The report: The State of Online Payments [December 2023]

Source: Invoice Cloud/Regina Corso Consulting

Why we picked it: Bill payment is a core consumer banking function, and understanding current consumer attitudes and behaviors will help map the next stage of innovation and adoption.

Executive Summary

While banks collect payments directly for mortgages, auto loans and credit cards, they also play a crucial role in expediting payments across the entire economy. By keeping pace with consumer payment preferences and frustrations, financial institutions can improve both the payment process and the customer experience.

Invoice Cloud commissioned Regina Corso Consulting to survey more than 2,000 U.S. adults about their payment behaviors and found valuable insights into the challenges and opportunities in the payments space. The numbers demonstrate there is still room to increase e-payment adoption, even in some big sectors.

To continue the momentum, companies need to promote digital payments, reduce friction and offer more options in the payment process.

Key Takeaways

- Consumers like digital payments for speed and flexibility. Of those who pay most bills online, 26% prefer paying by mobile device, while 17% prefer automatic payments.

- Despite rising adoption, there is still room for considerable growth in many digital payment channels.

- Six in 10 respondents said they had encountered problems paying bills digitally, most commonly forgetting their username or password.

- By promoting online bill pay and addressing pain points, billers can increase collections, reduce costs and improve the customer experience.

What we liked: The report offers important insights for banks to think about their own collections for mortgages, loan payments and credit cards and their role in facilitating third-party bill payments.

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

The Basics of Bill Pay and Preferences

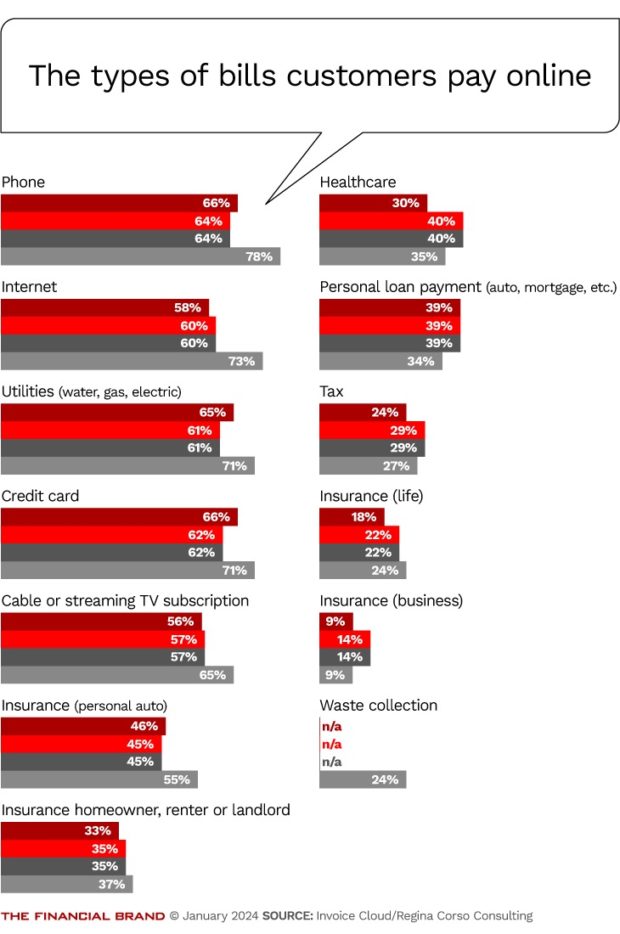

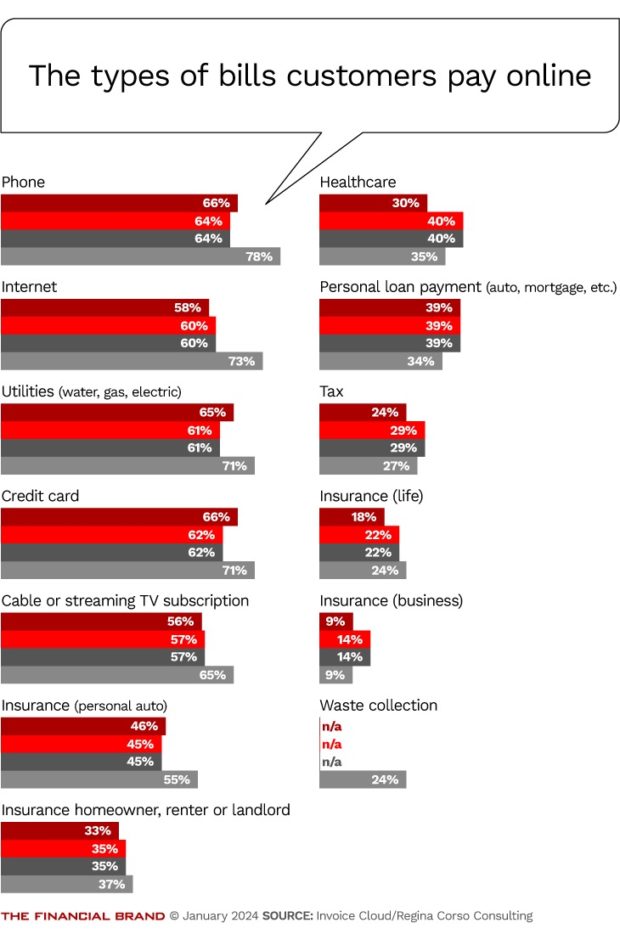

Across the board, consumers are paying more of their bills online. Of the many bills Americans pay on a regular basis, nearly three-quarters or more pay their phone, internet, utilities and credit cards online or through a mobile device. These trends have been inching upward steadily since 2020.

