When Apple Pay was launched in 2014 people predicted mobile pay options, powered by near field communications (NFC) technology, would soar, eventually eclipsing other types of payments.

So far that hasn’t happened. The preponderance of non-cash transactions continues to be handled using plastic cards.

Now that the cards themselves are becoming NFC-enabled, they may stick around even longer. Contactless cards already are widely used pretty much everywhere but the U.S. With major issuers rushing to roll out these cards (“a feeding frenzy” is how one consultant put it) and with a large majority of merchants able to accept them, that picture is changing.

Contactless cards — which allow users to just tap the terminal (or hover near it) to complete a transaction — add speed back to the in-person checkout experience with the same security that EMV cards provide.

What they don’t offer is the additional security of biometrics (fingerprint and/or facial scan) and two-factor authentication of mobile payments, Nor do they provide the slick financial management tools of mobile wallet payment apps. Some believe the momentum will shift in time toward digital wallets, but right now, plastic still prevails, and contactless has brought it further into the digital age.

The unfair advantage for financial brands.

Offering aggressive financial marketing strategies custom-built for leaders looking to redefine industry norms and establish market dominance.

Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

This webinar will offer a comprehensive roadmap for digital marketing success, from building foundational capabilities and structures and forging strategic partnerships, to assembling the right team.

Read More about Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

Big Issuers are Going Contactless

Acceptance of NFC payment technology by transit systems around the world has been a major force behind contactless card issuance. That scenario is now playing out in the U.S., as well, where about 20 cities have contactless transit fare systems in place or in the works, according to Digital Transactions. New York City is using them for its huge subway system and plans to extend it to buses, as well. Other cities in various stages of contactless rollout include Miami, Chicago, Portland, Ore., Nashville, Denver and Los Angeles.

“Once consumers have the daily experience in their transit systems, they’re more likely to tap and pay at a coffee shops and other merchants on the way to and from work,” Liz Karl, VP of Payments Consulting at American Express, told Tearsheet.

Amex is counting on that happening. Since July 2019 all newly issued and replacement U.S. American Express Consumer Cards have been contactless. Wells Fargo has also joined the rush to issue contactless cards. Chase was early to move and has already issued 20 million contactless cards.

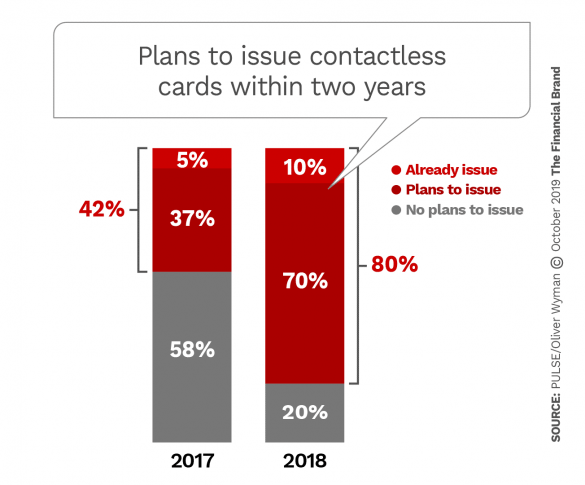

Financial institution plans to issue contactless debit and credit cards doubled from 2017 to 2018, according to a survey conducted by Oliver Wyman for PULSE.

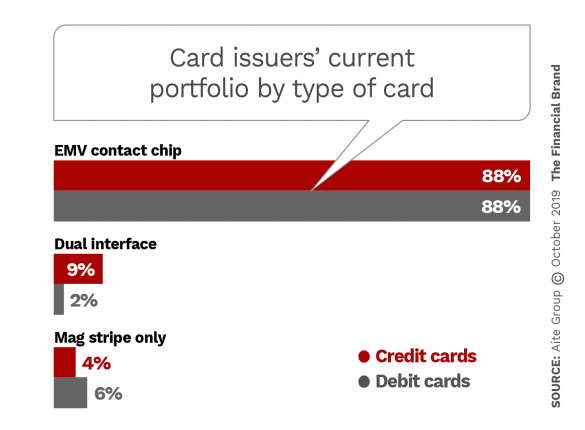

There’s a long way to go, however, before contactless cards make up the bulk of the cards in bank and credit unions’ card portfolios, as Aite Group data show.

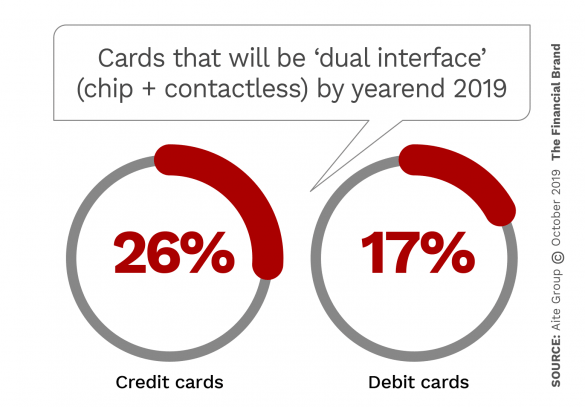

Most issuers will be issuing what are called dual interface cards, Aite notes in a report. These are chip cards capable of both contact and contactless transactions. While these cards were still a single-digit percentage of most issuers’ portfolios at the end of 2018, the respondents to the Aite Group survey predicted significant jumps by the end of 2019. This reinforces the notion of a “feeding frenzy.”

