In spite of the acceleration of use of digital banking channels during the pandemic, research by Simon-Kucher finds that the portion of sales that consumers and businesses completed from start to finish on institutions’ websites, mobile apps and related channels has remained astonishingly small.

Improving that performance ties in not only with the future of digital sales overall, but also has implications for financial institutions’ sales success through marketplace sites as well as their strategies for sales through budding financial services platforms and ecosystems.

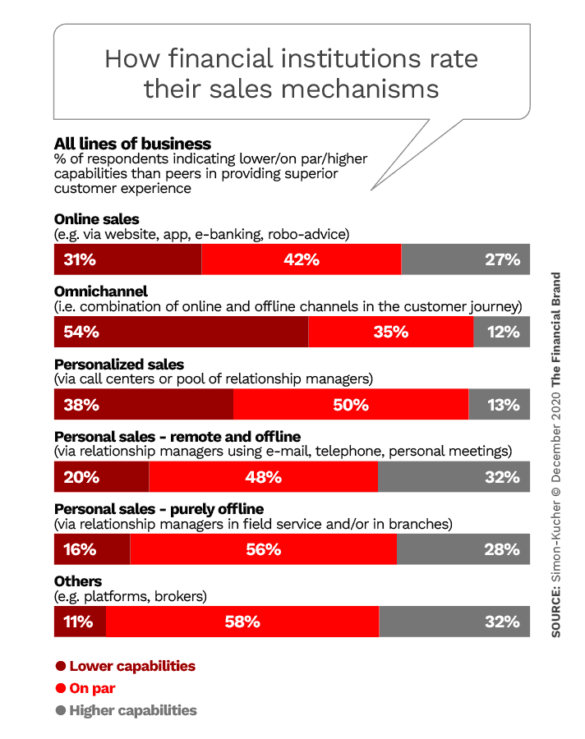

The consulting firm’s research indicates growing prioritization of digital sales by responding banks, which were drawn from the consultancy’s client base. However, frequently executives interviewed by the firm did not feel their institutions had digital selling where it needs to be. (All figures and charts in this report come from the U.S. and Canadian portions of the firm’s study sample.)

“Bankers feel the glass is half empty,” on both commercial and consumer digital sales, says Leo D’Acierno, Senior Advisor at Simon-Kucher. “They can see their world is going in the direction of digital sales, but they don’t feel like their own bank is getting there fast enough.”

