Financial institutions have been trying to better meet the needs of women for decades. Over that time there have been specialized women’s banking products, women appointed to head up women’s banking programs, even a handful of banks originally chartered to be women’s banks, substantially run by or owned by women.

Years ago one community bank, believing that women controlled deposits in most households, built its entire look and feel on attempting to appeal to women, from planting roses all around their branch buildings to continually baking cookies in the lobby to create a homey aroma.

For all that effort, however, often the financial needs of women continue to be spoken of as a challenge unmet. Why, after so much time and apparent attention, does this remain an issue?

Gender As a Segment Isn’t Unique Enough

Financial researcher Ron Shevlin thinks part of the problem is how the issue is identified.

“When marketers define a market they are trying to find groups of consumers who share unique needs,” says Shevlin, Director of Research for Cornerstone Advisors. In the wake of new research he conducted, which this article reviews, there is simply not enough unique about gender to make it the sole determining factor for design and development of financial products and approaches.

In fact, “women are not saying that they want separate products and they don’t [necessarily] want to deal with a banking officer of their own gender,” says Shevlin, even though both have been responses to the goal of better serving women consumers.

In his research, Shevlin found that few women preferred to deal with another woman representing a financial services provider. The older the woman respondent, the less they had this preference. While 21% of young Millennials (21-29) stated this preference, for example, only 8% of Baby Boomer (57-74) women preferred to discuss finances with a woman representative.

The Cornerstone research, sponsored by Acxiom, examines the attitudes of women compared to those of men towards banking products and services. Beyond an extensive survey of both men and women regarding their financial lives, the research also incorporates interviews with financial services executives, most of them women, for additional perspective.

Community Bankers’ Top Priorities This Year

CSI surveyed community bankers nationwide to learn their investments and goals. Read the interactive research report for the trends and strategies for success in 2024.

Improve Your Business Outcomes Through Data & Analytics

Gain centralized access to the credit bureaus and 20+ alternative data sources. Leverage advanced analytics to optimize marketing campaigns and loan decisions.

Read More about Improve Your Business Outcomes Through Data & Analytics

The study identifies clear issues women face in regard to finances. “There’s no shortage of statistics that depict the challenges of shortcomings women face in managing their financial lives,” the study’s preface states, citing figures from other research. This ranges from the shortfall many see in retirement funding to their often major income drop after a divorce.

The key question to address, according the report, is: “What can — and should — financial institutions do to improve the delivery of financial services to women?” Besides comparing attitudes of men versus women, the study added in marital status and educational attainment, to see what effect those factors had on people’s attitudes towards financial services providers.

Something that comes through in the report over and over is that men generally seem to feel much more confident about their understanding and handling of financial matters than women do.

A woman executive at a wealth management firm, quoted in the report, states that men tend to over-value their own financial expertise. While her comments were made specifically regarding investing, this pattern seems consistent through the study. Over much of the research, a pattern emerges that while women judge providers more severely than do men, they are more demanding of themselves as well.

The report makes the point that “simply improving ‘marketing to women’ efforts won’t do the trick.” Many studies over the years have indicated that women make most banking decisions for their families, the report notes. Shevlin says this almost suggests, why bother marketing to men?

Read More:

