The digital wallet is becoming the payment channel of choice worldwide. Usage continues to pick up in the U.S. as well, although Americans still love their plastic debit and credit cards.

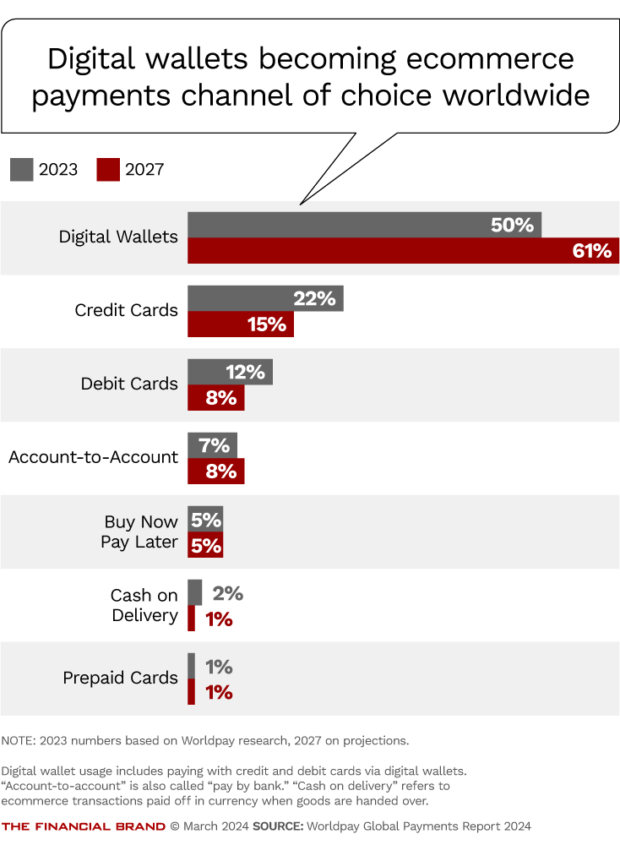

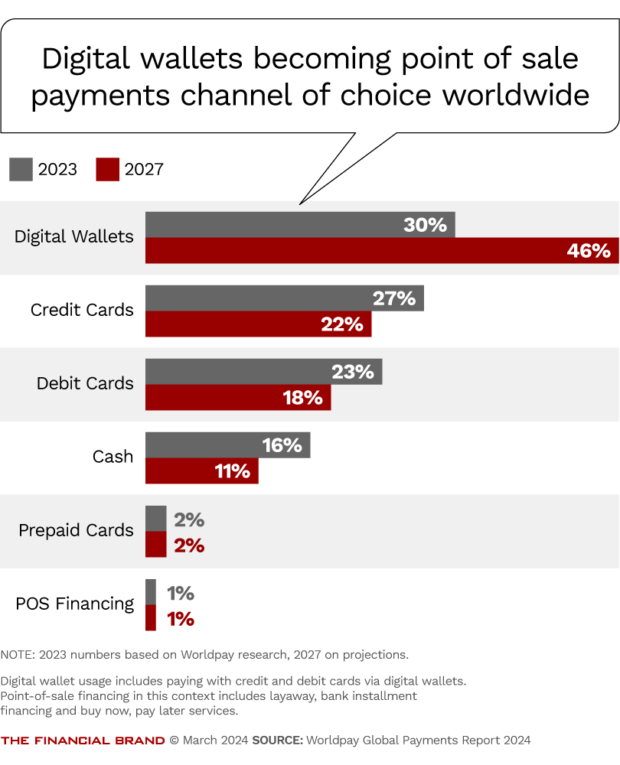

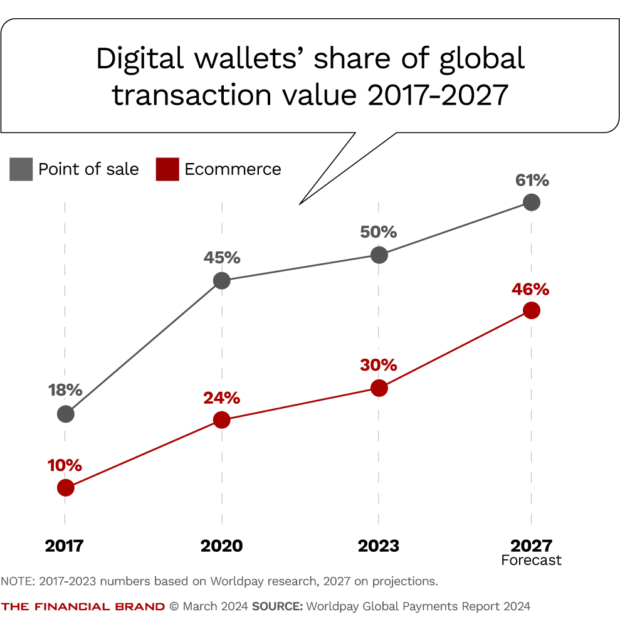

A study from Worldpay, The Global Payments Report 2024, estimates that digital wallets will account for 61% of ecommerce payments and 46% of point of sale payments worldwide by 2027.

