Projections for growth for the buy now, pay later business in 2024 are generally optimistic. But things aren’t all upbeat.

Some of the positive items:

• A new study by Juniper Research projects that global buy now, pay later transaction value will more than double in the next four years, from $334 billion in 2024 to $687 billion in 2028. Activity will spread to new markets, and in the U.S. and the U.K. BNPL will expand significantly, the report predicts.

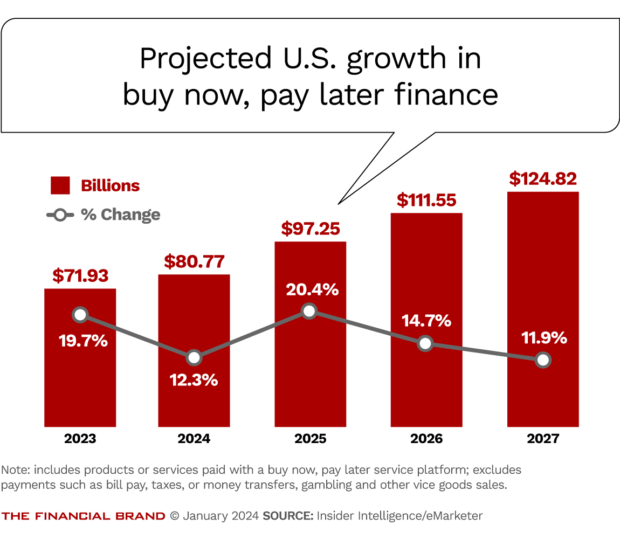

• Insider Intelligence/eMarketer predicts that in the U.S. alone, BNPL transaction value will rise from $80.8 billion in 2024 to $124.8 billion in 2027.

• In early January, Adobe released online shopping data for the complete 2023 holiday shopping season, a period that had been watched as a confirmation for U.S. BNPL after its first big weekend in November (Black Friday through Cyber Monday). Holiday-time BNPL spending online hit $16.6 billion, up 14% over 2022’s holiday season, a record. For the full year of 2023, BNPL spending online came to $75 billion, up 14.3%, also a record.

Some days after that announcement, Sebastian Siemiatkowski, CEO at Klarna, one of the giants of BNPL, told the host of a program on Canada’s BNN Bloomberg that the company initially celebrated the results of Black Friday for BNPL. Later, however, employees were a bit chastened. The jump wasn’t just BNPL becoming more popular:

“As we got into it a little deeper, we realized that a lot of [the volume] was discount-driven,” said Siemiatkowski. That didn’t change the numbers, but nevertheless took some of the wind out of their sails.

In the same interview, Siemiatkowski added a cautionary note for the longer term.

“So far we haven’t seen an increase in cost, and we haven’t seen an increase in unemployment. But when I see what is happening in the AI area, I would be very surprised if we didn’t see growth in unemployment associated with artificial intelligence.” That, coming from the head of a well-known fintech that uses artificial intelligence and which has been adopting GenAI.

“So far we haven’t seen an increase in cost, but we haven’t seen an increase in unemployment. But when I see what is happening in the AI area, I would be very surprised if we didn’t see growth in unemployment associated with artificial intelligence.”

— Sebastian Siemiatkowski, Klarna

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

The unfair advantage for financial brands.

Offering aggressive financial marketing strategies custom-built for leaders looking to redefine industry norms and establish market dominance.

Cautiously Optimistic or Optimistically Cautious, BNPL Rolls On

Meanwhile, Stockholm-based Klarna’s initial public offering could be coming soon and it might go public in the U.S.. He also announced a subscription program — Klarna Plus — that would include double rewards and special deals and benefits for U.S. users who pay a monthly fee of $7.99.

Klarna’s evolution is of a piece with competitor Affirm’s stated goal to become a payments company, not just a BNPL provider, as Max Levchin, co-founder and chief executive, announced at the company’s investor day in 2023. Across the category, BNPL companies are looking to expand as they seek to become steadily profitable. (Dive deeper: “Affirm Goes Big: How It Intends to Go Beyond BNPL to Own Payments”)

As the BNPL business evolves further in 2024, banks will also play an increasing role in the business, both through installment financing extended via their credit card programs and through more specialized programs. The field could shift significantly.

In a late 2023 report, Moody’s Investors Service wrote, “This year and next will be crucial for many [BNPL] firms as they strive to reduce costs and increase revenue while maintaining volume growth and market shares. Failure to achieve these goals may result in incumbent banks dominating the market and displacing most BNPL providers.”

