When Paducah Bank talks on social media, people listen.

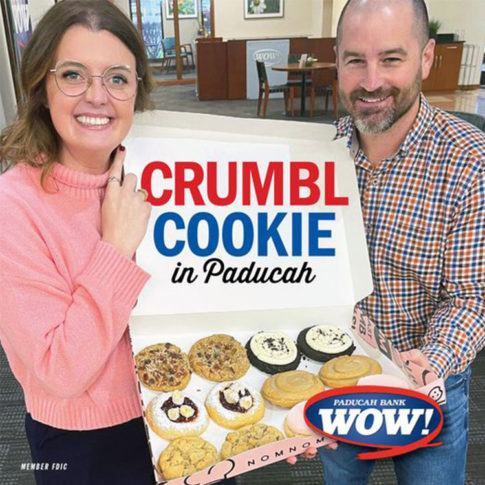

Its posts can generate tens of thousands of impressions and strong engagement. One Facebook post in January — about a cookie business coming to town — had 15,000 reactions. These are stats few financial institutions can claim, especially ones the size of this $910 million-asset bank in Paducah, Ky.

The enviable reach is one benefit of the bank’s social media room, which it created in November 2022. It converted one of its seven conference rooms to a space for videotaping a variety of content, complete with three different “sets” to use, as detailed in this article.

The investment has paid off, says Susan Guess, the bank’s chief marketing officer.

Within the first 11 months, Paducah Bank had increased its social media impressions across all of its accounts to 4.5 million, a 58.3% increase from the same period a year earlier.

The bank also garnered 336,021 video views from November 1, 2022 to September 20, 2023, an increase of 861% compared with the same period a year earlier. And it was posting at a relatively modest cadence by social media standards. It put up 85 new videos in that timeframe, which works out to roughly one video every four days.

“Beyond the numbers, the true victory lies in the stories we’ve been able to tell,” Guess says. “The addition of video content has breathed life into our online presence, transforming it from a one-dimensional experience to a dynamic, interactive platform.”

Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

This webinar will offer a comprehensive roadmap for digital marketing success, from building foundational capabilities and structures and forging strategic partnerships, to assembling the right team.

Read More about Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

Brand Recognition and Values Resonating with Gen Z

Has all of this attention contributed to account opening growth or generated new customer interest?

It’s difficult to tie such marketing efforts directly to bank growth, Guess concedes. But projects like Paducah Bank’s social media room have made ripples in the community and familiarized more people with the brand.

A brand that prioritizes the local community has a lot of appeal across the generations, Guess says. “People want to associate with people who are creative and involved in making a difference, and we believe that we do that,” she says.

And with young people in particular, who favor short content on platforms like TikTok and YouTube over traditional media, this kind of connection is key. Gen Z — loosely defined as people born between 1997 and 2012 — think about the businesses they patronize as an expression of their identity and ethics, according to research by McKinsey and others.

Facebook, which is popular with both Baby Boomers and twentysomethings, is one of Paducah Bank’s most effective channels. One January post on the platform, announcing Crumbl Cookies, a nationwide franchise that sells fresh-baked cookies, would be opening a store in the area in the spring, reached 75,000 people in three hours and accumulated over 15,000 engagements.

“Facebook is king for us,” Guess says.

The Social Media Efforts That Work Best for Paducah Bank

The social media hamster wheel can be taxing, with many companies posting content seemingly just to get something — anything — out there. But Paducah Bank has maintained a clear focus.

“When I was first hired here, our CEO said at the time, ‘If we do something, we’re going to do it right,'” Guess recalls. “We’re not about just creating a bunch of content for content purposes and not having it represent us in a professional, quality way.”

One of Paducah Bank’s strongest videos featured local meteorologist Noah Bergren, who was enlisted to provide a Christmas weather report. Bergren is renowned in the region for his on-air reporting during the violent tornadoes that ravaged western Kentucky in December 2021. The video for the bank, which featured Santa Claus asking if he should be concerned about the weather as he comes through Paducah, picked up over 33,000 views, nearly 550 likes and 66 comments on Facebook.

Capitalizing on the Christmas holiday has been effective in other ways, too. Every year since it started its Facebook page, Paducah Bank has held a “12 Days of Christmas” giveaway that it promotes on social media. Guess says this popular event — which ends with $250 gift cards being given away — never fails to deliver hundreds of shares and comments for the bank’s posts.

