A major growth opportunity is arising for banks and credit unions in home equity loans and lines of credit because of a massive increase in home prices.

Institutions choosing to go after this growth should proceed with both caution and an eye to offering more than a dusted-off version of the home equity credit of the past. The competition has changed since this type of credit was last hot.

In addition lenders will find that marketing home equity loans and lines will succeed best through tailored campaigns and even one-to-one outreach, rather than shotgun promotions.

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

Assessing the Home Equity Credit Opportunity

The market for home equity loans and lines of credit barely registered on the meter in recent years. Some major lenders like JPMorgan Chase and Wells Fargo basically paused the business after the pandemic hit.

Now, rising rates have cooled down primary mortgage markets for purchases and refinances. As housing prices continue to increase due to strong demand, the equity that people have in homes they already own keeps growing.

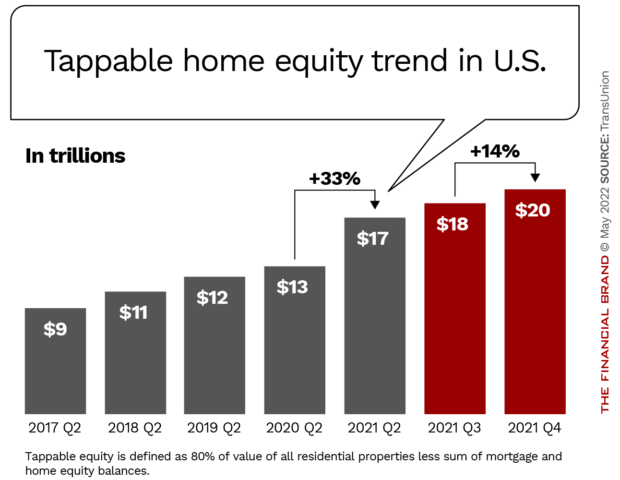

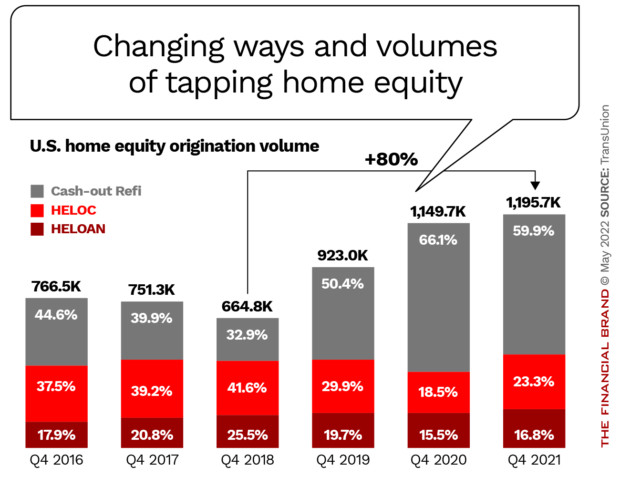

In fact, tappable home equity hit an all-time high of $20 trillion in the fourth quarter of 2021, according to a report by TransUnion. (The company considers “tappable” to be 80% of increases, with 20% as a prudent exclusion, less outstanding mortgage and home equity balances.) The number of cash-out refinancing mortgages — a primary mortgage way of extracting equity — dropped by 4% year over year in the quarter. At the same time home equity lines of credit (HELOCs) increased by 31% year over year and home equity loans rose by 13% year over year.

“Lenders had pulled back dramatically,” says Joe Mellman, SVP and Mortgage Business Leader at TransUnion. “So we had almost a decade of either negative or near-zero home equity credit accumulation. What sprouted to fill that vacuum was the unsecured personal loan, which wasn’t really a well-known product at all in banking prior to the housing market crash of 2007-2008.”

However, with rates rising, and home equity becoming a “pile of cash” in some lenders’ minds, the economics are changing. Unsecured personal loans carry higher rates than do secured home equity credit. Mellman says that the leading purpose of both forms of credit has been debt consolidation.

With home equity lending, especially HELOCs, on the menu again, Mellman says a two-stage cycle of debt consolidation and rate-cutting is underway. Major credit card debt may turn into unsecured personal lending, which is cheaper than cards, and then, for those with homes, home equity credit can take out the personal loans and at a lower rate.

