Lenders are finding both credit cards and personal loans to be a growth area, as the signs of consumer stress continue to rise.

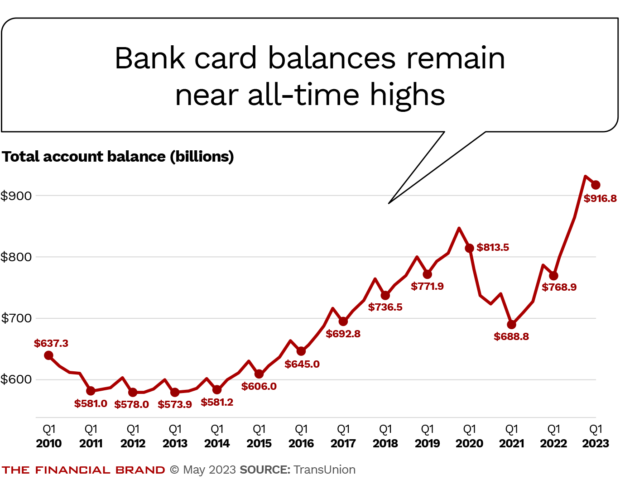

Bank credit card balances took a slight seasonal dip in the first quarter but remain at an all-time high, according to TransUnion. Unsecured personal loans, which are frequently used to consolidate credit card debt, hit a new high in the first quarter.

Beyond the trends in these two categories, consumers overall continued to add debt. Total household debt increased by 0.9%, or $148 billion, from the previous quarter, to a record $17.05 trillion, Federal Reserve data shows. To put that in perspective, total household debt is now $2.9 trillion higher than it was at the end of 2019, just before the pandemic recession hit.

The CEOs of major U.S. banks have been speaking for some time about credit card trends reflecting the gradual “normalization” of consumer behavior. During the early stages of the pandemic, card credit use fell and people used government stimulus money to pay down their balances.

Michele Raneri, vice president of U.S. research and consulting at TransUnion, says she sees some “glimmers of us returning to what I’ll call the ‘old normal.'” One is the first-quarter seasonal dip in credit card balances, which had been typical pre-pandemic.

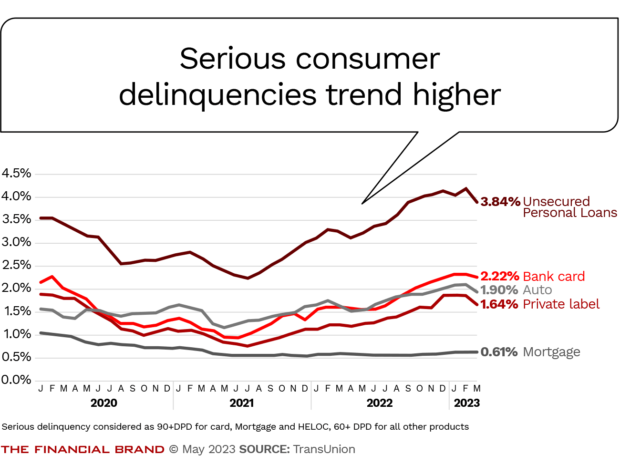

Normalization also means a return to higher delinquency rates — a challenge made more complicated than usual by inflation and the expectation of a recession.

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

Sustained Inflation Is New Territory for Consumer Lenders

Richard Fairbank, the chief executive officer at Capital One, said during a first-quarter earnings call that his company, which specializes in credit card lending, is using “informed assumptions” in hedging against the impact of inflation. It is a factor that he characterized as unprecedented, at least in its current form.

“None of us in the card business really have historical data to understand or predict the effects of significant increases in levels of inflation, but we are expecting inflation to impact consumer credit by compressing real incomes, and as a kind of separate effect from an unemployment effect.”

— Richard Fairbank, Capital One

“Since we haven’t seen sustained inflation for more than 40 years, we can’t really model this effect directly,” Fairbank continued. “But we can make informed assumptions in our outlook to sort of account for this effect.”

Speaking during a TransUnion webinar, Dan Simmons, senior director of financial institutions consulting at the credit bureau, made a similar point, saying that sustained high inflation is an economic twist that is new to the current generation of lenders.

He suggested that lenders in every consumer credit area have to be cognizant of the bigger picture because it all gets paid out of the same wallet.

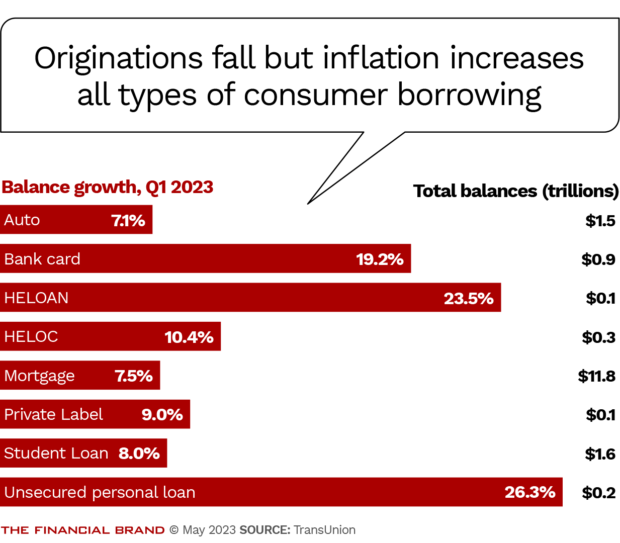

Originations in areas other than student loans and increasingly popular home equity lending were actually negative in the first quarter, and yet overall consumer credit balances are surging, Simmons said, noting that both credit cards and personal loans are at historic highs.