There’s also the matter of funding. Banks can raise insured deposits, but nonbank fintech BNPL players typically need to obtain funding from investors. (Klarna is a bank in its home base of Sweden and does raise deposits.)

“One big factor is the state of the nonbank wholesale funding market for this lending,” says Adam Shapiro, partner and co-founder at Klaros Group and a regulatory and fintech expert. “If the overall credit market sneezes, then the providers of wholesale funding tend to react as if someone’s got a dangerous new variant of Covid.”

Much of the banking industry participation in BNPL is through the credit card installment plan options offered by the largest players, including Chase, Citibank, American Express and others. There is also a growing group of large institutions providing merchant-side BNPL programs, such as Citizens Bank’s Citizens Pay and U.S. Bank’s Avvance.

But down the road there may be openings for smaller depository institutions with smaller card programs that are agile and willing to think outside of the card, suggests Shapiro.

“There could be opportunities to develop new revenue in a number of ways,” says Shapiro. “These could range from actually offering a BNPL program yourself to offering wholesale funding lines or access to a deposit-heavy balance sheet.”

Read more: Ready to Jump into BNPL in 2024? Read this 360-Degree Analysis from OCC

Examining Sources of the Growth in Buy Now, Pay Later

The growth in BNPL has been driven to a large extent by higher interest rates, thanks to the Federal Reserve’s inflation-fighting efforts.

An analysis by Morning Consult found that even though real personal disposable income grew a little at the end of 2023, for many consumers a gap remained.

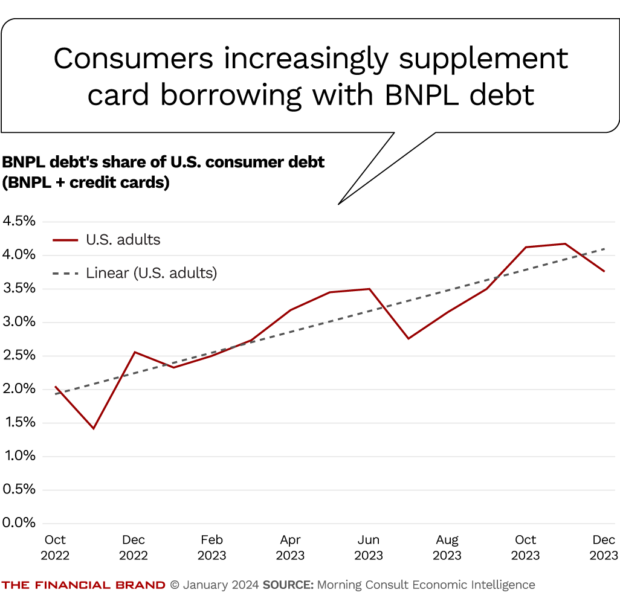

“Savings buffers have worn thin for many adults after several years of sustained price growth, leading consumers to more often supplement their income with debt to cover purchases,” the analysis says. “In the context of high interest rates, however, consumers’ preferred means of debt usage is evolving — and the added pressure to spend on holiday shopping has accelerated adoption of BNPL as an alternative to credit card debt.”

Following the 2023 holiday season, press coverage about people getting in over their heads with BNPL has been growing. For perspective’s sake, remember that before BNPL existed, the same kinds of stories appeared about credit cards. For all the marketing, debt is debt.

The Morning Consult analysis makes the point that its consumer credit surveys indicate that at yearend 2023, 14% of U.S. adults held BNPL debt, versus 40% who had credit card debt. In terms of dollars, the firm found that monthly BNPL debt averaged around $11, while card debt averaged $273. More specifically, among consumers who had BNPL debt monthly payments are averaging $86 and card payments are higher as well — $385 a month, on average.

As seen in the chart above, the split between monthly payments for BNPL and for cards is tipping steadily towards a growing portion for BNPL as more people attempt to supplement their cards. They want to borrow in a way that, given the current state of credit reporting, frequently still does not show up on standard credit bureau reports. Morning Consult found that the BNPL/card users tend to be higher spenders.

In spite of predictions to the contrary and the rising costs of capital, BNPL providers were able to make enough from consumers and retailers, plus interchange fees, to stay afloat last year, observes Simon Khalaf, CEO at Marqeta, a credit card and payment services firm. Usage of buy now, pay later has broadened beyond retail to include travel, entertainment and more.

“So many people are stacking up their BNPL usage,” Khalaf explains.

