Banking Approaches Ubiquity, Consumer Usage Lags

Here are some of the key insights from survey responses regarding mobile banking:

Offering of Mobile Banking: Mobile banking apps from banks and credit unions are being offered by almost all financial institutions in all asset categories in the United States. Seventy-eight percent of banks and credit unions have offered mobile banking for at least one year, and another 11% have implemented mobile services within the 12 months preceding the survey. The percentage of FIs that still have no plans to offer mobile services has dropped to 3% – half the rate found in the 2014 study.

As could be expected, larger banks and credit unions have been offering mobile banking longer than smaller FIs. FIs in the lowest asset tier in particular started offering mobile banking more recently, according to the study. Among the respondents with ‘no plans to offer mobile banking’, 2/3 had less than $100 million in assets. All respondent banks with more than $1 billion in assets currently are or will be offering mobile banking within the next two years.

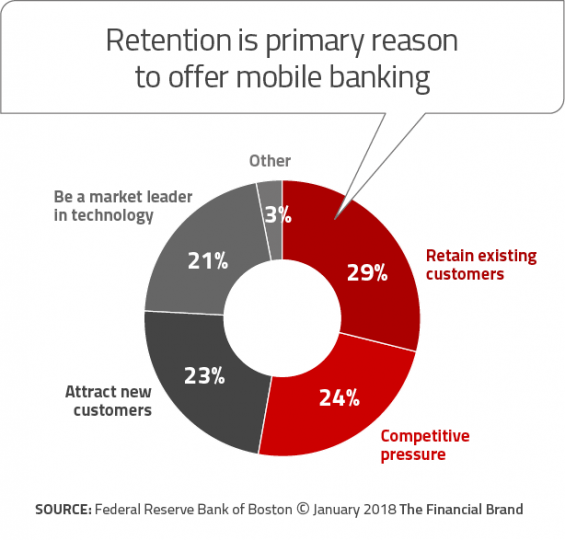

Rationale for Offering Mobile Banking: When organizations were asked about the reason for offering mobile banking, the most mentioned reason was to ‘retain existing customers’ (29%). ‘Competitive pressure’ was the second most mentioned reason for offering mobile banking (24%), with 23% choosing ‘attract new customers,’ and another 21% selecting the desire to ‘be a market leader in technology.’ Smaller organizations tended to want to retain customers/members, while larger organizations wanted to be viewed as leaders in technology.

Mobile Banking Functionality: The research by the Fed found that most financial institutions offer the five basic mobile banking services. Correlated with consumer use of mobile banking services, checking account balances and transferring funds between accounts within the same FI are the most common capabilities, offered by more than 90% of respondents, followed by the ability to view transaction history, bill payment functionality and having an integrated branch/ATM locator.

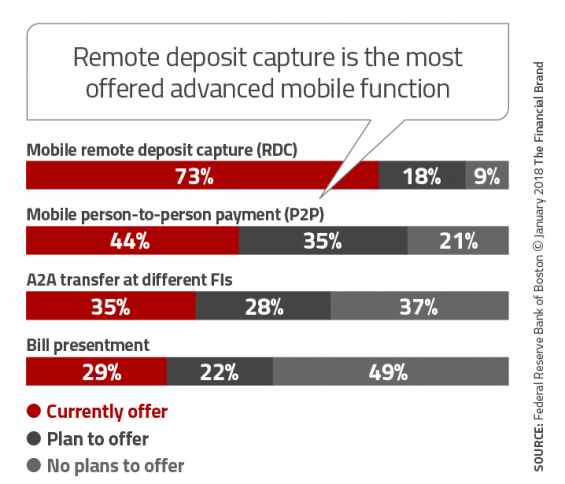

More advanced mobile banking functions, like remote deposit capture, P2P payments, transfers between accounts at different organizations and bill presentment were less likely to be offered (especially by smaller organizations). Personal financial management (PFM) services, access to brokerage accounts and cross-border payments are in the embryonic stages of development in most organizations.

Move the Needle from Attrition to Acquisition

Vericast’s 2024 Financial TrendWatch explores seven of today’s most critical financial services trends to provide a complete view of the current loyalty landscape.

Read More about Move the Needle from Attrition to Acquisition

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

Expanded Mobile Banking Usability: By the end of 2018, 77% of bank and 47% of credit union respondents will be providing mobile banking services to non-consumers, including commercial and small businesses, government agencies, educational entities, and nonprofits.

