The vast majority of banks and credit unions aren’t utilizing the most basic features available on their LinkedIn company pages.

Searching the banking category on LinkedIn, The Financial Brand found 5,228 banks with company pages worldwide, 2,284 of those based in the U.S., or 31.2% of all FDIC-insured institutions. There were 2,015 credit unions worldwide, 1,308 based in the U.S., or 18.3% of all credit unions in America.

Strangely, those numbers do not align with results from The Financial Brand’s 2013 Bank & Credit Union Marketing Survey, where 48.0% of banks and 46.6% of credit unions claimed to be “currently using” LinkedIn. Another 9% of respondents indicated they don’t currently use LinkedIn but have plans to in 2013.

Of course what constitutes “use” is very subjective. Many financial institutions seem to think that simply setting up their page is all they have to do. The Financial Brand picked out 100 banks and 100 credit unions with company pages on LinkedIn, and we found…

% with no hero image in profile: 66.0%

% not publishing any updates to followers: 78.5%

% that have not put anything in their “Products & Services” tab: 71.5%

% that do not use the “Careers” tab: 88.0%

# of banks using all the basic LinkedIn company page features: 6 out of 100

# of credit unions using all the basic LinkedIn company page features: 0 out of 100

Average followers (both banks and credit unions: 4,476

Median followers (both banks and credit unions): 337.5

Average followers (banks only): 8,677

Median followers (banks only): 777

Total followers (all 100 banks): 857,690

Average followers (credit unions only): 376

Median followers (credit unions only): 284

Total followers (all 100 credit unions): 37,599

The Financial Brand discovered that many financial institutions have more followers on LinkedIn than they do on Twitter. After extensive analysis encompassing thousands of bank and credit union social media pages in the past 12 months, The Financial Brand concludes that (generally speaking), financial institutions are generating the most social connections on Facebook, LinkedIn, Twitter and YouTube (in that order).

And hey, let’s face it: Everyone wants more followers. That’s what marketing and mass communications is all about. So let’s look at 12 things you can do to improve your financial institution’s company page and boost your follower count.

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

( Read More: Regulatory Shocker On Social Media In Banking Coming Soon )

1. Add a Hero Photo to Your Page

LinkedIn allows you to add a large 642×220 pixel photo or graphic image to your company page — very similar to what you can do with a Facebook Timeline Cover photo. But very few bank and credit union social media admins seem to know this, because a startling 66.0% of the financial institutions studied by The Financial Brand didn’t have a hero image.

This is an opportunity to create a powerful and pleasing visual aesthetic for your page — something really dynamic and eye-catching. So use it!

The best part is that LinkedIn doesn’t get all persnickety about what you put in your hero image like Facebook does, so you can create banner ads and text messages if you want. There really isn’t any limitation (just keep it professional).

2. Populate the ‘Products and Services’ Tab

Out of 200 banks and credit unions on LinkedIn, 143 (71.5%) had no information in the “Products” tab that’s built into every company page. Presumably financial marketers weren’t aware this feature existed. It’s been around for a long time, suggesting that the last time social media admins took a good look at their LinkedIn page may have been years ago.

You can add broad descriptions of your core services — loans, checking accounts, etc. — or you can get more specific and breakout your more unique products. Just make sure your most important products are listed first. If you have anything new to celebrate like a mobile banking app or PFM, you should include it.

You’ll also notice you can add a series of three more big images atop your list of products and services. Definitely take advantage of the generous 646×220 pixel space provided. You can even add a link to the images, just like you would a banner ad.

( Read More: 7 Ridiculously Simple Social Media Fixes For Financial Marketers )

3. Jazz Up Your Summary

Most banks and credit unions peel their LinkedIn page summary straight off the “About Us” section on their website. Or the history of their organization. Or a list of branches and hours. Or all the above. Really, it’s whatever they could get ahold of quickly and conveniently — cut and paste… done! These technical descriptions are dry and boring.

Consider this: Most visitors to your LinkedIn company page probably already know something about who you are — especially if you drove them their from your website. So take the opportunity to connect with the audience. Explain what you’re doing on LinkedIn, and express some personality.

For instance, check out Umpqua Bank. They don’t blather on about their asset size and how they “offer a wide range of financial services that provide a lifetime of value to your family.” They pass on the familiar rhetoric, and instead present something that almost feels poetic.