Accelerating consumers’ embrace of BNPL is a trend among bank credit card issuers to tighten up their standards, as pointed out in analysis from Insider Intelligence/eMarketer. The St. Louis Federal Reserve Bank tracks quarterly the percentage of banks that are tightening their credit card standards. At the height of the Covid period, in the third quarter of 2020, 71.7% of card issuing banks had tightened; a year later this had flip-flopped in favor of substantial loosening as the economy began to come back. But in the last quarter of 2022 tightening began again. In the fourth quarter of 2023, 28.9% of institutions were tightening.

Read more: Ready to Jump into BNPL in 2024? Read this 360-Degree Analysis from OCC

BNPL Grows in the Shadow of Trillion Dollar Card Debt

In 2023, outstanding credit card debt among banks and other issuers topped $1 trillion and that figure has caused considerable debate, and some alarm. During a recent eMarketer podcast, principal analyst David Morris acknowledged that debt levels like that grab headlines. But he said if debt levels are examined in the context of average household income, debt is growing at a slower rate.

However, Morris said he is concerned about rising delinquencies and charge-offs.

“I don’t think the average consumer is at a tipping point yet, but there’s a quick ramp happening here. If it continues to grow quickly, we’re in for a rough ride.”

— David Morris, Insider Intelligence/eMarketer

However, his co-podcaster, senior analyst Grace Broadbent, zeroed in on a separate trend: Consumers using BNPL for purchasing groceries, something that’s shown up in multiple studies.

“People have to buy those every week,” she said. “If they have a $100 grocery bill, then it’s $100 more the next week and the next and the next. It snowballs and gets out of hand.”

This brings up the issue of a fundamental split between “haves” and “have-lesses”:

Many consumers who were underbanked or not wealthy faced rising debt and had maxed out their cards, says Marqeta’s Khalaf. For many, banks tightening their standards meant they couldn’t open additional card accounts, so BNPL options were attractive. (Another factor, identified by Civic Science, is student debt and medical debt. People with those types of debt are more likely to tap BNPL, according to the firm’s research.)

BNPL firms approach credit differently than card issuers. In a “fireside chat” during a recent Piper Sandler investor event, Robert O’Hare, SVP of finance at Affirm, explained that each BNPL purchase is underwritten freshly at the time of purchase.

“This allows us to course correct or optimize the credit box as needed if we start to see signs of stress come through the repayment data that we’re staring at every week,” said O’Hare.

During the eMarketer podcast, David Morris suggested that the issue is the broader economy, and the portion of the population that needs to live paycheck to paycheck.

That people have to use BNPL for groceries “is very frightening,” said Morris. “But I don’t know that I’d point the finger at buy now, pay later.

Read more from our payments coverage:

- Could ‘Amazon One’ Palm Payments Get The Upper Hand Over Digital Wallets?

- Business Credit Card Issuers Face Competition but Also Opportunities in BNPL

- ‘Pay-By-Bank’ Trend Builds Momentum into 2024

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

Move the Needle from Attrition to Acquisition

Vericast’s 2024 Financial TrendWatch explores seven of today’s most critical financial services trends to provide a complete view of the current loyalty landscape.

Read More about Move the Needle from Attrition to Acquisition

Apple Pay Later Matched by Google Wallet BNPL Partnerships

You can’t talk about the future of buy now, pay later without touching on Apple Pay Later, which is now available to all Apple Pay users. This option is contained in the Apple “walled garden” — if you don’t have an iPhone, you can’t use any of it.

But now Android users will have an option of their own. In late 2023 Google Pay announced a pair of joint efforts to bring BNPL to its users. Beginning in January, the company is piloting BNPL options for users with both Affirm and Zip.

Marqeta’s Khalaf says the Apple and now Google moves have dual significance.

First, this reflects a shift in how consumer purchases are financed. Decades ago, credit cards melded a payment vehicle with a financing vehicle, the credit line. Khalaf says Apple decoupled the two, and coupled the financing piece to the digital wallet. “That’s something that I don’t believe has happened in the U.S. since the invention of the credit card,” says Khalaf.

The second aspect of the change concerns distribution, which is how Google Pay’s strategy differs. Apple Pay Later is financed by an Apple subsidiary, but Google Pay represents a pair of collaborations that give two BNPL companies entrée to new transaction streams.

“I would not be surprised to see Google announce more partnerships,” says Khalaf. “That will give BNPL firms another distribution mechanism.”

Read more: Five of the Best: BNPL Exploded in 2023, With More to Come in 2024