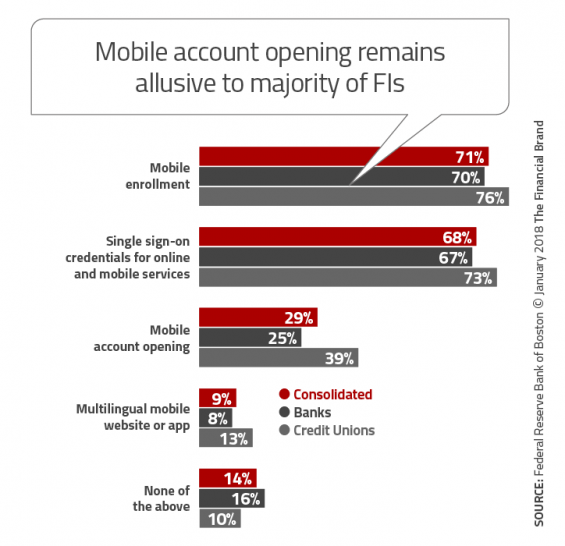

The ability to enroll for mobile banking and open an account with a mobile device is gaining traction. Of those surveyed, 71% supported mobile banking enrollment, with 68% supporting single sign-on (SSO) credentials for online and mobile banking. Aligned with several studies done by the Digital Banking Report, only 29% of all respondents supported the ability to open a checking or savings accounts through the mobile channel. The offering of these ‘usability’ capabilities is strongly correlated to size of organization.

Mobile Banking Usage: Consumer enrollment in mobile banking services is growing as more individuals rely on their mobile phones for access to financial services. While growing, the total enrollment and usage percentages for most organizations still falls embarrassingly short of potential.

The good news is that study consumer use of mobile banking is shifting from primarily accessing information (e.g., viewing balances, statements, and ATM locations) to performing more complex financial transactions. Enrollment and use by younger demographic groups also shows promise.

Only 54% percent of financial institutions that track the data (52% of banks and 61% of credit unions) reported that over 20% of their customers enrolled in mobile banking. Only 7% of organizations had an enrollment rate greater than 50%. When usage was measured, 56% of institutions had mobile banking usage rates of 20% or less, with only 8% having usage rates over 50%.

Financial organizations must realize that just offering mobile banking is not enough. To realize the full potential of mobile banking, ongoing promotion and education of mobile banking benefits must be done.

Barriers to Mobile Banking Adoption: The barriers to mobile banking adoption according to the financial institutions surveyed included ‘security concerns’ (70%), ‘banking needs met through other channels’ (61%); and ‘lack of trust in technology’ (60%). It must be remembered that the responses came from banks and credit unions and not from consumers. This could lead to biases caused by previous market research studies read.

Offering and Use of Mobile Payments Far From Universal

And here are some important findings from the Federal Reserve study regarding mobile payment services:

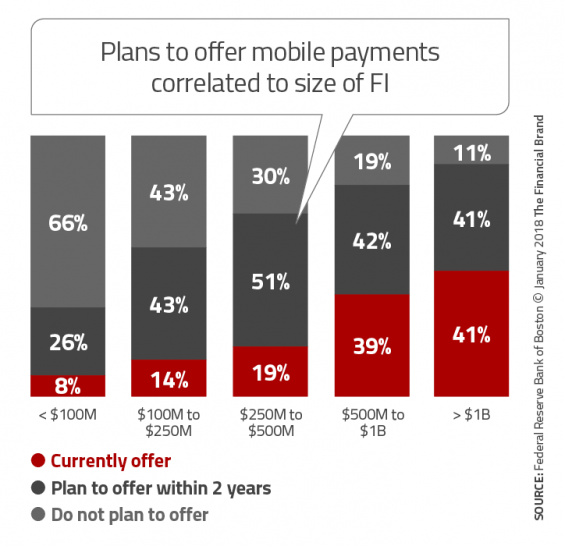

Offering Mobile Payment Capabilities: The offering of mobile payment capabilities is growing in response to competitive pressure and consumer expectations. While only 24% already offer mobile payments, 40% indicated that they ‘plan to offer within two years’. Interestingly, 36% of the responding organizations did not plan to offer payment services. (Note: the current offering level fell substantially short of the expected 57% that was predicted by the 2014 survey)

Not surprisingly, larger organizations are more likely to offer mobile payments, with 48% of respondents with assets over $1B and 39% of those with assets between $500M and $1B already offering mobile payment services. As with many components of digital banking, smaller financial institutions are trying to catch up to their larger peers.

Mobile Payments Strategy: When asked about their strategy for offering mobile payments, 67% of respondents rated ‘competition with other financial institutions’ as a ‘high’ driver in offering mobile payments, followed by ‘mobile payments momentum’ (60%), ‘competing with non-banks (50% ‘high’ rating) and ‘consumer demand (37%).

Mobile Payments Strategy: When asked about their strategy for offering mobile payments, 67% of respondents rated ‘competition with other financial institutions’ as a ‘high’ driver in offering mobile payments, followed by ‘mobile payments momentum’ (60%), ‘competing with non-banks (50% ‘high’ rating) and ‘consumer demand (37%).

The two leading strategies ways to offer mobile payments were ‘partnering with third-party payment processors’ (67%) and ‘partnering with NFC wallet providers’ 53%).

