Credit Card Customer Relationships

There are 531,540,000 credit cards in the United States, and the average American carries three credit cards in their wallet.1

By the end of 2020, 7 in 10 Americans had a credit card under their name.22

87% of Caucasian adults, 92% of Asian adults, 72% of Black adults, and 76% of Hispanic adults have credit cards.1

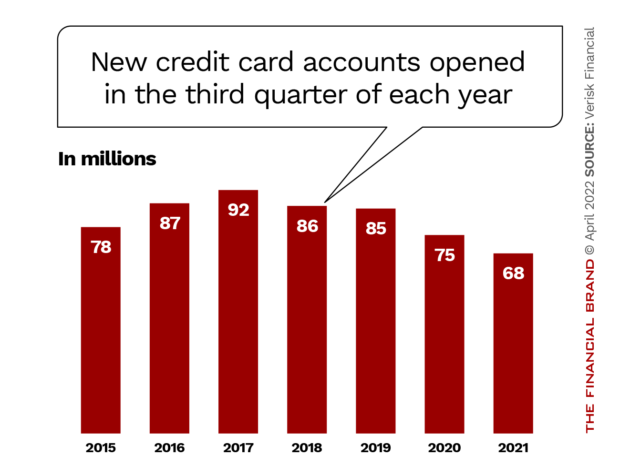

28 million super prime customers, 22 million prime and 18 million subprime opened new lines of credit in the third quarter of 2021, totaling 68 million new accounts.2

The three biggest complaints customers had with credit cards were collection issues (32.95%), billing problems (19.38%) and the payoff process (6.04%).3

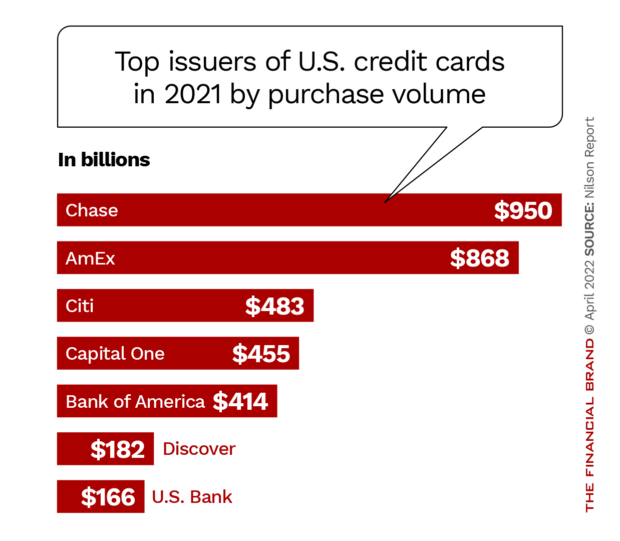

American Express has the highest customer credit card satisfaction score, followed by Discover and Capital One. Customers were least satisfied with Credit One Bank, followed by U.S. Bank and Synchrony Bank.4

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

Consumer Credit Card Balances, Payments & Debt

Nearly half (45.4%) of families carry some sort of credit card debt.6

39.5% of credit card users don’t use their cards for transactions but carry a credit card balance, and 24.4% of credit card holders don’t use their cards and have their accounts sitting dormant.5

The average American family credit card debt is $6,270.6

Outstanding credit card balances and purchase volumes in the U.S.21

Read More: 18 of the Best Credit Card & Debit Card Designs in Banking

Credit card debt is reaching new highs every quarter, up to $856 billion in the fourth quarter of 2021, a 6.5% hike in credit card debt from the previous quarter.7

There is $3.2 trillion worth of available credit card credit in the U.S., as of the fourth quarter of 2021.7

The average monthly credit card bill has an average minimum payment due of $110.50.3

U.S. households carrying credit card debt pay interest charges of $1,029 on average.8