- Improved Focus on Women’s Needs a Must for Financial Institutions

- Tectonic Shifts in Consumers’ Life Views Financial Marketers Must Grasp

How Men and Women Feel About Financial Advisors and Providers

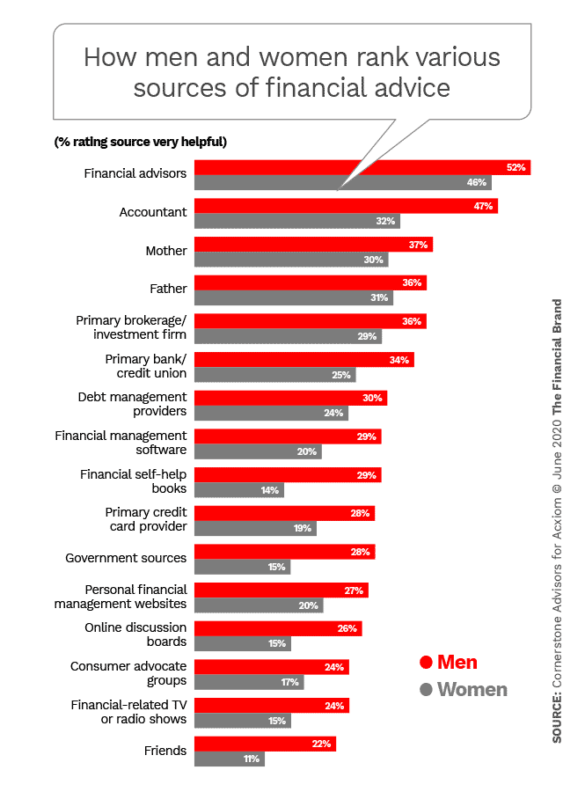

The study shows in multiple ways that men and women feel differently about financial matters and their abilities in that regard. It examines how helpful each gender felt about 16 different sources of financial advice, from paid advisors and parents to banks and credit unions to friends. In every category, women rated the source of assistance lower than men did.

Men didn’t rate banks and credit unions too highly, with 34% seeing them as “very helpful,” but even fewer — only one out of four — women see them as very helpful either. Even among the most highly rated provider categories, hardly more than half of either gender rated any source as very helpful — which should be a warning light to financial marketers.

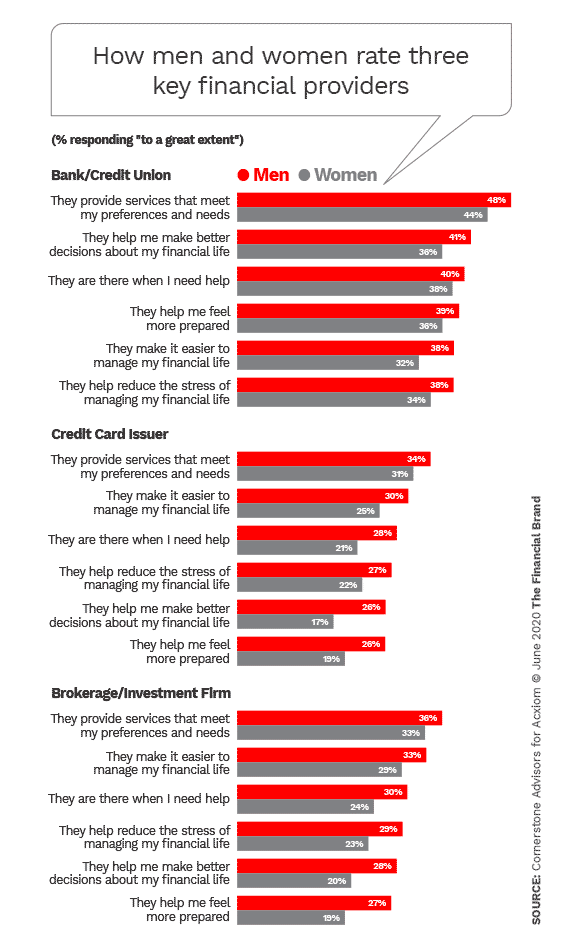

The study dug further into three categories of provider — banks and credit unions, credit card providers and brokerage and investment firms — asking men and women to rate them. The chart below shows the percentage in each category rating the provider as helping in a given area “to a great extent.”

An interesting angle the study found is that women tend to use fewer sources of help to manage their finances than men do. In part that is because they feel less comfortable discussing their financial affairs with these third parties. The following figures show consumers’ ratings for helpers they feel “very comfortable” consulting:

- Financial advisors: Men 60%, Women 52%

- Primary brokerage/investment firm: Men 51%, Women 39%

- Primary bank/credit union: Men 48%, Women 39%

- Primary credit card provider: Men 42%, Women 29%

Women typically rate themselves as less financially literate than men do, the study found. The figures below, using the four breakdowns among the survey sample, show how many study respondents’ rated themselves “very literate.”

