Visa’s mid-May unveiling of the concept of the “Visa Flexible Credential” has left payments industry people trying to work out what the move is really about, how it will work in practice, and what it will mean to the range of stakeholders. The latter includes consumer card holders, card issuers, merchants, and Visa itself.

Visa Flexible Credential won’t be rolled out until later in 2024 in the U.S. The debut won’t be with a bank but with Affirm, which offers debit card service as well as its original specialty of Buy Now, Pay Later service. In 2023, Affirm announced its ambitions to expand beyond its roots to be a dominant payments player. [Dig Deeper: Affirm Goes Big: How It Intends to Go Beyond BNPL to Own Payments]

The flexible credential will enable cardholders with a single card product to shift between various payment methods that they have with a single provider.

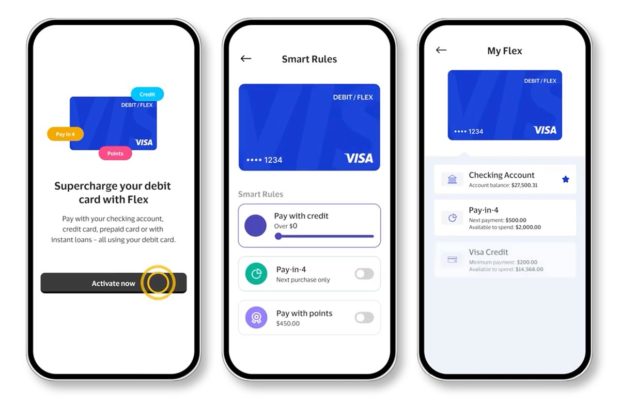

“Now people can easily set parameters or choose whether they use debit, credit, pay-in-four with Buy Now, Pay Later, or even pay using rewards points,” Visa said in a statement. The company has also talked about using the flexible credential for other payment options such as pay-by-bank service and cryptocurrency. The announcement, made during the annual Visa Payments Forum, noted that the concept is live in the company’s Asia region.

In its statement Visa said a study had found that more than half of card users said they want the ability to access multiple accounts through a single credential.

Accelerate Time-to-Market with Rapid Implementation

Create a sustainable competitive advantage with faster time to market by drastically reducing implementation time.

Read More about Accelerate Time-to-Market with Rapid Implementation

Navigate And Win The Branch Transformation Race

Learn how to navigate and win over customers with the right branch transformation. Listen to JP Lacroix and Marbue Brown discuss strategies, insights, and more.

Read More about Navigate And Win The Branch Transformation Race

The Big Picture on Visa Flexible Credential

It’s not uncommon in the payments business for providers to have multiple motives behind a new strategy — and Visa Flexible Credentials may be another such example.

The most obvious one is to encourage the throughput of more volume via Visa’s proprietary rails, says Richard Crone, CEO and founder at Crone Consulting. He points out that it costs next to nothing to push more payments through existing pipes. Volume is the lifeblood of the payments business.

But Crone also sees the new initiative as an attempt to build a new payments platform from Visa’s existing parts — sort of a “network of networks,” he says.

The competitive ripples could be significant. “Every one of the networks will be forced to announce something in response to Visa’s announcement,” Crone predicts. This includes Mastercard, American Express and Discover. Discover is in the midst of a proposed merger with Capital One, which belongs to the Visa and Mastercard networks already. This just adds more speculation to the questions of what Capital One will do if and when the merger occurs. Crone thinks Capital One could essentially set up a three-track system incorporating Flexible Credential technology.

Among other potential wrinkles could be how Walmart responds to this move. It offers its own digital wallet, Walmart Pay, and has expanded its ONE card offering, initially a debit card, to also include BNPL service. The retailer and would-be bank has recently had an acrimonious breakup with Capital One.

Erin McCune, expert partner in payments at Bain & Co., points out that Visa has talked about Flexible Credential as being an “issuer solution.”

“But I can’t imagine that’s the end game,” says McCune. She says that she strongly suspects that by the time Visa shows all its cards, no pun intended, Flexible Credential won’t be an issuer-centric solution in the end.

“The biggest winner here is the issuer,” says McCune — for now.

