In the face of continuing inflation, Americans continue to seek unsecured credit.

They are increasingly opting for additional card credit — as well as some additional unsecured personal loans — though the growth rate for the loans has been slowing as lenders favor super prime borrowers now, according to research from TransUnion. However, while in past quarters there’s been evidence that consumers had been applying big credit band aids to their finances, the price of that credit is beginning to give them pause, according to a separate TransUnion report.

The credit trends come from the company’s Quarterly Credit Industry Insights Report for the first quarter of 2024, based on developments seen in its credit report database. A separate consumer pulse study from the company, based on a sentiment survey taken in the second quarter, indicates that concerns about personal finances have reached the highest level in two years.

Beyond that, the pulse study uncovered a trend of interest to financial marketers and lenders alike: Nearly one in three consumers who plan to apply for new credit or to refinance have been abandoning those plans before they commit, typically because of the cost of fresh credit issued at today’s rate levels. Nearly half — 46% of the sample — included interest rates among their top three economic concerns.

Abandonment always happens as people shop around. However, now 32% of people who plan to apply for new credit or refinancing are dropping their attempts. “What we’re seeing now is a shift of consumers who are abandoning because the cost of credit is too high,” says Charlie Wise, senior vice president and head of global research and consulting at TransUnion.

Let’s look into the credit trends first, and then the state of consumer attitudes.

Data Insights Deliver: Bank Reaches 113% ROMI with Segmentation

Uncover the techniques behind this bank's impressive ROI boost through data-driven marketing.

Read More about Data Insights Deliver: Bank Reaches 113% ROMI with Segmentation

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs.

Consumers Lean Harder into Credit Cards as Issuers Tighten

Americans believe “the short-term pressure of inflation poses a more pressing problem to solve than the potential impact of higher interest rate credit, which includes higher monthly debt service,” according to TransUnion.

On June 12, the Labor Department reported that the consumer-price index for May was flat compared to April but up 3.3% from May 2023. Federal Reserve leaders indicated in response that the central bank will likely only make one interest-rate cut in 2024. Fed Chair Jerome Powell said that “you don’t want to be too motivated by any single data point.”

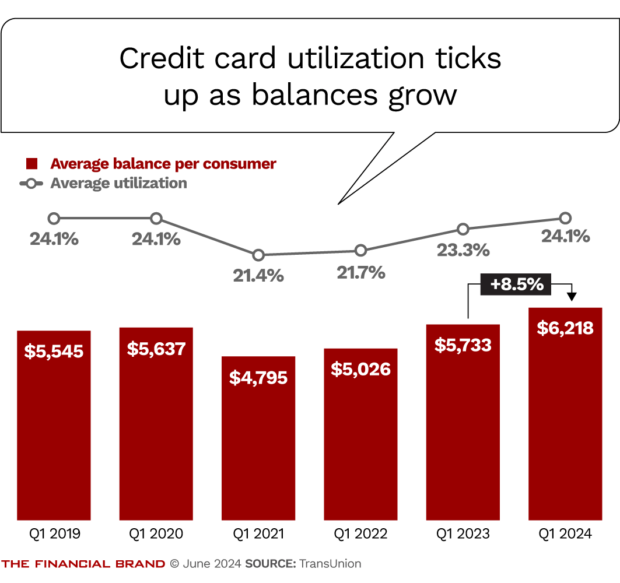

As of the first quarter of 2024, consumers hold more than 543.1 million bank credit cards, up 3.8% from the first quarter 2023 and up 19.2% over the first quarter of 2021. The average debt per borrower has also been climbing. It hit $6,218 in the first quarter, up 8.5% from the previous year and up nearly 30% since the first quarter 2021. Consumers are also using a growing portion of their cards’ credit lines, according to TransUnion data. The chart below illustrates these trends in greater detail.

Average new account credit lines granted by issuers are up 3.8% year over year. TransUnion points out that a greater portion of new accounts have been granted to people with super prime credit ratings, with issuers tightening up on all other customer credit risk tiers.

New credit lines extended to these customers typically run larger than for other groups. In addition, super primes tend to open new card accounts because they want a new card, not necessarily to use fully. Often they ditch another card in their wallet once they have the new one, according to Wise.

By contrast, when people in subprime and lower prime categories, especially, obtain new cards their intent is to borrow more.

“They’re always in the market for new credit,” Wise explains.

Read more: More Consumers Are Hitting their Card Limits. Are Delinquencies Next?

Make Sure Your Credit Scorecards Reflect Post-Pandemic Realties

The company notes that total new account credit lines granted were down 2.6%. The company believes this reflects a tightening policy on new account originations. Wise says several quarters must pass to see the full effect of issuers’ leaning more towards super primes.

