Influencer marketing is a way for businesses to reach and engage with their target audience. Though influencer marketing is commonly associated with industries like fashion, beauty, and travel, the banking sector also has started to recognize its potential in recent years.

This type of marketing is often more effective than traditional advertising, not just because of the opportunity for interaction with consumers, but because of the trust that influencers establish with their audience.

One way that influencers can be most useful to a banking brand is by providing exposure to younger audiences that are harder to reach with traditional advertising. Influencers can use their social media platform to talk about a product and its features while also showing how to use the product — a marketing approach that works particularly well with Gen Z and Gen Alpha consumers.

Moreover, influencers serve as another option when standard sources of traffic do not generate enough conversion.

Instant Messaging. Instant Impact.

Connect with your customers and provide lightning-fast support as effortlessly as texting friends. Two-way SMS text messaging is no longer optional.

Move the Needle from Attrition to Acquisition

Vericast’s 2024 Financial TrendWatch explores seven of today’s most critical financial services trends to provide a complete view of the current loyalty landscape.

Read More about Move the Needle from Attrition to Acquisition

Special Considerations for Banks Interested in Influencer Marketing

Banking marketers evaluating potential partnerships with content creators should be aware of some limitations.

1. Not all creators are willing to collaborate with brands in the financial services sector.

One of the main reasons for their reluctance is a sense that these brands impose excessive control over the creative process. Many creators would rather work with brands and industries that provide them with more flexibility and creative autonomy. Influencers value their creative freedom and authenticity, which can be limited when working with financial institutions.

2. Attracting new customers for banking brands is hard.

In comparison to other industries, generating interest in banking can be more challenging, in part because the products are more complex. With gaming, for example, people tend to try a product more readily, whether out of curiosity or for entertainment. But opening a bank account is a more substantial commitment, and people are unlikely to do so just to have a look. This leads to low conversion rates from paid channels for banks, when compared with other businesses in other industries. For savings and checking accounts specifically, conversion is low in comparison with benchmarks even of other financial products.

How to Choose the Right Influencers to Work With

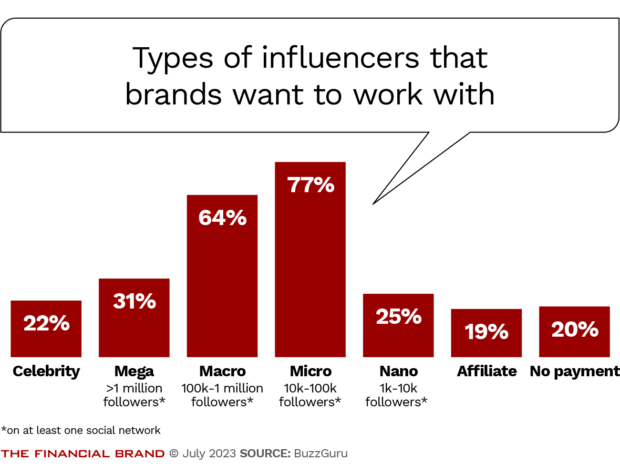

The majority of brands across all industries — 77% — prefer working with micro-influencers, according to BuzzGuru.

These influencers — with a range of 10,000 to 100,000 followers — have highly engaged, niche audiences that share specific interests or hobbies. For example, influencers who specialize in financial responsibility attract followers who want to manage their money more wisely.

By partnering with micro-influencers, marketers can make sure their messages are aligned with an audiences’ interests, thus maximizing the impact of their campaigns.

In some ways, choosing an influencer as a partner is similar to choosing a television program for airing an ad. Whoever the target audience is for a product must be similar to those who would watch that TV program or, in this case, similar to those who would follow a particular influencer.

In some ways, choosing an influencer as a partner is similar to choosing a television program for airing an ad. Whoever the target audience is for a product must be similar to those who would watch that TV program or, in this case, similar to those who would follow a particular influencer.

But there is an extra layer to the matchmaking when selecting influencers for banking brands. Beyond the target audience, it is crucial to prioritize alignment with the brand’s values and goals.