The second most common use of home equity credit is home improvement, in Mellman’s experience.

That’s picked up, he says, because more people are working from home, and they have been inclined to remodel. And with rising home prices, people that might have sold and moved up are staying put. “Fixing that home up becomes much more attractive,” says Mellman.

Read More:

- Consumers Ditch Branches and Use Digital Channels for Home Equity Applications

- How Home Equity Lenders Must Beat Back Online Threats

Understanding the Scope of Housing Prices’ Impact

Additional perspectives illustrate how significantly the increase in housing prices has impacted the wallets of U.S. homeowners, at least on paper.

ATTOM, a real estate data firm, reported in May 2022 that in the first quarter of the year 44.9% of mortgaged residential properties were classified as “equity-rich.” (The term means that outstanding loan balances secured by the property are 50% or less of the home’s estimated market value.) By contrast, a year earlier, 31.9% of mortgaged residential properties were equity-rich.

Unlike other periods, such as the residential real estate crash of 2007-2008, when such increases occurred here and there, ATTOM points out that increases in equity-rich levels have been seen in 45 states. So the potential for home equity loans and HELOCs is quite broad.

Reality Check:

Rising home prices only become a reality if a sale takes place. Otherwise they are more like a price index that home equity gets pegged to.

Experts point out that housing affordability is approaching the worst levels on record. Black Knight’s Home Price Index indicated that gains slowed slightly in March 2022, but that the impact of rising mortgage rates took a toll. The share of median household income needed to make principal and interest payments on an average-priced home hit 32.5% in April 2022, according to Black Knight.

Says the firm: “U.S. housing was the least affordable ever back in July 2006 when it took 34.1% to make that P&I payment. At the end of February 2022, we were already at 29.1% — and both rates and prices have continued to climb since then.”

Opined the New York Times regarding housing price increases: “It’s a remarkably positive story for Americans who own a home; it’s also inseparable from the housing affordability crisis for those who don’t.”

Given Americans’ broad return to credit cards once government stimulus money and other aid ran down, the approximately 65% of citizens who own homes can’t be blamed for seeing their homes as piggybanks under today’s price levels.

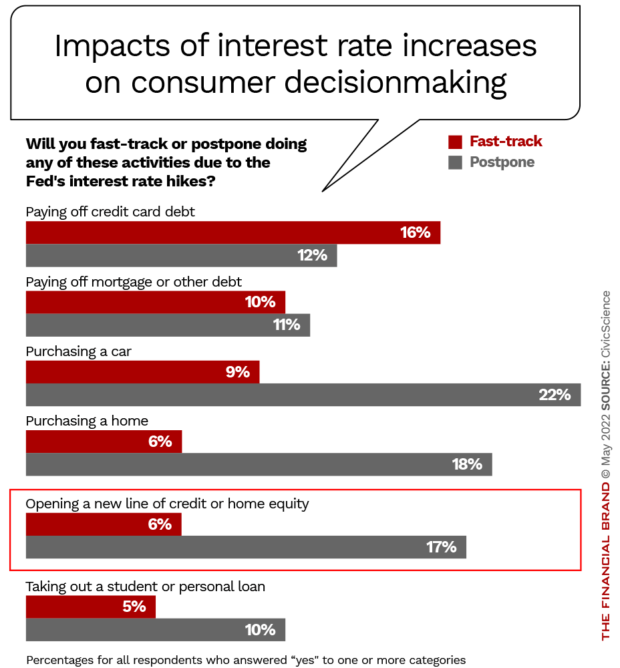

Still, given the uncertainties in the economy, some people may hold back. CivicScience asked people what they would fast-track and what they would postpone, in the wake of Federal Reserve rate increases. Interestingly, almost three times as many said they would postpone opening a line of credit or tapping home equity as said they would fast-track it.

During the May 2022 JPMorgan Chase Investor Day, Chairman and CEO Jamie Dimon was asked about home equity lending in light of all the new home equity available due to rising prices.

