Digital banking transformation has enabled many financial institutions to become more prepared for the future as the world was disrupted by the pandemic. For those banks and credit unions that have become the most digitally mature, the focus on improving the customer experience, increasing the use of data and advanced analytics, and deploying new technologies has positioned them at a competitive advantage.

Despite the progress made, all financial institutions will need to increase investment in digital banking transformation initiatives, responding to marketplace expectations and adjusting business models to reflect a highly altered banking ecosystem. A great deal of the focus in 2022 will need to be on back-office processes that are highly outdated and have slowed the progression of all digital banking transformation efforts.

The future will also see a greater involvement of banking staff in building humanized experiences for transactions that were initiated digitally. This will impact current business models, but will improve results of digital deployment efforts.

To determine the digital transformation maturity of financial institutions as well as the areas of focus and concern as we enter 2022, the Digital Banking Report conducted a research study of financial institutions globally. This research provides a foundation for understanding the ways digital banking transformation can drive success in the future.

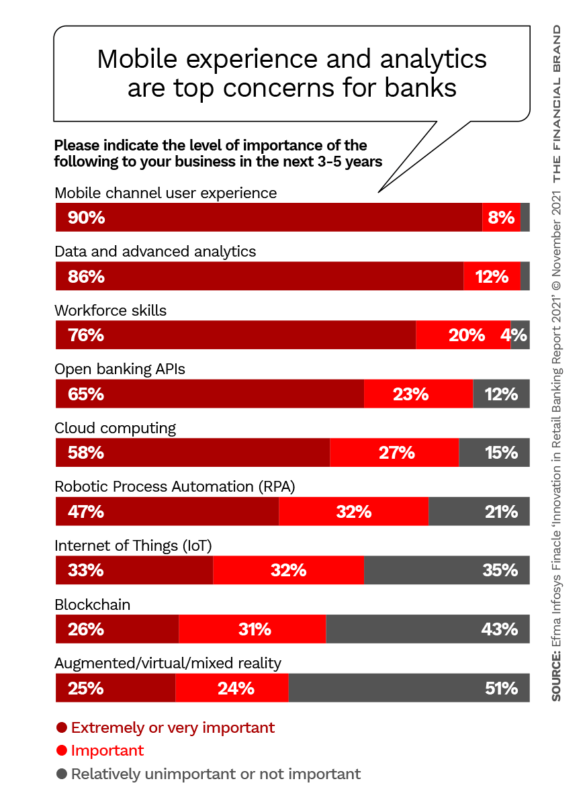

When financial institution executives were asked about the importance of alternative digital transformation strategies, improving the mobile channel user experience was seen to have extremely or very high importance by 90% of organizations. The importance of improving the mobile customer experience was followed closely by the need to improve the use of data, AI and advanced analytics (86% rated extremely or very high).

Illustrating the expansive scope of digital transformation initiatives at most financial institutions, there were several other components that ranked extremely or very high as well, including the need for a skilled workforce (76%), open banking APIs (65%), and cloud computing (58%).

Further down the prioritization scale were the need to apply automation to back-office processes, deploying internet of things solutions, leveraging blockchain technologies and augmented reality.

Read More:

- Executing What’s Possible With Digital Banking Transformation

- How to Avoid Digital Transformation Failures in Banking

- Digital Transformation Requires More Than Technology Upgrades

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

Creating A Community with CQRC’s Branch Redesign

Find out how SLD helped CQRC Bank to create the perfect harmony of financial services, local culture, and the human touch in their branch transformation.

Read More about Creating A Community with CQRC’s Branch Redesign

Progress Seen in Deployment of Digital Transformation

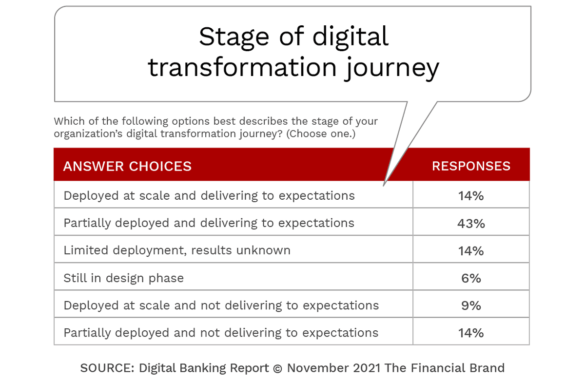

When asked about the progress of digital transformation efforts, only 14% of organizations surveyed indicated that the transformation was ‘deployed at scale’, which was lower than what we found in research done by the Digital Banking Report in 2020 (17%). This indicates that, despite progress being made, the marketplace is demanding more … faster.