Jeremiah Lotz, Managing VP of Digital Experience and Payments at PSCU, predicts consumer uptake of contactless cards “might surprise” some in the industry because of the cards’ faster transaction speeds.

Commenting in a Mercator Advisory Group newsletter, Lotz also predicts that 80% of merchants will adopt contactless payment methods by fall 2020. That may turn out to be conservative. At the time of the Apple Card launch in March 2019, Apple said that 70% of U.S. merchants accept Apple Pay, meaning they are NFC capable. In a 2018 report on contactless cards, A.T. Kearney observed that thanks to the EMV conversion, “Much of the required merchant infrastructure to accept contactless is already in place and turned on.”

Read More:

- Apple Card Rollout Threatens Traditional Financial Institutions

- Two Big Trends Shaking Up Retail Payments

Role of Contactless Cards Versus Mobile Wallets

Despite widespread interest in contactless cards, questions still come up about the need for them as consumer use of mobile wallets is growing.

An early read from the New York City contactless transit rollout is interesting. In the first few months of use, the city’s transit authority reported 80% of contactless fare payments came from digital wallets, and the rest from contactless cards, according to Business Insider. Commenting on this finding, Dan Sanford, Global Head of Contactless Payments at Visa told BI, “Mobile adoption is further along because it’s more mature than where we are in terms of card issuance.”

More than one industry observer has said that the growth of mobile wallet usage will drive use of contactless cards, because consumers will have become accustomed to the idea of “tapping to pay.”

Richard Crone, CEO of Crone Consulting, believes the opposite is true.

“Every contactless card issued, every contactless card promoted is a backhanded promotion for contactless mobile payment.”

— Richard Crone, Crone Consulting

The payment industry consultant told The Financial Brand that “every contactless card issued, every contactless card promoted is a backhanded promotion for contactless mobile payment.” He says that after waiting five years, the major issuers now see that they need to get serious about issuing contactless cards in order to avoid giving 15 basis points of every credit card transaction and a half cent on every debit card to transaction to Apple or one of the other wallet providers.

“This is a race for enrollment,” says Crone. “In order to keep the card base you have active, you have to add new utility and NFC is now a required utility.” But the unintended consequence, he believes, is that as these cards spread awareness of the ease and speed of contactless payments, they will also highlight the superior experience of mobile payment apps, Apple Pay in particular.

Not every consumer will want to pay using a mobile device, some argue. Crone responds that the mobile-averse crowd is “not a transaction-rich market — not what you build a business on. You build it on the young who expect contactless and in an enhanced manner.” Apple upped the game for that enhancement, he says, when it released the Apple Card in partnership with Goldman Sachs.

The payments game is far from won, however. For example, a huge part of the world, including some major U.S. players, doesn’t rely on NFC at all.

In China, 1.2 billion mobile payment users rely on barcodes for payments, not NFC. In the U.S. Walmart is a major holdout on NFC in part because its barcode-based Walmart Pay already is used by 58 million customers, as Crone points out. Starbucks and other merchants are big supporters of bar codes, as well. Even though Chase is tabling its QR code-based Chase Pay app effective in 2020, the consultant predicts both formats will coexist. Barcode does have the advantage of being independent of device and carrier, Crone notes.

Nobody in China is paying 15% to a device maker.

Considerations for Contactless Card Marketing

However the payments contest plays out, banks and credit unions must address several marketing challenges to have their institutions’ investments in contactless cards pay off. Even Crone agrees that plastic cards are not going away any time soon and that contactless is a required function.

In the Aite Group report, Senior Retail Banking Analyst Tiffani Montez writes that, “Financial institutions need to devise a strong value proposition for contactless cards, ensuring that the process of using a contactless card is easier than that of using an EMV chip or a digital wallet, and making sure that consumers understand that fraud protection is just as good, if not better, than EMV.”

Specifically, the report asks: “How do physical contactless cards and digital cards in a consumer’s digital wallet work together? And in what situations is it better for a consumer to use one payment method over another? Education about payment differences will be key.”

“Payment fragmentation” is another issue to address in promotions and educational materials. The report explains:

“The many ways a consumer can pay at the POS is mind boggling. Often, a consumer does not know whether it’s best to swipe, dip, or tap.”

Banks and credit unions need to work closely with merchants to make sure the latter understand the differences in payment options and can guide consumers through how to use the tap-and-go payment functionality.

The research and consulting firm also points out that marketers can target certain demographics such as where there is a need for quick and easy payments such as fast food, transportation, events, or festivals.