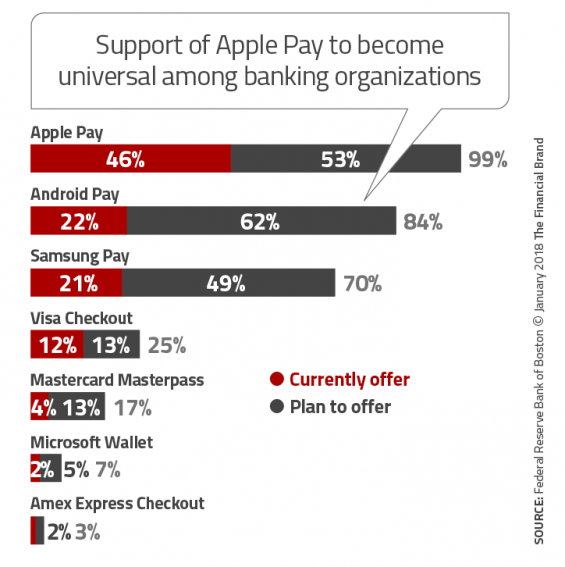

Mobile Wallet Strategies: While the Fed study was conducted at the end of 2016, it was surprising that there was not universal awareness of the four most prominent digital wallets (Apple Pay, Android Pay, Samsung Pay and PayPal). Awareness ranged from 98% for Apple Pay to only 74% for PayPal.

Despite this somewhat surprising lack of mobile wallet providers, the plan to offer one or more mobile wallet solutions was relatively strong. Apple Pay and Android Pay were the most mentioned, with Samsung Pay being the third most likely solution offered.

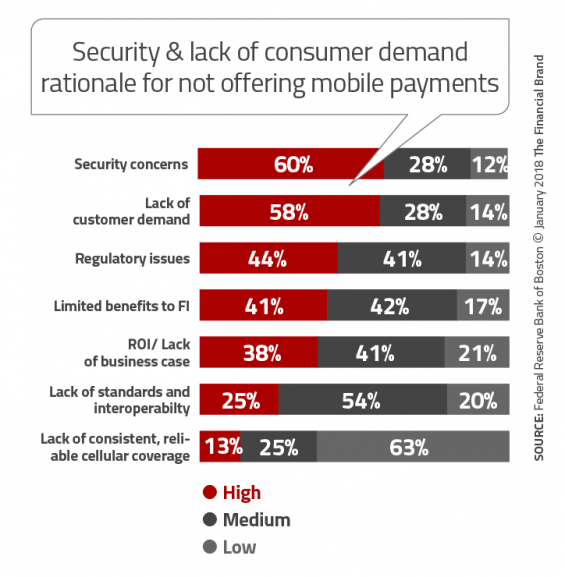

Mobile Wallet Barriers: Barriers to adoption (from the perspective of the financial institution) differed from the barriers to mobile banking adoption due to ‘transactional risk’ and the newness of the digital payments overall. According to the study, 51% of respondents rated ‘security’ as a high barrier to consumer adoption of mobile payments. In addition, 45% of organizations rated ‘market immaturity and fragmentation’ as being a high barrier. ‘Low merchant acceptance’ (44%) and ‘privacy’ (42%) were also rated high. Only 26% of respondents rated ‘lack of customer demand’ as a high barrier to offering mobile payments.

Mobile Wallet Barriers: Barriers to adoption (from the perspective of the financial institution) differed from the barriers to mobile banking adoption due to ‘transactional risk’ and the newness of the digital payments overall. According to the study, 51% of respondents rated ‘security’ as a high barrier to consumer adoption of mobile payments. In addition, 45% of organizations rated ‘market immaturity and fragmentation’ as being a high barrier. ‘Low merchant acceptance’ (44%) and ‘privacy’ (42%) were also rated high. Only 26% of respondents rated ‘lack of customer demand’ as a high barrier to offering mobile payments.

When asked for reasons why mobile payment solutions were not already offered, it was no surprise that security was at the top of the list. Surprisingly, while consumer demand was not a barrier to offer, it was considered a major reason for not offering.

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

The Future of Mobile Banking and Payments

By the end of 2018, virtually all financial institutions will be offering mobile banking as a part of their retail services portfolio. Mobile banking for small business and commercial segments may not achieve ubiquity within this time frame, but the offering of non-consumer mobile banking will be significantly higher.

With the offering of basic mobile banking services achieved, banks and credit unions must focus on adoption and usage growth, using mobile banking as a relationship-building tool. This can be achieved through increased education and promotion of value-added tools and services that consumers want, including P2P payments, card controls, external A2A mobile transfers, as well as vastly increased mobile alerts and security features (biometrics).

Organizations must also focus on the offering of mobile payment solutions in response to competition and consumer demand/expectations. More and more merchants are offering mobile payment functionality, increasing the need to respond to this marketplace dynamic. P2P payments are also extremely important to offer, using payment services to grow customer engagement and increase loyalty, which will improve competitive positioning and lifetime customer value.

Finally, as with most research around digital and mobile banking, the Fed study found that the largest financial organizations are earlier to market, offer more mobile banking and payments capabilities to more market segments, provide more advanced features (e.g., alerts and mobile account opening), and are moving towards offering greater security and risk tools.

Smaller organizations need to determine their mobile banking and mobile payments strategies immediately to keep pace with competitive and marketplace changes.