What is more concerning is that 43% of organizations surveyed indicated that digital transformation was ‘partially deployed’ compared to 63% last year. An additional 14% indicated that their efforts either had ‘limited deployment’ (12%) or were in the design phase (6%). Almost one in four institutions (23%) stated that their current deployments are not performing as desired.

As has been the case in recent years, the research found that there is a very strong correlation between ‘innovation pioneers’ and those firms where transformation was ‘deployed at scale’. This finding underscores that organizations where innovation is a priority are further ahead of peers in the desire to become a ‘digital bank’.

These leader organizations also had top management support, were more committed to investing in the customer experience and advanced analytics, and were more likely to measure results of their efforts. Not surprisingly, these firms had more positive financial results than firms where digital transformation was only partially deployed.

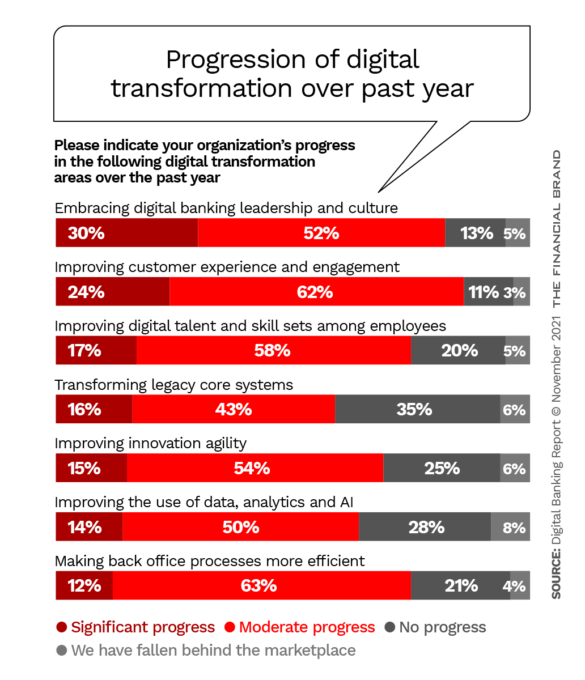

Digging deeper into the progress made in digital transformation, we see that while progress is being made in the leadership and cultural areas and improving the customer experience, significant gaps remain with transforming the legacy core systems and improving the use of data and advanced analytics.

Success of Digital Banking Transformation Still Lacking

As we stated last year, it is clear that financial institutions understand the important components of successful innovation and digital banking transformation. From improving the customer experience to using data and advanced analytics for improved personalization, organizations are not lacking in the knowledge needed to know where to focus efforts.

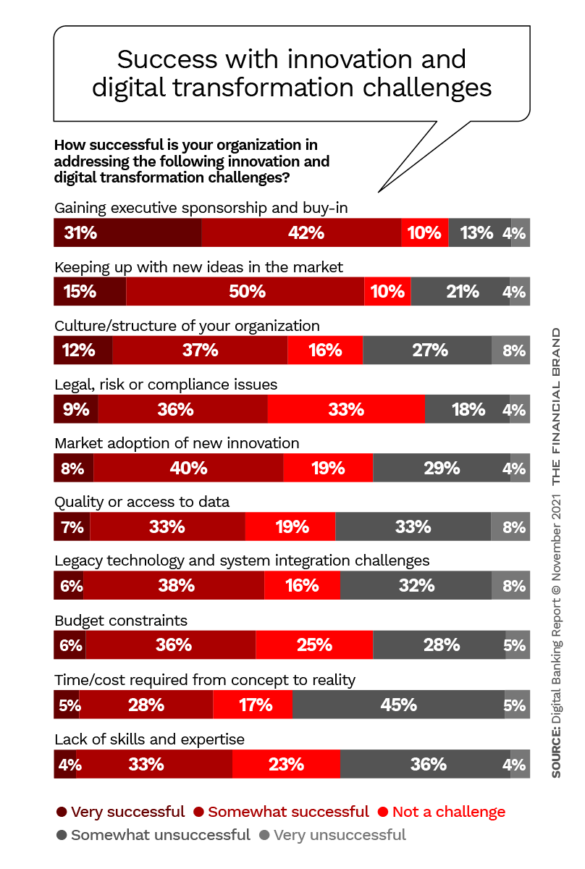

Unfortunately, when organizations were asked about the success of their innovation and digital transformation strategies in meeting key objectives, results were far from encouraging. Reinforcing the reality that almost than six in ten institutions surveyed indicated that digital transformation efforts were only partially deployed, the vast majority of digital transformation strategies had less than half the organizations indicating that a strategy had high or very high success. Even then, the highest rated component was executive sponsorship.

