Buy now, pay later credit may be prompting younger Americans to get in over their heads in debt.

This is the conclusion of two separate studies, one from Morning Consult and another from the Federal Reserve Bank of New York. The Morning Consult study is based on a survey of 2,223 U.S. adults taken in August. The Fed surveyed 1,000 people in June for its study.

This form of borrowing — which has gained a sizable foothold among more traditional consumer financing options in a relatively short period — is also evolving. Originally, 0% interest “pay in four” plans put BNPL on the map. Now, there are interest-bearing plans running six weeks, 12 weeks, or even longer, and the interest sometimes runs as high as 36%.

“Despite being fairly broad-based, with significant take-up among higher-educated and higher-income respondents, overall we find that those with lower credit scores and greater unmet credit needs make up a disproportionate share of all BNPL users,” the N.Y. Fed researchers said in a blog post about their findings.

“Furthermore, we find BNPL users to be overall more financially fragile, as measured by the average likelihood of being able to come up with $2,000 in the next month in case of emergency,” they wrote.

These studies are a critical heads up for consumer lenders and strategic planners across the banking industry. As BNPL providers like Klarna, Affirm and PayPal continue to build volume and expand their business models, more banks also are entering the field directly and through credit card programs.

American Express has had an installment plan option for card purchases — called “Plan It” — for years now. Chase and Citibank are among the banks that have started offering their credit cardholders the same choice. And then there is Apple Pay Later, the tech giant’s entry into this fray.

“The fact that a disproportionate share of BNPL users are already financially fragile raises questions about the resilience of BNPL lending and its performance following an adverse economic shock,” the Fed researchers said in the blog, “Liberty Street Economics.”

Banking Transformed Podcast with Jim Marous

Listen to the brightest minds in the banking and business world and get ready to embrace change, take risks and disrupt yourself and your organization.

Creating A Community with CQRC’s Branch Redesign

Find out how SLD helped CQRC Bank to create the perfect harmony of financial services, local culture, and the human touch in their branch transformation.

Read More about Creating A Community with CQRC’s Branch Redesign

Researchers See Trouble — and So Do Some BNPL Borrowers

The Morning Consult and N.Y. Fed studies examine trends that all consumer lenders should take into account, but especially those offering BNPL or considering it.

“This is really going to be front and center this year,” Jaime Toplin, senior financial services analyst at Morning Consult said in an interview with The Financial Brand.

“I think a lot of shoppers perceive buy now, pay later as a safer form of debt, just because they have the installment option,” Toplin added. “For users who are using it responsibly, it can be a really safe and great option.”

However, many BNPL users are showing signs of financial stress, the two studies show.

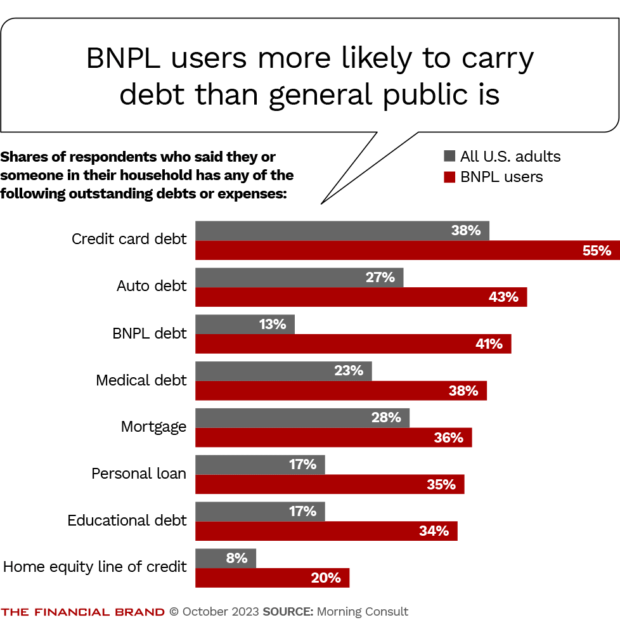

“BNPL users have a propensity for borrowing,” Toplin wrote in her report. “They’re more likely than the average consumer to live in households with higher rates of debt across the board.” This trend is illustrated in the chart below.

As the chart also shows, BNPL debt is carried by 41% of the households that have used it.

Even so, credit cards account for most of the debt in these households, 17 percentage points beyond the level for all U.S. adults. There are multiple reasons for that.

Interestingly, the Morning Consult study noted that one out of three buy now, pay later users have used a credit card to pay off BNPL debt. This may be a matter of convenience or, in order to avoid penalties, a matter of robbing Peter to pay Paul, but it is often also, in Toplin’s words, the start of “a vicious cycle that’s hard to overcome.”

