Financial marketers are used to targeting consumers in different demographic segments. New research, however, indicates that COVID-19 is shuffling the deck, creating new market segments that will need to be accounted for as America begins reopening.

The coronavirus pandemic has shaken up many people from feelings of material prosperity and caused much anxiety and rethinking about their lives. The unique nature of lockdowns, widespread sudden unemployment and the prospect of living in masks and gloves for months to come are having an impact.

In the early May edition of the J.D. Power Financial Services COVID-19 Survey, one in four respondents said their financial stress has gone up a lot, and another 30% said it has gone up a little.

It’s the Year of the Pivot: For marketers, understanding where people’s heads are at will be critical because it will make the difference between marketing messages and images that resonate and those that can be inadvertently offensive or, at least, tone deaf. The timing and the nature of any event-based marketing will hinge on coronavirus attitudes.

Many consumers would not appreciate an invitation to a customer appreciation day barbecue right now, for example, and even for those raring for some socializing, it’s hard to eat a brat on a bun with a face mask on. Oklahoma’s Citizens Bank of Edmond, which made a name for itself with an annual street fair with music called “Heard on Hurd,” recently decided to take the event online.

Americans haven’t been homogenous in outlooks and attitudes for some time, if they ever really were, and post COVID-19 the segments we separate into will be even more diverse in multiple ways.

The unfair advantage for financial brands.

Offering aggressive financial marketing strategies custom-built for leaders looking to redefine industry norms and establish market dominance.

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

A Major New Post-COVID Consumer Split: ‘Nervous’ Versus ‘Accepting’

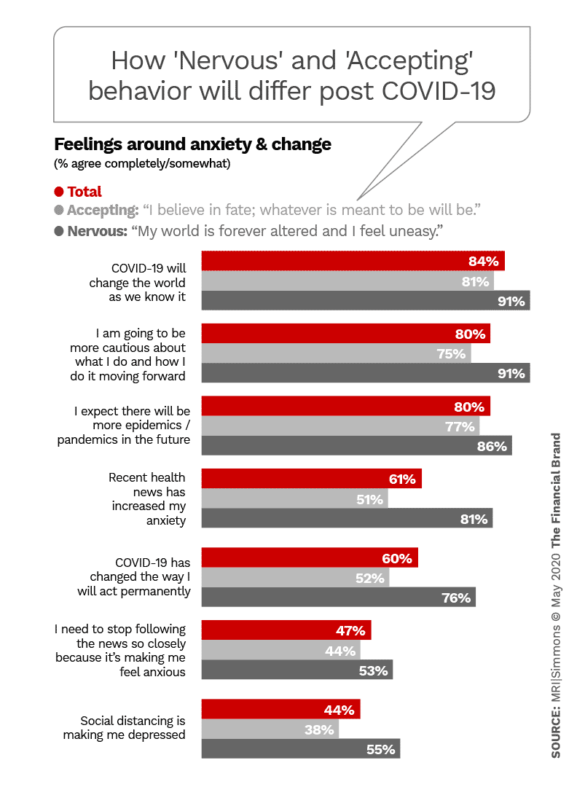

MRI-Simmons’ COVID-19 Consumer Insights Study and similar work by other organizations has started to probe how consumers will sort themselves out in the months ahead. MRI-Simmons’ study separated its sample into two self-identified attitudinal groups that often have very different views on life in the wake of the pandemic. The two groups, and their defining viewpoints:

- Nervous: “My world is forever altered and I feel uneasy.” 34% of the sample.

- Accepting: “I believe in fate; whatever is meant to be will be.” 66%.

Of course, many people in one group may exhibit shades of the other category’s attitudes. Here’s how the same group of people separated in terms of post COVID-19 behavior, rather than personal viewpoint:

- Live and learn: “I will be a lot more cautious in what I do and how I do it.” 54%

- Bounce-back: “I will go right back to living the way I did.” 46%

Over three-quarters — 78% of the nervous group say they are “live and learns,” while 58% of the accepters say they are “bounce backs.”

“People in the Nervous segment are markedly liberal and skew female,” the MRI-Simmons report notes. “People in the Accepting group are conservatives who skew male.”

The report also has this to say about the nervous group: “While politics color their reaction to the pandemic, people in the Nervous segment may have an inherent conscientious nature that drives a strong need for information from all available sources, a willingness to follow all mitigation tactics, and a lack of confidence in what the future may hold for the economy and their own financial prospects.

New Consumer Segments Promise to be Fluid

Other research during the pandemic period has broken out consumers into somewhat different groupings. Ernst & Young offers these four categories as part of its EY Future Consumer Index:

- Save & Stockpile: “Not so concerned about the pandemic, but worried about their families. Pessimistic about the long-term effects.” 35%.

- Cut Deep: “Hardest hit by the pandemic. Most pessimistic about the future. Spending less across all categories.” 27%.

- Stay Calm, Carry On: “Not changing their spending habits. Not directly impacted by the pandemic. Worried that others are stockpiling.” 26%.

