“Psshawww,” you may scoff. “This advice is definitely not for me. Is it?”

Oh, yes it is.

Before you start patting yourself on the back thinking you’ve got everything under control, you should know that The Financial Brand found 1 out of every 5 financial institutions had at least one glaring problem.

A tsunami has washed over the financial industry about how banks and credit unions need to use social media to “build relationships” and “engage consumers.” But many financial marketers have much more fundamental issues with social media they need to address before worrying about the subtler aspects. The following advice may feel obvious and a bit remedial, but it’s still a good reminder that there is much, much more to social media than just creating an account. And yes, the little details really do matter.

1. Add links to your active social channels on your website homepage.

Frequency of Problem: 1 in 25 financial institutions

How will the world know about your social media accounts if you don’t share them with people? Your website is the hub of your financial institution’s online activity, with thousands upon thousands of current and potential customers popping in and out every day. If you are active on social channels, you should have a link to them right on your website’s homepage. If you are really serious about building the size of your online community, you’ll find a way to bake social media links right into your website’s header or footer so that they are omnipresent wherever a visitor goes.

It’s surprising financial institutions like Desert Schools FCU that has over 10,000 Facebook fans and a respectable 800+ Twitter followers doesn’t put a link to either social channel on its website. Same thing for Redwood Credit Union, who has nearly 7,000 Facebook ‘Likes’ and roughly 800 Twitter followers. Now granted, some financial institutions may be omitting links to social channels on their homepage intentionally, but that isn’t likely to be the case very often.

Do not put links to social channels on your website just because you created an account somewhere. Only incorporate your active social channels into your website layout.

Instant Messaging. Instant Impact.

Connect with your customers and provide lightning-fast support as effortlessly as texting friends. Two-way SMS text messaging is no longer optional.

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

2. Remove links to inactive social channels on your website homepage.

Frequency of Problem: 1 in 30 financial institutions

Many financial institutions like to line up a series of social media icons on their website: Facebook, Twitter, YouTube, LinkedIn, Flickr, Foursquare Google+, Pinterest and Yelp. It looks impressive — “See, we’re involved in all this social media stuff!” But then you load up those social channels and what do you find? Maybe activity on one of them; the rest are pretty much dead.

Here’s what you’ll frequently see… The Facebook account has a few thousand fans. But the last video was uploaded to YouTube over a year ago. There’s nothing on the LinkedIn page but a company summary. Pinterest and Google+ were abandoned long ago (and even then, there was hardly anything posted). One credit union has even kept a link to its YouTube channel up on their website long after the account was “suspended due to a trademark claim by a third party.” It looks really bad.

This is ironic, because financial institutions are trying to present themselves as savvy social media marketers who are in synch with today’s digitally-connected world. What they don’t realize is that many consumers will have the exact opposite impression: “What a dud…”

If you aren’t actively using all your social channels, there is little- to no point putting links to them on your website.

3. Fix broken social media links on your website homepage.

Frequency of Problem: Roughly 1 in 7 financial institutions

Now you may think you’ve got problems #1 and #2 licked, because your website only links to your active social media channels. But does your link work? Maybe, maybe not. Maybe it works for you, but not for others. And there are few things that irritate website visitors more than clicking on a link that doesn’t work.

In The Financial Brand’s audit, we found around a dozen different flavors of malformed and dysfunctional links to social media channels on bank and credit union websites. Some financial institutions change the name of their social media accounts but forget to update the link on their website. Others have mistakenly linked URLs that admins use to manage social media accounts.

Quite frequently something goes wrong with “speed bumps,” those interstitial warnings placed between a bank or credit union website and a third-party website. A user clicks, sees the warning, clicks to continue… but doesn’t end up where they were supposed to.

Roughly 1 in 4 financial institutions using Twitter are using an older, deprecated link structure that sometimes works, sometimes not. Look at the link to Twitter on your website and if there is some code in it that says “/#!/” you need to take that part out.

Rather than illustrate the entire range and variety of every link offense financial marketers commit, let’s just make it real easy. Here is what your URLs should look like:

- https://www.facebook.com/TheFinancialBrand

- https://twitter.com/FinancialBrand

- https://www.youtube.com/TheFinancialBrand

- http://www.linkedin.com/company/The-Financial-Brand

It’s pretty simple. If your URLs don’t look basically like this, you could have a problem. If you see any funky characters or suspect syntax in your URLs, there could be an issue. Anything after a # or ? symbol is a major red flag.

4. Customize and complete your social media profiles.

On every social media channel, you should check to make sure you have completed and customized every possible part of your profile. For instance, it’s surprising how many banks and credit unions forget to include their web address. Some financial institutions haven’t yet upgraded their Facebook page with a Timeline Cover photo. Many still don’t know Twitter added a new, third image to profiles (photo, background and header images). And did you know LinkedIn company pages have a section where you can list your services (with links to product pages on your website)?