One out of four consumers using BNPL have had to pay late fees, 27% have seen their credit scores fall, and 22% have actually faced debt collectors, she said.

Early in BNPL’s evolution some proponents thought such short-term credit wouldn’t be a source of trouble. After all, the pay-in-four arrangement called for full payment within six weeks, they argued, with the first 25% of the bill due on purchase, typically. And the fact that the hot programs carried 0% interest for consumers — merchants subsidized the interest cost — is a big selling point for “classic” BNPL.

An idea floated in the early days was an app that would help users track the plans they had committed to, whether with one BNPL provider or across multiple providers. That hasn’t happened.

While the three major credit bureaus all launched different approaches to tracking buy now, pay later credit more than a year ago, not all BNPL providers are sharing their lending data.

Who’s Using BNPL? And Are They Financially Fragile?

Both Morning Consult and the N.Y. Fed looked at usage levels for buy now, pay later services.

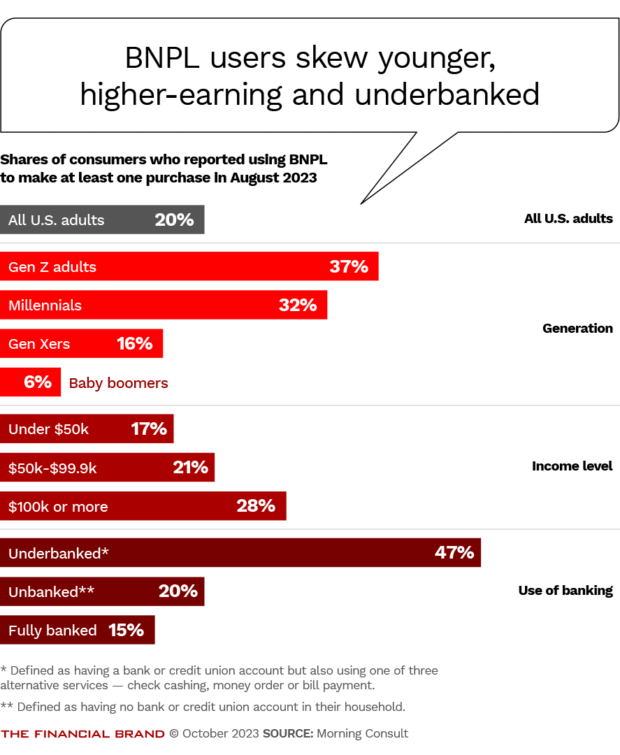

Morning Consult found that 20% of all U.S. adults used BNPL to make at least one purchase in August. As shown in the chart below, users tended to be younger (37% Gen Z adults and 32% Millennials), higher earning and underbanked. This survey defines “underbanked” as having a bank or credit union account but also using check cashing, money orders or bill payment.

Similar to Morning Consult, the Fed study found that 19% of all U.S. adults have used BNPL.

The Fed also delved into usage patterns from the perspective of credit scores. Researchers found that BNPL use was higher for people with credit scores below 620 — 43% used it — and higher for people who were 30 days or more past due at some point in the year — 37%. Beyond that, people who reported that they’d been turned down for other credit were also more likely to use BNPL — 41%. (A score of 620 is considered the beginning of subprime status. It’s generally indicative of past credit trouble or a lack of credit history.)

Regarding people’s being “financially fragile,” the Fed study found these patterns among BNPL users:

• Nearly one in three — 32.7% — had a credit score of less than 620, had had a credit application rejected, or had been delinquent on a loan in the past year.

• Only 42% of BNPL users said they could handle a financial shock by drawing on their savings and would not have to borrow to deal with the emergency. By contrast, among all respondents, 68% said they could draw on savings in emergencies.

• The BNPL users who would need to borrow said it would be from friends and family or from banks or credit cards.

Read more about buy now, pay later:

- The Lines Between Credit Cards and BNPL Are Blurring

- Inside Citizens Bank’s Growing ‘Buy Now, Pay Later’ Strategy

Which Comes First, BNPL or Financial Trouble?

There’s an element of “chicken or egg” here: Are some BNPL borrowers already having difficulties? Or does borrowing with buy now, pay end up creating or exacerbating the problem?

“We cannot dismiss the potential risks of overextension, whereby frequent use of BNPL funding leads to excessive debt accumulation over time, affecting a consumer’s ability to meet non-BNPL obligations,” the N.Y. Fed researchers wrote.

