For retailers and other businesses, the goal is making a sale.

“One of the toughest things that most merchants have to battle against online is the abandoned shopping cart or the abandoned checkout,” says U.S. Bank’s Mia Huntington.

Payments can play a role in helping a sale go through, and with U.S. Bank being one of the largest merchant payment processors in the country, it is naturally interested in tactics that can turn pending sales into purchases.

What it has found is that consumers want to be able to do more than choose between just cash or cards, regardless of where they shop. Increasingly, many are choosing some form of buy now, pay later financing as an alternative.

Why BNPL Matters:

The share of U.S. adults who used buy now, pay later at least once in August, according to a Morning Consult survey:1 in 5

As a result, U.S. Bank has launched its first merchant-based buy now, pay later program — called “Avvance” — making it available to a portion of its 1.3 million merchant customers to present as a payments choice at checkout. The rollout began in October and will continue into 2024, initially among U.S. merchants.

Join industry’s leading AI conference - free passes available!

Ai4 is coming to Las Vegas, August 12-14 2024. Join thousands of executives and technology innovators at the epicenter of the AI community.

Read More about Join industry’s leading AI conference - free passes available!

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

The Basics of U.S. Bank’s Avvance Program

U.S. Bank is taking a different approach with Avvance than what is typical of other buy now, pay later providers.

At present it does not offer a “classic” pay-in-four BNPL option, in which the consumer pays 25% of their bill up front, and then pays another 25% every other week for a total of six weeks. Instead, Avvance prospects will be offered an installment loan for anywhere from $300 up to $25,000 for terms ranging from three months to 60 months.

Merchants will be able to subsidize 0% offers if they choose. Otherwise, rates will be set according to borrower creditworthiness from single digits up to 24.99%.

“Consumers sometimes just prefer the certainty of installment payments over boosting their card balances.”

A mix of both is possible too. Merchants can choose to have, say, a 0% offer for certain goods as a promotion, with other goods or services available at standard financing rates. They receive the proceeds of their sale up front, less a merchant discount fee applied to each transaction.

The rates from Avvance are in line with the market, based on data from LendingTree, which tracks rates on credit card offers. In October the average rate offered on all new card offers was 24.46%. The offers ranged from a minimum of 21.04% to a high of 27.88%.

Huntington is the executive vice president of buy now, pay later and point-of-sale lending at U.S. Bank and Elavon, its merchant payment processing subsidiary. Elavon is one of the nation’s largest payment solutions providers for merchants and keeps an eye on consumer payments trends, she says.

“There is a bit of a narrative in the marketplace that BNPL users are people who don’t have a credit card and therefore are choosing to take a loan,” Huntington says. But consumers sometimes just prefer the certainty of installment payments over boosting their card balances.

Consumer research from J.D. Power corroborates this. It shows that about one in three people at risk of not being able to cover basic financial needs use BNPL. But so do nearly one in four people who can cover their basic financial needs.

The latter group of BNPL users appears to choose this option “out of preference, rather than necessity,” according to J.D. Power. Among BNPL users overall, 25% say they like the ability to budget using installments, J.D. Power said in an October compilation of multiple payment reports by the firm.

See all of our latest coverage on payments.

Why a Growing Number of Banks Are Offering BNPL

Sanjay Sakhrani, an analyst at Keefe, Bruyette & Woods, says banks’ growing role in buy now, pay later makes sense.

“It’s important to offer consumers a choice these days, because they demand it,” he says.

Even if it seems like BNPL competes with an institution’s own card programs, that’s not the case because there are competitors, both nonbank and bank, offering BNPL already, says Sakhrani, who is a managing director. “I think banks have to participate in this market in some way, shape or form.”

Multiple institutions, including U.S. Bank, offer consumers the option of turning credit card purchases into installment plan purchases after the fact. U.S. Bank’s entry is called ExtendPay Plan.

“BNPL isn’t just pay-in-four products,” says Sakhrani. “BNPL is also installment loans over multiple months or years. To me, that’s installment lending. Some consumers prefer those types of loans over credit card loans for a variety of reasons.” This includes the defined term and the fact that rates are frequently lower than those on credit cards.

It's Not an Either/Or Matter:

KBW analyst Sanjay Sakhrani thinks canny card issuers will increasingly see BNPL as a customer acquisition tool. Offer payment plans in some fashion and the borrowers can be cross-sold other types of credit in the future.

The cross-sell opportunity is part of U.S. Bank’s thinking.

Installment plans complement credit cards, in part because they can help the consumer avoid taking up a big chunk of their credit card line with a big purchase, says Rob Seidman, U.S. Bank’s chief product officer, point-of-sale lending/BNPL. Seidman is also formerly an official at BNPL specialist Sezzle.

Some people might qualify for additional credit cards, but many consumers don’t want any more cards, Seidman says. So offering a new, additional card at the time of the purchase, such as a store card promotion, might not clinch the sale, but an installment plan might.

“It’s widening the entire pie, versus cannibalizing any portion of the card, in this acquisition channel, which is important in our eyes,” says Seidman.

Read more: Will FedNow and BNPL Dent Credit Card Use?