For example, to attract consumers willing to sign up for a youth-oriented debit card with cash back, you would want to seek out influencers with a following that aligns with the target audience for your product. The followers should be young, active and loyal, but also have the kind of values that your brand attributes will resonate with.

To promote credit or investment products, the usual target is adults with higher levels of expendable income. So your brand would need influencers who distribute relevant content, talking about “grown-up” interests such as money management and smart lifestyle choices. Search for influencers who do reviews of credit or investment products, offer personal finance tips or talk about investment strategies.

Read more:

- College Athletes Are Great Social Media Boosters for Banking Brands

- Threads: What Banks and Credit Unions Think of Meta’s Twitter-Killer

The Basics of Influencer Marketing for Banking Brands

Here’s an overview of the steps that banks should take to ensure a successful influencer marketing effort.

1. Clearly define the audience for whatever you are promoting.

First, determine what you are going to advertise. Is it a product like a credit or debit card? Or do you plan to run a campaign dedicated to increasing familiarity with the bank’s brand?

Next, identify the ideal target audience. Be specific about the age range, gender, level of income, educational background, interests, values, etc.

For an online investment platform, the target might consist of tech-savvy individuals in the age range of 25 to 40. They would be educated professionals with a moderate to high income level and an interest in financial growth and wealth management.

2. Create a portrait of influencers to work with.

With a clear picture of the audience you want to attract, it becomes easier to determine the creators you need to seek out. The audience parameters help with assessing which creators are the best fit for generating a buzz around your product and attracting new customers.

3. Write a clear brief, without making it too boring or strict.

Establishing transparent communication with influencers regarding your expectations, the guidelines you would like them to follow, and the desired messaging for the product is important. Clearly outline the key features, benefits and brand values that need to be emphasized.

But then let influencers do their job: They know their audience well and should be allowed to take responsibility for presenting your product in the way that will be most engaging for their audience.

It is crucial to discuss expectations around the opportunity to review the draft of the video that highlights your product or brand and provide feedback on the content before its publication. This is to ensure the message accurately reflects the product’s features and aligns with brand’s requirements, while still respecting the influencer’s creativity and voice.

After the post appears, be sure to track the feedback from the influencer’s audience and follow the comments below the video to address concerns, clarify information, and provide additional support or information as needed.

4. Measure the results.

Banking brands have their own organic traffic, meaning the visitors who arrive at a website through (unpaid) search engine results or direct referrals. Brands working with an influencer also generally have other advertising efforts underway. This makes it difficult to measure the traffic that comes specifically from an influencer.

However, if the cost of acquiring a lead decreases, and does so within 7 to 14 days after the influencer engagement commences, and then continues to decrease, it is likely because of leads that came from the influencer. Potential customers who initially showed no interest in an advertisement might later recall it and proceed to search for information through search engines, where they are recorded as coming from a different traffic source.

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

This webinar will offer a comprehensive roadmap for digital marketing success, from building foundational capabilities and structures and forging strategic partnerships, to assembling the right team.

Read More about Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

Banks Using Influencer Marketing on YouTube

Some major banking brands already partner with influencers to achieve their marketing objectives.