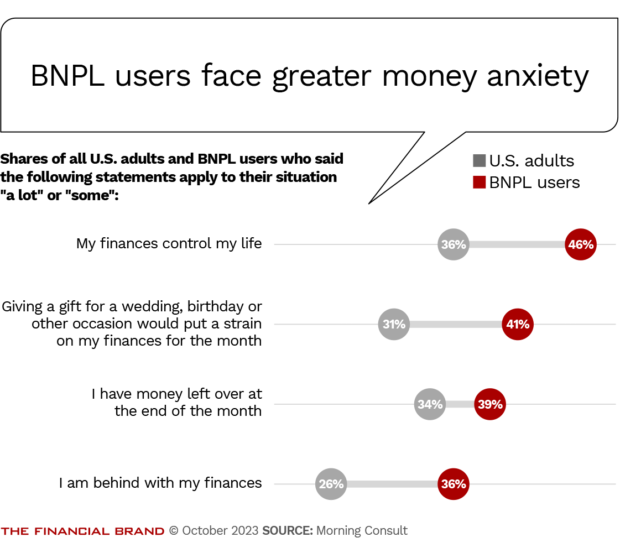

Morning Consult’s Toplin said her research indicates that BNPL users themselves are starting to feel that their financial health is slipping.

In the chart below, BNPL users’ answers to three of the Morning Consult questions make that financial stress clear. For example, 46% of BNPL users agree with the statement that “My finances control my life,” while only 36% of the entire sample felt that way. Having nearly half of the BNPL users saying that their financial issues rule their lives is significant.

Some other points from a related section of the Morning Consult report:

• 57% of the BNPL users say they worry about the money they have or the money they’ll save not being enough to last.

• 48% say their money situation is bad enough that they will never have the things they want in life.

• 46% say they are just getting by, financially.

Read more:

- How Some Community Banks Are Reviving Personal Lending

- See all of our latest coverage of buy now, pay later

Where Do Consumer Lenders Go from Here with BNPL?

As the buy now, pay later market evolves, new twists are emerging.

Some are in product design. In the spring, TD Bank introduced TD Clear, a credit card that charges 0% interest, but has a subscription fee instead, Toplin noted. For $10 per month, consumers can obtain a $1,000 line with a $45 minimum monthly payment. For $20 per month, the cardholder gets a $2,000 credit limit, with a $70 minimum payment.

There’s already been a leak, of sorts, reported by Bloomberg, that Affirm is exploring a variation on its service that would charge no interest on BNPL transactions made on its app. The leak came via the app code and Affirm would neither confirm nor deny the plan.

Another twist is Klarna’s “Pay Now” function, which allows consumers to divert what would otherwise be a BNPL purchase to a card they have instead. Either a debit or credit card can be loaded in the app. This keeps the consumer on Klarna’s shopping platform but allows them to avoid adding another installment plan to the ones they may already have. American Express’ “Pay It/Plan It” app gives people the chance to turn a charge card or credit card transaction into an installment plan or to leave it alone. Klarna is more or less arriving in the same place from the other direction.

“I think there is going to be a lot more of that as providers try to get ahead of credit issues. They’re aware that this is on its way to being a problem.”

— Jaime Toplin, Morning Consult

Sezzle recently introduced still another twist. It added a new “Pay-in-2” option, which requires half down at purchase and the rest due two weeks later. This runs counter to the prevailing BNPL trend in which the terms for qualifying purchases are growing longer.

Another development is that BNPL providers have been adding money management and budgeting tools to their lineups. Klarna is one example.

“I think there is going to be a lot more of that as providers try to get ahead of credit issues,” Toplin said. “They’re aware that this is on its way to being a problem.”

The future of BNPL may not be at stake — although someday the Consumer Financial Protection Bureau could make good on its threats to tighten BNPL regulation — but future growth could be. Based on both the Morning Consult and N.Y. Fed studies, one out of five people now use BNPL in some way.

“That’s really the core audience, the low-hanging fruit people who are easy to get and who have been interested,” said Toplin. “They’re going to have to add other features and new ways of attracting those prospective users who haven’t used it yet.”

The battle lines among lenders are reforming too. Even while major banks explore a digital wallet to infiltrate ecommerce further — with a soft launch of Paze underway — some BNPL providers with ecommerce roots are pushing harder to serve consumers in physical stores. Klarna’s homepage, for example, has a prominent button for help in finding live stores to shop at. That’s a change from much of the rest of the site, which serves as a shopping guide to Klarna ecommerce partners.