- Hibernate & Spend:“Most concerned about the pandemic. But best positioned to deal with it. Optimistic for the future. Spending more across the board.” 11%.

Here’s the twist: EY’s report suggests that the four categories of consumers mentioned above will not hold still. Instead, they will evolve as things move forward. So marketers must become even more agile and not let any thinking about post-COVID consumers harden so much that they become blind to a need to change strategy or tactics, perhaps significantly.

EY predicts that elements of the four segments above will feed into the evolution of five fresh segments. According to this view, the new segments will be:

- Get to Normal: “Spending largely unchanged. Daily lives were never really affected. Least concerned about the pandemic overall.” 31%

- Cautiously Extravagant “Middle to high income. Very focused on health but relatively optimistic despite a strong belief that a global recession is coming. Will spend more in areas important to them.” 25%

- Stay Frugal: “Spending slightly less, but some deep cuts. Trying to get back on their feet. Among the most pessimistic about the future.” 22%

- Keep Cutting: “Least educated. Least likely to be working. Making deep spending cuts. Changing what they buy and how. The pandemic was always a huge worry.” 13%

- Back with a Bang: “Younger and in work. Spending much more in all categories. Their daily lives were most disrupted. Now they’re the most optimistic.” 9%

Will COVID-19’s Long Tail Effects Shift Privacy Thinking?

A potential major shift in attitude towards privacy has also been suggested by EY in the wake of its study and past research on then-theoretical pandemic in a 2018 simulation conducted by the firm.

“Not sharing data is regarded as selfish: citizens are happy to make private information available, if it’s for the good of society.”

— EY report

Up to the arrival of COVID-19 Americans have tended to be private — unless they can gain something in exchange for personal information. Yet now 53% of the EY respondents say they would make their personal data available if it helped to monitor and track an infection cluster.

Now, the EY report states, “not sharing data is regarded as selfish: citizens are happy to make private information available, if it’s for the good of society.”

The current research indicates that at least half the country favors this, but others will no doubt still resist surrendering personal information for contact tracing. Will lower resistance to transparency for health reasons spread to other areas? Possibly — but there could also be a backlash if people’s trust is abused. Where this will leave people’s attitudes regarding sharing of information in the private sector, for the personalization of financial services, for example, remains to be seen.

The Challenge of Marketing Amid Coronavirus Extremes

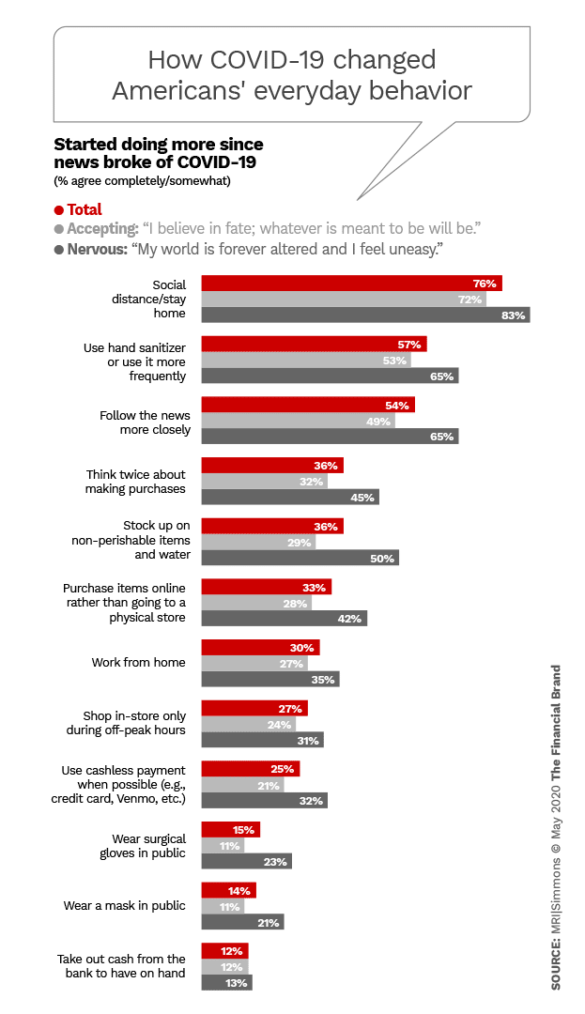

Financial marketers face a delicate balancing act in the face of the extremes of the nervous and accepting, the MRI-Simmons report shows. While some marketing and other communications could be targeted specifically for one audience or another, it’s likely that marketers will often have to find some agreeable middle ground to speak from.

As the chart below shows, the two groups are close on some issues, but diverge significantly on others. As an example of the latter, three-quarters of the nervous respondents but only a bit over half of the accepting respondents say “COVID-19 has changed the way I will act permanently.”

Financial institutions need to also remember that their employee ranks include people of both persuasions, not just their customer bases.

There’s also a factor close to home: Each marketer’s own viewpoint about COVID-19.

Each bank or credit union marketer will need to be able to put themselves in the place of consumers who feel the opposite of the way they feel, something that can be difficult with an often-emotional issue. This argues for careful review of marketing materials and multiple sets of eyes on all messaging, down to social media posts, to avoid imparting unintended meaning.