How U.S. Bank’s Avvance Will Work for Merchants and Consumers

Banks that would follow U.S. Bank and others into buy now, pay later should read a brochure aimed at merchants that’s offered on Avvance’s website. There’s considerable emphasis on the “point-of-sale” term.

“Buy now, pay later has become many things to many people,” says Huntington. “We describe what we’re doing as point-of-sale lending. Whether the person is checking out at a store, on a website, or if the merchant (such as a contractor) is in their home, one of the payment options made available is the ability to apply for a loan to finance the purchase.”

In pilots of Avvance, one of the test markets was home improvement contractors. “We found that the product really resonates in that market,” says Huntington.

Avvance can be used when the consumer is invoiced, which is an option that appeals to contractors.

Whenever consumers choose to use Avvance, they provide contact information. After a rapid credit evaluation, they receive a link to an offer that appears on their mobile phone. (The application process requires mobile numbers, rather than landlines.)

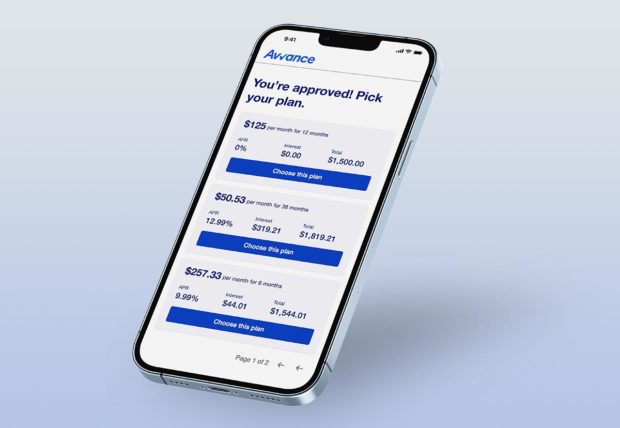

They get a choice of rates and terms and can pick their plan (see the smartphone screen above). They are shown both the monthly payment required in dollars and also see the annual percentage rate.

Read more about buy now, pay later financing:

- Inside Citizens Bank’s Growing ‘Buy Now, Pay Later’ Strategy

- BNPL’s Dark Side: Younger Consumers Face Credit Trouble Ahead

- The Strategy Behind Amazon Pay’s Buy Now, Pay Later Push

Avvance’s Marketing Strategy: A Focus on Prime Credit Quality

Avvance is aimed at consumers who are near-prime and above. But U.S. Bank may adapt the program for borrowers with subprime credit ratings later.

Huntington says that 0% offers will generally be shorter term and for people with superior credit ratings. Generally speaking, the higher the rate, the longer the term provided.

The bank is emphasizing longer-term plans for now, rather than the short-term, pay-in-four option that is more common. Meanwhile, some of the BNPL-only providers have been getting into longer terms lately.

“Everyone is sort of reinventing themselves, and the ecosystem is changing a bit.”

— Mia Huntington, U.S. Bank

The installment plans from Avvance will be co-branded with U.S. Bank. The thinking is that the brand recognition of the bank will boost trust, compared with using only the new Avvance name.

It is also possible that white-label BNPL programs for merchants will be offered down the road, though it is not part of the plan yet. “TBD,” says Huntington.

An interesting feature about Avvance is the element of privacy: Merchants will know only that a consumer has chosen to use this payment option.

“Everything runs through the consumer’s own device,” says Seidman. “The consumer will have full privacy and control over everything about the process for applying and then choosing to accept the offers or not.”

The idea is to embed the availability of the financing option in the merchant relationship, but with privacy built into the offer flow, according to Huntington. She expects that as the program evolves, more ways of embedding the installment option into the merchants’ sales processes will be developed, no matter if the venue is online or in person.

Read more about U.S. Bank:

- How U.S. Bank’s Innovation Team Hunts for Futuristic Ideas to Incubate

- Innovation and Digital Transformation is a Winning Formula at U.S. Bank

- How U.S. Bank Keeps Its Award-Winning Mobile App on the Leading Edge

Do Banks Have an Edge Over Standalone BNPL Providers?

KBW’s Sakhrani says that the growth in buy now, pay later usage hasn’t slowed down loan growth for credit card issuers in any noticeable way. This suggests that for banks that enter the business, some of the BNPL volume might be gravy.

Sakhrani foresees a bit of a tug of war developing between “traditional” BNPL players and the banks moving into a financing type that is new for them.

On one hand, “having scale and efficient funding is important,” he says, “and those can help provide better terms for consumers and merchants alike.” That’s an advantage banks bring to the table. Though deposits are harder to come by for many banks, their access to insured deposits is an advantage, as it is a steadier funding source than the options available to standalone BNPL players.

On the other hand, in the BNPL business, distribution is a key aspect and user experience is a key part of that. “Some of the fintechs might have an advantage in that regard,” Sakhrani says.

As the competition increases, all providers also have to pay attention to how well consumers understand their terms. The research from both J.D. Power and Morning Consult indicates that communication and trust are important.

“Companies that proactively build safeguards into their platforms are likely to earn more trust from current and prospective customers alike and ultimately better secure their future growth potential,” Morning Consult said in its report.