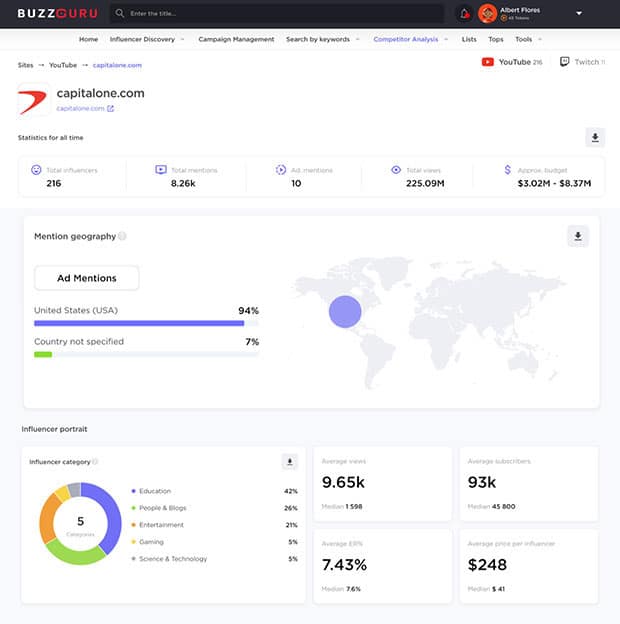

Capital One, a bank that heavily promotes credit cards, is one example. It has received more than 8,260 mentions from 216 influencers on YouTube since BuzzGuru’s analytical platform began tracking such data in 2017.

The majority of the influencers who have mentioned Capital One (94%) are based in the United States, which is to be expected for this U.S. bank. Among them are @ShayBudgets, who shares tips for saving money with her 86,000 subscribers, and @Travelwithchris, who has 283,000 subscribers following his adventures. These accounts attract people who are interested in smart money management and life hacks, which aligns well with a banking brand.

Capital One is active in social media in general, so its embrace of influencer marketing seems fitting. On The Financial Brand’s Power 100 Social Media Rankings in the second quarter of 2023, Capital One ranked No. 23. This global ranking is based on the cumulative size of an institution’s social media community and its overall activity across YouTube, Facebook, Twitter and Instagram.

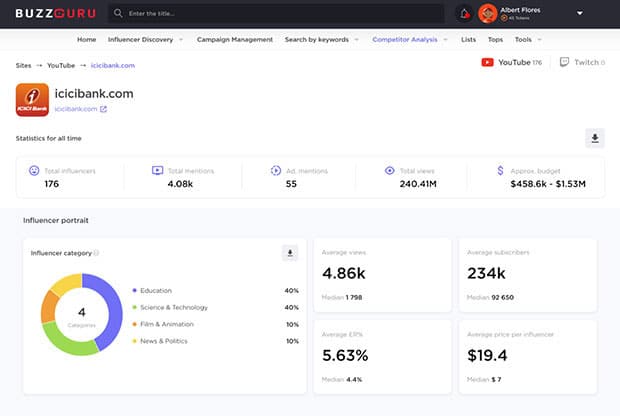

ICICI Bank, which is based in India, but operates in 17 countries, has collaborated over the years with 176 YouTube influencers who, collectively, got more than 240 million views on posts promoting the bank.

Like Capital One, ICICI Bank is in the Power 100, ranking at No. 3 for the second quarter. The bank is such a social media heavyweight that it has earned a spot in the top 10 every quarter for the past decade.

Read more:

- 3 Steps to Creating Experiential Marketing That Wows People

- See all of The Financial Brand’s latest coverage of social media in banking

The Potential Pitfalls of Influencer Marketing

Banking brands need to consider the potential pitfalls of influencer marketing and navigate those pitfalls wisely.

1. Fake statistics of influencers’ accounts. Creators can photoshop their statistics to make their audience look more mature and financially capable. This might result in a bank getting applications from those who are underage or from individuals who fail to complete the registration process.

2. Reputation of the creator. It is crucial for banks to carefully vet influencers in terms of their brand reputation. Avoid partnering with popular influencers who are involved in scandals and feuds with other influencers. Any association with a scandal-ridden influencer poses a threat to the bank’s reputation.

3. Content from the creator. Thoroughly study the content being posted by a creator who is of interest before agreeing to work with that person. Also study the content being posted around the time of publication for the bank’s message to ensure the advertisement will not appear in a content stream near a video containing sexist jokes or any other inappropriate content. (Guidelines on this should also be part of the agreement that the bank sets up in advance with the creator.)

Young, digitally-savvy consumers often turn to influencers for information, advice and inspiration. By carefully selecting influencers aligned with a bank’s target audience and values, marketers can drive engagement and deliver results exceeding that of traditional advertising.

About the author:

Pavel Beinia is the founder of BuzzGuru, an influencer discovery and marketing intelligence platform, and Famesters, a creative influencer marketing agency. He has more than 10 years of experience with influencer marketing.