Meanwhile, 90+ days past due delinquencies on cards rose in the first quarter to 2.55%, which is 60 basis points over 2023 delinquencies. TransUnion reports the growth rate has slowed.

One piece of advice Wise has for lenders is to carefully examine the credit scorecard they are basing credit decisions on. He says many pull multiple scores from among the industry’s providers, but ultimately make their underwriting decisions using custom scorecards of their own design.

He recommends a “freshness test.”

“If you’re relying on a scorecard that was built before the pandemic, things have changed,” says Wise. “There are a lot of variables that used to be very predictive, but they are not as predictive as they used to be. If you’re relying on a scorecard that you used pre-pandemic, you may not always get the results you might expect.”

Read more:

- Gen Z Credit Card Use is Outpacing Millennials’, Amid Financial Stress and Ballooning Debt

- CFPB’s Foray into BNPL Regulation Stirs Ire and Interest

- Is It Finally Time to Reinvent Credit Card Fees?

Unsecured Personal Loans Rise, But More Slowly

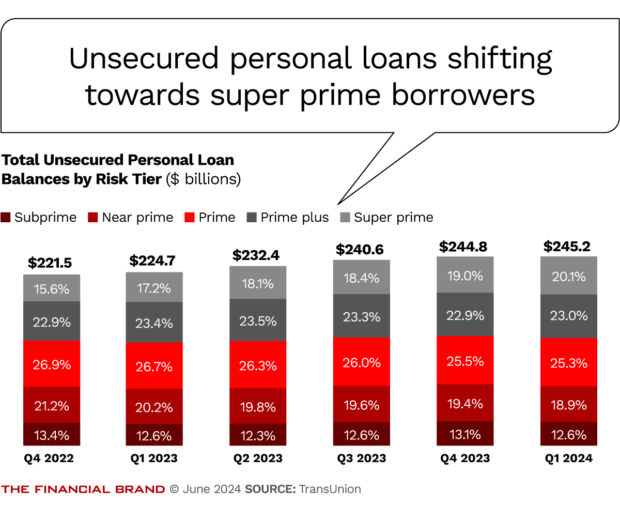

Consumers have been increasing their use of unsecured personal loans. The number of consumers who have at least one unsecured personal loan was up 5% year over year in the first quarter and up 24% since the first quarter of 2021. TransUnion reports that total unsecured personal loan balances grew 9% in the first quarter compared to the year before, to a total of $245 billion. One of the key purposes of unsecured personal loans is refinancing of a consumer’s outstanding credit card debt.

TransUnion reports that the growth rate for unsecured personal loans has slowed.

Wise says there’s been a similar move towards higher-level borrower tiers in personal loans. In part that reflects fintech personal lenders facing tighter funding and conserving their personal lending resources for superior credit risks.

“They’re being a bit selective regarding who gets those loans,” says Wise. He adds that in recent quarters there has been a good deal of growth among bank lenders that make personal loans. He’s noted traditional lenders running campaigns to promote personal loans for debt consolidation.

Due to this tightening, and tightening by other lender categories, delinquency levels in personal lending fell.

“It’s good news that delinquencies have come under control after spiking a year, year and a half ago,” says Wise.

Read more: When Will Mobile Banking Finally Kill the Plastic Credit Card?

Modern Customer Journey Mapping

Customers navigate a multi-touch, multi-channel journey before interacting with your brand. Do you deliver successful and seamless experiences at every touchpoint? Download webinar.

Solving the Deposit Puzzle: Strategies for Growth in Rate Uncertainty

Join Kasasa’s insightful webinar to explore effective strategies for navigating the complexities of rate uncertainty.

Read More about Solving the Deposit Puzzle: Strategies for Growth in Rate Uncertainty

Mood of the Consumer Low on Big Picture, Higher on Personal Circumstances

Half of the Americans queried for TransUnion’s second quarter pulse survey ranked inflation as their highest financial concern. In addition, 84% said it was one of their top three concerns.

About 30% of consumers overall said they intend to apply for new credit or to refinance existing credit sometime this year. Out of that 30%, more than half plan to apply for new credit cards this year. TransUnion said that this represents the highest level of intent to apply that it has seen in the time it has been doing the survey. Among consumers worried about inflation 62% want a new card.

The flip side of this, according to TransUnion’s survey, is that the current employment picture makes many optimistic about their own circumstances: 55% of respondents continue to be upbeat about their household finances.

“The optimism appears to be, in large part, driven by confidence in a stable employment situation and continued wage increases,” TransUnion reports.

However, the study also found that 48% of consumers now say that their incomes are not keeping up with inflation. This is a two percentage point rise over the year-earlier mark.