With inflation driving up prices, the credit necessary to pay for purchases is growing, from groceries to cars.

Higher Credit Card Balances and More ‘Revolvers’

Total bank credit card balances hit $917 billion in the first quarter, up 19.2% compared with the first quarter of 2022, according to TransUnion’s Q1 2023 Quarterly Credit Industry Insights Report. The average balance per consumer rose by 14.4% over the same period, to $5,733.

More borrowers are also becoming “revolvers,” meaning they run a balance instead of paying their bills off every month, based on data from the American Bankers Association’s Credit Card Market Monitor. (Its March data reflects the status as of the third quarter of 2022.)

The ABA reported that 43.4% of credit cardholders were revolvers who carried over a balance at least once in the third quarter and 33.6% were transactors who kept current each month (the remaining 23% were dormant). The share of revolvers grew by more than a percentage point from the previous quarter, as the other two categories shrunk, suggesting an increasing reliance on credit cards. The level of revolvers is returning to pre-pandemic levels seen in ABA studies.

This shift is a topic that came up during first-quarter earnings calls. At JPMorgan Chase, Chief Financial Officer Jeremy Barnum noted a 14% year-over-year increase in revenue in the “card services and auto lending” segment at his company, largely driven by “higher revolving balances” on cards. Credit card spending among Chase customers was up 13% over the year earlier and card balances were up 21%.

Higher Personal Loan Balances and More Minimum Payments

Total unsecured personal loan balances in the first quarter rose 26.3% from a year earlier, to $225 billion, a record high, though TransUnion says this was marked by the second consecutive quarter of slower year-over-year growth rates.

Many unsecured personal lenders have been tightening up in the face of increasing risk, focusing new credit on stronger credit tiers, according to Raneri. However, growth is still happening because those prime borrowers need more, so they are seeking higher amounts, she says.

Strong employment trends and a still-elusive recession have enabled many to keep up with these higher debt levels, Raneri adds.

But as debt levels continue to rise, the proportion of borrowers who are paying more than their minimum payments for their various loans is falling, according to TransUnion data. There has been a general downward trend in higher payments since early 2022, and after a partial rebound in early 2023, the decline continued. At the same time, growing balances have hiked the minimum payments for consumers in every credit tier, contributing to their inability to pay extra, TransUnion says.

All of this suggests, as TransUnion has pointed out in past quarterly reports, that more consumers are sustaining themselves with credit.

Read More:

- To Capitalize on Home Equity, Go Beyond Credit Scores

- This App Partners with Banks to Help Customers Manage Rising Debt

Rising Delinquencies and Chargeoffs in Consumer Credit

A growing number of consumers are slipping.

The chart below illustrates that in most types of consumer credit — including bank credit cards and unsecured personal loans — there has been an upward trend in the level of serious delinquency rates. (The definition of “serious” varies among credit types.)

TransUnion data indicates that more recently granted bank credit card accounts are going into serious delinquencies earlier than cardholder “vintages” going back six years. This is partly due to growth in the number of cardholders from the below-prime credit category.

TransUnion anticipates that credit card chargeoffs will continue to trend higher, even though it found that many lenders pulled back on granting credit to subprime tiers.

Raneri notes that 165.3 million Americans now have credit card accounts with at least one issuer, a 9% increase compared with the first quarter 2020. After a dip in 2021, when lenders became more conservative, they ramped up marketing again.

Looking to the future, Raneri says that lenders will need to continuously scrutinize their credit policies. The time of lending on the basis of credit scores alone is past, she says. Additional types of data must be monitored to evaluate which consumers should get credit in such a confusing economic period.

Learn More:

- [Webinar] Preparing to Survive the Storm of Delinquent Accounts

- Credit Unions Bulk Up in Commercial Lending and Home Equity

A Time for Caution, Constant Assessment and Course Corrections

Several credit card-issuing banks noted weakening credit performance during first-quarter earnings calls. But they also generally couched the decline in historical context and characterized it as “normalization.”

Some also emphasized the need to balance growth versus performance.

Brian Moynihan, Bank of America’s chairman and CEO, credited much of its 7% year-over-year increase in lending to credit card growth resulting from stepped-up card marketing. BofA opened 1.3 million credit card accounts in the first quarter alone. But the company also noted that credit card losses are climbing toward pre-pandemic levels again.

Among the leaders of major banks, Capital One’s Fairbank was the most explicit about consumer credit policy. Again touching on the aberrant pandemic period, he said, “We just assumed that was unsustainable. So we underwrote to much higher levels of losses. So as things normalize, that’s not really changing anything at Capital One. But at the same time, you see noise all over the place.”

He said Capital One makes many ongoing tweaks to its credit approach, based on identification of “little pockets that might be gapping out from expected performance or prior performance.”

Technology such as machine learning enables this kind of analysis, Fairbank said. It has also identified fresh opportunities.

“But credit can worsen,” he added, “and customers can perform not as well as it might appear.”