For example, while 66% paid their phone bill online in 2020, that number is now 78%. However, just 34% of consumers make personal loan payments (mortgage, auto, etc.) online or on a mobile device.

Payment channels: Mobile devices and online portals remain the top choices for most Americans when it comes to bill pay. Almost two-thirds (65%) have paid a bill by mobile device in the past twelve months, while over half (54%) have used an online portal supplied by a biller. Four in 10 have used an online portal supplied by a bank, while only a quarter have paid by phone, mailing a check, or in person.

Demographics: Not surprisingly, higher-income demographics are more likely to pay bills online and with mobile devices. More than half (58%) of those earning $100K or more used an online portal supplied by their bank, while only 27% of those earning less than $50K used a bank portal.

“Few customer touchpoints are as operationally important as sending bills and accepting the corresponding payments. As a main source of revenue, it’s in many organizations’ best interest to make this experience as seamless as possible for their customer base.”

Preferences by demographic: Not surprisingly, younger generations choose mobile devices as their preferred channel. Across all three younger segments (Gen Z, Millennials and Gen X), approximately a quarter prefer mobile devices, compared to only 14% of Boomers. Additionally, consumers from households earning $100K or more were also more likely to choose automatic payments as their preferred method.

Why consumers pay bills online: When asked why they pay bills online, three in 10 said they like the convenience and flexibility to pay whenever and wherever they want. Their preferred methods are split across multiple channels. Nearly a fifth (17%) prefer automatic payments, while 26% prefer a mobile device, 20% prefer a biller online portal and 17% prefer a bank online portal.

Payment method: When it comes to payment method, nearly two in five (39%) respondents use a debit card while approximately a quarter use a credit card. Notably, only 15% pay using their bank’s bill payment option, while 9% pay by either ACH or digital wallet.

Payment timing: When deciding which bills to pay first, nearly three in 10 pay each bill when they receive it. One in five say they pay the most critical bill first, while nearly one in 10 pay the easiest and quickest to pay, the highest balance, or let their auto pay determine.

Challenges and Opportunities in Digital Payments

By knowing more about payor preferences and challenges, banks and billers can find many opportunities to improve customer experience, improve cash flow and reduce late payments.

Passwords and reminders: Six in 10 respondents said they had encountered major problems paying their bills digitally. Nearly a quarter said they couldn’t remember their username and/or password, while 17% said they lacked payment reminders. Others noted payments took too long to process, the preferred payment method wasn’t available, or they didn’t get payment confirmation on the due date.

Resolving issues: When encountering an issue, more than 40% of survey respondents said their preferred way to connect with customer service was a phone call. Approximately a quarter (28%) preferred to chat online, while less than 10% preferred a chatbot or a phone call with an automated system.

Greater digital adoption for Baby Boomers: Baby Boomers are the most resistant to mobile, but many may be willing to adapt as a decline in check payments signals growing interest in digital payments. However, data suggests they have less confidence in online payments and continue to harbor concerns about security. To encourage adoption, billers must make self-service options easy to find and use and demonstrate security with trust in digital offerings.

Timing: Understanding when consumers prefer to pay their bills can be instrumental in helping them pay more bills on time. For example, for those who prefer to pay right when they receive it, billers can make it easy to make payments directly from the bill.

Meanwhile, for those who prefer the nearest due date, billers can send customized payment reminders close to when the payment is due. With the right information, they can learn to customize payment reminders down to the channel.

Paperless billing: Data indicates there remains room for greater enrollment in paperless billing. Only three in 10 survey respondents said they were enrolled in paperless billing for all of their recurring bills, while more than one-third reported being enrolled in paperless billing for more than half of their recurring bills.

Of those not enrolled in paperless, a third said they still preferred paper bills, a quarter said there was no option to enroll, and nearly a fifth said they were concerned about the security of their payment information. As enrollment reduces labor and costs, stagnant paperless billing adoption should be a red flag for billing organizations. They should be clear to let customers know paperless billing is available with notifications and a quick link for easy enrollment.

Automatic payments: Overall, just 17% of respondents said they prefer automatic payments. Of those enrolled in automatic payments, nearly half (45%) said half or more of their automatic payments are drafted from a bank account, while 39% said half or more are charged to a credit or debit card.

Why don’t more consumers embrace automatic payments? Several reasons.

One-third said they like to know their balance before funds are automatically removed from their account, while a quarter preferred to make manual payments each month. Nearly two-fifths either didn’t like the idea of funds being automatically removed from their account or weren’t certain they’d have the funds to cover it.

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

Instant Messaging. Instant Impact.

Connect with your customers and provide lightning-fast support as effortlessly as texting friends. Two-way SMS text messaging is no longer optional.

Improving the Online Payment Experience

To keep up with customer preferences and realize benefits, the report noted billers (and their banks) should do several things:

Promote adoption:

- Make it easy to find self-service options like paperless billing and online enrollment.

- Cater to both ends of the age spectrum by enrolling Boomers in self-service routes and offering payment channels preferred by Gen Z.

- Create or select a digital billing and payment solution designed to drive online payment adoption by engaging customers throughout the process.

Reduce friction:

- Evaluate the payment experience to identify and eliminate any friction points.

- Offer seamless mobile experiences, including mobile wallets.

- Prioritize the ease of the mobile payment experience with a platform for mobile screens and on-click payments by text.

- Leverage QR codes in bills in envelopes.

- Offer an optimized guest checkout route to help customers who forget their username or login.

Offer more options:

- Enable payment reminders to be customized by channel, customer information and more.

- Allow customers insights into and control over the amount and scheduled time of their automatic payments.