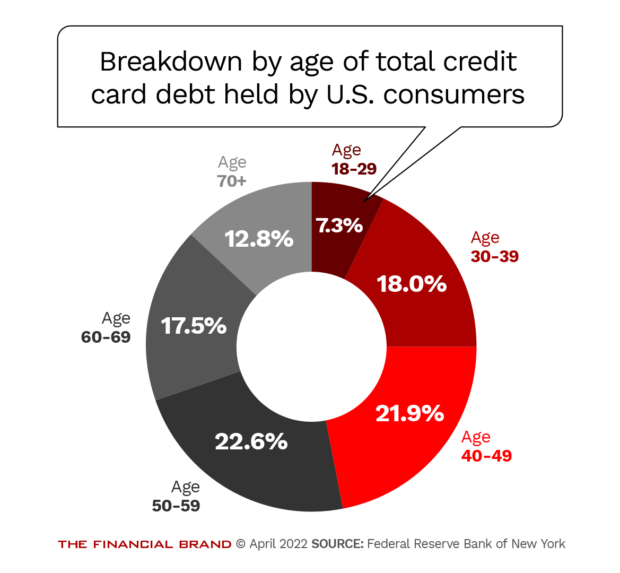

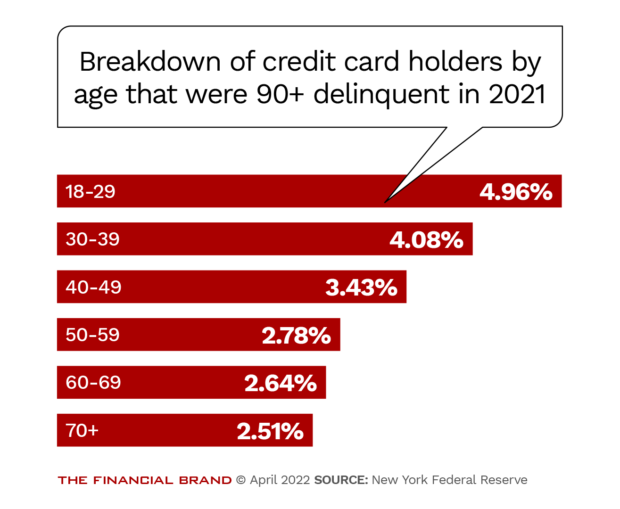

One in 12 credit cards has a 90+ day delinquency rate.7

Credit card holders in Alaska have the highest credit card balances at 30.9% above the overall average. Connecticut sits second at 15.1%, and Virginia at 14.3%. Meanwhile, Iowa had the lowest credit card balance — 17% lower than the overall average.9

Travel Rewards

More than one in six (17%) of travel rewards credit card holders put all their credit card purchases on their travel rewards card. But one in five (19%) of travel rewards credit card holders aren’t putting any of their credit card purchases on their travel rewards credit card.8

39% of travel rewards card holders used a cashback credit card more often than their travel rewards card since 2020.8

Americans with travel rewards credit cards have 64,800 rewards points/miles on average saved up. 56% of travel rewards card holders have fewer than 10,000 points/miles, but 25% have 50,000 or more points/miles.8

Of travel rewards cardholders, 14% say they opened a new travel rewards credit card account since 2020. 7% of Americans say they had a travel rewards credit card but canceled it in 2020 or 2021.8

The average initial points/miles bonus awarded for new credit card accounts increased by more than 19% in 2022.3

Cash Back, Incentives & Other Credit Card Rewards

The average cash back credit card’s initial rewards bonus increased by 6.60% year over year in Q1 2022.3

82% of credit cardholders aren’t interested in crypto rewards, but 13% would like to have the option and 5% are interested.10

Credit card companies are emphasizing credit card balance transfers over new-purchase financing, offering 0% intro rates on credit card balance transfers for 9.1% longer.3

Gen Z vs. Millennial Credit Card Trends

50% of credit-active Gen Z consumers in the U.S. have a credit card.11

27% of Gen Z consumers say they were turned down when applying for their first credit card — a rate that is two-times higher than any other generation.13

Credit cards (50%) were the most common financial product held by Gen Z, ahead of student loans (39%), auto loans (25%) and unsecured personal loans (4%).11