- Single, less-educated: Men 21%, Women 19%

- Married, less-educated: Men 30%, Women 21%

- Single, highly educated: Men 36%, Women 19%

- Married, highly educated: Men 50%, Women 32%

The dividing line between less-educated and highly educated in the study was possession of a bachelor’s degree or higher.

The study looked at how well consumers were doing by gender, marital status and educational level. From a summary in the report of a large table:

- Sufficient savings for emergencies: A wide gap was seen in the single, highly educated group, between men with adequate savings (61%) and women (43%).

- On track for long-term savings: Wider gaps were seen among the highly educated, both for singles and married, than among single and married with less education.

- Plan ahead for expenses: There was a strong difference in both married categories, with men reporting themselves as being planners by greater than ten or more percentage points.

- Earn competitive rates and returns on deposits and investments: While being highly educated raised this percentage for both genders, men generally reported doing better in this category.

- Pay reasonable rates on loans: While almost two thirds of men reported this, only about half of single, highly educated women did so.

Household Financial Management and Communication

“Overall, married consumers demonstrate stronger financial health and performance than single consumers, and highly educated consumers are financially fitter and higher-performing than less-educated consumers,” the report states.

Typically singles reported that they manage their own household finances — one exception was where parents handle decisions when they are in the same household.

However, an interesting discrepancy arose among married, highly educated consumers.

76% of the men in that group said that they manage household finances, while 53% of the women in the group do — adding up to significantly more than 100%. The study offered the option of stating that the respondent and their significant other split household financial management. (19% of men said so, as did 39% of the women — almost twice as many.) So shared decisionmaking isn’t the reason for the discrepancy.

“This finding leads us to speculate that this discrepancy is the result of misperceptions among couples regarding who manages the household finances or miscommunication between couples,” the report states.

The report points out that few consumers feel they make sound financial decisions. However, 54% of married, highly educated men say they are “very confident” about their financial decisions. By contrast, only 32% of married, highly educated women feel that way. Both married and single men consider themselves more financially literate than both married and single women do.

Read More: Can Your Financial Wellness Program Solve Millennials’ Money Stress?

So, Where Do Marketers Go from Here?

The report includes commentary from the additional executives that Shevlin interviewed. For instance, from Kathryn Petralia, CEO of Kabbage:

“Successful products embraced by working women — such as grocery delivery services, meal-kit subscriptions and dog-walking apps — save users time. Financial services must adapt, too. Create timesaving, straightforward tools to help women control their finances in the pediatrician’s waiting room, the curbside pickup and the business-class lounge. Women need easy-to-use, versatile technologies that give more control over our time.”

(Chances are a good many men might find such apps handy as well.)

Shevlin also quotes Désirée Dosch, CMO at SmartPurse and former head of the women’s segment at UBS Global Wealth Management as saying, “It’s dangerous to see women as one segment and to market to them this way. The diversity of women is very broad, and stereotypical missteps/flaws can happen very quickly.”

Sifting the data, and weighing the input from Petralia and the executives he interviewed separately from the consumer research, Shevlin sees the marketer’s challenge more as one of successful conversions. More important than the product itself is its delivery in a way that women at different points in their personal and work lives can best utilize. Developing products and delivering them in a way that can meet the needs of a multi-tasking working mother will produce better results, for example.

The report urges institutions to devise gender-specific engagement strategies. “Financial institutions should focus on changing the process, not the attitudes,” the report suggests. A class or two is not going to change attitudes formed over many years.

In addition, marketing financial services in ways that encourage collaboration between marriage partners in their joint finances can help, with the banking institution serving as a neutral third party. One possibility is technology that can help married couples link their finances for a total picture while permitting accounts to remain separate. The report notes that many young marrieds today tend to keep separate accounts until they have been married for a while.

“Today’s financial technology enables firms to provide better tools,” says Shevlin.