Dimon told attendees that the bank had not yet opened up home equity lending. (It had done cash-out refis during the pandemic.)

“It is obviously a product that is gaining appeal right now, and so we’re working on that,” said Dimon. “But remember that home equity was also a huge piece of the problem in the last crisis and generated a significant amount of our losses. And so, we just worked through all of that. So we’re working on it, it’s definitely appealing in this rate environment and we do not have it on offer yet.”

Read More:

- Over 50 Credit Card Trends & Statistics for Bankers

- Lender Alert: Struggling Consumers Using BNPL Almost 4x More Than Others

The Dark Side of a Home Equity Boom

There are many factors contributing to the current unpredictable environment. The influence of the return of significant inflation, meaningful interest rate hikes, the on-again/off-again concerns about Covid-19, the undecided battle over working from home versus returning to the office, the Great Resignation (or whatever they are calling it now), a strong job market that could turn south, the Russian-Ukrainian war, rising energy costs and more all bear on housing prices. And housing prices fuel home equity.

Even as the home equity finance opportunity warms up, some are predicting that home prices could take a major hit sometime in 2023 if the economy cools down.

Eyes Open:

The U.S. housing market is a subset of one of the most volatile economies seen in decades.

At the extreme, this could work against assumptions made when extending and pricing home equity credit. Banks and credit unions will have to weigh the benefits and risks of this window of opportunity — and need to decide how far they want to open the window.

A good example of this viewpoint is the economic forecast published in mid-April 2022 by Fannie Mae.

“Mortgage rates have ratcheted up dramatically over the past few months, and historically such large movements have ended with a housing slowdown,” the company stated. “Consequently, we expect home sales, house prices, and mortgage volumes to cool over the next two years.”

Fannie Mae projects that home price growth will “decelerate to a pace more consistent with income growth and interest rates.” If mortgage rates remain relatively high, the company expects first-time buyers to be priced out. This will slow demand and lower pricing.

On the other hand, the company does not expect a repeat of the Great Recession, due in part to less leverage in the housing finance system and better mortgage underwriting.

The impact on active lenders will hinge on controls and the balance of risk management and risk appetite.

Read about other loan growth opportunities:

- Cannabis Banking: Low-Cost Deposits and Business Loans Entice More Banks

- Electric Vehicle Sales Are Up — Lending Won’t Be Far Behind

Getting Aboard the Home Equity Credit Train

Banks and credit unions that decide to venture into home equity lending must balance prudence with the need to compete. Other traditional institutions will be out there, but so will fintech players who haven’t been competing in this area before.

Take Figure Lending LLC, a fintech founded by one of the co-founders of SoFi, which uses blockchain technology to automate functions. The company promises a 100% online application, complete with a video notary in some locations. The company’s home equity service promises “Approval in 5 minutes. Funding in 5 days.” Another fintech, Button Finance, promises funds for most borrowers within six days. Others don’t lend, but offer variations on tapping home equity.

Fintech Impact:

Traditional lenders will have to up their game to compete in home equity lending this time around.

Mellman says the home equity loans and lines have been off the table for so long that a key element will be communication.

“Lenders will need to take a proactive approach to educate consumers about what a beneficial product home equity credit can be,” explains Mellman.

Simply blasting out messages will waste marketing bucks, however. Mellman suggests that screening tools can help determine who makes a good prospect, looking at homeownership, equity, what else they owe and other factors.

The potential for fresh credit sales is strong. Mellman says that out of nearly every customer grouping TransUnion has analyzed, about half have enough equity in their homes to take seriously as equity credit candidates.

As traditional institutions move further into this line of business, there’s a regulatory nudge from Washington to consider.

In a speech Acting Comptroller of the Currency Michael Hsu warned of the risk in all secured consumer credit right now.

“Underlying collateral valuations securing retail products are elevated, driven by supply constraints in homes, automobiles and recreational vehicles,” said Hsu. “Elevated asset valuations increase the indebtedness of new borrowers and can contribute to unsustainable competitive trends.”

A kicker from Hsu: “As consumer indebtedness increases, pressure to maintain market share may facilitate loosened underwriting standards.”