Younger shoppers appreciate the flexibility of Buy Now, Pay Later, with 44% of Gen Z and 37% of Millennials expected to make a BNPL payment in 2022, compared to 23% of Gen X and 9.4% of Baby Boomers.12

While cash and debit cards are the top payment types across all consumers, Gen Z also welcomes non-traditional digital payment options. 53% use person-to-person payment apps (more than any other generation), 50% use PayPal, and 25% would consider using cryptocurrency.13

Read More: Millennials and Credit Cards: Separating Fact from Myth

36% of Gen Z uses credit cards for purchases between $30 and $150.13

59% of Gen Z with credit card debt don’t mind talking about it with friends and family.14

Younger Millennials carry an average debt of $2,288 from credit cards, while older millennials carry an average credit card debt of $6,675.9

Millennials represented 32.7% of credit card originations in Q2 2021, followed by Gen X with 28.8% and Baby Boomers with a 21.3% share.11

Mobile Wallets/Contactless Payments

There are over 175 million contactless cards in the U.S. market.15

51% of Americans are now using some form of contactless payment, which includes tap-to-pay credit cards and mobile wallets like Apple Pay.16

Nearly 150 million Americans say they’ve used a mobile wallet/contactless payment method at least one time.17

43.7% of the U.S. population is expected to try out and make at least one mobile contactless payment by 2025, compared to just over a third (36.4%) of customers using contactless payments in 2021.12

About 85% of transactions at grocery stores were conducted using contactless options, 39% at pharmacies, 38% at retailers, and 36% at restaurants.17

50% of consumers said a contactless payment is safer for their health than swiping or inserting their credit card.18

Read More: Growth of Digital Wallets and Contactless Payments Set to Explode

By 2025, QR-code payment users are expected to exceed 2.2 billion, equating to 29% of all mobile phone users globally.12

QR codes have a 70% usage rate in China (but only an 8% rate in Japan). Use of QR codes for payments is projected to expand internationally.12

Most credit card companies set the max threshold for a contactless credit card at $250.17

66% of issuer banks were providing contactless cards by 2020. 25% were planning to begin issuing contactless cards over the next one to three years. The remaining 9% had not yet altered their stance on contactless cards.5

APR, Interest Rates & Credit Card Fees

The average credit card APR was 18.32% in the first quarter of 2022.3

The credit card issuer with the longest 0% introductory APR is Wells Fargo, which promises 21 months of no interest with qualifying credit card balance transfers to its Reflect credit card. After that, the rate quickly rises to between 13.24% and 25.24%.

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

This webinar will offer a comprehensive roadmap for digital marketing success, from building foundational capabilities and structures and forging strategic partnerships, to assembling the right team.

Read More about Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

38% of credit card companies surveyed charge penalty rates. The highest penalty rate charged is 29.99% for defaulting on a credit card.19

Customers with good or excellent credit average 19.53% APRs on their credit cards and customers with bad-to-fair credit average 23.68%.19

The average APR for a travel rewards card is 19.75%.20

The average APR among student credit card offers increased the most compared to last year, rising by 95 basis points from 15.38% in Q1 2021 to 16.33% in Q1 2022.3

The average credit card annual fee is $21.94, which is up 14% from 2021.3

The average credit card balance transfer fee is 2.44%. It has decreased by 9.29% compared to last quarter and by almost 20% compared to last year.3

The average foreign transaction fee on a credit card is 1.44% — down by more than 38% since Q3 2014.3

The average cash advance fee on a credit card is $8.12.3

Sources: 1 Federal Reserve, 2 Verisk Financial, 3 WalletHub, 4 CreditCards.com, 5 American Bankers Association, 6 Value Penguin, 7 New York Federal Reserve, 8 Nerdwallet, 9 Experian, 10 Finder.com, 11 TransUnion, 12 Global Payments, 13 Alliance Data Systems, 14 Bankrate, 15 Visa, 16 Mastercard, 17 Finical Holdings, 18 American Express Digital Payments, 19 The Balance, 20 LendingTree, 21 Nilson Report, 22 CFPB