Interviews with five payments experts yielded the following analysis of the stakes in Flexible Credential, broken down by stakeholder type. (Visa didn’t respond to multiple requests for an interview.)

Read more: When Will Mobile Banking Finally Kill the Plastic Credit Card?

What Does Flexible Credential Mean for Consumers?

Payments veteran Peter Davey sums up his initial take, as a consumer, on Visa’s concept this way: “It’s kind of a so-what moment.”

“The reality of it is that they have taken older technology they developed for BNPL and are using it for other funding” for payments, explains Davey. He is venture partner at Alloy Labs. Part of Davey’s yawn reflects that any consumer who has put their payment credentials into a digital wallet like Apple Pay or Google Wallet already has their payment credentials in one place, though they typically aren’t interactive with each other.

From the consumer perspective, Visa Flexible Credential will become a feature of their mobile banking apps with participating providers, giving them a convenient way to have more flexibility in how they spend, says Bain’s McCune.

Sample screens from a demo video of Visa Flexible Credential that the company released at its payments forum.

Something to emphasize about Flexible Credential, as announced, is that the ability to shift among payments methods from one credential depends on the consumer having multiple relationships with one provider. Then they could either set a preference for the first choice, and backup choices, or pick among the methods available through that firm, when conducting a transaction. The Flexible Credential is a one-institution play for each consumer.

One challenge in the U.S. for Visa’s idea is our quintessential broad range of choices.

In part because of the enormous choice of providers that Americans have, they tend to “mix and match” among accounts and providers, points out Drew Edmond, associate partner at payment consultancy Glenbrook Partners. One person’s wallet, physical or digital, might include cards from multiple organizations, including banks, credit unions, neobanks and fintechs.

This undercuts the point of Flexible Credential, at least as set out so far, from the consumer’s perspective.

Edmond says that some consumers would like the idea of being able to set up other accounts with their banks as backups to their debit card account, saving embarrassment at checkout. But they’d have to have such alternatives already set up.

Davey says in many institutions making this happen would require piercing multiple functional silos — something that banks often aren’t good at.

“Many of the credit card issuers function completely separately from the rest of the bank, and they don’t talk to the bank.”

— Peter Davey, Alloy Labs

In many organizations, the credit card portfolio and the debit card portfolio are contained in separate entities.

Davey says that the attention drawn to pay-by-bank service in connection with Flexible Credential is premature for the U.S. consumer. He says that despite enthusiasm for pay-by-bank in some quarters it is far from becoming a significant reality in the U.S. Overall, he thinks Flexible Credential will mean more to consumers in other countries than to American consumers.

McCune says advantages such as paying with rewards could be attractive to some people, but she suspects that many will have already found a way to make that happen.

Read more: Consumers Have Embraced Digital Wallets. But They Also Want Them to Be Better

What’s Behind the Curtain at Visa?

Adding to the sense the experts have that there’s another shoe waiting to drop is that actual user interfaces don’t exist yet. Visa released short demo reels at its May event — but those are simply mockups.

At this point, Visa’s announcement has addressed the customer experience aspects of Flexible Credential, says Bryce Deeney, CEO of Equipifi, a fintech that sets up after-purchase Buy Now, Pay Later tied to bank and credit union debit card programs. He says the backshop aspects of the effort still seem to be a work in progress.

“I think Flexible Credential is going to catch fire in markets that are not mature, in countries where credit is not widely available,” says Deeney.

In a post on X following Visa’s May announcement, Max Levchin, co-founder and CEO at Affirm, said that Affirm has worked with Visa for years on the credential project.

He also added that debit card issuers anxious to add BNPL to their offering could engage Affirm to help.

“Your cardholders will thank you because debit+BNPL is the way,” Levchin posted. There could be a degree of “co-opetition” in store, given that Affirm’s own debit card (issued by Evolve Bank & Trust) passed the one million user mark recently and it’s a leader in BNPL.

Read more: CFPB’s Foray into BNPL Regulation Stirs Ire and Interest

Data Insights Deliver: Bank Reaches 113% ROMI with Segmentation

Uncover the techniques behind this bank's impressive ROI boost through data-driven marketing.