There is also a risk in the media where the financial institution’s messages appear. To the degree that an institution continues to use programmatic digital advertising, for example, Marketing needs to know where the institution’s messages are appearing. Brand safety issues abound.

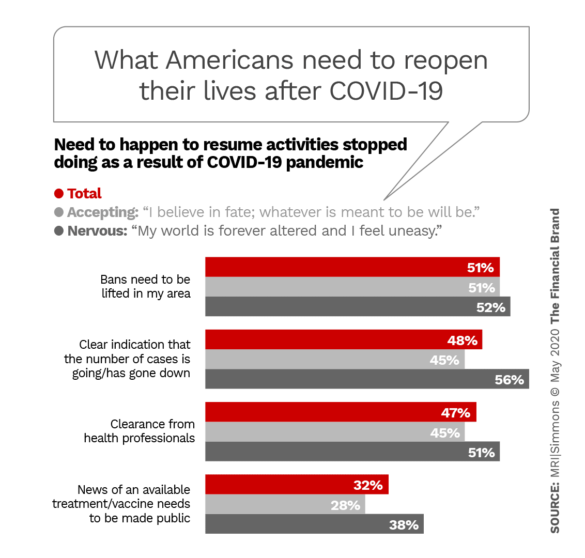

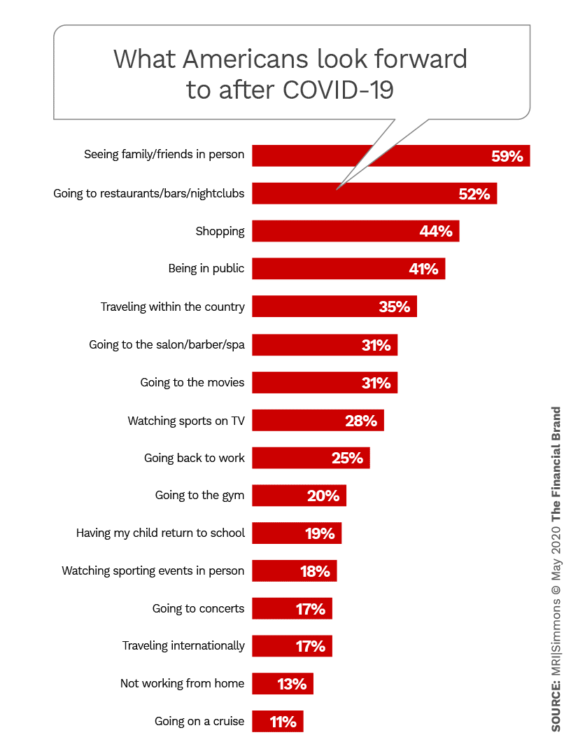

The MRI-Simmons study also makes it clear that Americans look forward to returning to something like life as they knew it. People want to resume activities that put them together with other people, and it may be a race in the weeks ahead between an impatient public’s desire for social interaction and governmental efforts to orchestrate a return to life with fewer restrictions.

Many of the nervous, however, will not be the first to brave your branch, your public event or visit the retailers that your institution banks, even as rules lift.

Read More:

- What Bankers Can Learn from an American Living Cashless & Masked in Shanghai

- Why Financial Institutions Should Continue Advertising, But Differently

How Can Financial Marketers Work with COVID-Derived Segments?

Banks and credit unions will be taking a fresh look at much of their marketing as America reopens. Every institution’s base, and prospects, will look different. However, each broad grouping identified will suggest targeted changes in approach to consider.

Resonate issued a crisis-era report that discusses various segments, including one called the “financial anxiety group.” This group bears some similarities to the “nervous” segment in the MRI-Simmons research. (Resonate research actually found that while 63.5% of respondents have concerns related to the health impact of coronavirus, 80.4% are worried about the disease’s economic impact.)

The company’s paper discusses ways to address this segment. The recommendations make a good illustration of the way financial marketers will need to reason out their approach to each segment that they identify.

1. This segment craves the feelings of stability and financial security that they fear are slipping away.

Tailoring suggested by Resonate includes offering money-saving strategies — even webinars about how to navigate the unemployment system and personal bankruptcy. “You could also offer alternative payment terms specifically for this group for loans or credit cards, such as removing low-balance fees,” the report states. “Offering content and offers to reassure them that you’re here to guide them during a trying time will be appreciated long after this crisis is over.”

Themes in an institution’s communications of national safety, freedom, preservation of social order and stability would mean much to this group, Resonate says.

2. Wealth and influence mean much to this group, either preserving it or pursuing it.

The report suggests creative and messaging that conveys ideas about prestige, importance, prosperity and power would mean much to this segment.

3. Priorities for this segment include higher deposit rates, customer support and bonuses for opening new accounts.

“It is critical to come from a place of empathy when speaking to this group,” the firm suggests. “Reassure them that your customer service reps are there to help them navigate unprecedented times. Let them know you can be reached during extended hours via online chat or through your mobile app… The more reassurance and offers you give to them, the more likely they are to stay loyal to you.”