Another study by J.D. Power looked at usage and satisfaction in the U.S. along with detail about the preferences for various digital wallets among generational groups as well as other demographic splits.

Both studies conclude that consumers’ quest for convenience is driving the growth in wallet adoption, with much of the push coming from Generation Z and Millennials. Both crave frictionless experiences and digital wallets fit the bill, according to Michelle Young, general manager and head of merchant solutions for financial institutions at Worldpay. As more Millennials and Gen Zers become small business owners, they will further push for acceptance of digital wallets as a way of building their businesses, according to Young.

Currently, J.D. Power’s research indicates that only 57% of U.S. small firms accept digital wallets, versus 94% accepting credit and debit cards. On the other hand, J.D. Power found that 79% of small businesses have a positive view of digital wallets, which suggests that more acceptance may be in the offing.

Acceptance may be abetted by increasing availability of options such as Tap to Pay with iPhone technology, which eliminates the need for a dedicated terminal capable of accepting digital wallets. Young also points out that offering digital wallet acceptance eliminates more cash from small businesses’ daily payment streams, which for some firms is a helpful safety factor.

Both firms note that the pandemic gave digital wallets a big push. But complacency would be dangerous for any wallet provider relying on momentum to keep growth going — and for card issuers whose volume is growing or being maintained by card transactions funneled through digital wallets.

That’s because the digital wallets are not only becoming table stakes for getting the business of the digitally inclined but also because convenience alone won’t be the dominant selling point forever.

J.D. Power’s 2024 Digital Wallet Satisfaction Study found that the overall satisfaction rating for wallets was 664 points out of possible total of 1,000 points — up four points from 2023.

That’s good but not great, according to Miles Tullo, managing director of financial services. He says wallets are strong on ease-of-use standard, but weaker on factors like customer support. To continue stoking growth, “they need to round out the product experience,” says Tullo. Besides improved customer service, he says there’s strong interest in rewards to incent consumers to use one wallet over another.

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

Looking at the Digital Wallet on the World Stage

In 2023, people used digital wallets for 50% of ecommerce spending and 30% of point of sale spending. Ecommerce transactions with digital wallets came to approximately $3.1 trillion and point of sale came to around $10.8 trillion.

This reflects multiple underlying trends. Gabriel de Monessus, head of global enterprise at Worldpay, notes that in markets where instant payments services like Brazil’s Pix are strong, they are part of digital wallets’ growth. In the U.S., however, instant payments are a new factor; FedNow for example was only introduced last summer in a soft launch. Pay by bank (also called “account-to-account” payment) is also a relatively new concept in the U.S. market, whereas in India over half of digital wallet transactions come from that stream.

The chart above illustrates growth in digital wallet usage globally from 2017 to projections for 2027. Over that 10-year period, use at point of sale will increase over threefold and use in ecommerce will be up over fourfold.

Read more: PayPal’s Dan Schulman on the Future of Banking: Digital, Seamless and Consolidated