Read More about Data Insights Deliver: Bank Reaches 113% ROMI with Segmentation

Register for Discovery2024 Conference

Join us August 8th for Discovery2024, your gateway to the strategic insights and human connections you may need to navigate the evolving financial landscape.

What Does Flexible Credential Mean for Issuers?

If issuers can make their silos talk to each other and get more consumers to adopt multiple payment options from their institutions, one advantage of Flexible Credential will be stickier relationships, according to Drew Edmond. He says this could be encouraged by offering better rewards for broader relationships. They could reflect multiple relationships as well as enrollment in Flexible Credential with that provider.

To the degree that the Visa concept can replace digital wallets — the same day, the company announced enhancements to its “tap to pay” service — could trim some costs.

“It’s better than paying Apple,” says Erin McCune, referring to the fee assessed by Apple Pay for transactions going through that digital wallet.

McCune points out that another Visa announcement at its forum concerned Visa Payment Passkey Service, designed to identify and authorize online payments with a quick scan of the user’s face or fingerprint. This could be part of the ultimate significance of Flexible Credential, putting flexibility and risk control technologies like Passkey together, giving the issuer a more-attractive offering, McCune suggests.

Some of the experts think that Flexible Credential may be of more interest to fintechs like PayPal and Square, moreso than major bank card issuers.

A PayPal, for example, offers more options under its roof than some banks do. This makes the choice of Affirm as the debut brand in the states especially worth watching.

[Dig Deeper:In a recent interview with The Financial Brand, the retired head of PayPal made predictions that resemble Visa Flexible Credentials. Read PayPal’s Dan Schulman on the Future of Banking: Digital, Seamless and Consolidated]

What Does Flexible Credential Mean for Merchants?

Payments innovations must be accepted and attractive in some fashion with merchants to catch on. Glenbrook Partners’ Drew Edmond thinks it’s too soon to say how they will take to it. Working with his firm’s own merchant roundtable discussion group, he knows Flexible Credential is on their radar. But he says frequently such reactions are a wait-and-see matter. The facts remain thin.

One benefit Edmond can see for merchants is that Flexible Credential will have backup built in, so purchases that might have been rejected with a standalone payment option will instead default to the next option as set up by the consumer.

Anything that helps a sale be completed is a positive for merchants, according to Edmond — “as long as the increase in revenue outweighs any administrative costs.”

Edmond says merchants will have to adjust to take Flexible Credential payments. At this point there are more questions than answers. A sampling of merchant questions, a LinkedIn post by Edmond:

- How will Flexible Credential change the use of “BIN” — bank identification number — data, especially as consumers shift among payment options?

- In practice will Flexible Credential transactions resemble Apple Card transactions, where a virtual card number is generated for each purchase?

- How will the concept affect recurring transactions that are automatically billed to the consumer?

At this point the impact on interchange fees wasn’t clear to payment experts interviewed for this story. That’s a key matter for merchants. In addition, says Bain’s McCune, merchants will have questions about the appropriate way of routing transactions made under Flexible Credential.

Read more: How the Mastercard/Visa Settlement with Retailers Could Remake the Payments Business

Modern Customer Journey Mapping

Customers navigate a multi-touch, multi-channel journey before interacting with your brand. Do you deliver successful and seamless experiences at every touchpoint? Download webinar.

Banking Transformed Podcast with Jim Marous

Listen to the brightest minds in the banking and business world and get ready to embrace change, take risks and disrupt yourself and your organization.

What Does Flexible Credential Mean for Visa?

Richard Crone thinks if Visa can get some momentum behind Flexible Credential that it could mean growth. He thinks it could position Visa for competition with other payment companies still trying to build out their operations.

“This is a ‘blue ocean’ opportunity for Visa, because it already has its own hub and spokes for payments.”

— Richard Crone, Crone Consulting

“Think of Flexible Credential as a computer or smartphone operating system,” says Crone, “routing to the desired application and application provider.” In this case, the routing is to the desired method of payment, creating the “network of networks” effect he spoke of earlier in this article.

How Flexible Credential will debut and evolve in the U.S. remains to be seen. Says Bain’s McCune: “My sense is that Visa is playing a very long game.”