Load up the public-facing profiles for all your social media accounts and use this checklist to see if you’ve got everything covered.

- Name of your financial institution. Duh, right? But some forget to include this in their social media profiles, so the public struggles to figure out who is behind the account.

- Geographic area served. This is particularly important if you have a common name like “First National” or “Community First.” How can someone know if they’ve got the right “First State Bank?”

- Phone number. You should be able to find somewhere to include your main (preferably toll-free) phone number in any social media profile. Facebook provides more robust opportunities to provide contact options.

- Hours of operation.

- Compliance stuff. If your compliance people feel your social media profiles should include language like “Equal Housing Lender” and “FDIC insured,” you need to find a space for it.

- Branch locations. In Facebook, you can add an app with a map and/or branch locator.

- Routing number. This is one bit of information that financial consumers are frequently looking for.

If you’re smart, you’ll look at the profiles of 20 other financial institutions for each channel you use to see how they have customized their presentation.

Remember, you don’t have to cram everything into your profiles as text. With every social channel, you almost always have multiple opportunities to embed information in profile images — “avatars,” Facebook Cover photos, background images in Twitter, etc.

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

5. Secure your Facebook username.

Frequency of Problem: 1 in 20 financial institutions

By default, every new company page created at Facebook is assigned a random number in its URL, like facebook.com/pages/yourcompany/123456789. You can and should shed all those extra numbers at the end of the URL. Once your page has at least 25 fans, you can permanently “claim” your Facebook name (also called a “vanity URL”) by visiting facebook.com/username. If you have any questions, you can check out Facebook’s help section for company page usernames.

For example, Xceed Financial has nearly 1,000 fans, but its Facebook URL is still carrying around all those unnecessary extra digits:

Currently: https://www.facebook.com/pages/Xceed-Financial-Credit-Union/76460751937

Should Be: https://www.facebook.com/pages/Xceed-Financial-Credit-Union

Claiming your vanity username does more than add an extra level of professionalism, and simplifying your Facebook URL. Custom Facebook URLs can increase your page’s SEO traction, both in search engines and within Facebook search. Not only will your brand or company’s website rank well for your company’s name when searched, your Facebook page’s likelihood of showing up in the search engine results will be higher.

6. Cross-pollenate your active social media channels.

If you want to build a social media following, you’ll need to do whatever you can whenever possible to attract that one extra ‘Like’ or YouTube subscriber. That means cross-promoting your social media accounts. Facebook should include apps and/or links to Twitter and YouTube. At Twitter, you can embed the URLs to your other social media channels in your background image. YouTube allows you to add links to just about anything you can think of — a product page, blog, etc. LinkedIn affords excellent opportunities to tie both YouTube and SlideShare into your profile.

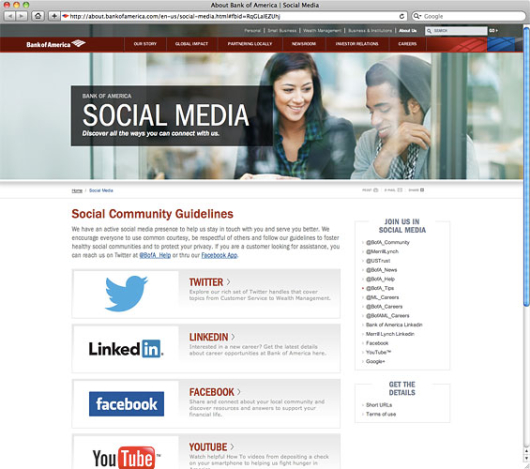

An alternate solution is to build a page on your website listing all your official social media channels. Then you can publish one single link to that page on all your social media profiles. Here’s a great example from BofA:

7. Manage those speed bumps.

Frequency of Problem: About 1 in every 4 financial institutions that use speed bumps could do a better job of it.

Roughly 80% of financial institutions in the U.S. put speed bumps between their main website and their social media pages. The widely accepted argument is that this is necessary to comply with regulations about warning users whenever a bank or credit union links to a third-party site. It’s the kind of silly lawyer stuff unique to America; financial institutions in no other country use speed bumps.

If your compliance people say speed bumps are required, at least manage them the right way.

It is super annoying to click on a financial institution’s social media icon that opens a speed bump in a new window/tab, and then when you click “Continue,” yet another window opens. Now you’ve got three open windows: the website, the speed bump, and the social media page. This is careless UX. While it’s not a bad practice to open speed bumps in a new window, this is where the creation of new windows should end. Once a user clicks “Continue,” they should be seamlessly redirected to the social media page within the same browser window.

If you want to see the absolute best way to handle speed bumps, check out Numerica Credit Union and how they manage links to Facebook and Twitter (down in the website’s footer). They use a slick-yet-remarkably-simple HTML hover trick to instantly trigger a floating “third-party site” warning. There’s no unnecessary extra clicks-to-continue nor annoying extra windows/tabs.