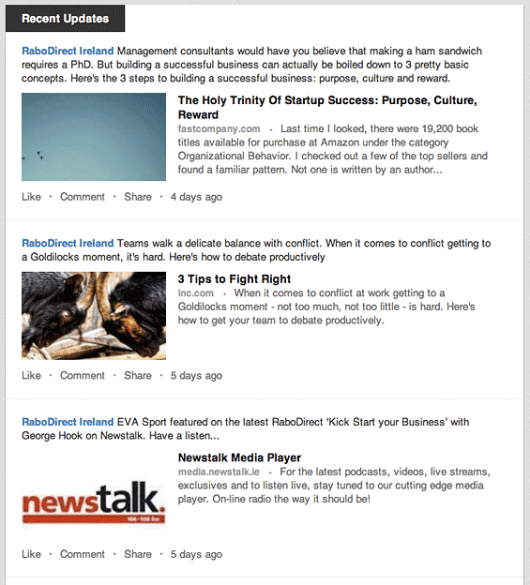

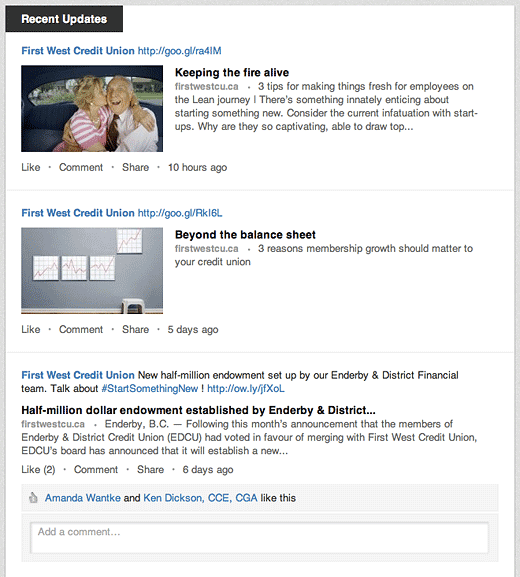

4. Publish Updates Regularly

Financial marketers have been able to publish updates to followers on their LinkedIn company pages since October 2011. Few have shown much interest. Skip ahead to 2013 and not much has changed. Out of 200 banks and credit unions on LinkedIn studied by The Financial Brand, only 43 have ever bothered to publish at least one update (not counting the posts LinkedIn auto-generates whenever a company adds a listing to the job board). The other 78.5% have never said a peep.

5. Use ‘Featured Updates to Highlight Your Best Content

Underneath every update you publish, there is a series of options: “Like,” “Comment,” “Share” and “Feature This Update.” The last option, “Feature This Update,” allows you to tack your post at the top of your stream so that it’s the first thing visitors to your page see. If you’re thinking this sounds similar to Facebook’s “pin” feature, you’re right — pretty much the same thing.

Instant Messaging. Instant Impact.

Connect with your customers and provide lightning-fast support as effortlessly as texting friends. Two-way SMS text messaging is no longer optional.

The unfair advantage for financial brands.

Offering aggressive financial marketing strategies custom-built for leaders looking to redefine industry norms and establish market dominance.

6. Add a Video to Your ‘Products & Services’ Tab

You can add any YouTube video simply by pasting the video’s URL into a box in the admin dashboard. It’s ridiculously easy.

7. Ask for Product and Service Reviews

LinkedIn provides all regular users the opportunity to recommend your financial institution’s products and services. This is one really good reason why it’s important to add your products and services to your LinkedIn profile, because without them LinkedIn users have nothing to recommend — it’s not even an option.

8. Utilize the ‘Career’ Tab

Only 12% of all banks and credit unions utilize LinkedIn’s “Career” tab on their company page.

Currently you have to pay to add the Careers feature, but if your organization has more than a couple hundred employees it may be worth it. LinkedIn is quickly becoming the go-to place for job seekers and job posters alike, so if you want to harness all that the site has to offer as a recruiting tool, you should look into it.

With a Silver or Gold Career Page gives you access to a full suite of features for promoting careers at your company, including a clickable banner, customizable modules, analytics on who is viewing the page, direct links to recruiters, video content, and more.

9. Promote Your Page

Out of 200 financial institutions studied by The Financial Brand, 18 were active on LinkedIn but didn’t bother promoting their company page on their website. Don’t be bashful. Use your website, contact page, blog, email signatures, newsletters, etc. to build up followers. Big banks like Citi have managed to accrue over 325,000 followers, while regional players have also amassed respectable LinkedIn followings. SunTrust has 22,550 followers, Union has 16,175 and Regions has 13,418.

10. Don’t Promote a Ghost Town

51 banks and credit unions in the study (25.5%) linked to their LinkedIn company page directly on their website homepage. 27 of them did so even though they have never sent a single LinkedIn update to their followers — not very social. And 14 have never done anything with their LinkedIn company page — no hero image, no Career tab, no Products/Services and no updates to followers.

Reality Check: This is pure silliness. Don’t bother promoting social media accounts you aren’t fully engaged in. You might think you’re making your financial institution look hip, cool and technologically “with it” by splashing all those social media icons on your site, but consumers will almost surely get the exact opposite impression when they run into a ghost town. If you walked into a bar or pub and no one was there, you’d wheel around and leave before both your feet crossed the threshold.

11. Take LinkedIn Seriously

When banks and credit unions don’t know about so many of LinkedIn’s basic features, it’s obvious that LinkedIn is treated as the redheaded stepchild in the social media mix by most financial marketers. Few spend any time familiarizing themselves with LinkedIn’s capabilities, nor do they study other company pages.

Go look around LinkedIn and you’ll see hundreds of banks and credit unions that popped in once to create a company profile and never came back again. This “set-it-and-forget-it” strategy isn’t how you’ll find success in LinkedIn, or any other social media channel.

( Read More: Stop Wasting Your Time With Social Networks Like Google+ )

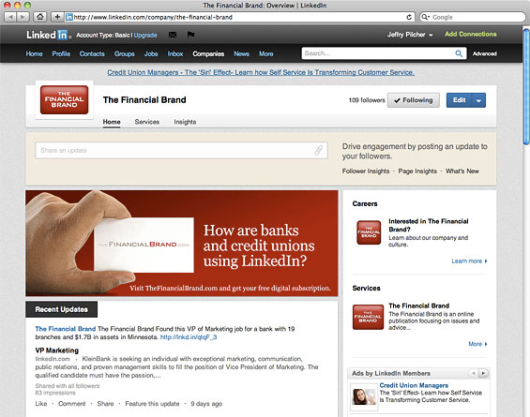

12. Follow The Financial Brand on LinkedIn

The Financial Brand will be actively monitoring this social media channel. We’ll be sharing the good, bad and ugly, just like we do at Facebook and Twitter. So if you want to stay abreast of the latest developments, pop on over to LinkedIn and hit the Follow button.

As a bonus, that’s where you can find the list of six banks that were the only ones in The Financial Brand’s study utilizing all of LinkedIn’s features and functionality.