Of significant concern should be the finding that the lowest levels of success were found in the components of skillsets, the ability to commit time and money to strategies, legacy technology and the quality and access to data. Many of these issues are foundational to digital transformation success.

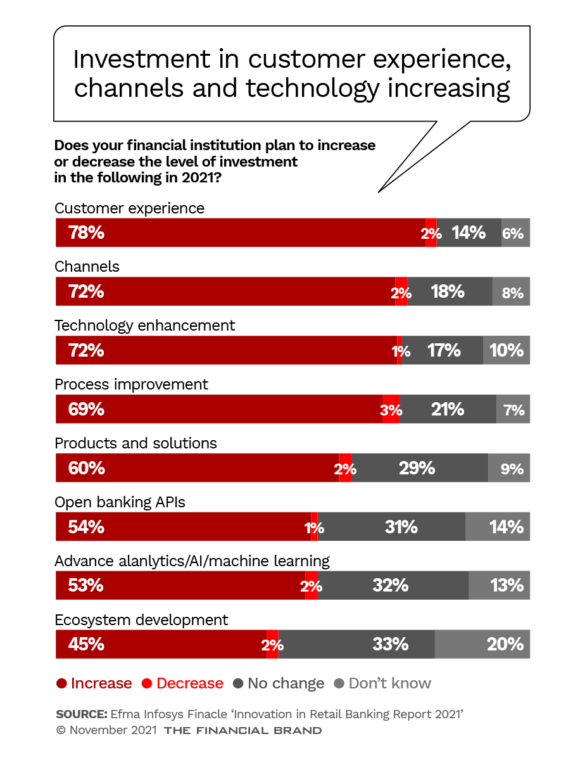

Investment in Digital Banking Transformation Increasing

Not unexpectedly, the investment in digital banking transformation is increasing across the board. Almost eight in ten organizations indicated an increase in improving the customer experience (78%), with 72% of organizations stating that they will be increasing investment in in channels and technology.

What continues to be concerning is that only half of the organizations surveyed (53%) mentioned they will be increasing investment in advanced analytics at a time when the same firms state that it is the second most important component of digital transformation and where progress to date is considered to be the second lowest.

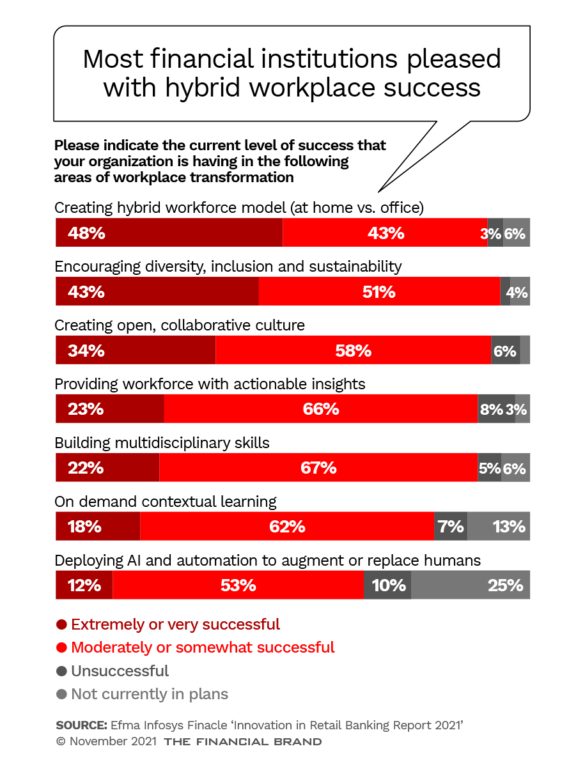

Workplace Transformation Proceeding Well

When organizations were asked about the success they are having with their workplace transformation, the results were encouraging. Financial institutions rated their ability to create a productive hybrid workplace model the highest, while also scoring themselves high on diversity and inclusion and creating a collaborative culture.

The area of greatest concern among banks and credit unions was the ability to augment humans with artificial intelligence (AI) and robotic process automation (RPA).