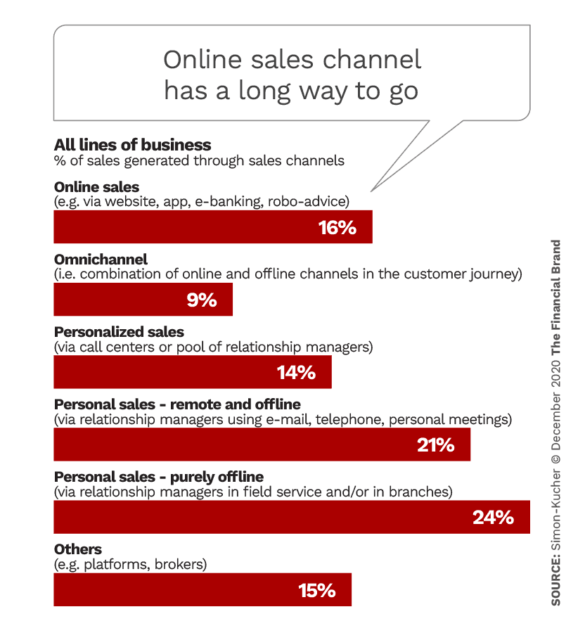

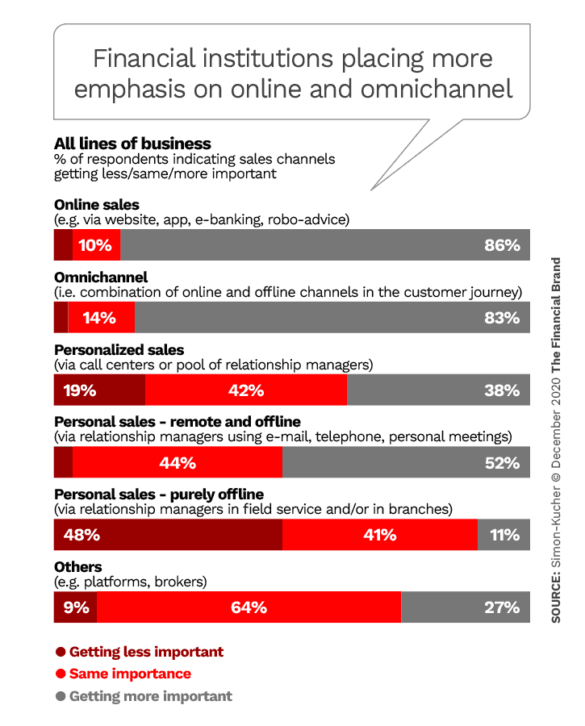

Even with the relatively broad definition of online sales in the chart above, sales accomplished entirely digitally without human intervention have remained small through the pandemic period. Nearly half of sales still rely on a personal connection with a banker, consisting of sales made remotely and offline (21%) and purely offline (24%). Only 9% of sales occur omnichannel, that is, a combination of online and offline channels. Out of all the channels available for selling, the study found, online sales of all kinds and omnichannel sales rank most highly among banks surveyed.

In an interview with The Financial Brand D’Acierno explains that senior bankers are saying that while their institutions have been pouring money into online and mobile sales mechanisms, they are not sure that they’ve gotten a fitting return on their investments.

Given the lingering impact of COVID-19 on consumer and business shopping habits, and the rapid adaptation that other industries have made to digital sales, the banking industry as a whole has been caught somewhat flat-footed. The research found that almost a third of executives surveyed feel that their online sales efforts are substandard and over half feel that way about their omnichannel capabilities.

What’s behind the lagging performance? D’Acierno suggests that one drag is something that had historically been a strength.

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

The unfair advantage for financial brands.

Offering aggressive financial marketing strategies custom-built for leaders looking to redefine industry norms and establish market dominance.

Branches Hold Back Digital Sales Efforts

While the data above paints a picture of an industry champing at the bit to sell digitally, intentions, until recently, have not been matched by actions, according to D’Acierno. Having grown comfortable with branch-based sales over more than 150 years, he explains, most institutions have moved quite tentatively into digital sales.

“In spite of all the talk about the digital superhighway, in many cases the last mile hasn’t been paved yet.”

— Leo D’Acierno, Simon-Kucher

And, quite bluntly, D’Acierno says, “in spite of all the talk about digital and the digital superhighway, in many cases the last mile hasn’t been paved yet.”

Many institutions’ digital sales mechanisms work well enough for the run of the mill sales transaction, but as soon as something out of the ordinary comes up, the business or consumer attempting to open the account digitally faces a dead end.

D’Acierno says the failure to complete the transaction isn’t a matter of consumers deciding that they want to finish up at a branch — they simply have no choice. He estimates that as much as 70% of customers can’t complete the account opening process entirely digitally.

As an example, D’Acierno points to opening of a business checking account digitally. For a sole proprietorship, which is close to being a consumer, opening the relationship online is simple and straightforward. However, small firms with other structures, such as LLCs or Subchapter S corporations, can’t complete the process without bringing the appropriate paperwork to a branch to verify their business identity.

This and other stumbling blocks don’t exist because of a lack of solutions — but because institutions simply haven’t implemented the solutions.

Historically, D’Acierno explains, that’s because the local branch was a “security blanket,” in his words, for both the applicant and the institution. Digital could be a convenient option, but there was always the branch for the last mile. In fact, many still use the term “omnichannel” to denote a process that a consumer may start, say, on a phone and continue it on a computer and wrap it up at a new accounts desk.

The problem here is that a good number of would-be customers, having hit a dead end digitally, arrived at branches in a frustrated state.

And COVID-19 knocked the props out from under the idea of the branch routinely being the backstop for an incomplete digital account opening process.

“Before the pandemic, it was not a terrible inconvenience to ask someone to go to a branch,” says D’Acierno, but under pandemic conditions, you’re asking the customer to do something that’s difficult, or sometimes impossible, or something they don’t want to do.

Coronavirus exposed the industry digital sales weak spot, and it’s not one that can be ignored again.

Getting The Digital Experience Where It Needs To Be

While the industry earned many kudos for pushing through so many Paycheck Protection Program loans as quickly as it did, D’Acierno says that experience also underscores the lack of digital readiness most institutions had. PPP was a relatively cookie-cutter program but getting applications completed and processed remotely took tremendous handholding and manual labor in many institutions, he explains. Few business owners interested in PPP assistance could find an Amazon-style customer experience, D’Acierno says.

“The downside of digital is that the customer is just one click away from giving up and saying, ‘You’ve just made this too hard for me’.”

— Leo D’Acierno, Simon-Kucher

“Ideally, digital should be an easier channel,” says D’Acierno, “but the downside of digital is that the customer is just one click away from giving up and saying, ‘You’ve just made this too hard for me’.”

Finding another potential bank or credit union is as close as doing a quick Google search, he points out.