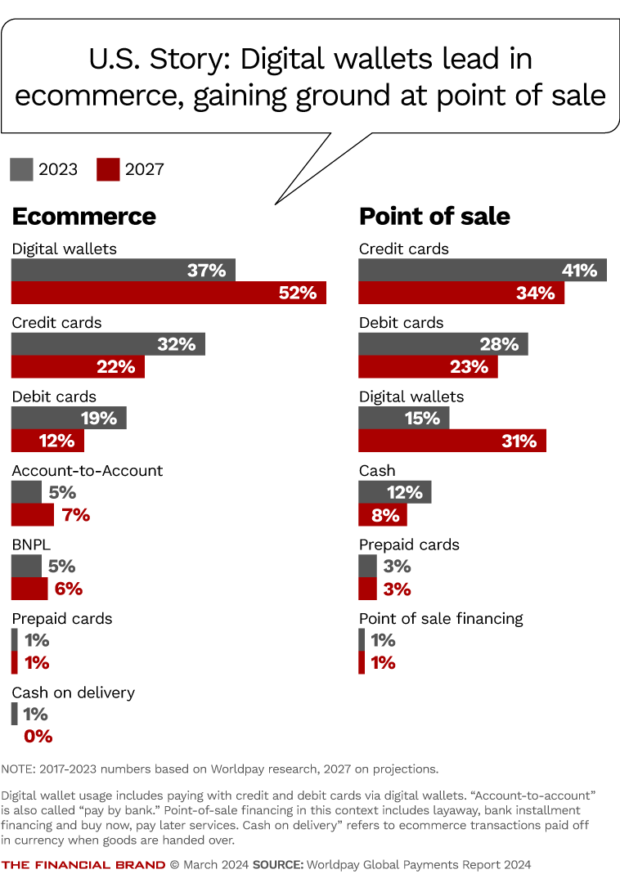

How the Digital Wallet Trend Looks in the United States

The figures are muddied a bit because of the overlap between digital wallets and cards. While the charts above show migration of transaction volume from credit and debit cards, that’s not precisely what’s going on.

“Consumer attraction to digital wallets isn’t a turn away from cards,” says the Worldpay report. “In card-dominated markets, card spend is simply shifting to digital wallets like Apple Pay, Google Pay and PayPal. Viewed in total, card transaction values are at an all-time high and continue to rise.”

Even putting aside services like Pix, wallets can contain other payment products besides cards, including certain person-to-person services. Apple Pay, for example, can include Apple Cash funds, while PayPal’s digital wallet can include funds retained in a PayPal account. There are also stored value wallets and other variations, many of which are included in Worldpay’s research — as well as wallets that are independent of mobile devices, a key example being Paze, a fledgling digital wallet for ecommerce introduced by Early Warning Services.

Worldpay estimates that 65% of digital wallet transactions in the U.S. are funded by credit and debit cards.

Indeed, during the 2022 investor day of JPMorgan Chase, an analyst asked Marianne Lake, now CEO of Consumer & Community Banking, if the bank was worried about the growth in digital wallets and buy now, pay later. She shrugged off the question, saying that so long as both were drawing on Chase card accounts, it wasn’t a concern. “As they grow, we grow,” said Lake.

Based on Worldpay’s research (above), Americans’ heavy use of cards, especially credit cards, will continue but more will migrate into digital wallets. At point of sale, Worldpay estimates digital wallets’ share of transaction value will double by 2027 to 31% of value. Digital wallets’ share of ecommerce in the U.S. is projected to rise to 52%.

Read more:

- Could ‘Amazon One’ Palm Payments Get The Upper Hand Over Digital Wallets?

- Shocker: Amex, Chase and Citi Top BNPL Satisfaction Rankings

- As Digital Wallet Use Goes Up, Financial Institutions Must Adapt

Digging into Preferences for Digital Wallet Brands

The Worldpay study did not publish breakdowns on consumers’ wallet preferences, but the J.D. Power research did. Overall, 48% of consumers had made a digital wallet payment in the previous 90 days. The study found, for example, that 40% used PayPal, 28% used Apple Pay, 22% used Venmo and 19% used Block/Square’s Cash App Pay, 15% used Google Pay, and 3% used Samsung Pay. (These figures and the ones that follow reflect payments made both at point of sale and in ecommerce.)

Frequent users show a different pattern. Among those who use the wallets at least once a month, Cash App Pay and Venmo get the highest volume. However, “power users” who transact with wallets at least five times a month most frequently use Apple Pay.

Tullo notes that 66% of Gen Z consumers surveyed had used a digital wallet within the last 90 days, while only 52% had used credit cards. The study found that 61% of Gen Y had used a wallet, and 44% of Gen X. Older consumers used digital wallets much less often.

Tullo also says there are some strong generational preferences by brand of wallet.

Generation Z favors Apple Pay (45% use it), followed by Cash App Pay (36%). Millennials use Google Pay most (47%), followed by Samsung Pay (44%) and Cash App Pay (42%).

Usage of digital wallets falls off after the two youngest generations. Generation X uses PayPal’s wallet the most (26%), followed by Google Pay (24%). Baby Boomers use PayPal most frequently (21%) as well, followed by Amazon Pay (17%). The oldest consumers, which J.D. Power calls “pre-boomers,” hardly use digital wallets.