The giveaway illustrates how brands can leverage the digital realm to create meaningful connections in the real world. For example, the bank brought in local businesses during the 2022 holiday season to showcase their products, also fostering relationships with the community and helping to promote the local economy during a time when many shoppers might be buying online from national retailers.

A video interview between Guess and the owner of Kentucky Kickz, a local retail shop that sells name-brand shoes and vintage shirts, went up on social media December 20, garnering over 6,000 views and 91 likes on Facebook. In another video, Guess invited Sara Bradley — a contestant on the 16th season of the reality show “Top Chef” — to talk about her restaurant in Paducah. That video picked up 21,000 views and 175 likes.

Meanwhile, a “Seven Questions With” video series has director of client experience Craig Felter asking employees seven fun and creative questions. It, too, has proven popular, Guess says.

“Our interviews with team members, customers, and community changemakers offer followers a more personal insight into who we are,” she says. “It’s a unique opportunity for our customers to share their stories, further solidifying our commitment to community and connection.”

Sometimes the content ideas happen on the spot. In early September, one of the local school districts recruited a new superintendent, Josh Hunt. Guess already had the interview booked to bring him to the social media room for a video shoot, but the day Hunt came in, Guess had one of the bank’s teen ambassadors shadowing her. “I was like, ‘You do the interview. We’ll put it on the teleprompter.’ And it turned out beautiful.”

Read more:

- Community Banks Are Missing Out on the Value of Social Media

- The Top U.S. Banks on Instagram for 2023

Facebook, YouTube, TikTok: Finetuning the Social Media Strategy

Paducah Bank’s videos don’t perform as well on YouTube as on Facebook. There is some traction on LinkedIn, Guess says, and occasional success with posting the videos to TikTok and Instagram.

But Guess says the aesthetic of the “Reels” function on Instagram isn’t as appealing to her because it requires shooting and editing in portrait mode instead of landscape. The same goes for TikTok.

That said, the vertical format for videos is popular with Gen Z.

Guess had hoped to enlist the bank’s most recent cohort of teen ambassadors to help her kick off the TikTok account. But the task proved more challenging than anticipated, not for any technical reasons, but rather just age-old teen awkwardness.

“They don’t always have the confidence, even though they might have their own channels,” she says. Of the 30 kids the bank had selected in its first round, only one really took to the idea and stood out.

For its next cohort of the teen ambassador program, the bank is emphasizing on the application a need for candidates who are comfortable interacting with customers on social media. “Our goal this year is to really engage them in a more powerful way,” Guess says. “We just have to figure out how to do that where they feel comfortable.”

Read more:

- The Fun Social Media Campaigns Keeping These Marketers Inspired

- See all of our latest coverage about social media

Weighing the Investment and the Pay Off for Paducah Bank

Paducah Bank’s massive growth in video views is particularly striking, given the obstacles Guess and her team encountered with video production throughout the year. For instance, her contracted videographer was unavailable over the summer, so no videos were posted on social media channels between late June and mid-August.

“We really didn’t have much of a summer,” she says.

Despite this two-month lapse, Guess says the videographer has been a great investment, especially in terms of quality control, which is crucial for creating a dedicated audience. Fuzzy focus and sketchy audio do not make for engaging content.

It costs roughly $200 to produce a video, sometimes $250 if there are three or four interviews. “It hasn’t been a big investment in terms of hiring videography services,” Guess says.

The expenses for Paducah Bank’s social media room have been relatively small overall. The initial investment was about $5,000, and because the bank has six other conference rooms available, losing access to this one for meetings hasn’t been disruptive.

The largest component of the overhead at this point is the giveaways and events that Paducah Bank promotes through its social media room.

Perhaps counterintuitively, amid the growth in video views and engagement, the number of clicks going to the Paducah Bank website from social media posts have decreased. But that, too, is a sign of success, Guess says. “There’s a reason: We directly upload videos to our social feeds, eliminating the need for clicks as videos autoplay.”

She considers engagements to be a better indicator of success. “Engagements reflect actions, indicating active interaction with our content.”

Check out The Financial Brand’s list of the Top Banks and Credit Unions on Social Media.