Solving the digital sales challenge is a practical matter, not an academic one. While they tend to have narrower product lines, direct banks and fintechs routinely operate where many mainstream banks haven’t been able to go, seamlessly.

The problem: Consumers and business can obtain extensive online services from these newcomers and from nonfinancial companies, so the bar is higher for digital sales.

Four Ways To Make Digital Sales Work For Your Institution

D’Acierno recommends four steps that can improve a digital sales effort:

1. Offer in-app support. There will still be times that the process goes tilt, but D’Acierno says institutions can no longer afford to leave the customer in charge of continuing or not continuing the transaction. The sales software should offer the stuck customer the opportunity for a phone chat or web chat right at that time or at least an email opportunity — without sending people to branches.

2. Create a welcoming experience that draws the customer in. D’Acierno says a key pointer from behavioral science is to avoid abstractions when marketing and selling. For example, don’t tell a consumer that the institution has thousands of ATMs. Instead, show them on a map centered on their location where the nearest ATMs are. The graphic illustration means much more than an amorphous number.

3. Use digital tools to make the process easier. Even though banking products are often much more complex than selling shoes, clothes or books like ecommerce firms, digital account sales can still be improved. D’Acierno says much of what tends to make digital financial sales clunky arises from compliance and other necessities that the likes of Amazon don’t face. However, there are ways to make the process less painful.

One example is providing a progress bar or other means of showing the customer how far they are in the enrollment process. “Don’t make the customer feel that they are trapped in a tunnel that they are never going to get out of,” the consultant warns.

4. Go for engagement. Too often financial institution digital sales efforts end with the sale, over and out. D’Acierno says a better approach is to immediately follow up with the next good thing. For example, if someone has just opted for a service that includes a loyalty program, the process should not only ask, “Do you know about our reward program?,” with details, but go on to show the new customer how to activate it so they begin getting deals or points immediately.

Whose Account Is It, Anyway?

Ideally, every digital sales attempt would take place on an institution’s own website or app, where the experience can be tightly controlled and where the institution can always put its best message right in front of the prospect. D’Acierno says that’s the best alternative. But realistically it is not the only way people and businesses will come to the institution for a digital sales transaction.

Executives surveyed believe that digital marketplaces where customers are shown relevant offers and the pricing on them will grow more important going forward. Many of these are comparison sites that present information about savings rates, CD rates, credit card deals, loans, mortgages and more. Some may go beyond merely listing information to providing connections to sales channels.

“On marketplace sites financial institutions have more trouble controlling their message and they don’t necessarily face an even playing field.”

In this environment, financial institutions have more trouble controlling their message and they don’t necessarily face an even playing field. Many of these sites carry disclaimers regarding their editorial objectivity versus the compensation they may receive from listed institutions. This is similar to the difference between your website being discovered for “free” via organic search versus paying per click on a Google ad that appears ahead of organic search results.

D’Acierno points out that higher compensation or faster payment of compensation by an institution are among factors that can influence how a specific institution appears on a marketplace site. This becomes a “B2B2C” arrangement.

An emerging challenge to digital sales efforts can be seen in newer efforts like Google Pay’s Google Plex accounts. As announced in late 2020, a small group of institutions, the largest being Citibank, will offer their own versions of a savings and transaction account through a marketplace maintained by Google. The offerings will be designed specifically for the Google platform. Application for the accounts will be through the Google platform as well.

This plays into a trend towards banks and credit unions, as well as other companies, becoming suppliers to platforms consisting of multiple firms offering frequently competitive services side by side with other institutions. This is beginning to happen on both the consumer and business banking fronts.

How much the look and feel of an institution’s offering will vary according to the platform. D’Acierno thinks the Google accounts could begin to resemble “banking as a service,” with each financial institution participating in a financial version of the “Intel Inside” effort where the chip manufacturer promoted its tiny but essential role in many computers.

What concerns D’Acierno is that many institutions says they are expecting to increase sales from stronger customer relationships. However, many told the firm that they don’t know that much about many customers due to data analytics limitations.

The biggest obstacles cited to more effective customer segmentation, for example, were:

- Lack of organizational/technological infrastructure 68%

- Behavioral data is missing 48%

- Data is not usable for IT/compliance reasons 36%

- Lack of skills to effectively use data 36%

To D’Acierno, that translates to “We’re betting the house on being closer to our customers — but we’re flying a bit blind.”

That’s a bad place to be, in a Google world. One point in favor of partnering with the giant is taking advantage of its superior digital skills. But when someone goes online to learn more about something, do they say “I read it here” or “I read it there”? No, they say they “Googled it.”